Concept explainers

Healthy Foods Inc. sells 50-pound bags of grapes to the military for

a. What is the break-even point in bags?

b. Calculate the profit or loss on 12,000 bags and on 25,000 bags.

c. What is the degree of operating leverage at 20,000 bags and at 25,000 bags? Why does the degree of operating leverage change as the quantity sold increases?

d. If Healthy Foods has an annual interest expense of

e. What is the degree of combined leverage at both sales levels?

a.

To calculate: The break-even point (BEP) of Healthy Foods Inc.

Introduction:

Break-even point (BEP):

It is a point of sale at which a company is in a no profit and no loss situation. The value of BEP is derived by dividing total fixed cost by the difference of revenue per unit and variable cost per unit.

Answer to Problem 12P

The BEP of Healthy Foods Inc. is 16,000 bags.

Explanation of Solution

Calculation of BEP of Healthy Foods Inc.:

b.

To calculate: The profit or loss for Healthy Foods Inc. on 12,000 as well as 25,000 bags.

Introduction:

Profit or Loss:

It refers to the gain or loss arising from the commercial transactions during a specified period of time and is used to assess the company’s financial performance.

Answer to Problem 12P

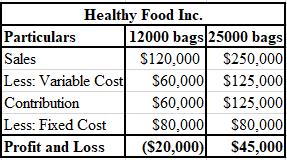

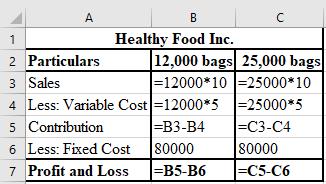

Calculation of profit or loss on 12,000 bags and 25,000 bags for Healthy Foods Inc:

Explanation of Solution

The formulae used for the computation of profit or loss of 12,000 bags and 25,000 bags:

c.

To calculate: The DOL for 20,000 and 25,000 bags of Healthy Foods Inc. and also explain the reason behind the change of DOL with the increase in the quantity sold.

Introduction:

Degree of operating leverage (DOL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 12P

The DOL for Healthy Foods Inc. for 20,000 bags is 5 times and for 25,000 bags is 2.78 times.

The reason behind this change of DOL is that the leverage has gone down and is far away from BEP. Hence, we can say that the leverage has decreased and the organisation is operating on a greater profit base.

Explanation of Solution

Calculation of DOL for 20,000 bags:

Calculation of DOL for 25,000 bags:

d.

To calculate: The DFL of Healthy Foods Inc.for 20,000 bags as well as 25,000 bags.

Introduction:

Degree of financial leverage(DFL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 12P

DFL for the company Healthy Foods Inc. for 20,000 bags is 2 times and for 25,000 bags is 1.29 times.

Explanation of Solution

Calculation of DFL for 20,000 bags:

Calculation of DFL for 25,000 bags:

Working note:

Calculation of EBIT on 20,000 bags:

Calculation of EBIT on 25,000 bags:

e.

To calculate: The DCL of Healthy foods Inc. at 20,000 and 25,000 bags, respectively.

Introduction:

Degree of combined leverage (DCL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 12P

DCL for the company Healthy Foods Inc. for 20,000 bags is 10 times and for 25,000 bags is 3.57 times.

Explanation of Solution

Explanation:

Calculation of DCL on 20,000 bags:

Calculation of DCL on 25,000 bags:

Want to see more full solutions like this?

Chapter 5 Solutions

EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

- Schylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardGelbart Company manufactures gas grills. Fixed costs amount to 16,335,000 per year. Variable costs per gas grill are 225, and the average price per gas grill is 600. Required: 1. How many gas grills must Gelbart Company sell to break even? 2. If Gelbart Company sells 46,775 gas grills in a year, what is the operating income? 3. If Gelbart Companys variable costs increase to 240 per grill while the price and fixed costs remain unchanged, what is the new break-even point?arrow_forwardShelby Industries has a capacity to produce 45.000 oak shelves per year and is currently selling 40,000 shelves for $32 each. Martin Hardwoods has approached Shelby about buying 1,200 shelves for a new project and is willing to pay $26 each. The shelves can be packaged in bulk; this saves Shelby $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27 with fixed costs of $350,000. Because the shelves dont require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. What is the minimum price per shelf that Shelby should accept for this special order?arrow_forward

- Jansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling 44,000 shelves for $32 each. Cutrate Furniture approached Jansen about buying 1,200 shelves for bookcases it is building and is willing to pay $26 for each shelf. No packaging will be required for the bulk order. Jansen usually packages shelves for Home Depot at a price of $1.50 per shell. The $1.50 per-shelf cost is included in the unit variable cost of $27, with annual fixed costs of $320.000. However, the $130 packaging cost will not apply in this case. The fixed costs will be unaffected by the special order and the company has the capacity to accept the order. Based on this information, what would be the profit if Jansen accepts the special order? A. Profits will decrease by $1,200. B. Profits will increase by $31,200. C. Profits will increase by $600. D. Profits will increase by $7,200.arrow_forwardDelta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.arrow_forwardKerr Manufacturing sells a single product with a selling price of $600 with variable costs per unit of $360. The companys monthly fixed expenses are $72,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of January when they will sell 500 units. How many units will Kerr need to sell in order to realize a target profit of $120,000? What dollar sales will Kerr need to generate in order to realize a target profit of $120,000? Construct a contribution margin income statement for the month of June that reflects $600,000 in sales revenue for Kerr Manufacturing.arrow_forward

- Maple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.arrow_forwardMarlin Motors sells a single product with a selling price of $400 with variable costs per unit of $160. The companys monthly fixed expenses are $36,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of November when they will sell 130 units. How many units will Marlin need to sell in order to realize a target profit of $48,000? What dollar sales will Marlin need to generate in order to realize a target profit of $48.000? Construct a contribution margin income statement for the month of February that reflects $200,000 in sales revenue for Marlin Motors.arrow_forwardCadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forward

- Faldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardDimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forwardFire Company is a service firm with current service revenue of $900,000 and a 40% contribution margin. Its fixed costs are $200,000. Ice Company has current sales of $420,000 and a 30% contribution margin. Its fixed costs are $90,000. What is the margin of safety for Fire and Ice? Compare the margin of safety in dollars between the two companies. Which is stronger? Compare the margin of safety in percentage between the two companies. Now which one is stronger? Compute the degree of operating leverage for both companies. Which company will benefit most from a 10% increase in sales? Explain why. Illustrate your findings in an Income Statement that is increased by 10%.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT