Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5PS

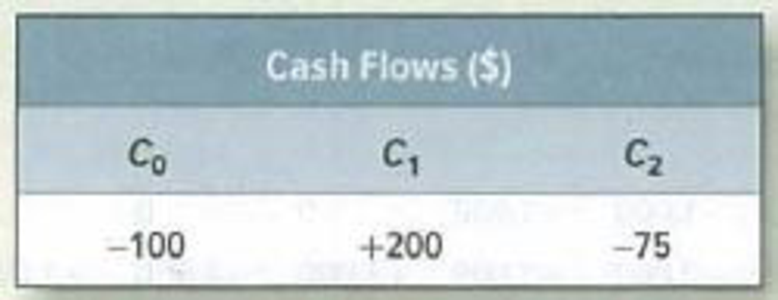

IRR rule* Consider a project with the following cash flows:

- a. How many internal rates of return does this project have?

- b. Which of the following numbers is the project IRR: (i) −50%; (ii) −12%; (iii) +5%; (iv) +50%?

- c. The

opportunity cost of capital is 20%. Is this an attractive project? Briefly explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

2. Investment Criteria. Consider the following information.

Expected Net Cash Flows

YearProject X

0($10,000)

16,500

23,500

33,000

41,000

Assume the discount rate is 10 percent.

a. Calculate Project X’s discounted payback period. Should the project be accepted?

b. Calculate the profitability index. Should the project be accepted?

c. Calculate the accounting rate of return. Should the project be accepted?

A firm evaluates all of its projects by using the NPV decision rule. Year Cash Flow 0 −$ 28,000 1 24,000 2 13,000 3 6,000 a. At a required return of 28 percent, what is the NPV for this project? b. At a required return of 35 percent, what is the NPV for this project?

A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows:

Year

Cash Flow

0

–$

28,400

1

12,400

2

15,400

3

11,400

If the required return is 15 percent, what is the IRR for this project?

Should the firm accept the project?

Chapter 5 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 3PSCh. 5 - IRR rule You have the chance to participate in a...Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - Capital rationing Suppose you have the following...

Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 9PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 13PSCh. 5 - Profitability index Look again at projects D and E...Ch. 5 - Prob. 15PSCh. 5 - Prob. 16PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Start with the partial model in the file Ch10 P23 Build a Model.xlsx on the textbooks Web site. Gardial Fisheries is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a. If each projects cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? b. Construct NPV profiles for Projects A and B. c. What is each projects IRR? d. What is the crossover rate, and what is its significance? e. What is each projects MIRR at a cost of capital of 12%? At r = 18%? (Hint: Consider Period 7 as the end of Project Bs life.) f. What is the regular payback period for these two projects? g. At a cost of capital of 12%, what is the discounted payback period for these two projects? h. What is the profitability index for each project if the cost of capital is 12%?arrow_forwardCAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project S requires an initial outlay at t = 0 of 17,000, and its expected cash flows would be 5,000 per year for 5 years. Mutually exclusive Project L requires an initial outlay at t = 0 of 30,000, and its expected cash flows would be 8,750 per year for 5 years. If both projects have a WACC of 12%, which project would you recommend? Explain.arrow_forwardCalculate the cash flows for each year. Based on these cash flows and the average project cost of capital, what are the projects NPV, IRR, MIRR, PI, payback, and discounted payback? Do these indicators suggest that the project should be undertaken?arrow_forward

- Consider the following cash flows: Year 0 1 2 3 4 5 6 Cash Flow -$9,000 $2,000 $3,600 $2,700 $2,100 $2,100 $1,600 C. IRR. Calculate the IRR for this project. The company’s required rate of return is 10%. Should it be accepted or rejected? D. NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? E. PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?arrow_forwardA firm evaluates all of its projects by applying the NPV decision rule. A project under consideration has the following cash flows: Year Cash Flow 0 –$ 28,900 1 12,900 2 15,900 3 11,900 What is the NPV for the project if the required return is 11 percent? At a required return of 11 percent, should the firm accept this project? What is the NPV for the project if the required return is 25 percent?arrow_forwardInvestment Criteria. Consider the following information. Expected Net Cash Flows Year Project X 0 ($10,000) 1 6,500 2 3,500 3 3,000 4 1,000 Assume the discount rate is 10 percent. Calculate Project X’s discounted payback period. Should the project be accepted Calculate the profitability index. Should the project be accepted? Calculate the accounting rate of return. Should the project be accepted?arrow_forward

- Comparing Investment Criteria [L01,2,3,5,7] Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$300,000 -$40,000 1 20,000 19,000 2 50,000 12,000 3 50,000 18,000 4 390,000 10,500 Whichever project you choose, if any, you require a 15 per cent return on your investment. a. If you apply the payback criterion, which will you choose? Why? b. If you apply the discounted payback criterion, which investment will you choose? Why? c. If you apply the NPV criterion, which investment will you choose? Why? d. If you apply the IRR criterion, which investment will you choose? Why? e. If you apply the profitability index criterion, which investment will you choose? Why? f. Based on your answers in (a) through (e), which project will you finally choose? Why? Please explain your calculations and conclusionsarrow_forwardThe cash flows associated with an investment project are as follows: Year Project Y 0 (40 000) 1 10000 2 10000 3 15000 4 20000 The required return is 5 percent. Reinvestment rate 6%. What’s the discount payback period of the projects? (compile a spreadsheet) Calculate NPV, PI, IRR , MIRR of a projects Should the firm accept the project?arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$29,000 −$29000 1 14,400 4,300 2 12,300 9,800 3 9,200 15,200 4 5,100 16,800 a) What is the Internal Rate of Return (IRR) for each of these projects? b) Using the IRR decision rule, which project should the company accept? c) If the required return is 11 percent, what is the Net Present Value (NV) for each of these projects? d) Using the NPV decision rule, which project should the company accept? e) Why do you think the NPV and IRR rules do not agree on same project approval/rejection direction?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License