FUND ACCOUNTING PRINCIPLES BUNDLE

25th Edition

ISBN: 9781265380311

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 7E

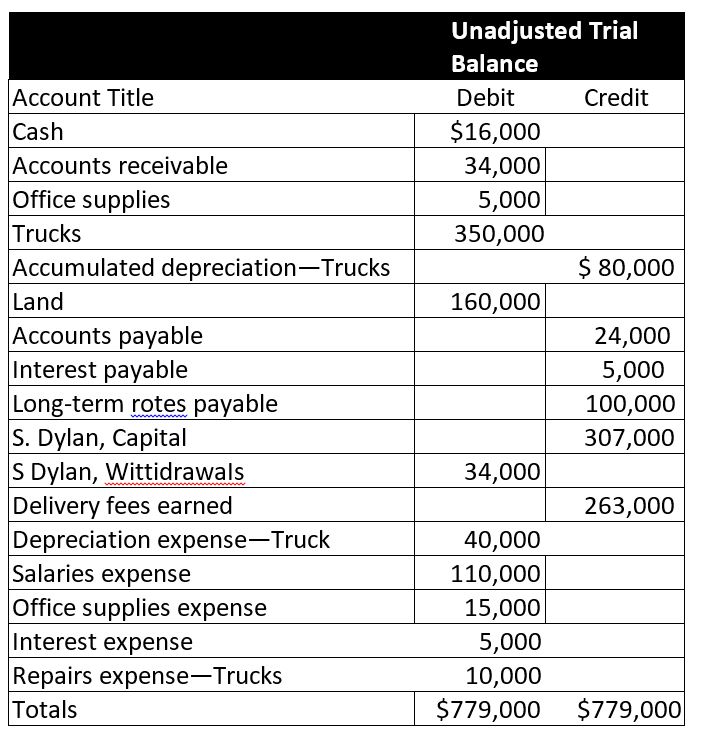

Exercise 4-7 Preparing a work sheet and recording closing entries P1 P2

The following unadjusted

- Use the following information about the company's adjustments to complete a 10-cotumn work sheet.

a. Unrecorded

b. The total amount of accrued interest expense at year-end is $6,000.

C. The cost of unused office supplies still available at year-end is $2,000.

Dylan. Capital account balance was $307,000 on December 31 of the prior year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Knowledge Check 01

On October 1, equipment costing $10,700, on which $7,070 of accumulated depreciation has been recorded (through that date) was

sold for $2,070 cash.

Prepare the appropriate journal entry for the sale of the equipment. (If no entry is required for a transaction/event, select "No Journal

Entry Required" in the first account field.)

Instructions

Chart of Accounts

General Journal

Instructions

Champion Company purchased and installed carpet in its new general offices on March 31 for a total cost of $18,000. The carpet is estimated to have a 15-year useful

life and no residual value.

Required:

a. Prepare the journal entries necessary for recording the purchase of the new carpet. Refer to the Chart of Accounts for exact wording of account

titles.

b. Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet assuming that Champion Company uses the

straight-line method. Refer to the Chart of Accounts for exact wording of account titles.

Instructions

First Question

Prior to adjustment at the end of the year, the balance in Trucks is $305,554 and the balance in Accumulated Depreciation-Trucks is $100,220. Details of the

subsidiary ledger are as follows:

A. Determine the depreciation rates per mile and the amount to be credited to the accumulated

Estimated

Accumulated Depreciation at

Miles Operated

depreciation section of each of the subsidiary accounts for the miles operated during the current year.

Truck No.

Cost

Residual Value

Useful Life

Beginning of Year

During Year

Round the rate per mile to two decimal places and credit to accumulated depreciation to the nearest

1

$82,971

$14,850

252,300 miles

20,200 miles

dollar.

2

59,412

6,150

295,900 miles

$13,950

32,900 miles

76,486

13,990

201,600 miles

61,060

7,700 miles

Truck No.

Rate per Mile

Miles Operated Credit to Accumulated Depreciation

4

86,685

22,830

236,500 miles

25,210

22,100 miles

1

$

20,200

A. Determine the depreciation rates per mile and the amount to be…

Chapter 4 Solutions

FUND ACCOUNTING PRINCIPLES BUNDLE

Ch. 4 - Prob. 1QSCh. 4 - Prob. 2QSCh. 4 - Computing ending capital balance using work sheet...Ch. 4 - Preparing a partial work sheet P1 The ledger of...Ch. 4 - Explaining temporary and permanent accounts Choose...Ch. 4 - Preparing closing entries from the ledger P2 The...Ch. 4 - Prob. 7QSCh. 4 - Prob. 8QSCh. 4 - Prob. 9QSCh. 4 - Prob. 10QS

Ch. 4 - Prob. 11QSCh. 4 - Prob. 12QSCh. 4 - Prob. 13QSCh. 4 - Prob. 14QSCh. 4 - Prob. 15QSCh. 4 - Prob. 16QSCh. 4 - Prob. 17QSCh. 4 - Prob. 18QSCh. 4 - Prob. 19QSCh. 4 - Prob. 20QSCh. 4 - Exercise 4-1 Extending adjusted account balances...Ch. 4 - Exercise 4-2 Extending accounts in a work sheet Pl...Ch. 4 - Exercise 4-3 Preparing adjusting entries from a...Ch. 4 - Exercise 4-4 Preparing unadjusted and adjusted...Ch. 4 - Exercise 4-5 Determining effects of closing...Ch. 4 - Exercise 4-6 Completing the income statement...Ch. 4 - Exercise 4-7 Preparing a work sheet and recording...Ch. 4 - Exercise 4-8

Preparing and posting closing...Ch. 4 - Exercise 4-9 Preparing closing entries and a...Ch. 4 - Exercise 4-10 Preparing closing entries and a...Ch. 4 - Prob. 11ECh. 4 - Exercise 4-12 Preparing a classified balance sheet...Ch. 4 - Exercise 4-13 Computing the current ratio A1 Use...Ch. 4 - Exercise 4-14 Preparing closing entries P2...Ch. 4 - Exercise 4-15 Computing and analysing the current...Ch. 4 - Exercise 4.16A Preparing reversing entries P4 Hawk...Ch. 4 - Exercise 4-17APreparing reversing entries P4 The...Ch. 4 - Problem 4-1A Applying the accounting cycle C2 P2...Ch. 4 - Problem 4-2A Preparing a work sheet, adjusting and...Ch. 4 - Problem 4-3A Determining balance sheet...Ch. 4 - Problem 4-4A Preparing closing entries, financial...Ch. 4 - Problem 4-5A Preparing trial balances, closing...Ch. 4 - Problem 4-6AA Preparing adjusting, reversing, and...Ch. 4 - Problem 4-1B Applying the accounting cycle C2 P2...Ch. 4 - Prob. 2PSBCh. 4 - Problem 4-3B Determining balance sheet...Ch. 4 - Prob. 4PSBCh. 4 - Problem 4-5B Preparing trial balances, closing...Ch. 4 - Problem 4-6BAPreparing adjusting, reversing, and...Ch. 4 - The December 31. 2019= adjusted trial balance of...Ch. 4 - Transactions from the Fast Forward illustration in...Ch. 4 - Prob. 2GLPCh. 4 - Prob. 3GLPCh. 4 - Based on Problem 4-6ACh. 4 - Prob. 5GLPCh. 4 - Refer to Apple' s financial statements in Appendix...Ch. 4 - Prob. 2AACh. 4 - Prob. 3AACh. 4 - Prob. 1DQCh. 4 - That accounts are affected by closing entries?...Ch. 4 - Prob. 3DQCh. 4 - What is the purpose of the Income Summary account?Ch. 4 - Prob. 5DQCh. 4 - Prob. 6DQCh. 4 - Why are the debit and credit entries in the...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - How is unearned revenue classified on the balance...Ch. 4 - Prob. 11DQCh. 4 - Prob. 12DQCh. 4 - Prob. 13DQCh. 4 - Prob. 1BTNCh. 4 - Prob. 2BTNCh. 4 - Prob. 3BTNCh. 4 - The unadjusted trial balance and information for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CALCULATING AND JOURNALIZING DEPRECIATION Equipment records for Byerly Construction Co. for the year follow. Byerly Construction uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired. REQUIRED 1. Calculate the depreciation expense for Byerly Construction as of December 31, 20--. 2. Prepare the entry for depreciation expense using a general journal.arrow_forwardCALCULATING AND JOURNALIZING DEPRECIATION Equipment records for Johnson Machine Co. for the year follow. Johnson Machine uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired. REQUIRED 1. Calculate the depreciation expense for Johnson Machine as of December 31, 20--. 2. Prepare the entry for depreciation expense using a general journal.arrow_forwardQuestion: Record the disposal of Machine A. Transaction General Journal Debit Credit January 1arrow_forward

- Chart of Accounts Instructions CHART OF ACCOUNTS Equipment acquired on January 6 at a cost of $360,550, has an estimated useful ife of 12 years and an estimated residual value of $69.910 General Ledger Required: a. What was the annual amount of deoreciation for Years 1-3 using the straight-ine method of depreciation? REVENUE ASSETS b. What was the book value of the equpment on January 1 of Year 47 410 Sales 110 Cash c Assuming that the equipment was sold on January 3 of Year 4 for $272.570, journalize the entry to record the sale Refer to the chart of 610 Interest Revenue accounts for the eract wording of the account ties CNOW journals do not use lines for journal explanations Every line on a journal page is used 111 Petty Cash 620 Gain on Sale of Delivery Truck for debit or credt entnes CNOW journals wit automaticaly indent a credit entry when a credit amount is entered 112 Accounts Receivable a. Assuming that the equipment had been sold on January 3 of Year 4 for $303,490 instead of…arrow_forwardIn detail pleasearrow_forwardprovide journal entries for the transaction letters: J, K, Larrow_forward

- Question Workspace Check My Work Record the adjusting entry for recording the interest due on a note payable liability. Assume that the company has a $2400 note payable outstanding on which they pay a 5% annual interest rate. Record the adjustment for interest due for one month's worth of interest.arrow_forwardAdjusting Entry for Depreciation Cowley Company just completed its first year of operations. The December 31 equipment account has a balance of $20,000. There is no balance in the Accumulated Depreciation—Equipment account or in the Depreciation Expense account. The accountant estimates the yearly equipment depreciation to be $5,000. TASK: Prepare the required adjusting entry to record the yearly depreciation for equipment, on the proper Financial Statement.arrow_forwardComplete the work sheet for Ramey Company, dated December 31, 20, through the adjusted trial balance using the following adjustment information: a. Expired or used-up insurance, 460. b. Depreciation expense on equipment, 870. (Remember to credit the Accumulated Depreciation account for equipment, not Equipment.) c. Wages accrued or earned since the last payday, 120 (owed and to be paid on the next payday). d. Supplies remaining, 80.arrow_forward

- How do I prepare this journal entryarrow_forwardSubject:arrow_forwardKnowledge Check 01 On January 1, the company purchased equipment that cost $10,000. The equipment is expected to be worth about (or has a salvage value of) $1,000 at the end of its useful life in five years. The company uses straight-line depreciation. It has not recorded any adjustments relating to this equipment during the current year. View transaction list View journal entry worksheet Complete the necessary December 31 journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY