To think critically about: The relationship between the value of an

Introduction:

The total sum of interest that is due for a particular time is the interest rate. The rate of interest can be due for a period as a proportion of the sum borrowed or deposited and as the proportion of the sum lent. The future sum of money that is worth today is described by the present value. The present value of the cash flows in the future with a particular discount rate is the present value of annuity.

Explanation of Solution

The relationship between the interest rate and the

- If the interest rate maximizes, the present value of the annuity would decrease and the present value of annuity would increase if the interest rate decreases.

- If the rate of interest increases, the

future value of the annuity would increase and the future value of annuity would decrease if the interest rate decreases.

To calculate: The present value of

Introduction:

The total sum of interest that is due for a particular time is the interest rate. The rate of interest can be due for a period as a proportion of the sum borrowed or deposited and as the proportion of the sum lent. The future sum of money that is worth today is described by the present value. The present value of the cash flows in the future with a particular discount rate is the present value of annuity.

Answer:

- The present value of annuity with an interest rate of 10% is $44,855.34.

- The present value of annuity with an interest rate of 5% is $56,368.66.

- The present value of annuity with an interest rate of 15% is $36,637.01.

Answer to Problem 38QP

- The present value of

annuity with an interest rate of 10% is $44,855.34. - The present value of annuity with an interest rate of 5% is $56,368.66.

- The present value of annuity with an interest rate of 15% is $36,637.01.

Explanation of Solution

Given information:

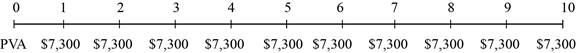

Person X purchased a ten-year

Time line:

Formula to calculate the present value of annuity:

Note: C denotes the annual cash flow, r denotes the rate of exchange, and t denotes the period.

Compute the present value of annuity at 10% interest:

Hence, the present value of annuity at 10% is $44,855.34.

Compute the present value of annuity at 5% interest:

Hence, the present value of annuity at 5% is $56,368.66.

Compute the present value of annuity at 15% interest:

Hence, the present value of annuity at 15% is $36,637.01097.

Want to see more full solutions like this?

Chapter 5 Solutions

Loose Leaf for Essentials of Corporate Finance

- Define the stated (quoted) or nominal rate INOM as well as the periodic rate IPER. Will the future value be larger or smaller if we compound an initial amount more often than annually—for example, every 6 months, or semiannually—holding the stated interest rate constant? Why? What is the future value of $100 after 5 years under 12% annual compounding? Semiannual compounding? Quarterly compounding? Monthly compounding? Daily compounding? What is the effective annual rate (EAR or EFF%)? What is the EFF% for a nominal rate of 12%, compounded semiannually? Compounded quarterly? Compounded monthly? Compounded daily?arrow_forwardCalculating interest earned and future value of savings account. If you put 6,000 in a savings account that pays interest at the rate of 3 percent, compounded annually, how much will you have in five years? (Hint: Use the future value formula.) How much interest will you earn during the five years? If you put 6,000 each year into a savings account that pays interest at the rate of 4 percent a year, how much would you have after five years?arrow_forward(1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest rate is 10%, compounded semiannually? (2) What is the PV of the same stream? (3) Is the stream an annuity? (4) An important rule is that you should never show a nominal rate on a time line or use it in calculations unless what condition holds? (Hint: Think of annual compounding, when INOM = EFF% = IPER.) What would be wrong with your answers to parts (1) and (2) if you used the nominal rate of 10% rather than the periodic rate, INOM/2 = 10%/2 = 5%?arrow_forward

- The present value of an annuity is the sum of the discounted value of all future cash flows. You have the opportunity to invest in several annuities. Which of the following 10-year annuities has the greatest present value (PV)? Assume that all annuities earn the same positive interest rate. An annuity that pays $500 at the end of every six months An annuity that pays $1,000 at the end of each year An annuity that pays $1,000 at the beginning of each year*** This is the correct option**** An annuity that pays $500 at the beginning of every six months A. An ordinary annuity selling at $2,514.15 today promises to make equal payments at the end of each year for the next eight years (N). If the annuity’s appropriate interest rate (I) remains at 8.00% during this time, the annual annuity payment (PMT) will be . B. You just won the lottery. Congratulations! The jackpot is $10,000,000, paid in eight equal annual payments. The…arrow_forwardSuppose you are going to receive $13,000 per year for 7 years. The appropriate interest rate is 8 percent. a.What is the present value of the payments if they are in the form of an ordinary annuity? b.What is the present value if the payments are an annuity due? c.Suppose you plan to invest the payments for 7 years, what is the future value if the payments are an ordinary annuity? d.Suppose you plan to invest the payments for 7 years, what is the future value if the payments are an annuity due?arrow_forwardSuppose you're going to receive $7800 per year for five years. the appropriate discount rate is 7.5%. A.What is the present value of the payments if they are in the form of an ordinary annuity? What is the present value if the payments are an annuity due? B. Suppose you plan to invest the payments for five years. What is the future value if the payments are an ordinary annuity? What if the payments are in annuity due? C. Which has the higher present value, the ordinary annuity or the annuity due? Which has a higher future value? Will this always be true?arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT