Concept explainers

Computation of Account Balances

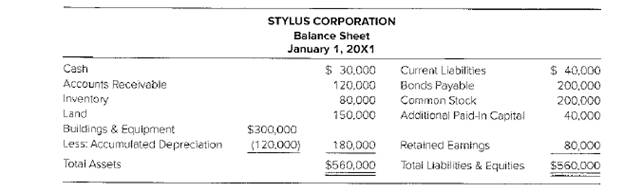

Pencil Company purchased 40 percent ownership of Stylus Corporation on January 1, 20X1,for $150,000. Stylus’s balance sheet at the time of acquisition was as follows:

During 20X1 Stylus Corporation reported net income of $30,000 and paid dividends of $9,000. The fair values of Stylus’s assets and liabilities were equal to their book values at the date of acquisition, with the exception of buildings and equipment, which had a fair value $35,000 above book value.

During 20X1 Stylus Corporation reported net income of $30,000 and paid dividends of $9,000. The fair values of Stylus’s assets and liabilities were equal to their book values at the date of acquisition, with the exception of buildings and equipment, which had a fair value $35,000 above book value.

All buildings and equipment had remaining lives of five year at the time of the business combination. The amount attributed to

Required

a. What amount of investment income will Pencil Company record during 20X1 under equity method accounting?

b. What amount of income will be reported under the cost method?

c. What will be the balance in the investment account on December 31, 20X1, under (1) cost method and (2) equity-method accounting?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Advanced Financial Accounting

- Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 52,300 $ 39,000 Accounts Receivable 99,000 59,000 Inventory 136,000 92,000 Land 66,000 49,000 Buildings & Equipment 417,000 268,000 Less: Accumulated Depreciation (151,000) (73,000) Investment in Smart Corporation 98,000 Total Assets $ 717,300 $ 434,000 Accounts Payable $ 141,500 $ 27,000 Mortgage Payable 300,800 288,000 Common Stock 72,000 40,000 Retained Earnings 203,000 79,000 Total Liabilities & Stockholders’ Equity $ 717,300 $ 434,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…arrow_forwardPhone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 52,300 $ 39,000 Accounts Receivable 99,000 59,000 Inventory 136,000 92,000 Land 66,000 49,000 Buildings & Equipment 417,000 268,000 Less: Accumulated Depreciation (151,000) (73,000) Investment in Smart Corporation 98,000 Total Assets $ 717,300 $ 434,000 Accounts Payable $ 141,500 $ 27,000 Mortgage Payable 300,800 288,000 Common Stock 72,000 40,000 Retained Earnings 203,000 79,000 Total Liabilities & Stockholders’ Equity $ 717,300 $ 434,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…arrow_forwardDetermine the consolidated assets as of December 31. On January 1, ABC Acquired 60 percent of the outstanding voting stock of XYZ for P301,500 cash consideration. The remaining 40 percent of XYZ had an acquisition date fair value of P138,500. On January 1, XYZ possessed equipment (5-year life) that was undervalued on its books P25,000.XYZ also had developed several secret formulas that ABC assessed at P50,000. Theses formulas, although not recorded on XYZ's financial records, were estimated to have a 20-year future life. ABC also determined that the inventory of XYZ is overvalued by P10,000. 80% of these inventories remain unsold by the end of the year. As of December 31, the financial statements appeared as follows:arrow_forward

- On January 1, Patterson Corporation acquired 80 percent of the 100,000 outstanding voting shares of Soriano, Inc., in exchange for $31.25 per share cash. The remaining 20 percent of Soriano’s shares continued to trade for $30 both before and after Patterson’s acquisition. At January 1, Soriano’s book and fair values were as follows: Book Values Fair Values Remaining Life Current assets $ 80,000 $ 80,000 Buildings and equipment 1,250,000 1,000,000 5 years Trademarks 700,000 900,000 10 years Patented technology 940,000 2,000,000 4 years $ 2,970,000 Current liabilities $ 180,000 $ 180,000 Long-term notes payable 1,500,000 1,500,000 Common stock 50,000 Additional paid-in capital 500,000 Retained earnings 740,000 $ 2,970,000 In addition, Patterson assigned a $600,000 value to certain unpatented technologies recently developed…arrow_forwardOn January 1, Patterson Corporation acquired 80 percent of the 100,000 outstanding voting shares of Soriano, Inc., in exchange for $31.25 per share cash. The remaining 20 percent of Soriano’s shares continued to trade for $30 both before and after Patterson’s acquisition. At January 1, Soriano’s book and fair values were as follows: Book Values Fair Values Remaining Life Current assets $ 80,000 $ 80,000 Buildings and equipment 1,250,000 1,000,000 5 years Trademarks 700,000 900,000 10 years Patented technology 940,000 2,000,000 4 years $ 2,970,000 Current liabilities $ 180,000 $ 180,000 Long-term notes payable 1,500,000 1,500,000 Common stock 50,000 Additional paid-in capital 500,000 Retained earnings 740,000 $ 2,970,000 In addition, Patterson assigned a $600,000 value to certain unpatented technologies recently developed…arrow_forwardBlank Corporation acquired 100 percent of Faith Corporation’s common stock on December 31, 20X2, for $207,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Blank Corporation Faith Corporation Assets Cash $ 66,000 $ 36,000 Accounts Receivable 85,000 39,000 Inventory 107,000 65,000 Buildings and Equipment (net) 224,000 151,000 Investment in Faith Corporation Stock 207,000 Total Assets $ 689,000 $ 291,000 Liabilities and Stockholders’ Equity Accounts Payable $ 82,000 $ 23,000 Notes Payable 142,000 61,000 Common Stock 99,000 43,000 Retained Earnings 366,000 164,000 Total Liabilities and Stockholders’ Equity $ 689,000 $ 291,000 At the date of the business combination, the book values of Faith’s net assets and liabilities approximated fair value. Assume that Faith Corporation’s accumulated depreciation on buildings and equipment on the acquisition date was $16,000. Required:…arrow_forward

- Enron Corporation acquired by Walt Corporation. Walt acquired 75 percent ownership on January 1, 2018, for $200,250. At that date, Enron reported common stock outstanding of $90,000 and retained earnings of $135,000, and the fair value of the non-controlling interest was $66,750. The differential is assigned to equipment, which had a fair value $42,000 more than book value and a remaining economic life of seven years at the date of the business combination. Enron reported net income of $45,000 and paid dividends of $18,000 in 2018. Prepare and explain the journal entries recorded by Walt during 2018 on its books if it accounts for its investment in Enron using the equity method.arrow_forwardABC Corporation acquired 70 percent of XYZ Corporation on August 1 for P420,000. On that date, XYZ Corporation had the following book values and market values. What is the amount of purchase differential recognized on the acquisition date consolidated balance sheet with respect to plant assets. *In good accounting form, please. Thank you!arrow_forwardLivermore Corporation acquired 90 percent of Tiger Corporation's voting stock on January 1,20X2, for $450,000. The fair value of the noncontrolling interest was $50,000 at the date of acquisition. Tiger reported common stock outstanding of $100,000 and retained earnings of $280,000. The differential is assigned to buildings with an expected life of 15 years at the date of acquisition. On December 31,20X4, Livermore had $30,000 of unrealized profits on its books from inventory sales to Tiger, and Tiger had $40,000 of unrealized profit on its books from inventory sales to Livermore. All inventory held at December 31, 20X4, was sold during 20 x5. On December 31,20 X5, Livermore had $18,000 of unrealized profit on its books from inventory sales to Tiger, and Tiger had unrealized profit on its books of 45,000 from inventory sales to Livermore. In 20x5 Tiger reported net income of $225,000. The amount Livermore will report as income from Tiger Company for year 20x5would bearrow_forward

- Pirate Corporation acquired 60 percent ownership of Ship Company on January 1, 20X8, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Ship Company. Accumulated depreciation on Buildings and Equipment was $75,000 on the acquisition date. Trial balance data at December 31, 20X8, for Pirate and Ship are as follows: Item Pirate Corporation Ship Company Debit Credit Debit Credit Cash $ 27,000 $8,000 Accounts Receivable 65,000 22,000 Inventory 40,000 30,000 Buildings and Equipment 500,000 235,000 Investment in Row Company 40,000 Investment in Ship Company 108,000 Cost of Goods Sold 150,000 110,000 Depreciation Expense 30,000 10,000 Interest Expense 8,000 3,000 Dividends Declared 24,000 15,000 Accumulated Depreciation $ 140,000 $ 85,000 Accounts Payable 63,000 20,000 Bonds Payable 100,000 50,000 Common Stock 200,000…arrow_forwardPirate Corporation acquired 60 percent ownership of Ship Company on January 1, 20X8, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Ship Company. Accumulated depreciation on Buildings and Equipment was $75,000 on the acquisition date. Trial balance data at December 31, 20X8, for Pirate and Ship are as follows: Item Pirate Corporation Ship Company Debit Credit Debit Credit Cash $ 27,000 $8,000 Accounts Receivable 65,000 22,000 Inventory 40,000 30,000 Buildings and Equipment 500,000 235,000 Investment in Row Company 40,000 Investment in Ship Company 108,000 Cost of Goods Sold 150,000 110,000 Depreciation Expense 30,000 10,000 Interest Expense 8,000 3,000 Dividends Declared 24,000 15,000 Accumulated Depreciation $ 140,000 $ 85,000 Accounts Payable 63,000 20,000 Bonds Payable 100,000 50,000 Common Stock 200,000…arrow_forwardCompute for the consolidated expenses to be reported for the year. On January 1, ABC Acquired 60 percent of the outstanding voting stock of XYZ for P301,500 cash consideration. The remaining 40 percent of XYZ had an acquisition date fair value of P138,500. On January 1, XYZ possessed equipment (5-year life) that was undervalued on its books P25,000.XYZ also had developed several secret formulas that ABC assessed at P50,000. Theses formulas, although not recorded on XYZ's financial records, were estimated to have a 20-year future life. ABC also determined that the inventory of XYZ is overvalued by P10,000. 80% of these inventories remain unsold by the end of the year. As of December 31, the financial statements appeared as follows:arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning