Concept explainers

Comprehensive Problem; Second Production Department-Weighted-Average Method

Old Country Links, Inc. produces sausages in three production department-Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then transferred to the Casing and Curing Department, where the mixture is force-fed into casings and then hung and cured in climate-controlled smoking chambers. In the packaging Department, the cured sausages are sorted, packed, and labeled. The company uses the weighted-average method in its

Required:

- Determine the Casing and Curing Department’s equivalent units of production for mixing, material, and conversion for the month of September. Do not round off your computations.

- Compute the Casing and Curing Department’s cost per equivalent unit for mixing, materials, and conversion for the month of September.

- Compute the Casing and Curing Department’s cost of ending work in process inventory for mixing, materials, conversion, and total for September.

- Compute the Casing and Curing Department’s cost of units transferred out to the Packaging Department for mixing materials, conversion, and in total for September.

- Prepare a cost reconciliation report for the Casing and Curing Department for September.

Computation of equivalent units for each element of cost, cost per equivalent unit and total cost of ending inventory and completed units describes the steps taken for computation of total units completed and equivalents units of each element of cost. The total cost of ending work in process and completed and transferred out shall be determined based on equivalent units and cost per equivalent units. The total units completed are computed by considering the total units in process and ending work in process units. The reconciliation statement of total cost to account and accounted has to be reconciled.

Requirement1:

TheEquivalent number units of each element of cost

Answer to Problem 13P

Solution: The total units completed and transferred out from process and equivalent units shall be as under:

| UNITS TO ACCOUNT FOR:

Beginning Work in Process units Add: Units Started in Process Total Units to account for: |

50.00 1.00 __________ 51.00 | |

|

UNITS TO BE ACCOUNTED FOR:

Units Completed Ending Work in Process Total Units to be accounted for: |

50.00 1.00 51.00 ________ 51.00 | |

Explanation of Solution

The computation of total units completed and transferred out shall be based on the total units in the process during the year. The total units to account for in the process is sum of beginning units of work in process and units started in the process during the year. The Ending units of work in process which is still in process at the end of the year shall be deducted from the total to find out the units completed and transferred out.

When the units completed in previous process is transferred to next process, then the cost of such completed units is taken as Transferred-in Cost of next process and the equivalent units for such Transferred in cost shall also be computed along with material and Conversion cost in next process. For computing the equivalent units of Transferred-in cost, equivalents units for units in process at the end shall be taken on the basis of 100% degree of completion as regards to Transferred-in cost (as the processing in previous process is completed in full which is represented by Transferred-in cost)

Requirement2:

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

The Cost perequivalent unit for each element of cost

Answer to Problem 13P

Solution: The statement showing the cost per equivalent unit for element is as under:

| Equivalent Units: | ||||||||

| Transferred in Cost | Material Cost | Conversion Cost | ||||||

| % Completion | Units | % Completion | Units | % Completion | Units | |||

| Units completed and transferred

Ending Work in Process Total Equivalent units | 100%

100% | 50.00

1.00 | 100%

80% | 50.00

0.80 | 100%

70% | 50.00

0.70 | ||

| 51 | 50.8 | 50.7 | ||||||

Explanation of Solution

The total cost of Transferred-in cost shall be the sum total of transferred in cost included in beginning work in process and added during the current period. The transferred-in cost per equivalent units shall be computed by dividing the total transferred-in cost by equivalent units of respective cost.

Requirement3:

The Cost of Ending work in process inventory in respect of material, conversion and in total

Answer to Problem 13P

Solution: The statement showing the cost of ending work in process is as under:

| Ending Work in Process (1 unit)

| Equivalent unit | Cost per EU | Total Cost | |||||

| Transferred-in cost | 1.00 | 1630 | 1630 | |||||

| Material cost | 0.80 | 120 | 96 | |||||

| Conversion Cost | 0.70 | 850 | 595 | |||||

| Total cost of Ending Work in process: | 2,321 | |||||||

Explanation of Solution

The total cost of ending work in process shall be computed by multiplying the equivalent units of each element in ending work in process by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement4:

The Cost of goods completed and transferred out

Answer to Problem 13P

Solution: The statement showing the cost of units completed and transferred out shall be as under:

| Units Completed and Transferred out (50 units)

| Equivalent unit | Cost per EU | Total Cost | ||||

| Transferred-in cost | 50 | 1630 | 81500 | ||||

| Material cost | 50 | 120 | 6000 | ||||

| Conversion Cost | 50 | 850 | 42500 | ||||

| Total Cost of Units completed and transferred out: | 130000 | ||||||

Explanation of Solution

The total cost of units completed and transferred out shall be computed by multiplying the equivalent units of each element in units completed (which is equal to completed units only) by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement5:

To show: The reconciliation statement showing the cost to account for and cost accounted for

Answer to Problem 13P

Solution: The reconciliation statement showing the cost to account for and accounted in ending work in process and completed units is as follows:

| RECONCILIATION STATEMENT | |||||||

| TOTAL COST TO ACCOUNT FOR:

| |||||||

| Transferred-in | Material | Conversion | |||||

| Beginning work in Process | 1,670 | 90 | 605 | ||||

| Cost Added during May | 81,460 | 6,006 | 42,490 | ||||

| Total Cost to account for: | 83,130 | 6,096 | 43,095 | ||||

| Total Cost to account for: | 132,321 | ||||||

| TOTAL COST ACCOUNTED FOR:

| |||||||

| Units Completed and Transferred out (50 units)

| |||||||

| Equivalent unit | Cost per EU | Total Cost | |||||

| Transferred-in cost | 50 | 1630 | 81500 | ||||

| Material cost | 50 | 120 | 6000 | ||||

| Conversion Cost | 50 | 850 | 42500 | ||||

| Total Cost of Units completed and transferred out: | 130000 | ||||||

| Ending Work in Process (1 unit)

| |||||||

| Equivalent unit | Cost per EU | Total Cost | |||||

| Transferred-in cost | 1.00 | 1630 | 1630 | ||||

| Material cost | 0.80 | 120 | 96 | ||||

| Conversion Cost | 0.70 | 850 | 595 | ||||

| Total cost of Ending Work in process: | 2,321 | ||||||

| Total Cost accounted for: | 132,321 | ||||||

| Difference (Total cost to account for-Total cost accounted) | Nil | ||||||

Explanation of Solution

The total cost to account for is the total cost of beginning work in process and cost added during the period in the process. The total cost accounted for is the cost assigned to ending work in process and units completed and transferred out.

The reconciliation means there shall be not be any difference between the total cost to account for and total accounted in the period.

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

Want to see more full solutions like this?

Chapter 5 Solutions

MANAGERIAL ACCOUNTING

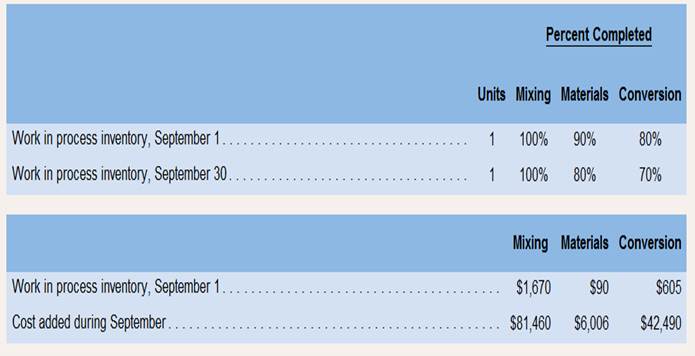

- Old Country Links, Incorporated, produces sausages in three production departments—Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then transferred to the Casing and Curing Department, where the mixture is force-fed into casings and then hung and cured in climate-controlled smoking chambers. In the Packaging Department, the cured sausages are sorted, packed, and labeled. The company uses the weighted-average method in its process costing system. Data for September for the Casing and Curing Department follow: Units Percent Completed Mixing Materials Conversion Work in process inventory, September 1 1 100% 90% 80% Work in process inventory, September 30 1 100% 80% 70% Mixing Materials Conversion Work in process inventory, September 1 $ 1,670 $ 90 $ 605 Cost added during September $ 81,460 $ 6,006 $ 42,490 Mixing cost represents the costs of the spiced…arrow_forwardOld Country Links, Inc., produces sausages in three production departments—Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then transferred to the Casing and Curing Department, where the mixture is force-fed into casings and then hung and cured in climate-controlled smoking chambers. In the Packaging Department, the cured sausages are sorted, packed, and labeled. The company uses the weighted-average method in its process costing system. Data for September for the Casing and Curing Department follow: Percent Completed Units Mixing Materials Conversion Work in process inventory, September 1 6 100 % 60 % 50 % Work in process inventory, September 30 6 100 % 20 % 10 % Mixing Materials Conversion Work in process inventory, September 1 $ 12,204 $ 54 $ 2,796 Cost added during September $ 174,976 $ 14,485 $ 131,474 Mixing cost represents the costs…arrow_forwardOld Country Links, Inc., produces sausages in three production departments—Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then transferred to the Casing and Curing Department, where the mixture is force-fed into casings and then hung and cured in climate-controlled smoking chambers. In the Packaging Department, the cured sausages are sorted, packed, and labeled. The company uses the weighted-average method in its process costing system. Data for September for the Casing and Curing Department follow: Percent Completed Units Mixing Materials Conversion Work in process inventory, September 1 6 100 % 60 % 50 % Work in process inventory, September 30 6 100 % 20 % 10 % Mixing Materials Conversion Work in process inventory, September 1 $ 13,404 $ 30 $ 2,964 Cost added during September $ 201,726 $ 14,592 $ 136,612 Mixing cost represents the costs…arrow_forward

- i need answers for req 4 and 5. Old Country Links, Incorporated, produces sausages in three production departments—Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then transferred to the Casing and Curing Department, where the mixture is force-fed into casings and then hung and cured in climate-controlled smoking chambers. In the Packaging Department, the cured sausages are sorted, packed, and labeled. The company uses the weighted-average method in its process costing system. Data for September for the Casing and Curing Department follow: Units Percent Completed Mixing Materials Conversion Work in process inventory, September 1 1 100% 60% 50% Work in process inventory, September 30 1 100% 20% 10% Mixing Materials Conversion Work in process inventory, September 1 $ 2,325 $ 70 $ 137 Cost added during September $ 275,435 $ 28,882 $ 138,966 Mixing cost…arrow_forwardA dedicated pharmaceutical plant uses the theory of constraints and has three processes: Mixing, Encapsulating, and Packaging. For Mixing, sufficient materials are released to produce 4,000 packages of product per day. Encapsulating has a buffer inventory of 8,000 units (work in process from Mixing). Packaging produces 4,000 units per day. Which of the three processes sets the production rate of 4,000 units per day? a. The Mixing Department b. The Encapsulating Department c. The Packaging Department d. Cannot be determinedarrow_forwardProcess activity analysis The Brite Beverage Company bottles soft drinks into aluminum cans. The manufacturing process consists of three activities: 1. Mixing: water, sugar, and beverage concentrate are mixed. 2. Filling: mixed beverage is filled into 12-oz. cans. 3. Packaging: properly filled cans are boxed into cardboard fridge packs. The activity costs associated with these activities for the period are as follows: The activity costs do not include materials costs, which are ignored for this analysis. Each can is expected to contain 12 ounces of beverage. Thus, after being filled, each can is automatically weighed. If a can is too light, it is rejected, or kicked, from the filling line prior to being packaged. The primary cause of kicks is heat expansion. With heat expansion, the beverage overflows during filling, resulting in underweight cans. This process begins by mixing and filling 6,300,000 cans during the period, of which only 6,000,000 cans are actually packaged. Three hundred thousand cans are rejected due to underweight kicks. A process improvement team has determined that cooling the cans prior to filling them will reduce the amount of overflows due to expansion. After this improvement, the number of kicks is expected to decline from 300,000 cans to 63,000 cans, thus increasing the number of filled cans to 6,237,000 [6,000,000 + (300,000 63,000)]. A. Determine the total activity cost per packaged can under present operations. B. Determine the amount of increased packaging activity costs from the expected improvements. C. Determine the expected total activity cost per packaged can after improvements. Round to three decimal places.arrow_forward

- Benson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules. During March, the following results are available for the first two departments: Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200% of direct labor. In the encapsulating department, the overhead rate is 150% of direct labor. Required: 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.) 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.) 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.arrow_forwardJoint cost allocation McKenzies Soap Sensations, Inc., produces hand soaps with three different scents: morning glory, snowflake sparkle, and sea breeze. The soap is produced through a joint production process thatcosts 30,000 per batch. Each batch produces 14,800 bottles of morning glory hand soap, 12,000bottles of snowflake sparkle hand soap, and 10,000 bottles of sea breeze hand soap at the split-offpoint. Each product is processed further after the split-off point, but the market value of a bottle ofany of the flavors at this point is estimated to be 1.25 per bottle. The additional processing costsof morning glory, snowflake sparkle, and sea breeze hand soap are 10.50, 0.55, and 0.60 perbottle, respectively. Morning glory, snowflake sparkle, and sea breeze hand soap are then sold for2.00, 2.20, and 2.40 per bottle, respectively. Instructions 1. Using the net realizable value method, allocate the joint costs of production to each product. 2. Explain why McKenzies Soap Sensations, Inc., always chooses to process each varietyof hand soap beyond the split-off point. 3. If demand for all products was the same, which product should McKenzies Soap Sensations, Inc., produce in the highest quantity?arrow_forwardHealthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments): Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor. Required: 1. Prepare a production report for the Mixing Department using the weighted average method. Follow the five steps outlined in the chapter. Round unit cost to three decimal places. 2. Prepare a production report for the Tableting Department. Materials are added at the beginning of the process. Follow the five steps outlined in the chapter. Round unit cost to four decimal places.arrow_forward

- Developing raw material cost standards Lakeway Manufacturing Co.manufactures and sells household cleaning products. The company’s research department has developed a new cleaner for which a standard cost must be determined. The new cleaner is made by mixing 11 quarts of triphate solution and 4 pounds of sobase granules and boiling the mixture for several minutes. After the solution has cooled, 2 ounces of methage are added. This “recipe” produces 10 quarts of the cleaner, which is then packaged in 1-quart plastic dispenser bottles. Rawmaterial costs are:Triphate solution . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.30 per quartSobase granules . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.74 per poundMethage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.20 per ounceBottle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.12 eachRequired:a. Using the preceding data, calculate the raw material cost for one bottle of…arrow_forwardSell or Process Further, Basic Analysis Carleigh, Inc., is a pork processor. Its plants, located in the Midwest, produce several products from a common process: sirloin roasts, chops, spare ribs, and the residual. The roasts, chops, and spare ribs are packaged, branded, and sold to supermarkets. The residual consists of organ meats and leftover pieces that are sold to sausage and hot dog processors. The joint costs for a typical week are as follows: Direct materials $81,000 Direct labor 33,800 Overhead 20,500 The revenues from each product are as follows: sirloin roasts, $78,000; chops, $71,000; spare ribs, $35,500; and residual, $8,600. Carleigh’s management has learned that certain organ meats are a prized delicacy in Asia. They are considering separating those from the residual and selling them abroad for $53,400. This would bring the value of the residual down to $3,200. In addition, the organ meats would need to be packaged and then air freighted to Asia. Further…arrow_forwardSell or Process Further, Basic Analysis Carleigh, Inc., is a pork processor. Its plants, located in the Midwest, produce several products from a common process: sirloin roasts, chops, spare ribs, and the residual. The roasts, chops, and spare ribs are packaged, branded, and sold to supermarkets. The residual consists of organ meats and leftover pieces that are sold to sausage and hot dog processors. The joint costs for a typical week are as follows: Direct materials $81,500 Direct labor 31,400 Overhead 24,500 The revenues from each product are as follows: sirloin roasts, $73,500; chops, $69,000; spare ribs, $36,000; and residual, $8,400. Carleigh's management has learned that certain organ meats are a prized delicacy in Asia. They are considering separating those from the residual and selling them abroad for $52,600. This would bring the value of the residual down to $2,900. In addition, the organ meats would need to be packaged and then air freighted to Asia. Further…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,