Concept explainers

Complete accounting cycle

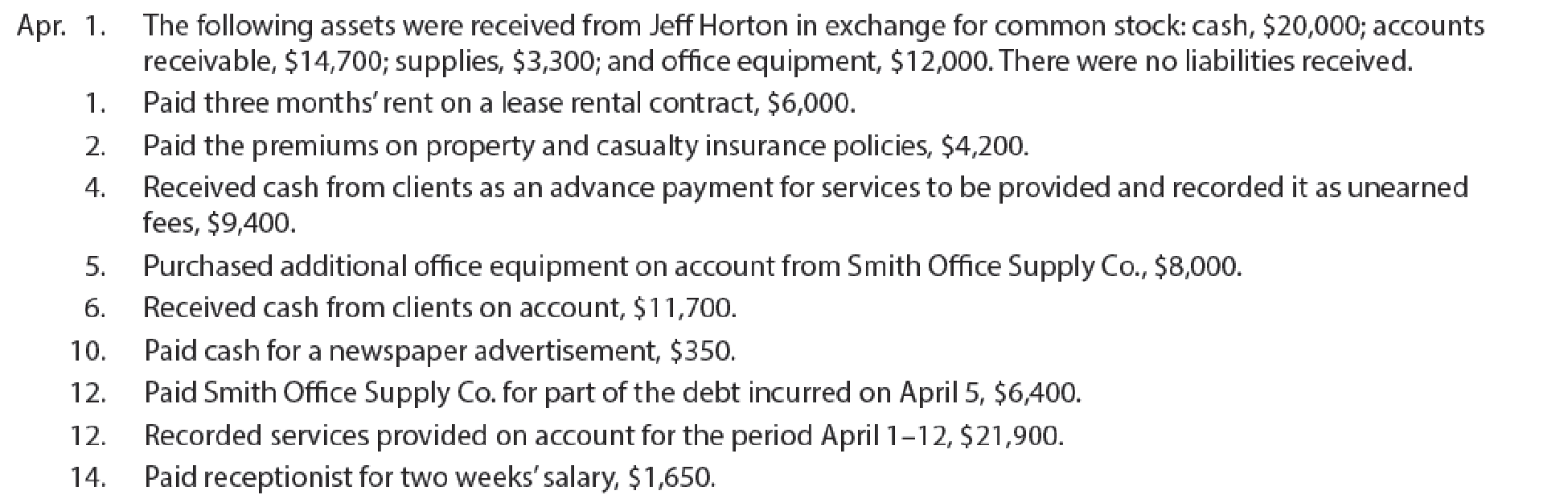

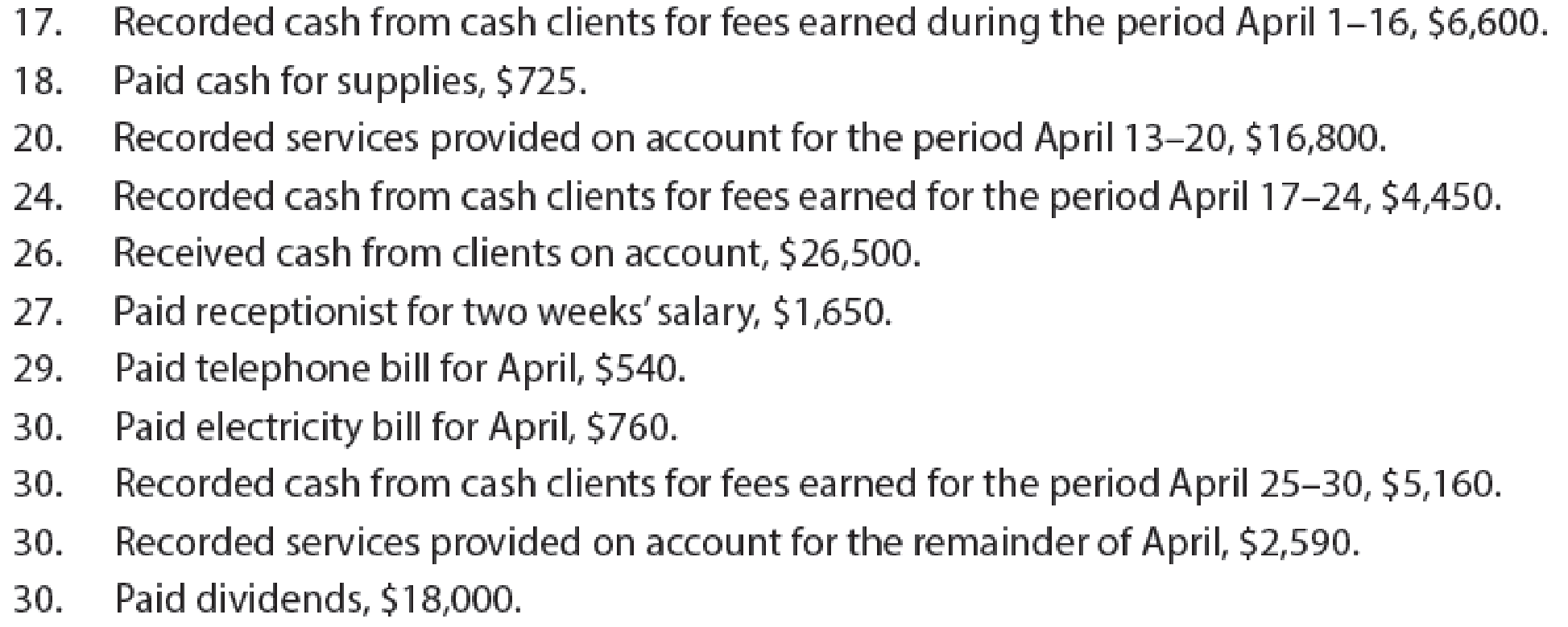

For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 20Y6, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud entered into the following transactions during April:

Record the following transactions on Page 2 of the journal:

Instructions

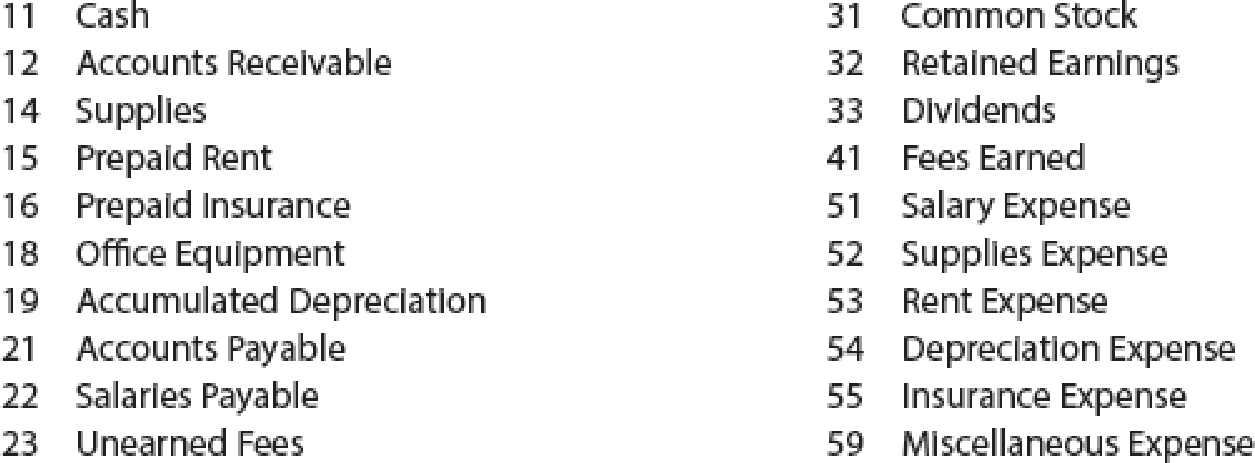

- 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.)

- 2. Post the journal to a ledger of four-column accounts.

- 3. Prepare an unadjusted

trial balance . - 4. At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).

- (a) Insurance expired during April is $350.

- (b) Supplies on hand on April 30 are $1,225.

- (c)

Depreciation of office equipment for April is $400. - (d) Accrued receptionist salary on April 30 is $275.

- (e) Rent expired during April is $2,000.

- (f) Unearned fees on April 30 are $2,350.

- 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet.

- 6. Journalize and post the

adjusting entries . Record the adjusting entries on Page 3 of the journal. - 7. Prepare an adjusted trial balance.

- 8. Prepare an income statement, a statement of stockholders’ equity, and a balance sheet.

- 9. Prepare and

post the closing entries. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. - 10. Prepare a post-closing trial balance.

1 and 2.

Journalize the transactions of April in a two column journal beginning on page 1 and the following in page 2.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Journalize the transactions of April in a two column journal beginning on page 1.

| Journal Page 1 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y6 | Cash | 11 | 20,000 | ||

| April | 1 | Accounts receivable | 12 | 14,700 | |

| Supplies | 14 | 3,300 | |||

| Office equipment | 18 | 12,000 | |||

| Common stock | 31 | 50,000 | |||

| (To record the receipt of assets) | |||||

| 1 | Prepaid Rent | 15 | 6,000 | ||

| Cash | 11 | 6,000 | |||

| (To record the payment of rent) | |||||

| 2 | Prepaid insurance | 16 | 4,200 | ||

| Cash | 11 | 4,200 | |||

| (To record the payment of insurance premium) | |||||

| 4 | Cash | 11 | 9,400 | ||

| Unearned fees | 23 | 9,400 | |||

| (To record the cash received for the service yet to be provide) | |||||

| 5 | Office equipment | 18 | 8,000 | ||

| Accounts payable | 21 | 8,000 | |||

| (To record the purchase of supplies of account) | |||||

| 6 | Cash | 11 | 11,700 | ||

| Accounts receivable | 12 | 11,700 | |||

| (To record the cash received from clients) | |||||

| 10 | Miscellaneous expense | 59 | 350 | ||

| Cash | 11 | 350 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 12 | Accounts payable | 21 | 6,400 | ||

| Office supplies | 11 | 6,400 | |||

| (To record the payment made to creditors on account) | |||||

| 12 | Accounts receivable | 12 | 21,900 | ||

| Fees earned | 41 | 21,900 | |||

| (To record the revenue earned and billed) | |||||

| 14 | Salary Expense | 51 | 1,650 | ||

| Cash | 11 | 1,650 | |||

| (To record the payment made for salary) | |||||

Table (1)

| Journal Page 2 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y6 | Cash | 11 | 6,600 | ||

| April | 17 | Fees earned | 41 | 6,600 | |

| (To record the receipt of cash) | |||||

| 18 | Supplies | 14 | 725 | ||

| Cash | 11 | 725 | |||

| (To record the payment made for automobile expense) | |||||

| 20 | Accounts receivable | 12 | 16,800 | ||

| Fees earned | 41 | 16,800 | |||

| (To record the payment of advertising expense) | |||||

| 24 | Cash | 11 | 4,450 | ||

| Fees earned | 41 | 4,450 | |||

| (To record the cash received from client for fees earned) | |||||

| 26 | Cash | 11 | 26,500 | ||

| Accounts receivable | 12 | 26,500 | |||

| (To record the cash received from clients) | |||||

| 27 | Salary expense | 51 | 1,650 | ||

| Cash | 11 | 1,650 | |||

| (To record the payment of salary) | |||||

| 29 | Miscellaneous Expense | 59 | 540 | ||

| Cash | 11 | 540 | |||

| (To record the payment of telephone charges) | |||||

| 31 | Miscellaneous Expense | 59 | 760 | ||

| Cash | 11 | 760 | |||

| (To record the payment of electricity charges) | |||||

| 31 | Cash | 11 | 5,160 | ||

| Fees earned | 41 | 5,160 | |||

| (To record the cash received from client for fees earned) | |||||

| 31 | Accounts receivable | 12 | 2,590 | ||

| Fees earned | 41 | 2,590 | |||

| (To record the revenue earned and billed) | |||||

| 31 | Dividends | 33 | 18,000 | ||

| Cash | 11 | 18,000 | |||

| (To record the dividends made for personal use) | |||||

Table (2)

2, 6 and 9.

Record the balance of each account in the appropriate balance column of a four-column account and post them to the ledger.

Explanation of Solution

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 1 | 1 | 20,000 | 20,000 | |||

| 1 | 1 | 6,000 | 14,000 | ||||

| 2 | 1 | 4,200 | 9,800 | ||||

| 4 | 1 | 9,400 | 19,200 | ||||

| 6 | 1 | 11,700 | 30,900 | ||||

| 10 | 1 | 350 | 30,550 | ||||

| 12 | 1 | 6,400 | 24,150 | ||||

| 14 | 1 | 1,650 | 22,500 | ||||

| 17 | 2 | 6,600 | 29,100 | ||||

| 18 | 2 | 725 | 28,375 | ||||

| 24 | 2 | 4,450 | 32,825 | ||||

| 26 | 2 | 26,500 | 59,325 | ||||

| 27 | 2 | 1,650 | 57,675 | ||||

| 29 | 2 | 540 | 57,135 | ||||

| 31 | 2 | 760 | 56,375 | ||||

| 31 | 2 | 5,160 | 61,535 | ||||

| 31 | 2 | 18,000 | 43,535 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 1 | 1 | 14,700 | 14,700 | |||

| 6 | 1 | 11,700 | 3,000 | ||||

| 12 | 1 | 21,900 | 24,900 | ||||

| 20 | 2 | 16,800 | 41,700 | ||||

| 26 | 2 | 26,500 | 15,200 | ||||

| 31 | 2 | 2,590 | 17,790 | ||||

Table (4)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 1 | 1 | 3,300 | 3,300 | |||

| 18 | 2 | 725 | 4,025 | ||||

| 31 | Adjusting | 3 | 2,800 | 1,225 | |||

Table (5)

| Account: Prepaid Rent Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 1 | 1 | 6,000 | 6,000 | |||

| 31 | Adjusting | 3 | 2,000 | 4,000 | |||

Table (6)

| Account: Prepaid Insurance Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 2 | 1 | 4,200 | 4,200 | |||

| 31 | Adjusting | 3 | 350 | 3,850 | |||

Table (7)

| Account: Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 1 | 1 | 12,000 | 12,000 | |||

| 5 | 1 | 8,000 | 20,000 | ||||

Table (8)

| Account: Accumulated Depreciation-Office equipment Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 31 | Adjusting | 3 | 400 | 400 | ||

Table (9)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 5 | 1 | 8,000 | 8,000 | |||

| 12 | 1 | 6,400 | 1,600 | ||||

Table (10)

| Account: Salaries Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 31 | Adjusting | 3 | 275 | 275 | ||

Table (11)

| Account: Unearned Fees Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 4 | 1 | 9,400 | 9,400 | |||

| 31 | Adjusting | 3 | 7,050 | 2,350 | |||

Table (12)

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 1 | 1 | 50,000 | 50,000 | |||

Table (13)

| Account: Retained earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 1 | 0 | |||||

| 31 | Closing | 4 | 53,775 | 53,775 | |||

| 31 | Closing | 4 | 18,000 | 35,775 | |||

Table (14)

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 31 | 2 | 18,000 | 18,000 | |||

| 31 | Closing | 4 | 18,000 | ||||

Table (15)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 12 | 1 | 21,900 | 21,900 | |||

| 17 | 2 | 6,600 | 28,500 | ||||

| 20 | 2 | 16,800 | 45,300 | ||||

| 24 | 2 | 4,450 | 49,750 | ||||

| 31 | 2 | 5,160 | 54,910 | ||||

| 31 | 2 | 2,590 | 57,500 | ||||

| 31 | Adjusting | 3 | 7,050 | 64,500 | |||

| 31 | Closing | 4 | 64,500 | ||||

Table (16)

| Account: Salary expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 14 | 1 | 1,650 | 1,650 | |||

| 27 | 2 | 1,650 | 3,300 | ||||

| 31 | Adjusting | 3 | 275 | 3,575 | |||

| 31 | Closing | 4 | 3,575 | ||||

Table (17)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 31 | Adjusting | 3 | 2,000 | 2,000 | ||

| 31 | Closing | 4 | 2,000 | ||||

Table (18)

| Account: Supplies expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 31 | Adjusting | 3 | 2,800 | 2,800 | ||

| 31 | Closing | 4 | 2,800 | ||||

Table (19)

| Account: Depreciation expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 31 | Adjusting | 3 | 400 | 400 | ||

| 31 | Closing | 4 | 400 | ||||

Table (20)

| Account: Insurance expense Account no. 54 | ||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 20Y6 | ||||||||

| April | 31 | Adjusting | 3 | 350 | 350 | |||

| 31 | Closing | 4 | 350 | |||||

Table (21)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y6 | |||||||

| April | 10 | 1 | 350 | 350 | |||

| 29 | 2 | 540 | 890 | ||||

| 31 | 2 | 760 | 1,650 | ||||

| 31 | Closing | 4 | 1,650 | ||||

Table (22)

3.

Prepare an unadjusted trial balance for Company.

Explanation of Solution

Unadjusted trial balance:

Unadjusted trial balance is that statement which contains complete list of accounts with their unadjusted balances. This statement is prepared at the end of every financial period.

Prepare an unadjusted trial balance for Company.

| Company RC | |||

| Unadjusted Trial Balance | |||

| As of April 31, 20Y6 | |||

| Account titles | Account No. | Debit balances | Credit balances |

| Cash | 11 | 43,535 | |

| Accounts Receivable | 12 | 17,790 | |

| Supplies | 14 | 4,025 | |

| Prepaid Rent | 15 | 6,000 | |

| Prepaid Insurance | 16 | 4,200 | |

| Office Equipment | 18 | 20,000 | |

| Accumulated Depreciation | 19 | 0 | |

| Accounts Payable | 21 | 1,600 | |

| Salaries Payable | 22 | 0 | |

| Unearned Fees | 23 | 9,400 | |

| Common Stock | 31 | 50,000 | |

| Retained Earnings | 32 | 0 | |

| Dividends | 33 | 18,000 | |

| Fees Earned | 41 | 57,500 | |

| Salary Expense | 51 | 3,300 | |

| Rent Expense | 52 | 0 | |

| Supplies Expense | 53 | 0 | |

| Depreciation Expense | 54 | 0 | |

| Insurance Expense | 55 | 0 | |

| Miscellaneous Expense | 59 | 1,650 | |

| Totals | $118,500 | $118,500 | |

Table (23)

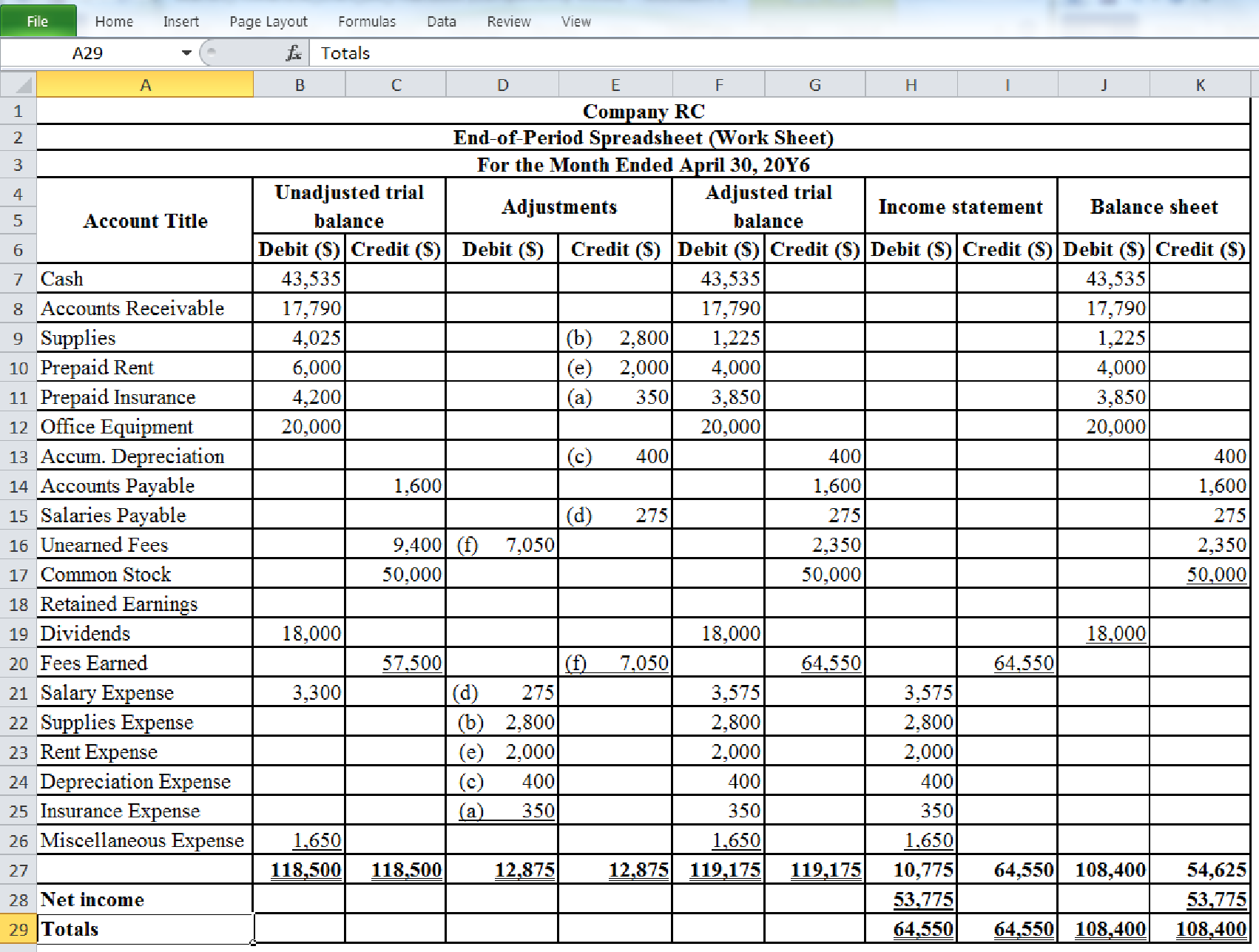

5.

Enter the unadjusted trial balance on an end of period spreadsheet and complete the spread sheet.

Explanation of Solution

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare the end of period spreadsheet and enter the unadjusted trial balance:

Table (24)

6.

Journalize the adjusting entries of Company RC for April 31.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Prepare the adjusting entries:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) | |

| 20Y6 | Insurance expense | 55 | 350 | ||

| April | 31 | Prepaid insurance | 16 | 350 | |

| (To record the insurance expense for April) | |||||

| 31 | Supplies expense | 53 | 2,800 | ||

| Supplies | 14 | 2,800 | |||

| (To record the supplies expense) | |||||

| 31 | Depreciation expense | 54 | 400 | ||

| Accumulated Depreciation | 19 | 400 | |||

| (To record the depreciation and the accumulated depreciation) | |||||

| 31 | Salaries expense | 51 | 275 | ||

| Salaries payable | 22 | 275 | |||

| (To record the accrued salaries payable) | |||||

| 31 | Rent expense | 52 | 2,000 | ||

| Prepaid rent | 15 | 2,000 | |||

| (To record the rent expense for April) | |||||

| 31 | Unearned fees | 23 | 7,050 | ||

| Fees earned | 41 | 7,050 | |||

| (To record the receipt of unearned fees) | |||||

Table (25)

7.

Prepare an adjusted trial balance of Company RC for April 31, 20Y6.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare the adjusted trial balance:

| Company RC | |||

| Adjusted Trial Balance | |||

| As of April 31, 20Y6 | |||

| Account title | Account | Debit balances ($) | Credit balances ($) |

| Cash | 11 | 43,535 | |

| Accounts Receivable | 12 | 17,790 | |

| Supplies | 14 | 1,225 | |

| Prepaid Rent | 15 | 4,000 | |

| Prepaid Insurance | 16 | 3,850 | |

| Office Equipment | 18 | 20,000 | |

| Accumulated Depreciation | 19 | 400 | |

| Accounts Payable | 21 | 1,600 | |

| Salaries Payable | 22 | 275 | |

| Unearned Fees | 23 | 2,350 | |

| Common Stock | 31 | 50,000 | |

| Retained Earnings | 32 | 0 | |

| Dividends | 33 | 18,000 | |

| Fees Earned | 41 | 64,550 | |

| Salary Expense | 51 | 3,575 | |

| Rent Expense | 52 | 2,800 | |

| Supplies Expense | 53 | 2,000 | |

| Depreciation Expense | 54 | 400 | |

| Insurance Expense | 55 | 350 | |

| Miscellaneous Expense | 59 | 1,650 | |

| Totals | $119,715 | $119,175 | |

Table (26)

8.

Prepare an income statement for the year ended April 31, 20Y6.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

| Company RC | ||

| Income Statement | ||

| For the year ended April 31, 20Y6 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Fees Earned | 64,550 | |

| Expenses: | ||

| Salaries Expense | 3,575 | |

| Rent Expense | 2,800 | |

| Supplies Expense | 2,000 | |

| Depreciation Expense- Building | 400 | |

| Insurance Expense | 350 | |

| Miscellaneous Expense | 1,650 | |

| Total Expenses | (10,775) | |

| Net Income | 53,775 | |

Table (27)

Statement of stockholders’ equity: The statement which reports the changes in stock, paid-in capital, retained earnings, and treasury stock, during the year is referred to as statement of stockholders’ equity.

Prepare the statement of stockholders equity for the year ended April 31, 20Y6.

| Company RC | |||

| Statement of Stockholders’ Equity | |||

| For the Month Ended April 31, 20Y6 | |||

| Particulars | Common stock | Retained earnings | Total |

| Beginning balances, April 1, 20Y6 | $0 | $0 | $0 |

| Issued common stock | $50,000 | $50,000 | |

| Net income | $0 | $53,775 | $53,775 |

| Dividends | $0 | ($18,000) | ($18,000) |

| Ending balances, April 31, 20Y6 | $50,000 | $35,775 | $85,775 |

Table (28)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as of April 31, 20Y6:

| Company RC | ||

| Balance Sheet | ||

| As of April 31, 20Y6 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current assets: | ||

| Cash | 43,535 | |

| Accounts receivable | 17,790 | |

| Supplies | 1,225 | |

| Prepaid rent | 4,000 | |

| Prepaid insurance | 3,850 | |

| Total current assets | 70,400 | |

| Property, plant, and equipment: | ||

| Office equipment | 20,000 | |

| Accumulated depreciation | (400) | |

| Total property, plant, and equipment | 19,600 | |

| Total assets | $90,000 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | 1,600 | |

| Salaries payable | 275 | |

| Unearned fees | 2,350 | |

| Total liabilities | 4,225 | |

| Stockholders’ Equity | ||

| Common stock | 50,000 | |

| Retained earnings | 35,775 | |

| Total stockholders’ equity | 85,775 | |

| Total liabilities and stockholders’ equity | $90,000 | |

Table (29)

9.

Journalize the closing entries for Company RC.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Date | Account title and explanation | Post. Ref. | Debit ($) | Credit ($) | |

| 20Y6 | |||||

| April | 31 | Fees Earned | 41 | 64,550 | |

| Salary Expense | 51 | 3,575 | |||

| Rent Expense | 52 | 2,800 | |||

| Supplies Expense | 53 | 2,000 | |||

| Depreciation Expense | 54 | 400 | |||

| Insurance Expense | 55 | 350 | |||

| Miscellaneous Expense | 59 | 1,650 | |||

| Retained Earnings (1) | 32 | 53,775 | |||

| (To record the closing entry for revenue and expense account to retained earnings account) | |||||

| 20Y6 | 31 | Retained Earnings | 32 | 18,000 | |

| April | Dividends | 33 | 18,000 | ||

| (To record the closing entry for dividends account) | |||||

Table (30)

Working note (1):

Calculate the amount of retained earnings account:

10.

Prepare a post–closing trial balance of D Consulting for the month ended April 31, 20Y6.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post–closing trial balance for the year ended April 31, 20Y6:

| Company RC | |||

| Post-Closing Trial Balance | |||

| As of April 31, 20Y6 | |||

| Account title | Account No. | Debit Balances | Credit Balances |

| Cash | 11 | 43,535 | |

| Accounts Receivable | 12 | 17,790 | |

| Supplies | 14 | 1,225 | |

| Prepaid Rent | 15 | 4,000 | |

| Prepaid Insurance | 16 | 3,850 | |

| Office Equipment | 18 | 20,000 | |

| Accumulated Depreciation | 19 | 400 | |

| Accounts Payable | 21 | 1,600 | |

| Salaries Payable | 22 | 275 | |

| Unearned Fees | 23 | 2,350 | |

| Common Stock | 31 | 50,000 | |

| Retained Earnings | 32 | 35,775 | |

| Totals | $90,400 | $90,400 | |

Table (31)

Want to see more full solutions like this?

Chapter 4 Solutions

FINANCIAL&MANAGERIAL ACCOUNTING(LL)W/AC

- Complete accounting cycle For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 20Y2, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond entered into the following transactions during July: Record the following transactions on Page 2 of the journal: Instructions 1. Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a) Insurance expired during July is 375. (b) Supplies on hand on July 31 are 1,525. (c) Depreciation of office equipment for July is 750. (d) Accrued receptionist salary on July 31 is 175. (e) Rent expired during July is 2,400. (f) Unearned fees on July 31 are 2,750. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forwardFor the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 2016, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basis. Rosebud Consulting entered into the following transactions during April: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of April, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during April is 350. b. Supplies on hand on April 30 are 1,225. c. Depreciation of office equipment for April is 400. d. Accrued receptionist salary on April 30 is 275. e. Rent expired during April is 2,000. f. Unearned fees on April 30 are 2,350. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 4 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardJournal entries and trial balance On October 1, 20Y4, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 18,000. 4. Paid rent for period of October 4 to end of month, 3,000. 10. Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13. Purchased equipment on account, 10,500. 14. Purchased supplies for cash, 2,100. Oct. 15. Paid annual premiums on property and casualty insurance, 3,600. 15. Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21. Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24. Recorded jobs completed on account and sent invoices to customers, 14,150. 26. Received an invoice for truck expenses, to be paid in November, 700. 27. Paid utilities expense, 2,240. 27. Paid miscellaneous expenses, 1,100. 29. Received cash from customers on account, 7,600. 30. Paid wages of employees, 4,800. 31. Paid dividends, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 16 Equipment 18 Truck 21 Notes Payable 22 Accounts Payable 31 Common Stock 33 Dividends 41 Fees Earned 51 Wages Expense 53 Rent Expense 54 Utilities Expense 55 Truck Expense 59 Miscellaneous Expense 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 20Y4. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forward

- Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forwardFor the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 2016, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consulting, on a full-time basis. Diamond Consulting entered into the following transactions during July: Instructions 1.Journalize each transaction in a two-column journal starting on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3.Prepare an unadjusted trial balance. 4.At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during July is 375. b. Supplies on hand on July 31 are 1,525. c. Depreciation of office equipment for July is 750. d. Accrued receptionist salary on July 31 is 175. e. Rent expired during July is 2,400. f. Unearned fees on July 31 are 2,750. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. (Income Summary is account #33 in the chart of accounts.) Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardJournal entries and trial balance On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 40,000. b. Paid rent on office and equipment for the month, 4,800. c. Purchased supplies on account, 2,150. d. Paid creditor on account, 1,100. e. Earned sales commissions, receiving cash, 18,750. f. Paid automobile expenses (including rental charge) for month, 1,580, and miscellaneous expenses, 800. g. Paid office salaries, 3,500. h. Determined that the cost of supplies used was 1,300. i. Paid dividends, 1,500. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of October 31, 20Y6. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for October. 5. Determine the increase or decrease in retained earnings for October.arrow_forward

- Following is the chart of accounts of Sanchez Realty Company: Sanchez completed the following transactions during April (the first month of business): Required 1. Journalize the transactions for April in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of April 30, 20. 4. Prepare an income statement for the month ended April 30, 20. 5. Prepare a statement of owners equity for the month ended April 30, 20. 6. Prepare a balance sheet as of April 30, 20. If you we using CLGL, use the year 2020 when preparing all reports.arrow_forwardEddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forwardFollowing is the chart of accounts of Smith Financial Services: Smith completed the following transactions during June (the first month of business): Required 1. Journalize the transactions for June in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of June 30, 20. 4. Prepare an income statement for the month ended June 30, 20. 5. Prepare a statement of owners equity for the month ended June 30, 20. 6. Prepare a balance sheet as of June 30, 20.arrow_forward

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forwardOn March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardEFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning