Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 11PS

The

- a. Explain to Mr. Clops why this is not the correct procedure.

- b. Show him how to adapt the IRR rule to choose the best project.

- c. Show him that this project also has the higher

NPV .

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Finance Question

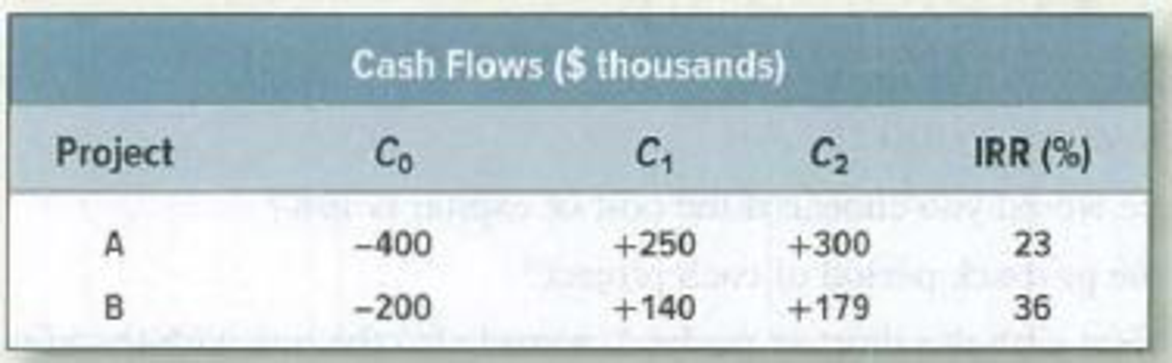

Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments:

Cash Flows ($thousands)

Project

C0

C1

C2

IRR(%)

A

-400

+250

+300

23

B

-200

+140

+179

36

The opportunity cost of capital is 5%.

Mr. Clops is tempted to take B, which has the higher IRR.

Why should not Mr. Clops base his decision on the IRR?

Multiple Choice

When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A.

The NPV gives the right choice. In this case the NPV of Project A is $150 > $50 the NPV of Project B

When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A.

The NPV gives the right choice. In…

a. Cobre Company is considering the purchase of new equipment that will speed up the process for extracting copper.

The equipment will cost $3,800,000 and have a life of 5 years with no expected salvage value. The expected cash

flows associated with the project are as follows:

Year

Cash Revenues

Cash Expenses

$6,000,000

$4,800,000

6,000,000

4,800,000

3

6,000,000

4,800,000

4

6,000,000

4,800,000

6,000,000

4,800,000

b. Emily Hansen is considering investing in one of the following two projects. Either project will require an investment o

$75,000. The expected cash revenues minus cash expenses for the two projects follow. Assume each project is

depreciable.

Year

Project A

Project B

1.

$2,500

$22,500

2

30,000

30,000

45,000

45,000

4

75,000

22,500

75,000

22,500

c. Suppose that a project has an ARR of 30% (based on initial investment) and that the average net income of the

project is $220,000.

d. Suppose that a project has an ARR of 50% and that the investment is $250,000.

3.

Chapter 5 Solutions

Principles of Corporate Finance

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following projects would you feel safest in accepting? Assume the opportunity cost of capital is 12% for each project. ☐(a) “Project A” that has a small, but negative, NPV. ☐(b) “Project B” that has a positive NPV when discounted at 10%. ☐(c) “Project C” that has a cost of capital that exceeds its internal rate of return. ☐(d) “Project D” that has a zero NPV when discounted at 14%. darrow_forwardMr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments: Cash Flows ($thousands) Project C0 C1 C2 IRR(%) A -400 +250 +300 23 B -200 +140 +179 36 The opportunity cost of capital is 5%. Mr. Clops is tempted to take B, which has the higher IRR. Why should not Mr. Clops base his decision on the IRR? Multiple Choice When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A. The NPV gives the right choice. In this case the NPV of Project B is $120 > $90 the NPV of Project A When projects have different sizes (very different cash flows in year 0), the IRR may give the wrong solution.In this case project B has a higher IRR than project A. However, project B is half the size of project A. The NPV gives the right choice. In…arrow_forwardSNA company management is considering two competing investment Projects A and B. Year Project A Project B Initial Investment 1000 1000 1 275 300 2 275 300 3 275 300 4 275 300 5 275 300 DISCOUNT RATE 3.15% help management to choose the most desirable Project .You must use each technique from 1 to 4 and get the answer? 1)Payback Period Technique.2) Discounted Payback Period Technique.3) Net Present Value Technique4) Profitability Index Technique.arrow_forward

- Suppose that you could invest in the following projects but have only $29,700 to invest. How would you make your decision and in which projects would you invest? Project Cost NPV A $ 7,850 $ 3,200 B 11,060 6,460 C 9,200 4,150 D 6,540 3,090 You should invest in which of the following options? A & B only B & C only B & D only A, B, & C B, C & Darrow_forwardBarnard Manufacturing is considering three capital investment proposals. At this time, Barnard only has funds available to pursue one of the three investments. |(Click the icon to review the proposals.) Which investment should Barnard pursue at this time? Why? Since each investment requires a different initial investment and presents a positive NPV, Barnard Manufacturing should use the profitability index to compare the profitability of each investment. Select the labels for the evaluation measure you determined above. Enter the amounts into the formula, beginning with Equipment A, and calculate the amount you will use to evaluate each investment. (Enter all amounts as positive numbers. Round the evaluation measure to two decimal places, X.XX.) - X Data Table Equipment A Equipment B Equipment C Present value of net cash inflows 1,832,478 S 1,865,471 $ 2,169,724 (1,650,881) (1,516,643) (1,749,777) Initial Investment 181,597 S 348,828 S 419,947 NPV Print Donearrow_forwardMr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments: Cash Flows ($thousands) Project C0 C1 C2 IRR(%) A -450 +250 +300 14 B -225 +120 +179 19.8 The opportunity cost of capital is 5%. Mr. Clops is tempted to take B, which has the higher IRR. However, Mr. Clops is wrong. Show him how to adapt the IRR rule to choose the best project Multiple Choice WIn this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is less thant the IIRR= 7.7% WIn this case project B has a higher IRR than project A. However, project B is half the size of project A. Mr. Clops can compute the incremental IRR (IIRR). Mr. Clops should take project A when the discount rate is less thant the IIRR= 10%arrow_forward

- Making the accept or reject decision Hungry Whale Electronics's decision to accept or reject project Alpha is independent of its decisions on other projects. If the firm follows the NPV method, it should project Alpha. Which of the following statements best explains what it means when a project has an NPV of $0? O When a project has an NPV of $0, the project is earning a rate of return less than the project's weighted average cost of capital. It's OK to accept the project, as long as the project's profit is positive. O When a project has an NPV of $0, the project is earning a rate of return equal to the project's weighted average cost of capital. It's OK to accept a project with an NPV of $0, because the project is earning the required minimum rate of return. O When a project has an NPV of $0, the project is earning a profit of $0. A firm should reject any project with an NPV of $0, because the project is not profitable.arrow_forwardYou are a project manager for your company and you are faced with five potential projects that you can invest in. Free cash flow projections and additional relevant data are given for each project in the table below. Assume that there are no cash flows after year 3. Assume that you can only take each project once and that you can only choose one project. Which project would you invest in? Select the best answer. Project Project A Project B Project C Project D Project E O I. Project A II. Project B III. Project C IV. Project D O V. Project E FCF Forecasts by Year (in $1,000) 0 2 1 500 (400) (400) (300) (250) (300) 75 60 75 135 115 175 3 650 210 190 200 Interest Rate (EAR) 8.0% 10.0% 10.0% 12.0% 12.0% IRR 25.00% 17.57% 15.92% 17.81% 19.96%arrow_forward3. I need help with multiple choice finance home work question Which of the following statements is incorrect? If a firm's target average accounting return is less than that calculated for a given project then the project should be accepted. If the NPV of a project is positive, it should be accepted. If a project has a payback which is faster than the company requires the project should be accepted. If the cost of capital is greater than the IRR, the project should be accepted. If a project has a profitability index greater than one the project should be accepted.arrow_forward

- Suppose an investor is concerned about a business choice in which there are three projects, the probability and returns are given below. Probability Return 0.4 $100 0.4 40 0.2 -30 The expected value of the uncertain investment is $ ----------- (round off to the nearest dollararrow_forwardA company is considering three alternative Investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Complete this question by entering your answers in the tabs below. a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will It accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Required A Required B Compute the net present value of each project. Potential Projects Project A Present value of net cash flows Initial investment Net present value Required C Project E Project C $10,685 (10,000)arrow_forwardYou and another analyst are asked to choose between two projects. Your manager tells you that the opportunity cost of capital is 10%. The other analyst points out that Project B has an IRR of 37.3%, which is much higher than Project A’s IRR of 24.7%, so he thinks Project B is the better project. Do you agree or disagree? Explain your answer. If you disagree with the intern, explain why the other analyst’s logic is incorrect.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License