COST ACCOUNTING

16th Edition

ISBN: 9781323169261

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.39P

ABC, health care. Crosstown Health Center runs two programs: drug addict rehabilitation and aftercare (counseling and support of patients after release from a mental hospital). The center’s budget for 2017 follows.

| Professional salaries: | ||

| 4 physicians × $150,000 | $600,000 | |

| 12 psychologists × $75,000 | 900,000 | |

| 16 nurses × $30,000 | 480,000 | $1,980,000 |

| Medical supplies | 242,000 | |

| Rent and clinic maintenance | 138,600 | |

| Administrative costs to manage patient charts, food, laundry | 484,000 | |

| Laboratory services | 92,400 | |

| Total | $2,937,000 |

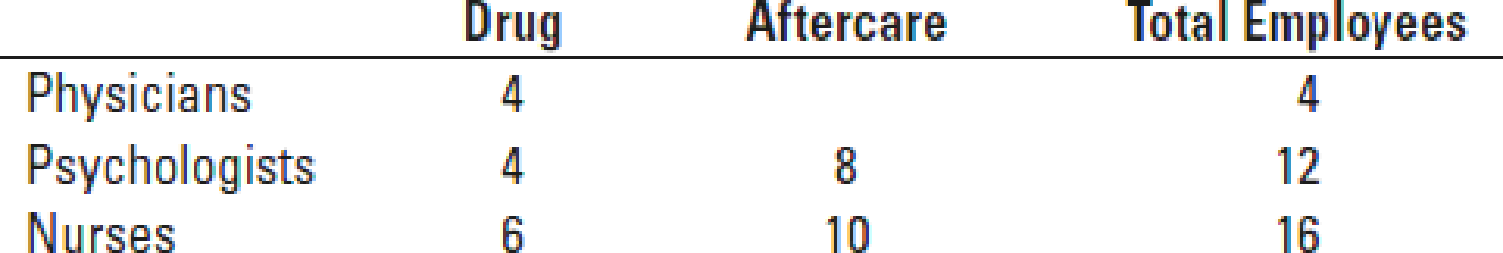

Kim Yu, the director of the center, is keen on determining the cost of each program. Yu compiles the following data describing employee allocations to individual programs:

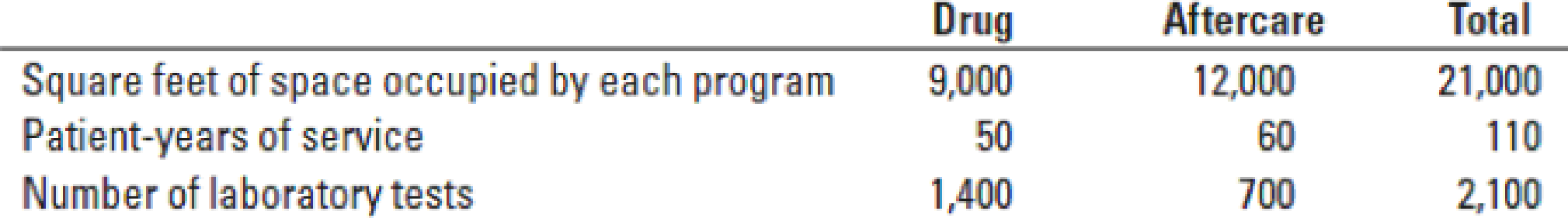

Yu has recently become aware of activity-based costing as a method to refine costing systems. She asks her accountant, Gus Gates, how she should apply this technique. Gates obtains the following budgeted

- a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to programs, calculate the budgeted indirect cost rates for medical supplies: rent and clinic maintenance; administrative costs for patient charts, food, and laundry; and laboratory services.

Required

- b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each program and the budgeted cost per patient-year of the drug program.

- c. What benefits can Crosstown Health Center obtain by implementing the ABC system?

- 2. What factors, other than cost, do you think Crosstown Health Center should consider in allocating resources to its programs?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General Hospital, a not-for-profit acute care facility, has the following cost structure for its inpatient services:

Fixed costs

$1,093,754

Variable cost per inpatient day

$19

Charge (revenue) per inpatient day

$105

The hospital expects to have a patient load of 1,599 inpatient days next year. Assume that 18 percent of the hospital's inpatient days come from a managed care plan that wants a 27 percent discount from charges. What is the change in profit if the hospital accepts the proposal?

ABC, health care. Crosstown Health Center runs two programs: drug addict rehabilitation and aftercare (counseling and support of patients after release from a mental hospital). The center’s budget for 2017 follows.

TASK SEVEN

ABC, health care. Crosstown Health Center runs two programs: drug addict rehabilitation and after care (counseling and support of patients after release from a mental hospital). The center’s budget for 2017 follows.

Professional salaries:

4 physicians * $150,000 $600,000

12 psychologists * $75,000 900,000

16 nurses * $30,000 480,000 $1,980,000

Medical supplies 242,000

Rent and clinic maintenance 138,600

Administrative costs to manage patient charts, food, laundry 484,000

Laboratory services…

Chapter 5 Solutions

COST ACCOUNTING

Ch. 5 - What is broad averaging, and what consequences can...Ch. 5 - Why should managers worry about product...Ch. 5 - What is costing system refinement? Describe three...Ch. 5 - What is an activity-based approach to designing a...Ch. 5 - Describe four levels of a cost hierarchy.Ch. 5 - Why is it important to classify costs into a cost...Ch. 5 - What are the key reasons for product cost...Ch. 5 - Prob. 5.8QCh. 5 - Department indirect-cost rates are never...Ch. 5 - Prob. 5.10Q

Ch. 5 - Prob. 5.11QCh. 5 - Prob. 5.12QCh. 5 - Activity-based costing is the wave of the present...Ch. 5 - Increasing the number of indirect-cost pools is...Ch. 5 - The controller of a retail company has just had a...Ch. 5 - Conroe Company is reviewing the data provided by...Ch. 5 - Prob. 5.17MCQCh. 5 - Cost hierarchy. Roberta, Inc., manufactures...Ch. 5 - ABC, cost hierarchy, service. (CMA, adapted)...Ch. 5 - Alternative allocation bases for a professional...Ch. 5 - Plant-wide, department, and ABC Indirect cost...Ch. 5 - Plant-wide, department, and activity-cost rates....Ch. 5 - ABC, process costing. Sander Company produces...Ch. 5 - Department costing, service company. DLN is an...Ch. 5 - Activity-based costing, service company....Ch. 5 - Activity-based costing, manufacturing. Decorative...Ch. 5 - ABC, retail product-line profitability. Fitzgerald...Ch. 5 - Prob. 5.28ECh. 5 - Activity-based costing. The job-costing system at...Ch. 5 - ABC, product costing at banks,...Ch. 5 - Problems 5-31 Job costing with single direct-cost...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - Department and activity-cost rates, service...Ch. 5 - Activity-based costing, merchandising. Pharmahelp,...Ch. 5 - Choosing cost drivers, activity-based costing,...Ch. 5 - ABC, health care. Crosstown Health Center runs two...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - ABC, implementation, ethics. (CMA, adapted) Plum...Ch. 5 - Activity-based costing, activity-based management,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The administrator of Break-a-Leg Hospital is aware of the need to keep his costs down because he just negotiated a new capitated arrangement with a large insurance company. Below are selected planned and actual expenses for the previous month. Givens: Budgeteda Actual A Patient days 27,000 26,000 B Pharmacy $120,000 $160,000 C Miscellaneous supplies $66,000 $77,500 D Fixed overhead costs $808,000 $880,000 1. Prepare a flexible expense estimate for variable costs. . Flexible budget estimate. Budgeted Flexible Actual Patient days 27,000 26,000 Cost per patient day $6.89 $9.13 Total cost $186,000 $237,500 2. Compute the volume variance.3. Compute the cost variance. 4. Compute the per unit cost variance. 5. Is the unfavorable variance caused by the volume of patients or the cost…arrow_forwardLackawanna Community College has three divisions: Liberal Arts, Sciences, and Business Administration. The college's comptroller is trying to decide how to allocate the costs of the Admissions Department, the Registrar's Department, and the Computer Services Department. The comptroller has compiled the following data for the year just ended. Department Admissions Annual Cost $118,000 Registrar Computer Services 197,000 420,000 Planned Courses Budgeted Enrollment Budgeted Credit Hours Requiring Computer Work 12 es Division Liberal Arts Sciences Business Administration 1,100 850 31,000 28,750 22,750 25 750 25 Required: 1. Distribute the departmental costs to the college's three divisions based on the allocation base given. 2. Choose the better allocation base for distributing the cost to the following departments: Complete this question by entering your answers in the tabs below. Required 1 Required 2 1 of 7 Next > Prevarrow_forwardManagement of Seattle Community Hospital has decided to allocate its three support departments (administration, public relations, and maintenance) to its three operating departments (surgery, in-patient, and out-patient). Budgeted information for the year follows: Direct costs administration $5,400,000 public relations 1,100,000 maintenace and janitorial 1,700,000 Surgery 9,000,000 In-patient 12,000,000 outpatient services 8,000,000 allocation Bases Administration Dollars of assets employed public relations Number of employees maintnance and Janitorial Hours of equipment operation Expected Utilizations Assets Employed Number of Employees Hours of Equipment Operation Administration $1,500,000 20 2,000 Public Relations 900,000 10 1,000 Maintenance and Janitorial 1,600,000 75 3,000 Surgery 4,000,000 20 25,000 In-patient care 2,500,000…arrow_forward

- Lackawanna Community College has three divisions: Liberal Arts, Sciences, and Business Administration. The college's comptroller is trying to decide how to allocate the costs of the Admissions Department, the Registrar's Department, and the Computer Services Department. The comptroller has compiled the following data for the year just ended. Department Admissions Registrar Computer Services Division Liberal Arts Annual Cost $136,000 233,000 492,000 Sciences Business Administration Budgeted Budgeted Enrollment Credit Hours 2,900 1,750 1,650 49,000 42,250 36,250 Required: 1. Distribute the departmental costs to the college's three divisions based on the allocation base given. 2. Choose the better allocation base for distributing the cost to the following departments: Department and Allocation Base Planned Courses Requiring Computer Work Complete this question by entering your answers in the tabs below. Admissions (enrollment) Registrar (credit hours) Computer Services (courses requiring…arrow_forwardJackson County Senior Services is a nonprofit organization providing three services to seniors who live in their own homes—home nursing, Meals on Wheels, and housekeeping. Revenue and expense data for the past year follow: Total Home Nursing Meals on Wheels Housekeeping Revenues $ 925,000 $ 266,000 $ 409,000 $ 250,000 Variable expenses 472,000 116,000 203,000 153,000 Contribution margin 453,000 150,000 206,000 97,000 Fixed expenses: Depreciation 70,500 8,900 40,900 20,700 Liability insurance 43,900 20,600 7,700 15,600 Program administrators’ salaries 115,500 40,200 38,600 36,700 General administrative overhead* 185,000 53,200 81,800 50,000 Total fixed expenses 414,900 122,900 169,000 123,000 Net operating income (loss) $ 38,100 $ 27,100 $ 37,000 $ (26,000) *Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, is considering discontinuing the housekeeping program. The depreciation in…arrow_forwardThe Safe Clinic computes a cost of treating each patient. It allocates costs to departments and then applies departmental overhead costs to individual patients using a different budgeted overhead rate in each department. The following are budgeted for both departments in Safe Clinic for 2010: - Pharmacy Medical Records Department overhead cost RM225,000 RM300,000 No. of prescriptions filled (pharmacy) 80,000 - No. of patients visited (medical records) - 55,000 In June 2010, David Lim paid 2 visits to the clinic and had 4 prescriptions filled at the pharmacy. 1) Compute the budgeted departmental overhead rates for both departments. 2) Compute the total budgeted overhead cost applied to the patient, David Lim in June…arrow_forward

- jacobsville Hospital has budgeted costs of $850,000 in diagnostic imaging. The total estimated activity-based usage is 2,500 images. Total costs for the entire hospital are estimated to be $3,000,000. The activity rate per image is a. $340b. $1,200c. $860d. $1,540arrow_forwardJackson County Senior Services is a nonprofit organization providing three services to seniors who live in their own homes-home nursing, Meals on Wheels, and housekeeping. Revenue and expense data for the past year follow: Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance Program administrators' salaries General administrative overhead* Total fixed expenses Net operating income (loss) Home Total Nursing $ 929,000 $ 270,000 471,000 112,000 458,000 158,000 69,800 44,000 8,900 20,800 115,800 40,800 185,800 54,000 415,400 124,500 $ 42,600 $ 33,500 Required 1A Required 1B *Allocated on basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, is considering discontinuing the housekeeping program. The depreciation in housekeeping is for a small van used to carry the housekeepers and their equipment from job to job. If the program were discontinued, the van would be donated to a charitable organization.…arrow_forwardMeals To Go operates a chain of 10 hospitals in the Los Angeles area. Its central food-catering facility, Mealman, prepares and delivers meals to the hospitals. It has the capacity to deliver up to 1,460,000 meals a year. In 2017, based on estimates from each hospital controller, Mealman budgeted for 1,050,000 meals a year. Budgeted fixed costs in 2017 were $1,533,000. Each hospital was charged $6.16 per meal—$4.70 variable costs plus $1.46 allocated budgeted fixed cost. Recently, the hospitals have been complaining about the quality of Mealman’s meals and their rising costs. In mid-2017, Meals To Go’s president announces that all Meals To Go hospitals and support facilities will be run as profit centers. Hospitals will be free to purchase quality-certified services from outside the system. Dean Wright, Mealman’s controller, is preparing the 2018 budget. He hears that three hospitals have decided to use outside suppliers for their meals, which will reduce the 2018 estimated demand to…arrow_forward

- Jackson County Senior Services is a nonprofit organization providing three services to seniors who live in their own homes-home nursing, Meals on Wheels, and housekeeping. Revenue and expense data for the past year follow: Revenues Variable expenses Contribution margin Fixed expenses: Depreciation Liability insurance Program administrators' salaries General administrative overhead Total fixed expenses Net operating income (loss) "Allocated on the basis of program revenues. Meals on Wheels $ 408,000 Total $925,000 Home Nursing $ 264,000 473,000 117,000 452,000 147,000 203,000 205,000 Housekeeping $ 253,000 153,000 100,000 69,700 9,000 40,300 20,400 43,700 20,300 8,000 15,400 115,400 40,500 38,300 36,600 185,000 52,800 81,600 50,600 413,800 122,600 168,200 123,000 $ 38,200 $ 24,400 $ 36,800 $ (23,000) The head administrator of Jackson County Senior Services, Judith Miyama, is considering discontinuing the housekeeping program. The depreciation in housekeeping is for a small van used to…arrow_forward1. The Dental Services department of Our Town Community Health Center provides 3 services: Routine examinations, cleanings, and fillings. The fully allocated costs in 2020 for the Dental Services Department were $600,000. Information on the services performed in 2020 are listed in the table below. Total Charges Billed 300,000 187,500 210,000 Service #Procedures Total Revenues 2,000 1,500 700 $260,000 $170,000 $210,000 Exams Cleanings Fillings A) Using the Cost to Charge Ratio Method using charges, what is the cost incurred during 2020 for the Dental Services Department to perform exams, cleanings, and fillings (in aggregate)? B) What is the average cost per exam, per deaning, and per filling? 2) The Dental Services Department Manager just found out about another way to estimate their service costs: the RVU Method. Exams have an RVU of 1 Cleanings have an RVU of 0.75 Fillings have an RVU of 3 A) How many RVUs did the Dental Services Department produce in 20207? B) What is the cost per…arrow_forwardMeals To Go operates a chain of 10 hospitals in the Los Angeles area. Its central food-catering facility, Mealman, prepares and delivers meals to the hospitals. It has the capacity to deliver up to 1,460,000 meals a year. In 2017, based on estimates from each hospital controller, Mealman budgeted for 1,050,000 meals a year. Budgeted fixed costs in 2017 were $1,533,000. Each hospital was charged $6.16 per meal—$4.70 variable costs plus $1.46 allocated budgeted fixed cost. Recently, the hospitals have been complaining about the quality of Mealman’s meals and their rising costs. In mid-2017, Meals To Go’s president announces that all Meals To Go hospitals and support facilities will be run as profit centers. Hospitals will be free to purchase quality-certified services from outside the system. Dean Wright, Mealman’s controller, is preparing the 2018 budget. He hears that three hospitals have decided to use outside suppliers for their meals, which will reduce the 2018 estimated demand to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License