Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 7PS

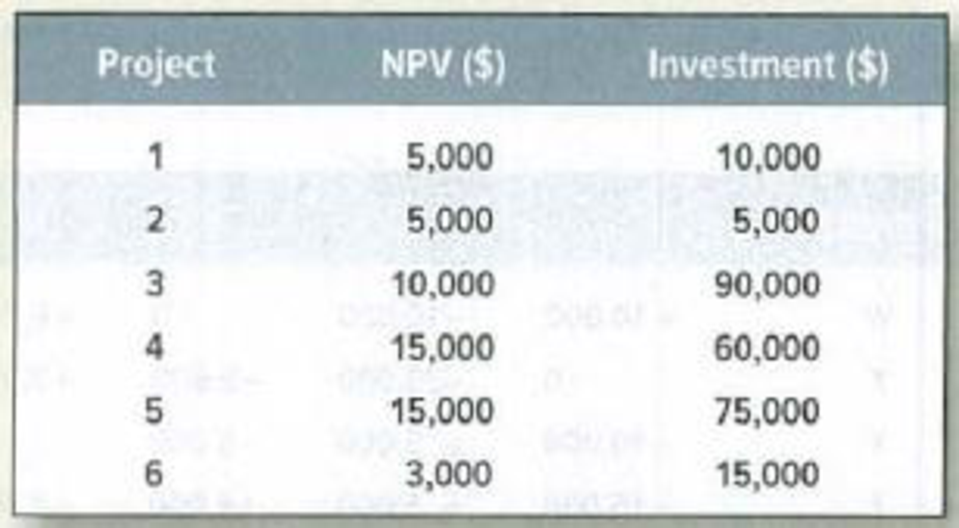

Capital rationing* Suppose you have the following investment opportunities, but only $90,000 available for investment. Which projects should you take?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Capital budgeting problems and what king of you used for solving (NPV and IRR PROBLEMS )

A firm has the following investment alternative. Each one lasts a year

Investment A B C

Cach inflow $1,150 $560 $600

Cash outflow $1000 $500 $500

The firm's cost capital 7 percent. A and B are mutually exclusive, and B and C are mutually exclusive.

a. What is the net value of investment A? Investment B? investment C?

B. W hat is the internal rate on investment A? investment B? INvestment C?

c. Which invedstment(s) should the firm make? Why?

d. If the firm had unlimited sources of funds, which investments should it make? Why?

e. If there another alternative, investment D, with an internal rate of return of 6 percent, would that alter your anser to question (d)? why?

f. If the firm's cost of…

Capital budgeting problems and what king of you used for solving (NPV and IRR PROBLEMS )

A firm has the following investment alternative. Each one lasts a year

Investment A B C

Cach inflow $1,150 $560 $600

Cash outflow $1000 $500 $500

The firm's cost capital 7 percent. A and B are mutually exclusive, and B and C are mutually exclusive.

d. If the firm had unlimited sources of funds, which investments should it make? Why?

e. If there another alternative, investment D, with an internal rate of return of 6 percent, would that alter your anser to question (d)? why?

f. If the firm's cost of capital rose to 10 percent, what effect would that have on investment A's internal rate return?

(Ignore income taxes in this problem.) If an investment of $14,760 now will yield $18,000 at the end of one year, then the internal rate of return for this investment to the nearest whole percentage is:

Select one:

a.

14%

b.

18%

c.

22%

d.

28%

Chapter 5 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 3PSCh. 5 - IRR rule You have the chance to participate in a...Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - Capital rationing Suppose you have the following...

Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 9PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 13PSCh. 5 - Profitability index Look again at projects D and E...Ch. 5 - Prob. 15PSCh. 5 - Prob. 16PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Rate of Return (%) Number of Investment Projects (for $1,000 each) 25 1 20 2 15 3 10 4 5 5 The table shows the projected rate of return and number of investment projects that might be undertaken by a small firm. Each project requires an investment of $1,000. If the interest rate increases from 5 percent to 15 percent, the amount of loanable funds demanded by this firm Group of answer choices increases by $1,000. increases by $3,000. decreases by $2,000. decreases by $3,000.arrow_forwardSolve the problem. A financier plans to invest up to $500,000 in two projects. Project A yields a return of 10% on the investment, whereas Project B yields a return of 15% on the investment. Because the investment in Project B is riskier than the investment in Project A, the financier has decided that the investment in Project B should not exceed 40% of the total investment. How much should she invest in each project to maximize the return on her investment?arrow_forwardConsider a project with a net investment of $40,000 and the following net cash flows: Annual Cash Flow Year 1 $25,000 Year 2 $36,000 Year 3 $8,000 If the company's cost of capital is 5%, what would be the net present value of the project? a. $19,560 b. $19,800 c. $20,900 d. $23,373 Between equity and debt capital a. Debt is safer than equity b. No option is correct c. Both debt and equity are equally risky d. Equity is riskier than debtarrow_forward

- (Ignore income taxes in this problem.) Your Company is considering an investment in a project that will have a three-year life. The project will provide a 4% internal rate of return and is expected to have a $40,000 cash inflow the first year and a $0 cash inflow in the second year, and $50,000 cash inflow in the third year. What investment is required in the project?arrow_forward(Ignore income taxes in this problem.) The discount rate is 1%. Your Corporation is considering an investment project that will require an initial investment of $15,000 and will generate the following net cash inflows in each of the three years of the project: Year 1 Year 3 Year 7 Cash inflows.......... $8,000 $7,000 $9,000 Cash outflows........ $0 $0 $2,500 What is the net present value for this project? Group of answer choices $5,670 $5,092 $5,782 $4,722 $4,890arrow_forwardYou would like to invest in the following Project: Year Cash Flow 0 $-55,000 1 30,000 2 37,000 Your boss insists that only projects that return $1.10 in today's dollars for every $1 invested can be accepted. The discount rate is 10%. Based on this criteria, should you accept the Project? Why?arrow_forward

- You are considering an investment in a clothes distributer. The company needs $105,000 today and expects to repay you $120,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 17%. What does the IRR rule say about whether you should invest? What is the IRR of this investment oppurtunity? The IRR of this investment opppurtunity is ____%arrow_forwardGive typing answer with explanation and conclusion A company pursues a cost-cutting initiative that costs $21,000 to implement. Thereafter, however, the initiative reduces after-tax costs by $6,500 per year perpetually. The company relies on 64% debt financing at a 11.4% pretax interest rate. The company marginal tax rate is 31%. The company β is 1.41, short-term risk-free rate is 7.4%, and required risk premium for the market portfolio is 11.0%. Find the project’s net present value. -19,083 -23,090 -25,399 -27,939 -20,991arrow_forwardEstablish a finance plan that assumes the sales estimates at the take price level would have been increased by $500,000. This means that the current take price level of $9,170,000 would increase by $500,000. This change would offer more collateral to the bank, and the bank would then increase the GAP loan. The GAP loan requires 200% collateral in unsold rights. This change would impact the equity investment. Question: What would be the new equity investment be if the budget stays the same?arrow_forward

- Suppose your company needs $10 million to build a new assembly line. Your target debt-equity ratio is 3.0. The flotation cost for new equity is 20%, but the flotation cost for debt is only 5%. Your boss has decided to fund the project by borrowing money, because the flotation costs are lower, and the needed funds are relatively small. a) What do you think about the rationale behind borrowing the entire amount? b) What is the true cost of building the new assembly line after taking flotation costs into account?arrow_forwardThe net present value of an investment is the present value of the expected cash flow minus the initial investment. The company's managers hf. require a 9% return (required rate of return). The managers are considering buying a device that costs ISK 210,000. The device will create a cash flow of ISK 84,000. during the next three years, at the end of each year. What is the net present value of this investment (net present value of investment)? Group of answer choices a. ISK 21,261 b. ISK 212,604 c. ISK 2,629 d. 42,000 ISKarrow_forward(Ignore income taxes in this problem.) Kiwi Company is considering an investment in a project that will have a two year life. The project will provide a 10% internal rate of return, and is expected to have a P40,000 cash inflow the first year and a P50,000 cash inflow in the second year. What investment is required in the project? P90,000 P81,810 P77,660 P74,340arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to Invest in Foreign Stocks (INVESTING FOR BEGINNERS); Author: The Money Tea;https://www.youtube.com/watch?v=Qzj4VozcO9s;License: Standard Youtube License