PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 5, Problem 3SQ

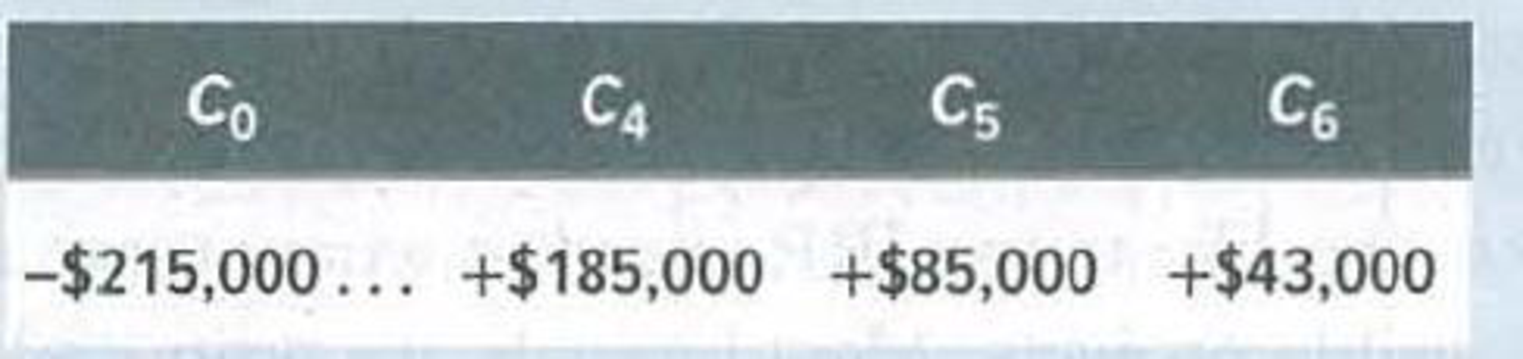

(XIRR) What is the

(All other cash flows are 0.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following statements is incorrect regarding project appraisal techniques?

At IRR, the NPV of a project is equal to 0

If the IRR of a project is 8%, its NPV calculated using a discount rate greater than 8%, will be less than 0

If the NPV of a project is greater than 0, then its PI will exceed 1.

If the PI of a project equals 0, then the project's initial cash outflow equals the PV of its cash inflows

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows .

a.

A project’s NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting the TV at the IRR to find its PV .

b.

The higher the WACC used to calculate the NPV, the lower the calculated NPV will be

c.

If a project’s NPV is greater than zero, then its IRR must be less than the WACC .

d.

If a project’s NPV is greater than zero, then its IRR must be less than zero.

e.

The NPVs of relatively risky projects should be found using relatively low WACCs

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

a.

A project's NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting the TV at the IRR to find its PV.

b.

The higher the WACC used to calculate the NPV, the lower the calculated NPV will be.

c.

If a project's NPV is greater than zero, then its IRR must be less than the WACC.

d.

If a project's NPV is greater than zero, then its IRR must be less than zero.

e.

The NPVs of relatively risky projects should be found using relatively low WACCs.

Provide explanation for choice

Chapter 5 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. a. If Project A has a higher IRR than Project B, then Project A must also have a higher NPV. b. If a project has normal cash flows and its IRR exceeds its cost of capital, then the project's NPV must be positive. c. The IRR calculation implicitly assumes that all cash flows are reinvested at the cost of capital. d. If Project A has a higher IRR than Project B, then Project A must have the lower NPV. e. The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business.arrow_forwardSimms Corp, is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. A. -4.04% B. -4.44% C.-5.67% D. -4.17% E. -4.53%arrow_forwardWhich one of the following statements is correct? If the initial cost of a project is increased, the net present value of that project will also increase. The net present value is positive when the required return exceeds the internal rate of return. If the internal rate of return equals the required return, the net present value will equal zero. Net present value is equal to an investment's cash inflows discounted to today's dollars.arrow_forward

- Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. Select one: a. The lower the WACC used to calculate it, the lower the calculated NPV will be. b. If a project's NPV is greater than zero, then its IRR must be less than zero. c. The NPV of a relatively low-risk project should be found using a relatively high WACC. d. A project's NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV), then discounting the TV at the WACC. e. If a project's NPV is less than zero, then its IRR must be less than the WACC.arrow_forwardWhich of the following projects have conventional cash-flow streams? Select all that are conventional. A) Project A B) Project B C) Project C D) Project Darrow_forward2. What are the free cash flows that are relevant to analyzing the two projects? Compute the NPVs of the two projects. Which project creates more value?arrow_forward

- Consider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forwardXYZ Corp. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the WACC or negative, in both cases it will be rejected. Year 0 1 2 3 Cash flows -$1,000 $325 $425 $525arrow_forwardExplain the Incremental Cash Flows from Undertaking a Project?arrow_forward

- Simms Corp. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. Year 0 1 2 3 Cash flows -$1,025 $425 $425 $425arrow_forwardWhich of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. a. A project's NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV), then discounting the TV at the WACC. b. The NPV of a relatively low-risk project should be found using a relatively high WACC. c. If a project's NPV is less than zero, then its IRR must be less than the WACC. d. The lower the WACC used to calculate it, the lower the calculated NPV will be. e. If a project's NPV is greater than zero, then its IRR must be less than zero.arrow_forwardMathematically, we can determine the rate of return for a given project’s cash flow series by identifying an interest rate that equates the present worth of its cash flows to zero. Select one: True False and explainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Working capital explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XvHAlui-Bno;License: Standard Youtube License