To calculate: The size of settlements, and if Person X is a plaintiff, what will be his choice on the interest rate.

Introduction:

The series of payments that are made at equal intervals is an

Answer to Problem 58QP

Solution:

The size of the settlement or the award is $527,202.72.

Explanation of Solution

Given information:

Person X serves on a jury. A plaintiff sues the city for the injuries that are continued after the accident of a sweeper in the street. In the trial, the doctors stated that it will be 5 years earlier the plaintiff would be able to return back to work. The decision made by the jury was in favor of the plaintiff. Person X is the foreperson of the jury. The jury proposes that the plaintiff will be provided an award that is as follows:

- a) The present value of the 2 years back pay. The annual salary of the plaintiff for the last 2 years would have been $43,000 and $46,000.

- b) The present value of the 5 years’ salary in future is assumed to be $49,000 for a year.

- c) The sum that has to be paid for the pain and suffering is $200,000.

- d) The amount of the court costs is $25,000.

It has to be assumed that the payment of the salary is made at the end of the month in equal amounts. The rate of interest is 7% at an effective annual rate.

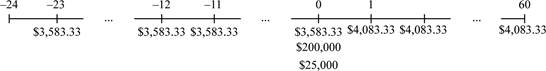

Time line of the cash flow:

Note: The cash flows here would have happened in the past and will also occur in the future. It is essential to find the present cash flows. Before computing the present value of the cash flow, it is essential to adjust the rate of interest and thus, the effective monthly interest rate can be found. Finding the annual percentage rate with compounding monthly and dividing it by twelve, it will provide the effective monthly rate. The annual percentage rate with the monthly compounding is calculated as follows:

Compute the annual percentage rate with the effective annual rate:

Hence, the annual percentage rate is 0.0678 or 6.78%.

To determine the today’s value of the back pay from 2 years ago, it is essential to find the

Formula to calculate the future value of an annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the future value annuity:

Hence, the future value of an annuity is $44,362.73.

Formula to compute the future value:

Note: C denotes the annual cash flow or an annuity payment, r represents the rate of interest, and t denotes the number of payments.

Compute the future value:

Hence, the future value is $47,468.12

Note: The future value of the annuity is determined by the effective monthly rate and the future value of the lump sum is determined by the effective annual rate. The other alternate way to determine the future value of the lump sum with the effective annual rate as long it is utilized for 12 periods. The solution would be the same in either way.

Now the today’s value of the last year’s back pay is calculated as follows:

Compute the future value annuity:

Hence, the future value of the annuity is $47,457.81.

Next, it is essential to determine today’s value of the 5 year’s future salary.

Formulae to calculate the present value annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity for without fee:

Hence, the present value of the annuity is $207,276.79.

The today’s value of the jury award is calculated by adding the sum of salaries, the court costs, and the compensation for the pain and sufferings. The award amount is calculated as follows:

Hence, the award amount or the size of the settlement is $527,202.72.

Want to see more full solutions like this?

Chapter 5 Solutions

Loose Leaf for Essentials of Corporate Finance

- A wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $32,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 10 percent, how much must the donor contribute today to fully fund the scholarship? Please do not give solution and formulae in image format.. thankuarrow_forwardYou won the state lottery and took the payout as a $1,823,475 lump sum today. Your spouse has decided that you need to invest this money for the next 9 years and can expect it to earn an average annual rate of return of 8.00%. If this comes to pass, how much money will be in the account at the end of the period?arrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $38,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 5 percent, how much must the donor contribute today to fully fund the scholarship?arrow_forward

- A student has borrowed $27,500 in Perkins loans (available to students with exceptional need). The rate on the loan is 5% and the government has paid the interest while the student has been in school. To simplify the calculations assume annual tuition and loan payments. What are the differences in the payment amount and the total paid if the student pays the loan back in 5 years and in 20 years? Is the availability of the student loan interest likely to reduce the after-tax cost of the loan?arrow_forwardRon Sample is the grand prize winner in a college tuition essay contest awarded through a local organization's scholarship fund. The winner receives $7,000 at the beginning of each year for the next 5 years. How much (in $) should be invested at 6% interest compounded annually to award the prize? (Round your answer to the nearest cent.)arrow_forwardSuppose that your colleague has approached you with an opportunity to lend $25,000 to her laundry business in Accra. The business, called Do it yourself launderette, plans to offer home services to customers at area. Funds would be used to lease a delivery vehicle, purchase supplies, and provide working capital. Terms of the proposal are that you would receive $5,000 at the end of each year in interest with the full $25,000 to be repaid at the end of a ten[1]year period. a) Assuming a 10% required rate of return, calculate the present value of cash flows and the net present value of the proposed investment. b) Based on this same interest rate assumption, calculate the cumulative cash flow of the proposed investment for each period in both nominal and present[1]value terms. c) If we are to use the monetary approach to exchange rate determination, what will be the predicted effect on the exchange rate of domestic currency if domestic real income increases? d) Using the same…arrow_forward

- Suppose your friend is celebrating her 35th birthday today and wants to start saving for her anticipated retirement at age 65. She wants to be able to withdraw $80,000 from her savings account on each birthday for 15 years following her retirement; the first withdrawal will be on her 66th birthday. Your friend intends to invest her money in the local credit union, which offers 9 percent interest per year. She wants to make equal annual payments on each birthday into the account established at the credit union for her retirement fund. If she starts making these deposits on her 36th birthday and continues to make deposits until she is 65 (the last deposit will be on her 65th birthday), what amount must she deposit annually to be able to make the desired withdrawals at retirement? b) Suppose your friend has just inherited a large sum of money. Rather than making equal annual payments, she has decided to make one lump-sum payment on her 35th birthday to cover her retirement needs.…arrow_forwardYour grandfather wants to establish a scholarship in his father’s name at a local university and has stipulated that you will administer it. As you’ve committed to fund a $15,000 scholarship every year beginning one year from tomorrow, you’ll want to set aside the money for the scholarship immediately. At tomorrow’s meeting with your grandfather and the bank’s representative, you will need to deposit ___________ (rounded to the nearest whole dollar) so that you can fund the scholarship forever, assuming that the account will earn 4.50% per annum every year. Oops! The bank representative just reported that he misquoted the available interest rate on the scholarship’s account. Your account should earn 7.00%. The amount of your required deposit should be revised to____________. This suggests there is (an inverse / a direct) relationship between the interest rate earned on the account and the present value of the perpetuity.arrow_forwardYou believe that you can set aside $1,200 each year for the next four years, starting immediately, in order to buy a small fishing boat for your retirement. Your friend Luis promises that he’ll pay you back $4,900 that he owes you three years from now, so you will add that to the payment you make at the start of year 4. Then, at the start of year 5, you will increase your payment to $1,400; in year 6, to $1,500; and in year 7, to $1,600. Every payment will be deposited in a fund bearing 4% interest compounded annually. How much will you have set aside for your boat at the end of the seventh year?arrow_forward

- “Suppose that your parents are willing to lend you $20,000 for part of the cost of your college education and living expenses. They want you to repay them the $20,000 without any interest, in a lump sum 15 years after you graduate, when they plan to retire and move. Meanwhile, you will be busy repaying federally guaranteed loans for the first 10 years after graduation. But you realize that you won’t be able to repay the lump sum without saving up. So you decide that you will put aside money in an interest-bearing account every month for the first five years before the payment is due. You feel comfortable with setting aside $275 a month (the amount of the payment on your college loans, which will be paid off after 10 years). How high an annual nominal rate on savings do you need to accumulate the $20,000, in 60 months, if interest is compounded monthly? Enter into a spreadsheet the values of d = 275, r = 0.05 (annual rate), and n = 60, and the savings formula with r replaced…arrow_forwardSuppose that your parents are willing to lend you $20,000 for part of the cost of your college education and living expenses. They want you to repay them the $20,000, without any interest, in a lump sum 15 years after you graduate, when they plan to retire and move. Meanwhile, you will be busy repaying federally guaranteed loans for the first 10 years after graduation. But you realize that you won’t be able to repay the lump sum without saving up. So you decide that you will put aside money in an interest-bearing account every month for the five years before the payment is due. You feel comfortable with putting aside $275 a month (the amount of the payment on your college loans, which will be paid off after 10 years). How high an annual nominal interest rate on savings do you need to accumulate the $20,000 in 60 months, if interest is compounded monthly? Enter into a spreadsheet the values d 5 275, r 5 0.05 (annual rate), and n 5 60, and the savings formula with r replaced by r/12 (the…arrow_forwardUse the formula for the value of an annuity to solve:To offer scholarship funds to children of employees, a company invests $15,000 at the end of every three months in an annuity that pays 9% compounded quarterly. a. How much will the company have in scholarship funds at the end of ten years? b. Find the interest.Round answers to the nearest dollar.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning