EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

17th Edition

ISBN: 9781260464900

Author: BLOCK

Publisher: MCGRAW-HILL LEARNING SOLN.(CC)

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 28P

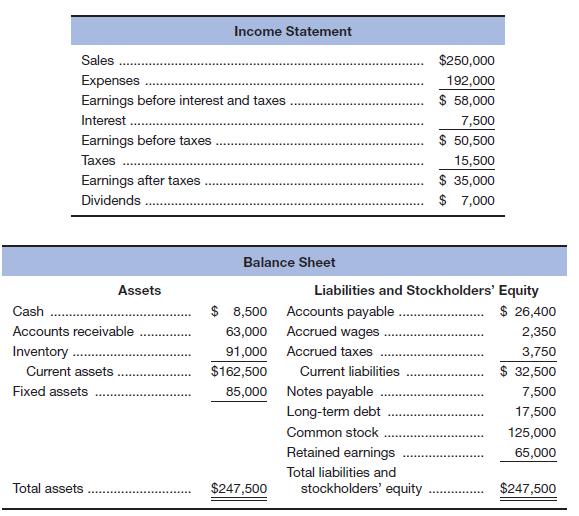

The Manning Company has financial statements as shown next, which are representative of the company’s historical average.

The firm is expecting a 35 percent increase in sales next year, and management is concerned about the company’s need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing store. Among liabilities, only current liabilities vary directly with sales.

Using the percent-of-sales method, determine whether the company has external financing needs, or a surplus of funds.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Manning Company has financial statements as shown next, which are representative of the company's historical average. The firm

is expecting a 30 percent increase in sales next year, and management is concerned about the company's need for external funds.

The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset

utilization in the existing store. Among liabilities, only current liabilities vary directly with sales.

Sales

Expenses

Earnings before interest and taxes

Interest

Earnings before taxes

Taxes

Earnings after taxes

Dividends

Cash

Accounts receivable

Inventory

Current assets

Fixed assets

Income Statement

Total assets

Assets

$ 280,000

222,800

$ 57,200

7,800

$ 49,400

15,800

$ 33,600

$ 6,720

Balance Sheet (in $ millions)

Liabilities and Stockholders' Equity

$ 5,000 Accounts payable

Accrued wages

86,000

77,000

Accrued taxes

$ 168,000

88,000

Current liabilities

Notes payable

Long-term debt

Common stock

Retained…

The Manning Company has financial statements as shown next, which are representative of the company's historical average. The firm

is expecting a 30 percent increase in sales next year, and management is concerned about the company's need for external funds.

The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset

utilization in the existing store. Among liabilities, only current liabilities vary directly with sales.

Sales

Expenses

Earnings before interest and taxes

Interest

Earnings before taxes

Taxes

Earnings after taxes

Dividends

Current assets

Income Statement

Cash

Accounts receivable

Inventory

Fixed assets

Total assets

Assets

The firm

$ 250,000

184,800

$ 65,200

8,600

$ 56,600

16,600

$ 40,000

$ 16,000

Balance Sheet (in $ millions)

$ 221,000

Liabilities and Stockholders' Equity

$ 4,000 Accounts payable

Accrued wages

53,000

68,000

Accrued taxes

$ 125,000

96,000

Current liabilities

Notes payable

Long-term debt…

The Manning Company has financial statements as shown next, which are representative of the company's historical average. The firm

is expecting a 30 percent increase in sales next year, and management is concerned about the company's need for external funds.

The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset

utilization in the existing store. Among liabilities, only current liabilities vary directly with sales.

Income Statement

Sales

$220,000

158,000

$ 62,000

9,400

$ 52,600

17,400

$ 35,200

Expenses

Earnings before interest and taxes

Interest

Earnings before taxes

Тахes

Earnings after taxes

Dividends

$ 8,800

Balance Sheet

Assets

Liabilities and Stockholders' Equity

$ 5,000

61,000 Accrued wages

77,000 Accrued taxes

Cash

$

Accounts payable

$ 25,700

Accounts receivable

2,400

4,900

$ 33,000

9,400

Inventory

$143,000

89,000 Notes payable

Current assets

Current liabilities

Fixed assets

Long-term debt

Common stock…

Chapter 4 Solutions

EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

Ch. 4 - What are the basic benefits and purposes of...Ch. 4 - Explain how the collections and purchases...Ch. 4 - With inflation, what are the implications of using...Ch. 4 - Explain the relationship between inventory...Ch. 4 - Prob. 5DQCh. 4 - Discuss the advantage and disadvantage of level...Ch. 4 - What conditions would help make a percent-of-sales...Ch. 4 - Prob. 1PCh. 4 - Philip Morris expects the sales for his clothing...Ch. 4 - Galehouse Gas Stations Inc. expects sales to...

Ch. 4 - The Alliance Corp. expects to sell the following...Ch. 4 - Prob. 5PCh. 4 - Cyber Security Systems had sales of 3,500 units at...Ch. 4 - Dodge Ball Bearings had sales of 15,000 units at...Ch. 4 - Sales for Ross Pro’s Sports Equipment are expected...Ch. 4 - Vitale Hair Spray had sales of 13,000 units in...Ch. 4 - Delsing Plumbing Company has beginning inventory...Ch. 4 - On December 31 of last year, Wolfson Corporation...Ch. 4 - At the end of January, Higgins Data Systems had an...Ch. 4 - At the end of January, Mineral Labs had an...Ch. 4 - Convex Mechanical Supplies produces a product with...Ch. 4 - The Bradley Corporation produces a product with...Ch. 4 - Sprint Shoes Inc. had a beginning inventory of...Ch. 4 - J. Lo’s Clothiers has forecast credit sales for...Ch. 4 - Simpson Glove Company has made the following sales...Ch. 4 - Watt’s Lighting Stores made the following sales...Ch. 4 - Ultravision Inc. anticipates sales of $290,000...Ch. 4 - The Denver Corporation has forecast the following...Ch. 4 - Wright Lighting Fixtures forecasts its sales in...Ch. 4 - The Volt Battery Company has forecast its sales in...Ch. 4 - Graham Potato Company has projected sales of...Ch. 4 - Harry’s Carryout Stores has eight locations. The...Ch. 4 - Archer Electronics Company’s actual sales and...Ch. 4 - Prob. 27PCh. 4 - The Manning Company has financial statements as...Ch. 4 - Conn Man’s Shops, a national clothing chain, had...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Manning Company has financial statements as shown next, which are representative of the company’s historical average. The firm is expecting a 30 percent increase in sales next year, and management is concerned about the company’s need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing store. Among liabilities, only current liabilities vary directly with sales. Income Statement Sales $ 200,000 Expenses 149,600 Earnings before interest and taxes $ 50,400 Interest 9,200 Earnings before taxes $ 41,200 Taxes 17,200 Earnings after taxes $ 24,000 Dividends $ 6,000 Balance Sheet Assets Liabilities and Stockholders' Equity Cash $ 6,000 Accounts payable $ 22,900 Accounts receivable 55,000 Accrued wages 2,300 Inventory 69,000 Accrued taxes 4,800 Current assets $ 130,000 Current liabilities $ 30,000 Fixed…arrow_forwardSupposing that the 2022 sales are projected to increase by 25% over the year 2021 sales and that there is proportional relationship between sales to operating costs, interest expenses, current assets and spontaneous liabilities. The company has been operating at full capacity and planned to maintain the dividend ratio and profit margin position of the previous year.Required i. Using the Percentage of Sales proforma method, compute the additional funds needed (AFN), assuming that the company was operating at full capacity in the year 2021. ii. Using the Formula method, compute the additional funds needed, assuming that the company was operating at full capacity in the year 2021.arrow_forwardYou are a financial Manager of Chevron Corp. You need to assess the effectiveness of working capital management of the company for 2018 using the following data. What is the 2018 Inventory turnover? 2017 Account Receivable = 15,353,000 2018 Account Receivable = 15,050,000 2017 Inventory = 5,585,000 2018 Inventory = 5,704,000 2017 Accounts Payable = 14,565,000 2018 Accounts Payable = 13,953,000 2017 Sales = 134,674,000 2018 Sales = 158,902,000 2017 Cost of Sales = 95,114,000 2018 Cost of Sales = 113,997,000 2017 Purchases = 95,114,000 2018 Purchases = 123,435,000arrow_forward

- Suppose that Wall-E Corp. currently has the balance sheet shown below, and that sales for the year just ended were $7.4 million. The firm also has a profit margin of 20 percent, a retention ratio of 25 percent, and expects sales of $9.4 million next year. Fixed assets are currently fully utilized, and the nature of Wall-E's fixed assets is such that they must be added in $1 million increments. Assets Current $2,294,000 Current liabilities Long-term debt Equity assets Fixed assets 5,402,000 Liabilities and Equity Total assets $7,696,000 Total liabilities and equity $2,368,000 1,700,000 3,628,000 $7,696,000 If current assets and current liabilities are expected to grow with sales, what amount of additional funds will Wall-E need from external sources to fund the expected growth? (Enter your answer in dollars not in millions.) Additional funds neededarrow_forwardSuppose a firm has had the following historic sales figures. What would be the forecast for next year's sales using the average approach? You must use the built-in Excel function to answer this question. Input area: Year Sales 2016 2017 2018 es es e $ 1,500,000 $ 1,750,000 $ 1,400,000 2019 $ 2,000,000 2020 $ 1,600,000 Output area: Next year's salesarrow_forwardYou are a financial Manager of Chevron Corp. You need to assess the effectiveness of working capital management of the company for 2018 using the following data. What is the 2018 Receivable turnover? 2017 Account Receivable = 15,353 000 2018 Account Receivable = 15.050,00O 2017 Inventory = 5,585.000 2018 Inventory = 5 704.00O 2017 Accounts Payable= 14 565 00I 2018 Accounts Payable = 13 953 000 2017 Sales 134,674 000 2018 Sales 158.902 000. 2017 Cost of Sales = 95 114.000 2018 Cost of Sales = 113 997 000 2017 Purchases= 95 114 000 2018 PurchaSes = 123 435 000arrow_forward

- Alpha Milk Corp is considering taking over their competitor, Dana Dairy Products, and asked your consultancy firm to perform financial statement analysis to assess feasibility of this strategic initiative. You are given the following key financial ratios, the firm’s income statement and the balance sheet. You can assume that there are 365 days in a year. a) Using the information provided for 31 Dec 2005, calculate the following: net working capital, current ratio, quick ratio, inventory turnover, average collection period, total debt ratio, gross profit margin, net profit margin, return on total assets, return on equity. b) Evaluate the company’s performance against industry average ratios and compare with last year’s results. To answer, please refer to pictures attachedarrow_forwardFind online the annual 10-K report for Costco Wholesale Corporation (COST) for fiscal year 2015 (filed in October 2015). a. Compute Costco's net profit margin, total asset turnover, and equity multiplier. b. Verify the DuPont Identity for Costco's ROE. c. If Costco's managers wanted to increase its ROE by 1 percentage point, how much higher would their asset turnover need to be? a. Compute Costco's net profit margin, total asset turnover, and equity multiplier. The net profit margin is %. (Round to two decimal places.) The total asset turnover is (Round to two decimal places.) The equity multiplier is (Round to two decimal places.) b. Verify the DuPont Identity forCostco's ROE. The ROE is %. (Round to two decimal places.) c. If Costco's managers wanted to increase its ROE by 1 percentage point, how much higher would their asset turnover need to be? The total assets turnover should be (Round to two decimal places.) The total asset turnover should be % (Round to two decimal places and…arrow_forwardBased on this information, create and solve a ratio analysis: In their most recent discussion with VP Finance, they were informed that total sales next year (2022) was expected to be $1,500,000. You should assume the same amount of turnover in 2022 as there was in the past 5 years. Number of new hires and turnover by year Year New Hires Turnover 2017 10 5 2018 20 7 2019 22 9 2020 25 12 2021 15 15 Sales per year Year Service Sales Product Sales 2017 $250,000 $ 200,000 2018 $350,000 $325,000 2019 $400,000 $450,000 2020 $550,000 $600,000 2021 $625,000 $675,000 How many employees need to be hired in 2022, show all calculationsarrow_forward

- You've collected the following information about Groot, Inc.: Profit margin Total asset turnover Total debt ratio Payout ratio = 4.44% = 3.50 = .25 = 29% a. What is the sustainable growth rate for the company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the ROA? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Sustainable growth rate b. ROA % 15.54 %arrow_forwardUsing ROI and RI to evaluate investment centers This problem continues the Piedmont Computer Company situation from Chapter 23. Piedmont Computer Company reported 2020 sales of $3,500,000 and Operating income of $183,600. Average total assets during 2020 were $600,000. Piedmont Computer Company’s target rate of return is 16%. Calculate Piedmont Computer Company’s profit margin ratio, asset turnover ratio, ROI, and RI for 2020. Comment on the results.arrow_forwardMoore Money is a financial services firm specializing in fixed-income investments. You have beenasked by the accounting manager to analyze the company’s financial data from the last quarter. Youfind the firm had return on investment (ROI) of 15% and asset turnover of 0.5. What was the returnon sales (ROS) for the quarter?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License