1.

Calculate the material handling rate that would have been used by Person K’s predecessor at Industries NA.

1.

Explanation of Solution

Activity-based costing: It is a method that helps in finding the activities performed by a company and it tracks the indirect costs to the activities of the company that consumes resources.

Calculate the material handling rate that would have been used by Person K’s predecessor at Industries NA.

Working note:

Calculate total material handling department costs.

| Particulars | Amount |

| Payroll | $180,000 |

| Employee benefits | $36,000 |

| Telephone | $38,000 |

| Other utilities | $22,000 |

| Material and supplies | $6,000 |

| $6,000 | |

| Total material handling department costs | $288,000 |

Table (1)

2.a.

Calculate the revised material handling costs to be allocated on a per purchase order basis.

2.a.

Explanation of Solution

Calculate the revised material handling costs to be allocated on a per purchase order basis.

| Particulars | Amount |

| Total material handling department costs | $288,000 |

| Less: Direct costs: | |

| Direct government payroll | $36,000 |

| $7,200 | |

| Direct phone line | $2,800 |

| Material handling costs applicable to purchase orders (A) | $242,000 |

| Total number of purchase orders (B) | 242,000 |

| Material handling cost per purchase order (A ÷ B) | $1.00 |

Table (2)

b.

Discuss the reason behind purchase orders might be a more reliable cost driver than the dollar amount of direct material.

b.

Explanation of Solution

Purchase orders can be a more dependable cost driver than is the dollar amount of direct material, since resources are disbursed in the handling a purchase order. The size of the order does not essentially have an effect on the depletion of resources.

3.

Calculate the change in material handling cost applied to government contracts by NAI as a result of the new cost assignment approach.

3.

Explanation of Solution

There is a $74,600 decrease in the material handling costs allocated to government contracts by NAI as a result of the new allocation method calculated as follows:

| Particulars | Amount |

| Previous Method: | |

| Government material (A) | $2,006,000 |

| Material handling rate (B) | 10% |

| Total (1 =A × B) | $200,600 |

| New Method: | |

| Directly traceable material handling costs ($36,000+($36,000 × 20%) + $2,800)) | $46,000 |

| Purchase orders (80,000 × $1) | $80,000 |

| Total ( 2 = A × B) | $126,000 |

| Net reduction ( 1–2) | $74,600 |

Table (3)

4.

Prepare a

4.

Explanation of Solution

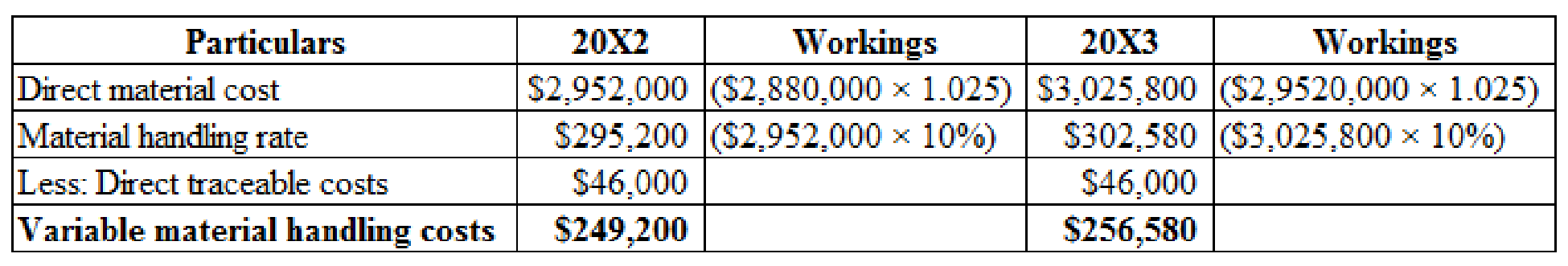

Calculate forecasted variable material handling costs.

Figure (1)

Calculate forecasted purchase orders:

| Particulars | Forecasted Purchase orders | |

| 20X2 ($242,000 × 1.05) | $254,100 | |

| 20X3 ($254,100 × 1.05) | $266,805 | |

| Governmental purchase orders (Purchase orders × 33%) | $83,853 | $88,046 |

Table (4)

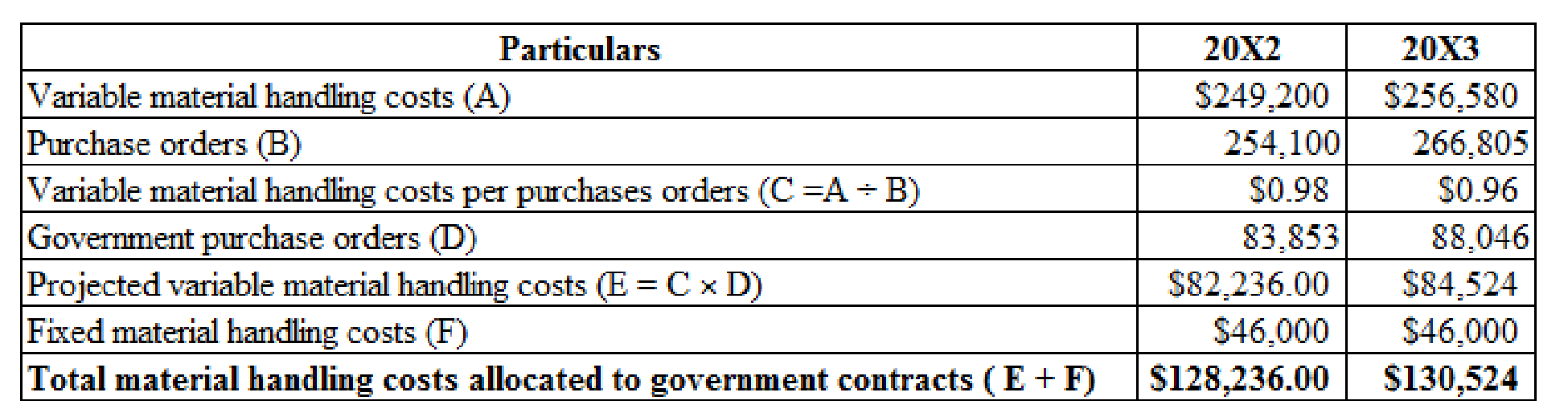

Calculate material handling costs allocated to governmental contracts.

Figure (2)

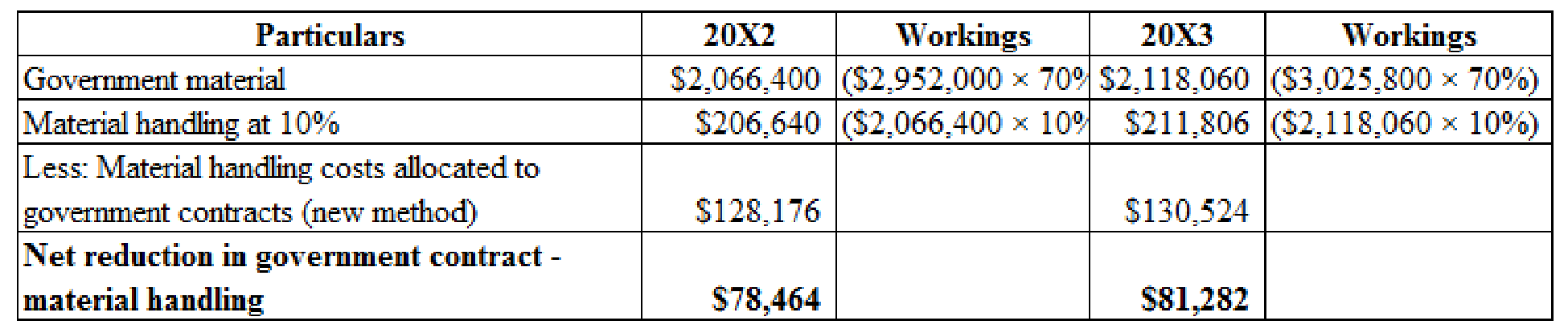

Calculate cumulative dollar impact.

Figure (3)

The cumulative dollar impact of the recommended change in allocating material handling department costs is $234,346 ($74,600 +$78,464 +$81,282).

5.a.

Discuss the reason for Person K has an ethical conflict related to the standards of ethical conduct for

5.a.

Explanation of Solution

Denoting to the standards of ethical conduct for management accountants of Person K faces the following ethical issues are given below:

Competence:

- “Provide decision support information and recommendations that are accurate, clear, consise and timely.”

Integrity:

- “Refrain from engaging in any conduct that would prejudice Person L’s ability to carry out her duties ethically.”

- “Abstain from engaging in or supporting any activity that would discredit person L’s profession.”

Credibility:

- “Disclose all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports analyses or recommendations. Person L has information that Person J should see if he is going to make a reliable judgement about the results of the Government contracts unit.”

b.

Identify the several steps that Person L could take to resolve the ethical conflict.

b.

Explanation of Solution

The steps of Person K could take to resolve these ethical conflicts are as follows:

- Person K should first follow the recognized policies at NAI.

- If this method does not decide the conflict or if such policies do not exist, Person K must communicate the problem with her immediate superior, suppose when it looks that the superior is involved. If the government contracts unit manager, Person P is her controller, then she apparently cannot debate the problem with him. In this case she must go to the next upper managerial level and proceed, up to the audit committee of the board of director, until the conflict is decided.

- She must also discuss the position with an independent advisor to explain the issues involved and find an accepting of possible courses of an action.

- If the ethical conflict still happens after draining all levels of internal review, then person K might have no other course of action than to leave from the company and submit an useful memorandum to an suitable demonstrative of the company.

Want to see more full solutions like this?

Chapter 5 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- In the current year, Big Burgers, Inc., expanded its fast-food operations by opening several new stores in Texas. The company incurred the following costs in the current year: market appraisal ($50,000), consulting fees ($72,000), advertising ($47,000), and traveling to train employees ($31,000). The company is willing to incur these costs because it foresees strong customer demand in Texas for the next several years. What amount should Big Burgers report as an expense in its income statement associated with these costs?arrow_forwardSmall City currently has 1 million square feet of office space, of which 900,000 square feet is occupied by 3,000 employees who are mainly involved in professional services such as finance, insurance, and real estate. Small City’s economy has been fairly strong in recent years, but dueto the current global recession, employment growth is expected to be somewhat low over the next few years, with projections of an increase of just 100 additional employees per year for the next three years. The amount of space per employee is expected to remain the same. However, anew 50,000 square-foot office building was started before the recession and its space is expected to become available at the end of the current year (one year from now). No more space is expected to become available after that for quite some time.a. What is the current occupancy rate for office space in Small City?b. How much office space will be absorbed each year for the next three years?c. What will the occupancy rate be at…arrow_forwardThe ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.6 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $306,500, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.6 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $5.8 million, of which $900,000 of the purchase price would represent land value, and $4.9 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $645,000 per year for a term of…arrow_forward

- The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $303,500, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $5.2 million, of which $900,000 of the purchase price would represent land value, and $4.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $555,000 per year for a term of…arrow_forwardThe ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.7 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $310,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.7 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $6.5 million, of which $900,000 of the purchase price would represent land value, and $5.6 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $750,000 per year for a term of…arrow_forwardThe ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.7 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $310,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.7 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $6.5 million, of which $900,000 of the purchase price would represent land value, and $5.6 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $750,000 per year for a term of…arrow_forward

- Hemisphere, LLC is planning to outsource its 51-person information technology (IT) department to Dyonyx. Hemisphere’s president believes this move will allow access to cutting-edge technologies and skill sets that would be cost prohibitive to obtain on its own. If it is assumed that the loaded cost of an IT employee is $100,000 per year and that Hemisphere will save 25% of this cost through outsourcing, determine the present worth of the total savings for a 5-year contract at an interest rate of 6% per year, compounded monthlyarrow_forwardPeronto’s Inc. is an asphalt contractor located in Kansas City, Mo. Peronto’s Inc. is planning on expanding into the Chicago market is budgeting that the start-up expenditures for the new Chicago facilities will be $25,000. These expenditures will be for the location of a new facility and the incremental expenditures for conducting business in a new territory. The CFO for Peronto’s believes that the $25,000 start upexpenditures should be recognized as an asset because they will benefit the company for many periods in the future. Your role as the staff accountant is to determine the correct recognition for the start up expenditures. Your interpretation of the guidance: The correct recognition of the $25,000 start up expenditures will be: a. as an asset b. as an expensearrow_forwardThe ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciatedover 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15…arrow_forward

- The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $4.5 million, of which $900,000 of the purchase price would represent land value, and $3.6 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of…arrow_forwardYou are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $ 1.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $ 29 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Project Year Earnings Forecast ($ million) 1 2 . . . 9 10 Sales revenue 28.00028.000 28.00028.000 28.00028.000 28.00028.000 minus−Cost of goods sold 16.80016.800 16.80016.800 16.80016.800 16.80016.800 equals=Gross profit 11.20011.200 11.20011.200 11.20011.200 11.20011.200 minus−Selling, general, and administrative expenses 2.3202.320 2.3202.320 2.3202.320 2.3202.320…arrow_forwardPaul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $600,000 long-term loan from Gulfport State Bank, $150,000 of which will be used to bolster the Cash account and $450,000 of which will be used to modernize equipment. The company’s financial statements for the two most recent years follow: Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 110,000 $ 250,000 Marketable securities 0 28,000 Accounts receivable, net 607,000 400,000 Inventory 1,045,000 695,000 Prepaid expenses 30,000 32,000 Total current assets 1,792,000 1,405,000 Plant and equipment, net 1,946,400 1,470,000 Total assets $ 3,738,400 $ 2,875,000 Liabilities and Stockholders Equity…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT