Concept explainers

Activity-based costing, service company. Speediprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials Speediprint classifies its various printing jobs as standard jobs or special jobs. Speediprint’s simple

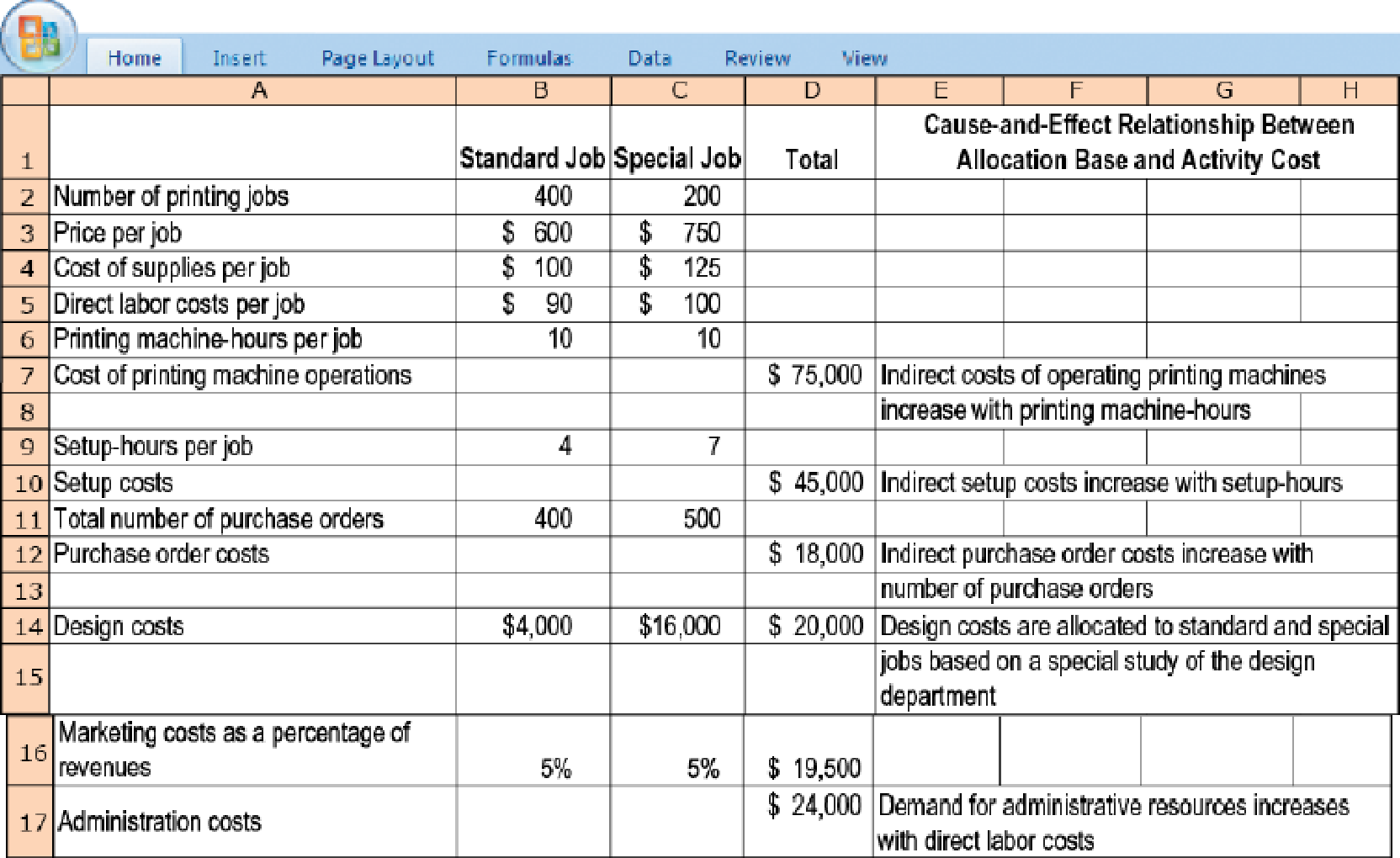

Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint’s ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect-cost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special jobs. Speediprint collects the following information for the fiscal year 2017 that just ended.

- 1. Calculate the cost of a standard job and a special job under the simple costing system.

Required

- 2. Calculate the cost of a standard job and a special job under the activity-based costing system.

- 3. Compare the costs of a standard job and a special job in requirements 1 and 2. Why do the simple and activity-based costing systems differ in the cost of a standard job and a special job?

- 4. How might Speediprint use the new cost information from its activity-based costing system to better manage its business?

Trending nowThis is a popular solution!

Chapter 5 Solutions

EBK HORNGREN'S COST ACCOUNTING

- Speediprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Speediprint classifies its various printing jobs as standard jobs or special jobs. Speediprint’s simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Speediprint operates at capacity and allocates all indirect costs using printing machine-hours as the allocation base. Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint’s ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirectcost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special…arrow_forwardSpeediprint Corporation owns a small printing press that prints leaflets, brochures, and advertising materials. Speediprint classifies its various printing jobs as standard jobs or special jobs. Speediprint’s simple job-costing system has two direct-cost categories (direct materials and direct labor) and a single indirect-cost pool. Speediprint operates at capacity and allocates all indirect costs using printing machine-hours as the allocation base. Speediprint is concerned about the accuracy of the costs assigned to standard and special jobs and therefore is planning to implement an activity-based costing system. Speediprint’s ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirectcost pool there would now be six categories for assigning indirect costs: design, purchasing, setup, printing machine operations, marketing, and administration. To see how activity-based costing would affect the costs of standard and special…arrow_forwardDelauder Enterprises makes a variety of products that it sells to other businesses. The company's activity-based costing system has four activity cost pools for assigning costs to products and customers. Details concerning that activity-based costing system are listed below: Activity Cost Pool Supporting assembly Processing batches. Processing orders. Serving customers Number of units purchased Number of batches. Activity Measure. Direct labor-hours (DLHS) Number of batches. Number of orders. Number of customers The cost of serving customers, $1,608.00 per customer, is the cost of serving a customer for one year. Grennon Corporation buys only one of the company's products. The details of last year's purchases of this product are listed below: Number of orders Direct labor-hour requirement. Selling price Direct materials cost Direct labor cost 1,500 units 5 batches 2 orders Activity Rate $ 3.45 per DLH $ 193.30 per batch $83.05 per order. $ 1,608.00 per customer 0.25 DLHS per unit $…arrow_forward

- Johnson Gardening Company provides lawn and garden services to its clients. The company uses an activity-based costing system for its overhead costs. The company has provided the following data from its activity-based costing system. Activity Cost Pool Total Cost Total Activity Mowing/trimming $150,750 12,250 hours Job support 25,725 1,800 jobs Client support 7,250 250 clients Other 100,000 Not applicable Total $283,725 The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Guzman family, requested 26 jobs during the year that required a total of 150 hours of gardening. For these services, the client was charged $5,000.Required:a.…arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below, along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor. Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers Activity Rate $10 per direct labor-hour $90 per batch $286 per order $ 2,602 per customer The company just completed a single order from Interstate Trucking for 2,800 custom seat cushions. The order was produced in four batches. Each seat cushion required 0.3 direct labor-hours. The selling price was $141.10 per unit, the direct materials cost was $102 per unit, and the direct labor cost was $14.20 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company’s activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Activity Measure Activity Rate Supporting direct labor Number of direct labor-hours $ 5.55 per direct labor-hour Batch processing Number of batches $ 107.00 per batch Order processing Number of orders $ 275.00 per order Customer service Number of customers $ 2,463.00 per customer The company just completed a single order from Interstate Trucking for 1,000 custom seat cushions. The order was produced in two batches. Each seat cushion required 0.25 direct labor-hours. The selling price was $20 per unit, the direct materials cost was $8.50 per unit, and the direct labor cost was $6.00 per unit. This was Interstate Trucking’s only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking…arrow_forward

- Activity-based costing. The job-costing system at Melody’s Custom Framing has ve indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs: Job 220, an order of 17 intricate personalized frames, and Job 330, an order of 5 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect-cost pool and the budgeted quantity of activity driver are as follows.arrow_forwardFoam Products, Inc., makes foam seat cushions for the automotive and aerospace industries. The company’s activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Activity Measure Activity Rate Supporting direct labor Number of direct labor-hours $ 5.55 per direct labor-hour Batch processing Number of batches $ 107.00 per batch Order processing Number of orders $ 275.00 per order Customer service Number of customers $ 2,463.00 per customer The company just completed a single order from Interstate Trucking for 1,000 custom seat cushions. The order was produced in two batches. Each seat cushion required 0.25 direct labor-hours. The selling price was $20 per unit, the direct materials cost was $8.50 per unit, and the direct labor cost was $6.00 per unit. This was Interstate Trucking’s only order during the year. Required: Calculate the customer margin on sales to…arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers Activity Rate $ 11 per direct labor-hour $ 92 per batch $ 272 per order $ 2,609 per customer The company just completed a single order from Interstate Trucking for 1,500 custom seat cushions. The order was produced in two batches. Each seat cushion required 0.4 direct labor-hours. The selling price was $141.90 per unit, the direct materials cost was $105 per unit, and the direct labor cost was $14.70 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forward

- ACTIVITY-BASED COSTING. The job-costing system at Shirley's Custom Framing has five indirect-cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs: Job 215, an order of 16 intricate personalized frames, and Job 325, an order of six standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. The total budgeted costs in each indirect-cost pool and the budgeted quantity of each activity driver are as follows. Purchasing Material handling Machine maintenance Product inspection Packaging Budgeted Overhead $ 25,600 32,900 150,000 11,200 12,400 $232,100 Number of purchase orders Number of material moves Machine-hours Activity Driver Purchase orders processed Material moves Number of inspections Units produced Machine-hours Inspections Units produced Information related to…arrow_forwardDurban Metal Products makes specialty metal parts and uses activity-based costing for internal decision-making purposes. The company has four activity cost pools as follows: Activity Cost Pool Order size Customer orders Product testing Selling Activity Measure Number of direct labor-hours Number of customer orders Number of testing hours Number of sales calls The company's owner wants to know the cost of a customer order requiring 200 direct labor-hours, 11 hours of product testing, and 5 sales calls. Required: What is the total overhead cost assigned to this order? Activity Cost Pool Order size Customer orders Product testing Selling Total overhead cost Activity Rate $ 17.90 per direct labor-hour $ 351.00 per customer order $ 77.00 per testing hour $ 1,496.00 per sales call ABC Costarrow_forwardForner, Inc., manufactures and sells two products: Product Z1 and Product Z8. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity Estimated Expected Activity Activity Overhead Activity Cost Pools Labor-related Measures Cost Product Z1 Product Z8 Total DLHS $112,190 40,440 609,770 600 2,000 Machine setups Оrder size 2,600 1,200 6, 200 setups 500 700 MHs 3,000 3,200 $762,400 The activity rate for the Machine Setups activity cost pool under activity-based costing is closest to: Multiple Cholce $203.26 per setup $190.55 per setup $122.97 per setup 92 F AQI 61 nere to search DELLarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College