Advanced Financial Accounting

12th Edition

ISBN: 9781259916977

Author: Christensen, Theodore E., COTTRELL, David M., Budd, Cassy

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.5E

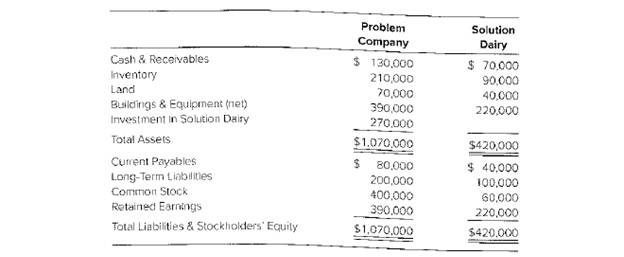

Problem Company owns 90 percent of Solution Dairy’s stock. The balance sheets of the twocompanies immediately the Solution acquisition showed the following amounts:

The Pair value of thenoncontrolling interest at the date of acquisition was determined to be $30,000. The full amount of the increase over book value is assigned to kind held by Solution. At the date of acquisition, Solution owed Problem $8,000 plus $900 accrued interest. Solutionhad recorded the accrued interest, but Problem had not.

Required

Prepare and complete a consolidated balance sheet worksheet.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $97,300. At that date, the fair value of the noncontrolling interest was $41,700. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

Item

Phone Corporation

Smart Corporation

Cash

$ 58,300

$ 22,000

Accounts Receivable

109,000

49,000

Inventory

144,000

79,000

Land

73,000

36,000

Buildings & Equipment

426,000

266,000

Less: Accumulated Depreciation

(166,000)

(75,000)

Investment in Smart Corporation

97,300

Total Assets

$ 741,600

$ 377,000

Accounts Payable

$ 142,500

$ 26,000

Mortgage Payable

331,100

233,000

Common Stock

68,000

39,000

Retained Earnings

200,000

79,000

Total Liabilities & Stockholders’ Equity

$ 741,600

$ 377,000

At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…

Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $97,300. At that date, the fair value of the noncontrolling interest was $41,700. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

Item

Phone Corporation

Smart Corporation

Cash

$ 58,300

$ 22,000

Accounts Receivable

109,000

49,000

Inventory

144,000

79,000

Land

73,000

36,000

Buildings & Equipment

426,000

266,000

Less: Accumulated Depreciation

(166,000)

(75,000)

Investment in Smart Corporation

97,300

Total Assets

$ 741,600

$ 377,000

Accounts Payable

$ 142,500

$ 26,000

Mortgage Payable

331,100

233,000

Common Stock

68,000

39,000

Retained Earnings

200,000

79,000

Total Liabilities & Stockholders’ Equity

$ 741,600

$ 377,000

At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…

Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition:

Item

Phone Corporation

Smart Corporation

Cash

$ 52,300

$ 39,000

Accounts Receivable

99,000

59,000

Inventory

136,000

92,000

Land

66,000

49,000

Buildings & Equipment

417,000

268,000

Less: Accumulated Depreciation

(151,000)

(73,000)

Investment in Smart Corporation

98,000

Total Assets

$ 717,300

$ 434,000

Accounts Payable

$ 141,500

$ 27,000

Mortgage Payable

300,800

288,000

Common Stock

72,000

40,000

Retained Earnings

203,000

79,000

Total Liabilities & Stockholders’ Equity

$ 717,300

$ 434,000

At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…

Chapter 5 Solutions

Advanced Financial Accounting

Ch. 5 - Where is the balance assigned to the...Ch. 5 - Why must a noncontrolling interest be reported in...Ch. 5 - Prob. 5.3QCh. 5 - Prob. 5.4QCh. 5 - Prob. 5.5QCh. 5 - Prob. 5.6QCh. 5 - Prob. 5.7QCh. 5 - Prob. 5.8QCh. 5 - Prob. 5.9QCh. 5 - Prob. 5.10Q

Ch. 5 - Under what Circumstances would a parent company...Ch. 5 - Prob. 5.12QCh. 5 - Prob. 5.13QCh. 5 - Prob. 5.14AQCh. 5 - Prob. 5.15AQCh. 5 - Consolidation Worksheet Preparation The newest...Ch. 5 - Prob. 5.2CCh. 5 - Prob. 5.3CCh. 5 - Prob. 5.4CCh. 5 - Prob. 5.5CCh. 5 - Prob. 5.1.1ECh. 5 - Prob. 5.1.2ECh. 5 - Prob. 5.1.3ECh. 5 - Prob. 5.1.4ECh. 5 - Prob. 5.2.1ECh. 5 - Prob. 5.2.2ECh. 5 - Prob. 5.2.3ECh. 5 - Prob. 5.2.4ECh. 5 - Prob. 5.2.5ECh. 5 - Prob. 5.3ECh. 5 - Prob. 5.4ECh. 5 - Balance Sheet Worksheet Problem Company owns 90...Ch. 5 - Prob. 5.6ECh. 5 - Prob. 5.7ECh. 5 - Prob. 5.8.1ECh. 5 - Prob. 5.8.2ECh. 5 - Prob. 5.8.3ECh. 5 - Prob. 5.8.4ECh. 5 - Prob. 5.8.5ECh. 5 - Prob. 5.8.6ECh. 5 - Prob. 5.8.7ECh. 5 - Prob. 5.9ECh. 5 - Prob. 5.10ECh. 5 - Prob. 5.11ECh. 5 - Prob. 5.12ECh. 5 - Prob. 5.13ECh. 5 - Prob. 5.14ECh. 5 - Prob. 5.15ECh. 5 - Prob. 5.16ECh. 5 - Prob. 5.17AECh. 5 - Prob. 5.18AECh. 5 - Prob. 5.19PCh. 5 - Prob. 5.20PCh. 5 - Prob. 5.21.1PCh. 5 - Multiple-Choice Questions on Applying the Equity...Ch. 5 - Prob. 5.21.3PCh. 5 - Prob. 5.21.4PCh. 5 - Prob. 5.22PCh. 5 - Computation of Account Balances Pencil Company...Ch. 5 - Prob. 5.24PCh. 5 - Equity Entries with Differential On January 1,...Ch. 5 - Equity Entries with Differential Plug Corporation...Ch. 5 - Prob. 5.27PCh. 5 - Prob. 5.28PCh. 5 - Prob. 5.29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 52,300 $ 39,000 Accounts Receivable 99,000 59,000 Inventory 136,000 92,000 Land 66,000 49,000 Buildings & Equipment 417,000 268,000 Less: Accumulated Depreciation (151,000) (73,000) Investment in Smart Corporation 98,000 Total Assets $ 717,300 $ 434,000 Accounts Payable $ 141,500 $ 27,000 Mortgage Payable 300,800 288,000 Common Stock 72,000 40,000 Retained Earnings 203,000 79,000 Total Liabilities & Stockholders’ Equity $ 717,300 $ 434,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…arrow_forwardLivermore Corporation acquired 90 percent of Tiger Corporation's voting stock on January 1,20X2, for $450,000. The fair value of the noncontrolling interest was $50,000 at the date of acquisition. Tiger reported common stock outstanding of $100,000 and retained earnings of $280,000. The differential is assigned to buildings with an expected life of 15 years at the date of acquisition. On December 31,20X4, Livermore had $30,000 of unrealized profits on its books from inventory sales to Tiger, and Tiger had $40,000 of unrealized profit on its books from inventory sales to Livermore. All inventory held at December 31, 20X4, was sold during 20 x5. On December 31,20 X5, Livermore had $18,000 of unrealized profit on its books from inventory sales to Tiger, and Tiger had unrealized profit on its books of 45,000 from inventory sales to Livermore. In 20x5 Tiger reported net income of $225,000. The amount Livermore will report as income from Tiger Company for year 20x5would bearrow_forwardBronze Corporation agrees to acquire the net assets of Wall Corporation on January 1, 20X1. Wall has the following balance sheet on the date of acquisition: Wall Corporation Balance Sheet January 1, 20X1 Assets Liabilities and Equity Accounts receivable . . . . . . . . . $ 79,000 Current liabilities . . . . . . . . . . . . . . $145,000 Inventory . . . . . . . . . . . . . . . . . . 112,000 Bonds payable . . . . . . . . . . . . . . . 100,000 Other current assets . . . . . . . . . . 55,000 Common stock . . . . . . . . . . . . . . . . 200,000 Equipment (net) . . . . . . . . . . . . . 294,000 Paid-in capital in excess of par . . . 50,000 Trademark . . . . . . . . . . . . . . . . . 30,000 Retained earnings . . . . . . . . . . . . . 75,000 Total assets. . . . . . . . . . . . . . . $570,000 Total liabilities and equity . . . . . $570,000 An appraiser determines that in-process R&D exists and has an estimated value of $14,000. The appraisal indicates that the following assets have fair…arrow_forward

- X Company purchased a (100%) controlling interest in Y Company by issuing $2,000,000 worth of common shares. The business combination agreement has an earnout clause that states the following: X Company would pay 10% of any earnings in excess of $750,000 to Y's shareholders in the first year following the acquisition. On acquisition date, X's shares had a market value of $80 per share.Required:a) Assuming that Y's net income in the first year following the acquisition was $950,000, prepare any journal entries (for X Company) that are necessary to reflect Y's results under IFRS 3 Business Combinations.b) Assuming that the agreement called for Y's shareholders to be compensated with 1,250 shares for any decline in X's share price, what journal entries would be required under IFRS 3, if the market value of X's shares dropped to $64 within the year?arrow_forwardPederson Company acquires the net assets of Shelby Company by issuing 100,000 of its $1 par value shares of common stock. The shares have a fair value of $20 each. Just prior to the acquisition, Shelby’s balance sheet is attached:Fair values agree with book values except for the building, which is appraised at $450,000.The following additional information is available:^ The equipment will be sold for an estimated price of $200,000. A 10% commission will be paid to a broker.^ A major R&D project is underway. The accumulated costs are $56,000, and the estimated value of the work is $90,000.^ A warranty attaches to products sold in the past. The estimated future repair costs under the warranty are $40,000.^ Shelby has a customer list that has value. It is estimated that the list will provide additional income of $100,000 for three years. An intangible asset such as this is valued at a 20% rate of return.Record the acquisition of Shelby Company on the books of Pederson Company. Provide…arrow_forwardOn December 31, 20X8, Parkway Corporation acquired 80 percent of Street Company's common stock for $104,000 cash. The fair value of the noncontrolling interest at that date was determined to be $26,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Parkway Corporation Street Company Cash $ 90,000 $ 20,000 Accounts Receivable 80,000 35,000 Inventory 100,000 40,000 Land 40,000 60,000 Buildings and Equipment 300,000 100,000 Less: Accumulated Depreciation (100,000) (40,000) Investment in Street Company 104,000 Total Assets $ 614,000 $ 215,000 Accounts Payable 120,000 30,000 Mortgage Payable 200,000 100,000 Common Stock 50,000 25,000 Retained Earnings 244,000 60,000 Total Liabilities and Equity $ 614,000 $ 215,000 On that date, the book values of Street's assets and liabilities approximated fair value except for inventory, which had a fair value of $45,000, and buildings and equipment,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License