Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 16PS

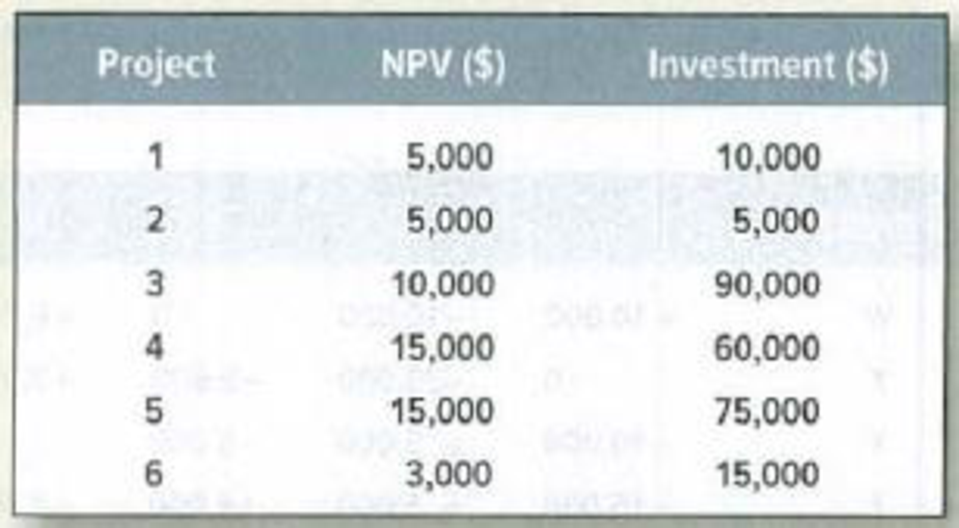

Capital rationing* Suppose you have the following investment opportunities, but only $90,000 available for investment. Which projects should you take?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose that you could invest in the following projects but have only $29,700 to invest. How would you make your decision and in

which projects would you invest?

Project Cost

A

$7,850

B

C

D

11,060

9,200

6,540

NPV

$3,200

6,460

4,150

3,090

You should invest in project(s)

Using capital rationing to make capital investment decisions

Mountain Manufacturing is considering the following capital investment proposals. Mountains requirement criteria include a maximum payback period of five years and a required rate of return of 12.5%. Determine if each investment is acceptable or should be rejected (ignore qualitative factors). Rank the acceptable investments in order from most desirable to least desirable.

Suppose that you could invest in the following projects but have only $29,670 to invest. How would you make your decision and in

which projects would you invest?

Project

Cost

NPV

A

$8,260

$4,300

BCD

10,850

6,470

9,070

4,830

7,170

3,940

You should invest in project(s)

E

Chapter 5 Solutions

Principles of Corporate Finance

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 13. I need help with finance home work question asap please What is the profitability index for a project that requires an initial cash outflow in the amount of $5,000,000 and has a NPV of $750,000?arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forwardSuppose that you could invest in the following projects but have only $24,480 to invest. Which projects would you choose? Project Cost NPV w $ 7,970 $ 3,000 x 10,990 7,530 y 8,500 4,280 z 6,750 3,890 You should invest in project(s)?arrow_forward

- 19. Capital rationing (S5.4) Suppose you have the following investment opportunities, but only $90,000 available for investment. Which projects should you take? Project NPV ($) Investment ($) 1 2 3 4 5 6 5,000 5,000 10,000 15,000 15,000 3,000 10,000 5,000 90,000 60,000 75,000 15,000 Page 144arrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forward不 Data table You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the IRRS of the two projects? b. If your discount rate is 4.6% what are the NPVS of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRS of the two projects? The IRR for project A is ☐ %. (Round to one decimal place.) (Click on the following icon in order to copy its contents into a spreadsheet.) Project A Year 0 - $49 Year 1 $24 B - $99 $18 Year 2 $21 $40 Print Done Year 3 Year 4 $19 $14 $50 $61arrow_forward

- (Table: Investment Projects) Use Table: Investment Projects. If the market interest rate declines from 15% to 11.5%, then the quantity of loanable funds demanded will increase by: Project IF G ІН || J Z L M a. $200. b. $1,000. c. $2,000. d. $2,200. Rate of Return on Investment 20% 18 16 14 12 10 18 6 Cost of Investment $500 300 1,000 200 2,000 1,500 1,200 800arrow_forwardWhich of the following projects would you feel safest in accepting? Assume the opportunity cost of capital is 12% for each project. ☐(a) “Project A” that has a small, but negative, NPV. ☐(b) “Project B” that has a positive NPV when discounted at 10%. ☐(c) “Project C” that has a cost of capital that exceeds its internal rate of return. ☐(d) “Project D” that has a zero NPV when discounted at 14%. darrow_forwardA firm is considering two investment projects, Y and Z. These projects are NOT mutually exclusive. Assume the firm is not capital constrained. The initial costs and cashflows for these projects are: 0 1 2 3 Y -40,000 17,000 17,000 15,000 Z -28,000 12,000 12,000 20,000 Using a discount rate of 9% calculate the net present value for each project. What decision would you make based on your calculations? How would your decision change if the discount rate used for calculating the net present value is 15%? Calculate an approximate IRR for each project. Assume the hurdle rate is 9%. What decision would you make based on your calculations? Calculate the payback period for each project. The company looks to select investment projects paying back in 2 years. What decision would you make based on your calculations? Critically discuss Net Present Value (NPV), Internal Rate of Return (IRR) and payback period as criteria for investment appraisal.arrow_forward

- You identify an investment project with the following cash flows. If the discount rate is 10%, what is the present value of these cash flows? Y1- $500 Y2- $550 Y3- $800 Y4- $450. Please type answer no write by hend.arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, use the PI to determine which projects the company should accept. What is the PI of project B?(Round to two decimal places.) Cash Flow Project A Project B Year 0 −$1,800,000 −$2,400,000 Year 1 $500,000 $1,200,000 Year 2 $600,000 $1,100,000 Year 3 $700,000 $1,000,000 Year 4 $800,000 $900,000 Year 5 $900,000 $800,000 Discount rate 5% 17%arrow_forwardAn investment firm is considering two alternative investments, A and B, under two possible future sets of economic conditions, good and poor. There is a .60 probability of good economic conditions occurring and a .40 probability of poor economic conditions occurring. The expected gains and losses under each economic type of conditions are shown in the following table: Economic Conditions Investment Good Poor A $900,000 –$800,000 B 120,000 70,000 Using the expected value of each investment alternative, determine which should be selected.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

How to Invest in Foreign Stocks (INVESTING FOR BEGINNERS); Author: The Money Tea;https://www.youtube.com/watch?v=Qzj4VozcO9s;License: Standard Youtube License