Concept explainers

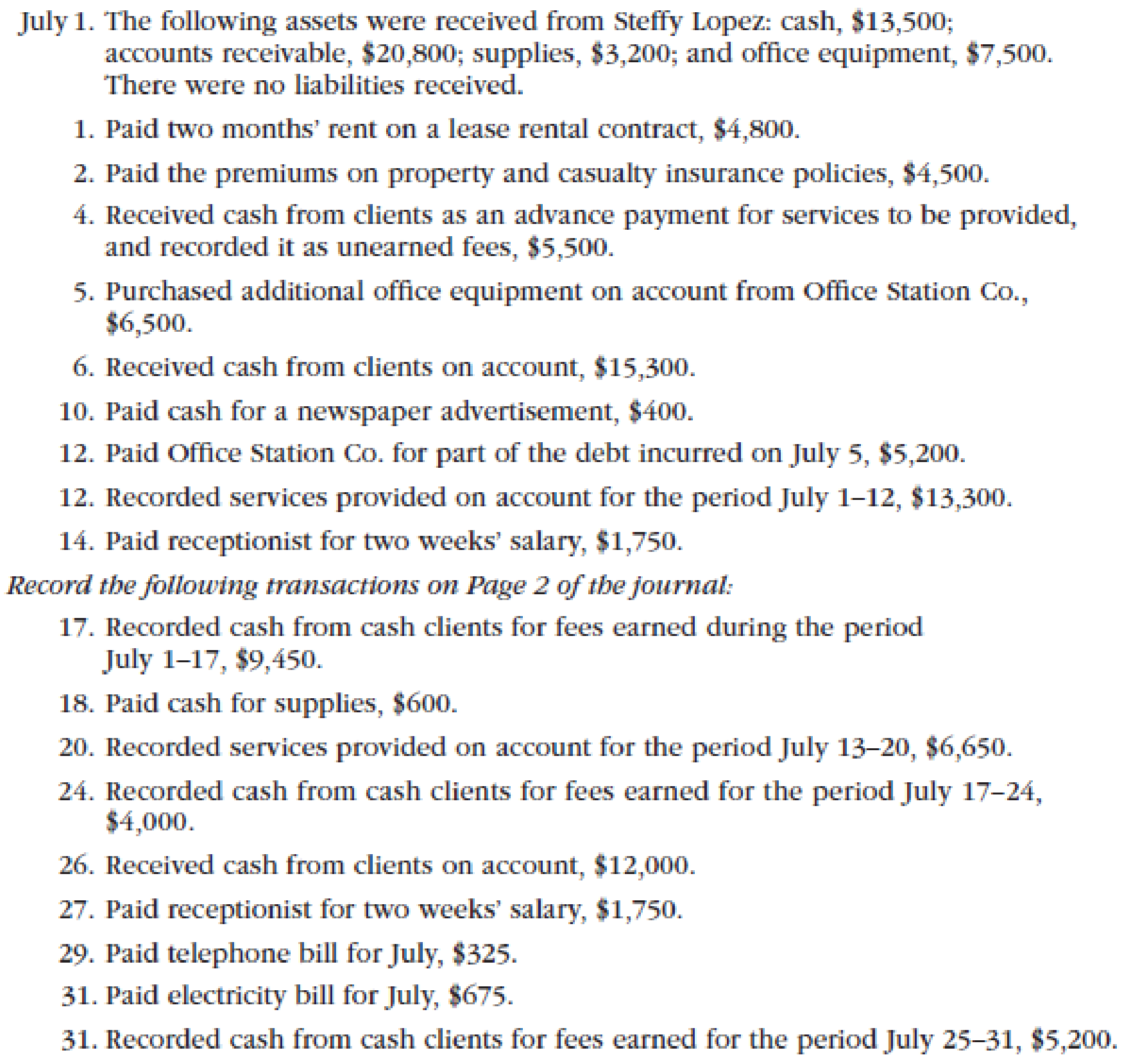

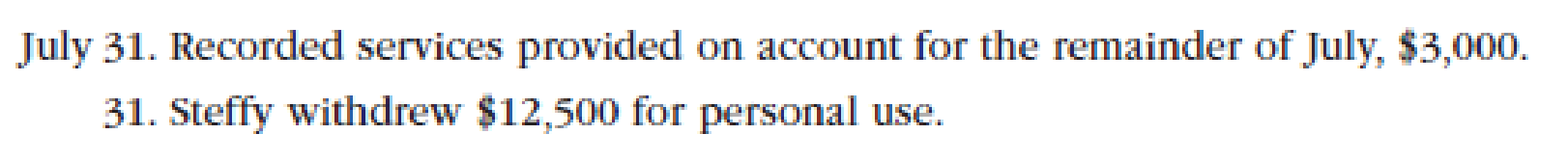

For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2016, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond Consulting entered into the following transactions during July:

Instructions

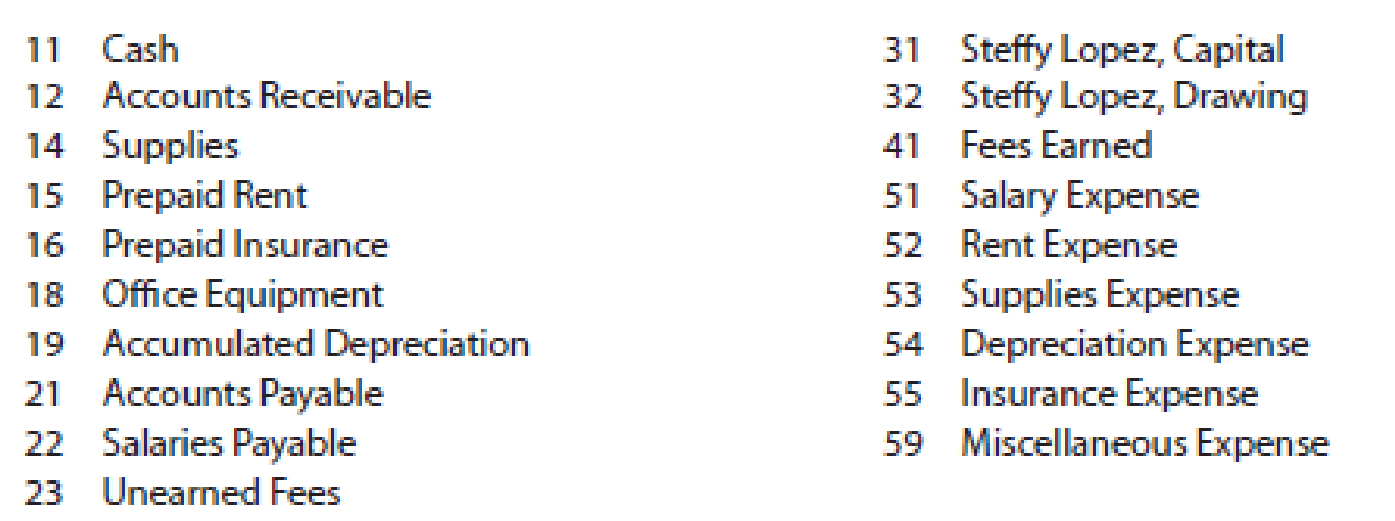

1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.)

2. Post the journal to a ledger of four-column accounts.

3. Prepare an unadjusted

4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).

- a. Insurance expired during July is $375.

- b. Supplies on hand on July 31 are $1,525.

- c.

Depreciation of office equipment for July is $750. - d. Accrued receptionist salary on July 31 is $175.

- e. Rent expired during July is $2,400.

- f. Unearned fees on July 31 are $2,750.

5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet.

6. Journalize and post the

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a statement of owner’s equity, and a balance sheet.

9. Prepare and post the closing entries. (Income Summary is account #33 in the chart of accounts.) Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry.

10. Prepare a post-closing trial balance.

(1)

Journalize the transactions of July in a two column journal beginning on page 1.

Explanation of Solution

Journal: Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts: T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance: The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries: An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement: An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet: A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries: Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance: After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

Journal: Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts: T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance: The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries: An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement: An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet: A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries: Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance: After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

Journalize the transactions of July in a two column journal beginning on page 1.

| Journal Page 1 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2016 | Cash | 11 | 13,500 | ||

| July | 1 | Accounts receivable | 12 | 20,800 | |

| Supplies | 14 | 3,200 | |||

| Office equipment | 18 | 7,500 | |||

| Common stock | 31 | 45,000 | |||

| (To record the receipt of assets) | |||||

| 1 | Prepaid Rent | 15 | 4,800 | ||

| Cash | 11 | 4,800 | |||

| (To record the payment of rent) | |||||

| 2 | Prepaid insurance | 16 | 4,500 | ||

| Cash | 11 | 4,500 | |||

| (To record the payment of insurance premium) | |||||

| 4 | Cash | 11 | 5,500 | ||

| Unearned rent | 23 | 5,500 | |||

| (To record the cash received for the service yet to be provide) | |||||

| 5 | Office equipment | 18 | 6,500 | ||

| Accounts payable | 21 | 6,500 | |||

| (To record the purchase of supplies of account) | |||||

| 6 | Cash | 11 | 15,300 | ||

| Accounts receivable | 12 | 15,300 | |||

| (To record the cash received from clients) | |||||

| 10 | Miscellaneous expense | 59 | 400 | ||

| Cash | 11 | 400 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 12 | Accounts payable | 21 | 5,200 | ||

| Office supplies | 11 | 5,200 | |||

| (To record the payment made to creditors on account) | |||||

| 12 | Accounts receivable | 12 | 13,300 | ||

| Fees earned | 41 | 13,300 | |||

| (To record the revenue earned and billed) | |||||

| 14 | Salary Expense | 51 | 1,750 | ||

| Cash | 11 | 1,750 | |||

| (To record the payment made for salary) | |||||

Table (1)

| Journal Page 2 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2016 | Cash | 11 | 9,450 | ||

| July | 17 | Fees earned | 41 | 9,450 | |

| (To record the receipt of cash) | |||||

| 18 | Supplies | 14 | 600 | ||

| Cash | 11 | 600 | |||

| (To record the payment made for automobile expense) | |||||

| 20 | Accounts receivable | 12 | 6,650 | ||

| Fees earned | 41 | 6,650 | |||

| (To record the payment of advertising expense) | |||||

| 24 | Cash | 11 | 4,000 | ||

| Fees earned | 41 | 4,000 | |||

| (To record the cash received from client for fees earned) | |||||

| 26 | Cash | 11 | 12,000 | ||

| Accounts receivable | 12 | 12,000 | |||

| (To record the cash received from clients) | |||||

| 27 | Salary expense | 51 | 1,750 | ||

| Cash | 11 | 1,750 | |||

| (To record the payment of salary) | |||||

| 29 | Miscellaneous Expense | 59 | 325 | ||

| Cash | 11 | 325 | |||

| (To record the payment of telephone charges) | |||||

| 31 | Miscellaneous Expense | 59 | 675 | ||

| Cash | 11 | 675 | |||

| (To record the payment of electricity charges) | |||||

| 31 | Cash | 11 | 5,200 | ||

| Fees earned | 41 | 5,200 | |||

| (To record the cash received from client for fees earned) | |||||

| 31 | Accounts receivable | 12 | 3,000 | ||

| Fees earned | 41 | 3,000 | |||

| (To record the revenue earned and billed) | |||||

| 31 | Dividends | 33 | 12,500 | ||

| Cash | 11 | 12,500 | |||

| (To record the dividends made for personal use) | |||||

Table (2)

(2), (6) and (9)

Record the balance of each accounts in the appropriate balance column of a four-column account and post them to the ledger.

Explanation of Solution

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 1 | 1 | 13,500 | 13,500 | |||

| 1 | 1 | 4,800 | 8,700 | ||||

| 2 | 1 | 4,500 | 4,200 | ||||

| 4 | 1 | 5,500 | 9,700 | ||||

| 6 | 1 | 15,300 | 25,000 | ||||

| 10 | 1 | 400 | 24,600 | ||||

| 12 | 1 | 5,200 | 19,400 | ||||

| 14 | 1 | 1,750 | 17,650 | ||||

| 17 | 2 | 9,450 | 27,100 | ||||

| 18 | 2 | 600 | 26,500 | ||||

| 24 | 2 | 4,000 | 30,500 | ||||

| 26 | 2 | 12,000 | 42,500 | ||||

| 27 | 2 | 1,750 | 40,750 | ||||

| 29 | 2 | 325 | 40,425 | ||||

| 31 | 2 | 675 | 39,750 | ||||

| 31 | 2 | 5,200 | 44,950 | ||||

| 31 | 2 | 12,500 | 32,450 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 1 | 1 | 20,800 | 20,800 | |||

| 6 | 1 | 15,300 | 5,500 | ||||

| 12 | 1 | 13,300 | 18,800 | ||||

| 20 | 2 | 6,650 | 25,450 | ||||

| 26 | 2 | 12,000 | 13,450 | ||||

| 31 | 2 | 3,000 | 16,450 | ||||

Table (4)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 1 | 1 | 3,200 | 3,200 | |||

| 18 | 2 | 600 | 3,800 | ||||

| 31 | Adjusting | 3 | 2,275 | 1,525 | |||

Table (5)

| Account: Prepaid Rent Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 1 | 1 | 4,800 | 4,800 | |||

| 31 | Adjusting | 3 | 2,400 | 2,400 | |||

Table (6)

| Account: Prepaid Insurance Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 2 | 1 | 4,500 | 4,500 | |||

| 31 | Adjusting | 3 | 375 | 4,125 | |||

Table (7)

| Account: Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 1 | 1 | 7,500 | 7,500 | |||

| 5 | 1 | 6,500 | 14,000 | ||||

Table (8)

| Account: Accumulated Depreciation-Office equipment Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 31 | Adjusting | 3 | 750 | 750 | ||

Table (9)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 5 | 1 | 6,500 | 6,500 | |||

| 12 | 1 | 5,200 | 1,300 | ||||

Table (10)

| Account: Salaries Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 31 | Adjusting | 3 | 175 | 175 | ||

Table (11)

| Account: Unearned Fees Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 4 | 1 | 5,500 | 5,500 | |||

| 31 | Adjusting | 3 | 2,750 | 2,750 | |||

Table (12)

| Account: SL Capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 1 | 1 | 45,000 | 45,000 | |||

| 31 | Closing | 4 | 33,475 | 33,475 | |||

| 31 | Closing | 4 | 12,500 | 20,975 | |||

Table (13)

| Account: Drawings Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 31 | 2 | 12,500 | 12,500 | |||

| 31 | Closing | 4 | 12,500 | ||||

Table (14)

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 31 | Closing | 4 | 44,350 | 44,350 | ||

| 31 | Closing | 4 | 10,875 | 33,475 | |||

| 31 | Closing | 4 | 33,475 | ||||

Table (15)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 12 | 1 | 13,300 | 13,300 | |||

| 17 | 2 | 9,450 | 22,750 | ||||

| 20 | 2 | 6,650 | 29,400 | ||||

| 24 | 2 | 4,000 | 33,400 | ||||

| 31 | 2 | 5,200 | 38,600 | ||||

| 31 | 2 | 3,000 | 41,600 | ||||

| 31 | Adjusting | 3 | 2,750 | 44,350 | |||

| 31 | Closing | 4 | 59,700 | ||||

Table (16)

| Account: Salary expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 14 | 1 | 1,750 | 1,750 | |||

| 27 | 2 | 1,750 | 3,500 | ||||

| 31 | Adjusting | 3 | 175 | 3,675 | |||

| 31 | Closing | 4 | 3,675 | ||||

Table (17)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 31 | Adjusting | 3 | 2,400 | 2,400 | ||

| 31 | Closing | 4 | 2,400 | ||||

Table (18)

| Account: Supplies expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 31 | Adjusting | 3 | 2,275 | 2,275 | ||

| 31 | Closing | 4 | 2,275 | ||||

Table (19)

| Account: Depreciation expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 31 | Adjusting | 3 | 750 | 750 | ||

| 31 | Closing | 4 | 750 | ||||

Table (20)

| Account: Insurance expense Account no. 54 | ||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 2016 | ||||||||

| July | 31 | Adjusting | 3 | 375 | 375 | |||

| 31 | Closing | 4 | 375 | |||||

Table (21)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| July | 10 | 1 | 400 | 400 | |||

| 29 | 2 | 325 | 725 | ||||

| 31 | 2 | 675 | 1,400 | ||||

| 31 | Closing | 4 | 1,400 | ||||

Table (22)

(3)

Prepare unadjusted trial balance of Consulting D at July, 31.

Explanation of Solution

Prepare an unadjusted trial balance of Consulting D for the month ended July, 31 as follows:

|

D Consulting Unadjusted Trial Balance July 31, 2016 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 32,450 | |

| Accounts receivable | 12 | 16,450 | |

| Supplies | 14 | 3,800 | |

| Prepaid insurance | 16 | 4,500 | |

| Prepaid rent | 15 | 4,800 | |

| Office Equipment | 18 | 14,000 | |

| Accounts payable | 21 | 1,300 | |

| Unearned fees | 23 | 5,500 | |

| SL Capital | 31 | 45,000 | |

| Dividends | 33 | 12,500 | |

| Fees earned | 41 | 41,600 | |

| Salary expense | 51 | 3,500 | |

| Miscellaneous expense | 59 | 1,500 | |

| Total | $93,400 | $93,400 | |

Table (23)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $93,400.

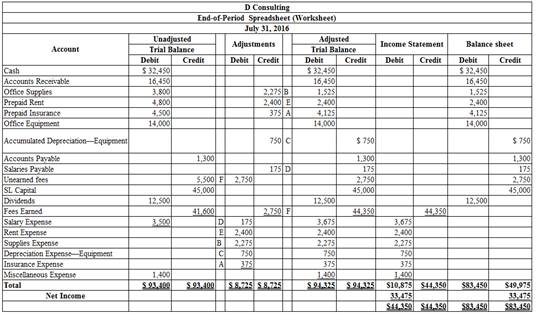

(5)

Enter the unadjusted trial balance on an end-of-period spreadsheet.

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (24)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

(6)

Journalize the adjusting entries of Consulting D for July 31.

Explanation of Solution

The adjusting entries of Consulting D for July 31, 2016 are as follows:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) | |

| 2016 | Insurance expense | 55 | 375 | ||

| July | 31 | Prepaid insurance | 16 | 375 | |

| (To record the insurance expense for July) | |||||

| 31 | Supplies expense | 53 | 2,275 | ||

| Supplies | 14 | 2,275 | |||

| (To record the supplies expense) | |||||

| 31 | Depreciation expense | 54 | 750 | ||

| Accumulated Depreciation | 19 | 750 | |||

| (To record the depreciation and the accumulated depreciation) | |||||

| 31 | Salaries expense | 51 | 175 | ||

| Salaries payable | 22 | 175 | |||

| (To record the accrued salaries payable) | |||||

| 31 | Rent expense | 52 | 2,400 | ||

| Prepaid rent | 15 | 2,400 | |||

| (To record the rent expense for July) | |||||

| 31 | Unearned fees | 23 | 2,750 | ||

| Fees earned | 41 | 2,750 | |||

| (To record the receipt of unearned fees) | |||||

Table (25)

Working notes:

(7)

Prepare adjusted trial balance of Consulting D for July 31, 2016.

Explanation of Solution

An adjusted trial balance of Consulting D for July 31, 2016 is prepared as follows:

|

D Consulting Adjusted Trial Balance July 31, 2016 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 32,450 | |

| Accounts receivable | 12 | 16,450 | |

| Supplies | 14 | 1,525 | |

| Prepaid insurance | 16 | 4,125 | |

| Prepaid rent | 15 | 2,400 | |

| Office Equipment | 18 | 14,000 | |

| Accumulated Depreciation-Office equipment | 19 | 750 | |

| Accounts payable | 21 | 1,300 | |

| Salaries payable | 22 | 175 | |

| Unearned fees | 23 | 2,750 | |

| Common stock | 31 | 45,000 | |

| Dividends | 33 | 12,500 | |

| Fees earned | 41 | 44,350 | |

| Salary expense | 51 | 3,675 | |

| Rent expense | 52 | 2,400 | |

| Supplies Expense | 53 | 2,275 | |

| Depreciation expense | 54 | 750 | |

| Insurance expense | 55 | 375 | |

| Miscellaneous expense | 59 | 1,400 | |

| Total | $94,325 | $94,325 | |

Table (26)

The debit column and credit column of the adjusted trial balance are agreed, both having balance of $94,325.

(8)

Prepare an income statement for the year ended July 31, 2016.

Explanation of Solution

An income statement for the year ended July 31, 2016 is as follows:

| D Consulting | ||

| Income Statement | ||

| For the year ended July 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Fees Earned | 44,350 | |

| Expenses: | ||

| Salaries Expense | 3,675 | |

| Rent Expense | 2,400 | |

| Supplies Expense | 2,275 | |

| Depreciation Expense- Building | 750 | |

| Insurance Expense | 375 | |

| Miscellaneous Expense | 1,400 | |

| Total Expenses | 10,875 | |

| Net Income | $33,475 | |

Table (28)

Hence, the net income of D Consulting for the year ended July 31, 2016 is $33,475.

Prepare the statement of owner’s equity for the year ended July 31, 2016.

Explanation of Solution

The statement of owner’s equity for the year ended July 31, 2016 is as follows:

| D Consulting | ||

| Statement of Owner’s Equity | ||

| For the Year Ended July 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| SL, Capital, July 1, 2016 | 0 | |

| Add: Net income | $33,475 | |

| Add: Investment made during the period | 45,000 | |

| Less: Withdrawals | (12,500) | |

| Increase in owner’s equity | 65,975 | |

| SL,, Capital, July 31, 2016 | $65,975 | |

Table (29)

Hence, owner’s equity for the year ended July 31, 2016 is 65,975.

Prepare the balance sheet of D Consulting at July 31, 2016.

Explanation of Solution

The balance sheet of D Consulting at July 31, 2016 is prepared as follows:

| D Consulting | ||

| Balance Sheet | ||

| At July 31, 2016 | ||

| Assets | ||

| Current Assets: | $ | $ |

| Cash | 32,450 | |

| Accounts Receivable | 16,450 | |

| Supplies | 1,525 | |

| Prepaid Rent | 2,400 | |

| Prepaid Insurance | 4,125 | |

| Total Current Assets | 56,950 | |

| Property, plant and equipment: | ||

| Office Equipment | 14,000 | |

| Less: Accumulated Depreciation | 750 | |

| Total Plant Assets | 13,250 | |

| Total Assets | $70,200 | |

| Liabilities | ||

| Current Liabilities: | 1,300 | |

| Accounts Payable | 175 | |

| Salaries Payable | 2,750 | |

| Unearned Rent | 4,225 | |

| Total Liabilities | ||

| Owners’ Equity | ||

| SL Capital | 65975 | |

| Total Owners’ Equity | 65,975 | |

| Total Liabilities and Owners’ Equity | $70,200 | |

Table (30)

Therefore, the total assets and total liabilities plus retained earnings of Company D at July 31, 2016 are $70,200.

(9)

Journalize the closing entries for D Consulting.

Answer to Problem 5PA

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 31, 2016 | Fees Earned | 41 | 44,350 | |

| Income Summary | 34 | 44,350 | ||

| (To record the closure of revenues account ) | ||||

| Income Summary | 34 | 10,875 | ||

| Salary Expense | 51 | 3,675 | ||

| Rent Expense | 52 | 2,400 | ||

| Supplies Expense | 53 | 2,275 | ||

| Depreciation Expense- Office Equipment | 54 | 750 | ||

| Insurance Expense | 55 | 375 | ||

| Miscellaneous Expense | 59 | 1,400 | ||

| (To close the expenses account. Then the balance amount are transferred to income summary account) | ||||

| Income Summary | 34 | 33,475 | ||

| SL Capital | 32 | 33,475 | ||

| (To close balance of income summary are transferred to owners’ capital account) | ||||

| SL’s Capital | 32 | 12,500 | ||

| SL Drawing | 33 | 12,500 | ||

| (To Close the capital and drawings account) | ||||

Table (31)

Explanation of Solution

- Service revenue is revenue account. Since the amount of revenue is closed, and transferred to SL’s capital account. Here, Company D earned an income of $160,000. Therefore, it is debited.

- Wages Expense, Rent Expense, Insurance Expense, Utilities Expense, Laundry Supplies Expense, Depreciation Expense, SL Capital, and Miscellaneous Expense are expense accounts. Since the amount of expenses are closed to Income Summary account. Therefore, it is credited.

- Owner’s capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

- Owner’s drawings are a component of owner’s equity. It is credited because the balance of owners’ drawing account is transferred to owners ‘capital account

(10)

Prepare post–closing trial balance of D Consulting for the month ended July 31, 2016.

Explanation of Solution

Prepare a post–closing trial balance of D Consulting for the month ended July 31, 2016 as follows:

|

Company D Post-closing Trial Balance July, 31, 2016 | |||

| Particulars | Account Number | Debit $ | Credit $ |

| Cash | 11 | 32,450 | |

| Accounts receivable | 12 | 16,450 | |

| Supplies | 14 | 1,525 | |

| Prepaid rent | 15 | 2,400 | |

| Prepaid insurance | 16 | 4,125 | |

| Office Equipment | 18 | 14,000 | |

| Accumulated depreciation –Office Equipment | 19 | 750 | |

| Accounts payable | 21 | 1,300 | |

| Salaries payable | 22 | 175 | |

| Unearned rent | 23 | 2,750 | |

| S’s Capital | 31 | 45,000 | |

| Retained earnings | 32 | 20,975 | |

| Total | $70,950 | $70,950 | |

Table (32)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $70,950.

Want to see more full solutions like this?

Chapter 4 Solutions

Cengagenow For Financial Accounting

- For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 2016, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud Consulting entered into the following transactions during April: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during April is 350. b. Supplies on hand on April 30 are 1,225. c. Depreciation of office equipment for April is 400. d. Accrued receptionist salary on April 30 is 275. e. Rent expired during April is 2,000. f. Unearned fees on April 30 are 2,350. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardOn October 1, 2016, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2016. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forwardOn November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month, Patty completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016. 4. Determine the excess of revenues over expenses for November. 5. Can you think of any reason why the amount determined in (4) might not be the net income for November?arrow_forward

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardComplete accounting cycle For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 20Y2, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond entered into the following transactions during July: Record the following transactions on Page 2 of the journal: Instructions 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a) Insurance expired during July is 375. (b) Supplies on hand on July 31 are 1,525. (c) Depreciation of office equipment for July is 750. (d) Accrued receptionist salary on July 31 is 175. (e) Rent expired during July is 2,400. (f) Unearned fees on July 31 are 2,750. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forward

- Complete accounting cycle For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 20Y6, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud entered into the following transactions during April: Record the following transactions on Page 2 of the journal: Instructions 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a) Insurance expired during April is 350. (b) Supplies on hand on April 30 are 1,225. (c) Depreciation of office equipment for April is 400. (d) Accrued receptionist salary on April 30 is 275. (e) Rent expired during April is 2,000. (f) Unearned fees on April 30 are 2,350. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardIn October, A. Nguyen established an apartment rental service. The account headings are presented below. Transactions completed during the month of October follow. a. Nguyen deposited 25,000 in a bank account in the name of the business. b. Paid the rent for the month, 1,200, Ck. No. 2015. c. Bought supplies on account, 225. d. Bought a truck for 18,000, paying 1,000 in cash and placing the remainder on account e. Bought Insurance for the truck for the yean 1,400, Ck. No. 2016. f. Sold services on account 5,000. g. Bought office equipment on account from Henry Office Supply, 2,300. h. Sold services for cash for the first half of the month, 6,050. i. Received and paid the bill for utilities, 150, Ck. No. 2017. j. Received a bill for gas and oil for the truck. 80. k. Paid wages to the employees, 1,400, Ck Nos. 20182020. l. Sold services for cash for the remainder of the month, 4,200. m. Nguyen withdrew cash for personal use, 2,000, Ck. No. 2021. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, reanalyze each transaction.arrow_forwardOn October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forward

- Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Instructions 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardWyoming Tours Co. is a travel agency. The nine transactions recorded by Wyoming Tours during June 2016, its first month of operations, are indicated in the following T accounts: Indicate for each debit and each credit: (a) whether an asset, liability, owners equity, drawing, revenue, or expense account was affected and (b) whether the account was increased (+) or decreased (). Present your answers in the following form, with transaction (1) given as an example:arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,