PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 10PS

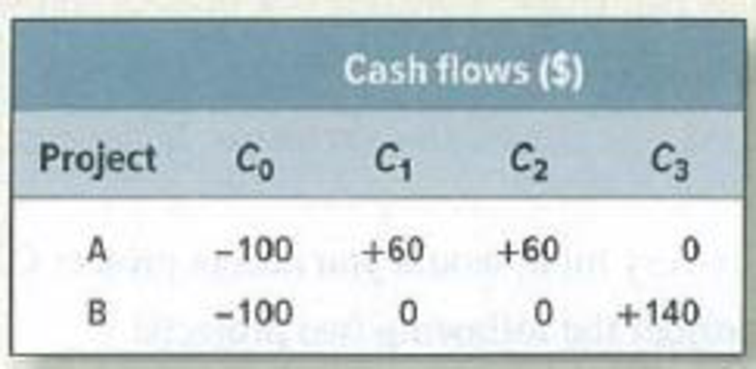

- a. Calculate the NPV of each project for discount rates of 0%, 10%, and 20%. Plot these on a graph with NPV on the vertical axis and discount rate on the horizontal axis.

- b. What is the approximate IRR for each project?

- c. In what circumstances should the company accept project A?

- d. Calculate the NPV of the incremental investment (B – A) for discount rates of 0%, 10%, and 20%. Plot these on your graph. Show that the circumstances in which you would accept A are also those in which the IRR on the incremental investment is less than the

opportunity cost of capital.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Project Analysis. Assume that you are evaluating the following three mutually exclusive projects: A. Complete the following analyses. (For the last two lines, Terminal Value, please write in the dollar amount of the terminal value.) B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs. C. Using different discount rates, is it possible to get different rankings within the NPV calculation? Why or why not? D. If 10 percent is the required return, which project is preferred? E. Which is the fairer representation of these two projects, TRR or IRR? Why?

Consider the following two investment alternatives:

The firm's MARR is known to be 15%.(a) Compute the IRR of Project B.(b) Compute the PW of Project A. (c) Suppose that Projects A and B are mutually exclusive. Using the IRR, whichproject would you select?

The following information is available on two mutually exclusive projects. All numbers are in ‘000s.

Project Year 0 Year 1 Year 2 Year 3 Year 4

A $700 $300 $300 $400 $400

B $700 $600 $300 $200 $100

a: If the minimum acceptable rate of return is 10%, which project should be selected using the Net Present Value (NPV) method? Which project should be selected if the Internal Rate of Return (IRR) method is used?

b: At what cross‐over rate would the firm be indifferent between the two projects? What is the NPV for both projects at the crossover rate?

c: How much should cash flow in year 3 for project B increase or decrease in order for NPV(B) to be equal to NPV(A)?

Chapter 5 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Start with the partial model in the file Ch10 P23 Build a Model.xlsx on the textbooks Web site. Gardial Fisheries is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a. If each projects cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? b. Construct NPV profiles for Projects A and B. c. What is each projects IRR? d. What is the crossover rate, and what is its significance? e. What is each projects MIRR at a cost of capital of 12%? At r = 18%? (Hint: Consider Period 7 as the end of Project Bs life.) f. What is the regular payback period for these two projects? g. At a cost of capital of 12%, what is the discounted payback period for these two projects? h. What is the profitability index for each project if the cost of capital is 12%?arrow_forwardWallace Company is considering two projects. Their required rate of return is 10%. Which of the two projects, A or B, is better in terms of internal rate of return?arrow_forwardDefine each of the following terms: Capital budgeting; payback period; discounted payback period Independent projects; mutually exclusive projects Net present value (NPV) method; internal rate of return (IRR) method; profitability index (PI) Modified internal rate of return (MIRR) method NPV profile; crossover rate Nonnormal cash flow projects; normal cash flow projects; multiple IRRs Reinvestment rate assumption Replacement chain; economic life; capital rationing; equivalent annual annuity (EAA)arrow_forward

- Average rate of return The following data are accumulated by Watershed Inc. in evaluating two competing capital investment proposals: Determine the expected average rate of return for each project.arrow_forwardNet present value method, present value index, and analysis for a service company First United Bank Inc. is evaluating three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows: Instructions 1. Assuming that the desired rate of return is 15%, prepare a net present value analysis for each project. Use the present value table appearing in Exhibit 2 of this chapter. 2. Determine a present value index for each project. (Round to two decimal places.) 3. Which project offers the largest amount of present value per dollar of investment? Explain.arrow_forwardCalculate the project cash flows for each year. Based on these cash flows and the average project cost of capital, what are the projects NPV, IRR, MIRR, PI, payback, and discounted payback? Do these indicators suggest that the project should be undertaken?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License