a.

To calculate: The EPS of Lopez-Portillo Company before the expansion, if EBIT is 9% on total assets.

Introduction:

Earning per share (EPS):

It is the profit per outstanding share of a public company. A higher EPS indicates higher value of the company because investors are ready to pay higher price for one share of the company.

a.

Answer to Problem 25P

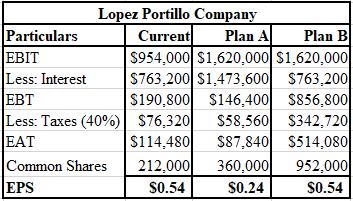

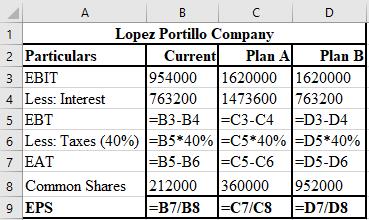

The calculation of EPS of current plan, plan D, and plan E of Lopez-Portillo Company is shown below.

Explanation of Solution

The formulae used for the computation of EPS of current plan, plan D, and plan E are shown below.

Working notes:

Calculation of interest on current plan:

Calculation of common shares of current plan:

Calculation of interest of plan A:

Calculation of common shares of plan A:

Calculation of common shares of plan B:

Note : The interest of plan B is unchanged.

b.

To calculate: The DFL of Lopez-Portillo company of each plan.

Introduction:

Degree of Financial Leverage (DFL):

It refers to the leverage ratio that evaluates the company’s EPS to the variations in its operating income. This ratio indicates that higher DFL leads to the higher earnings of the firm.

b.

Answer to Problem 25P

The DFL of current plan is 5 times , plan A is 11.07 times, and plan B is 1.89 times.

Explanation of Solution

Computation of DFL of current plan:

Computation of DFL of plan A:

Computation of DFL of plan B:

c.

To calculate: The EPS of each Plan and also determine the impact of each plan of Lopez-Portillo company.

Introduction:

Earning per share(EPS):

It is the profit per outstanding share of a public company. A higher EPS indicates higher value of the company because investors are ready to pay higher price for one share of the company.

c.

Answer to Problem 25P

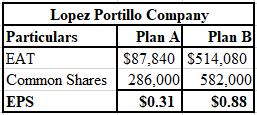

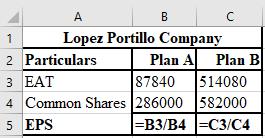

The calculation of EPS of plan A and plan B of Lopez-Portillo Company is shown below.

Explanation of Solution

The formula used for the computation of EPS of Plan A and Plan B are shown below.

Plan B will provide a higher EPS on a constant basis.

Working notes:

Calculation of common shares of plan A:

Calculation of common shares of plan B:

d.

To explain: The reason behind the concern of CFO about the stock values of Lopez-Portillo Company.

Introduction:

Share price:

The highest price of one share of a company that an investor is willing to pay is termed as the share’s price. It is the current price used for the trading of such shares.

d.

Answer to Problem 25P

The CFO of the company is concerned about the value of the stock because it impacts capital budgeting decisions and it also influences the ability to finance projects.

Explanation of Solution

The reason behind CFO’s concern about the common stock values are as follows:

(a) Common stock creates shareholder’s wealth.

(b) It impacts the capital budgeting decisions.

(c) It also influences the potential of financing any undertaken projects either at a high or low cost of capital.

Want to see more full solutions like this?

Chapter 5 Solutions

EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

- Dickinson Company has $12,020,000 million in assets. Currently half of these assets are financed with long-term debt at 10.1 percent and half with common stock having a par value of $8. Ms. Smith, Vice President of Finance, wishes to analyze two refinancing plans, one with more debt (D) and one with more equity (E). The company earns a return on assets before interest and taxes of 10.1 percent. The tax rate is 40 percent. Tax loss carryover provisions apply, so negative tax amounts are permissable. Under Plan D, a $3,005,000 million long-term bond would be sold at an interest rate of 12.1 percent and 375,625 shares of stock would be purchased in the market at $8 per share and retired. Under Plan E, 375,625 shares of stock would be sold at $8 per share and the $3,005,000 in proceeds would be used to reduce long-term debt. a. How would each of these plans affect earnings per share? Consider the current plan and the two new plans. b-1. Compute the earnings per share if return on…arrow_forwardLuxembourg Port Co. has assets of €100 million (including €10 million in cash) and debt of €20 million. If the company borrows an additional €10 million to repurchases €20 million of stock, what is the new debt-to-equity ratio?arrow_forwardLear Incorporated has $820,000 in current assets, $360,000 of which are considered permanent current assets. In addition, the firm has $620,000 invested in fixed assets. Lear wishes to finance all fixed assets and half of its permanent current assets with long-term financing costing 9 percent. The balance will be financed with short-term financing, which currently costs 5 percent. Lear’s earnings before interest and taxes are $220,000. Determine Lear’s earnings after taxes under this financing plan. The tax rate is 30 percent. As an alternative, Lear might wish to finance all fixed assets and permanent current assets plus half of its temporary current assets with long-term financing and the balance with short-term financing. The same interest rates apply as in part a. Earnings before interest and taxes will be $220,000. What will be Lear’s earnings after taxes? The tax rate is 30 percent.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning