Concept explainers

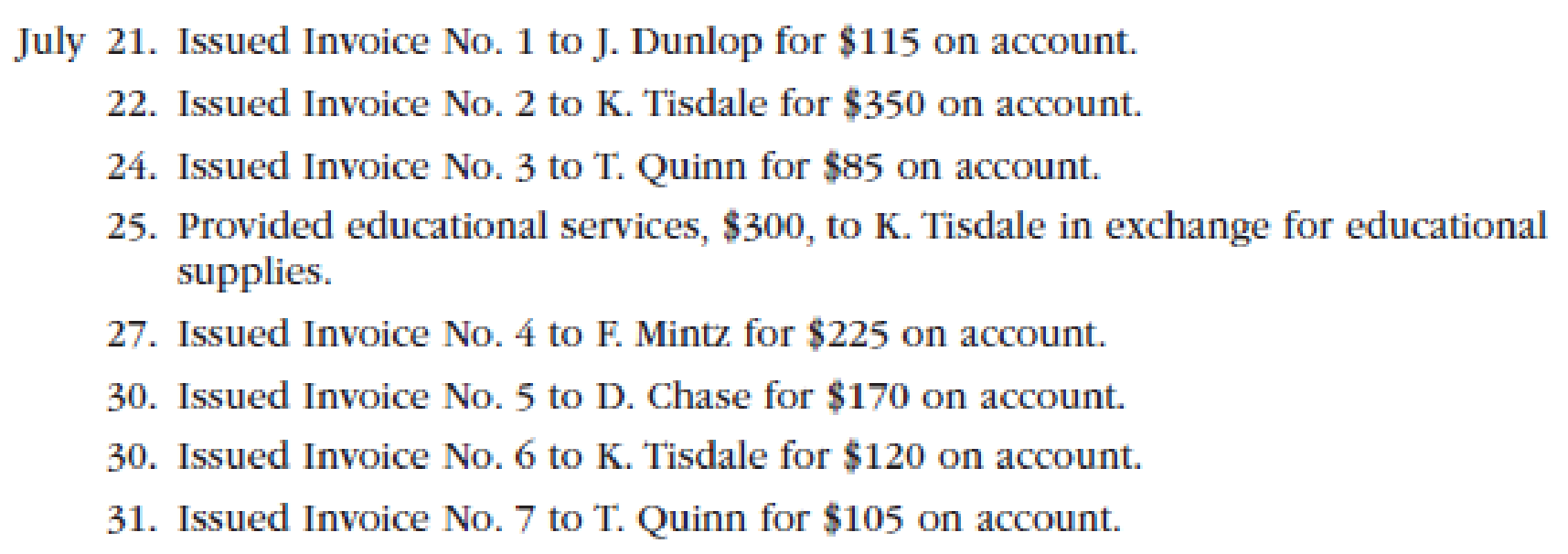

Sage Learning Centers was established on July 20, 2016, to provide educational services. The services provided during the remainder of the month are as follows:

Instructions

1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the

2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings:

3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31?

b. What is the balance of the accounts receivable controlling account at July 31?

4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?

(1) and (2)

Record the transactions in General journal, Revenue journal, Accounts Receivable subsidiary ledger, and General ledger.

Explanation of Solution

General Journal: The journal where the debit and credit entries of the accounting transactions are recorded in a chronological order are referred to as general journal.

Special Journal: Special journal records a single kind of transactions that occurs frequently. For example: Revenue Journal is a special journal which records all revenue earned on account.

General ledger: It is the primary ledger, which contains all balance sheet and income statement accounts. For example: Cash Account, Equipment Accounts, and Rent Accounts etc.

Subsidiary ledger: This is a ledger in which individual balance of every account is recorded. This is an expansion of the general ledger. The subsidiary ledger records the individual balances and hence there is no need to record the individual balances in the general ledger.

Controlling Account: Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. For example: Accounts Receivable Subsidiary ledger is represented in Accounts Receivable ledger.

The following table shows the revenue journal of SL Centers.

| Revenue Journal | |||||

| Date | Invoice No. | Accounts Debited | Post Ref. |

Accounts Receivable Dr. Fees Earned Cr. | |

| 2016 | |||||

| July | 21 | 1 | J D | ✓ | 115 |

| 22 | 2 | K T | ✓ | 350 | |

| 24 | 3 | T Q | ✓ | 85 | |

| 27 | 4 | F M | ✓ | 225 | |

| 30 | 5 | D C | ✓ | 170 | |

| 30 | 6 | K T | ✓ | 120 | |

| 31 | 7 | T Q | ✓ | 105 | |

| 31 | 1170 | ||||

| (12) (41) | |||||

Table (1)

The above transactions were transacted on account. Hence, they were posted in revenue journal.

The following table shows the general journal of SL Centers.

General Journal

| Date | Description | Post Ref. | Debit | Credit | |

| 2016 | |||||

| July | 25 | Supplies | 300 | ||

| Fees Earned | 300 | ||||

Table (2)

Supplies are assets for the business; it increases the assets of the business. So debit supplies. Fees earned are component of owners’ equity and it increases it. So credit fees earned.

Accounts Receivable Subsidiary Ledger

Name: D C

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| 2016 | |||||||

| July | 30 | R1 | 170 | 170 | |||

Table (3)

Name: F M

| Date | Items | Post Ref. | Debit | Credit | Balance | |||

| 2016 | ||||||||

| July | 27 | R1 | 225 | 225 | ||||

Table (4)

Name: J D

| Date | Items | Post Ref. | Debit | Credit | Balance | |||

| 2016 | ||||||||

| July | 21 | R1 | 115 | 115 | ||||

Table (5)

Name: K T

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| 2016 | |||||||

| July | 22 | 350 | 350 | ||||

| 30 | 120 | 470 | |||||

Table (6)

Name: T Q

| Date | Items | Post Ref. | Debit | Credit | Balance | |

| 2016 | ||||||

| July | 24 | 85 | 85 | |||

| 31 | 105 | 190 |

Table (7)

The above transactions were transacted on account. Hence they are posted in the account receivable subsidiary of D C, J D, F M, T Q, and K T.

General Ledger

Account: Account Receivable

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| July | 31 | R1 | 1,170 | 1,170 | |||

Table (8)

The general ledger records the summary of the subsidiary ledger accounts. So 1,170 from revenue journal are recorded in the general ledger.

Account: Supplies

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| July | 25 | J1 | 300 | 300 | |||

Table (9)

The general ledger records the summary of the subsidiary ledger accounts. So services provided for 300 to K T, in exchange of supplies are posted in supplies account.

Account: Fees Earned

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| July | 25 | J1 | 300 | 300 | |||

| 31 | R1 | 1170 | 1170 | ||||

Table (10)

The general ledger records the summary of the subsidiary ledger accounts. So 300 from supplies account and 1,170 from revenue journal are recorded in the fees earned.

(3) a.

Determine the sum of the balances of the customer accounts in the subsidiary ledger at 31st July.

Answer to Problem 1PA

The sum of balances of customers’ accounts in subsidiary ledger accounts is shown in the following table.

| Customers Account | Amount |

| D C | 170 |

| F M | 225 |

| J D | 115 |

| K T | 470 |

| T Q | 190 |

| Total | 1170 |

Table (11)

Explanation of Solution

The sum of balances of customers’ accounts in subsidiary ledger accounts is calculated by adding the balances of customers’ accounts.

b.

Determine the balance of the accounts receivable controlling account.

Answer to Problem 1PA

The balance of the accounts receivable controlling account is 1,170.

Explanation of Solution

Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. Since the balance of accounts receivable ledger is 1,170, so the balance of the accounts receivable controlling account is 1,170.

4.

Explain the benefits of the computerized system over the manual system.

Explanation of Solution

If SL Centers will start using computerized accounting system, then it can handle its accounting process more efficiently. Each sale transaction will record in electronic invoice form. The posting to accounts subsidiary ledgers as well as general ledgers will be automatic. There is no chance of double posting or clerical errors. Manual verification of controlling account with subsidiary ledger accounts is not required.

Want to see more full solutions like this?

Chapter 5 Solutions

Cengagenow For Financial Accounting

- Sage Learning Centers was established on July 20 to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardThe transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forward

- Piedmont Inc. has the following transactions for its first month of business: A. What are the individual account balances, and the total balance, in the accounts payable subsidiary ledger? B. What is the balance in the Accounts Payable general ledger account?arrow_forwardGlobal Services Company had the following transactions during the month of August: a. Record the August revenue transactions for Global Services Company into the following revenue journal format: b. What is the total amount posted to the accounts receivable and fees earned accounts from the revenue journal for August? c. What is the August 31 balance of the Morgan Corp. customer account assuming a zero balance on August 1?arrow_forwardDuring the month of October 20--, The Pink Petal flower shop engaged in the following transactions: Selected account balances as of October 1 were as follows: The Pink Petal also had the following subsidiary ledger balances as of October 1: REQUIRED 1. Record the transactions in a sales journal (page 7), cash receipts journal (page 10), purchases journal (page 6), cash payments journal (page 11), and general journal (page 5). Total, verify, and rule the columns where appropriate at the end of the month. 2. Post from the journals to the general ledger, accounts receivable ledger, and accounts payable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

- The transactions completed by Revere Courier Company during December 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December 2016, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardOn November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month, Patty completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016. 4. Determine the excess of revenues over expenses for November. 5. Can you think of any reason why the amount determined in (4) might not be the net income for November?arrow_forwardKelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owners equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.arrow_forward

- On October 1, 2016, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2016. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forwardPrepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and calculate the ending balance for the account. Assume an Accounts Payable beginning balance of $7,500. A. May 12, purchased merchandise inventory on account. $9,200 B. June 10, paid creditor for part of previous months purchase, $11,350arrow_forwardHorizon Consulting Company had the following transactions during the month of October: a. Record the October revenue transactions for Horizon Consulting Company in the following revenue journal format: b. What is the total amount posted to the accounts receivable and fees earned accounts from the revenue journal for October? c. What is the October 31 balance of the Pryor Corp. customer account assuming a zero balance on October 1?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College