MANAGERIAL ACCT.F/MANAGERS>CUSTOM<

4th Edition

ISBN: 9781307090147

Author: Noreen

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5A, Problem 5A.2E

Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements L04—2, LO4—6

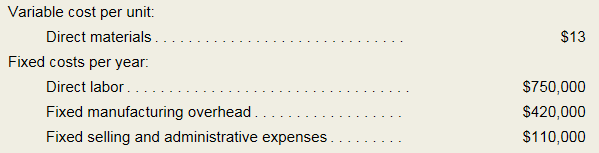

Lyons Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

vj

subject-Accounting

Hanks recently produced & sold 2777 units. Fixed costs per unit at this level of activity amounted to $8; variable costs per unit were $9. How much total cost would the company anticipate if during the next period it produced & sold 6919 units? Note: assume this level is still within the relevant range

Round your final answer to 2 decimal places

ch7q39

Units Sold to Break Even, Unit Variable Cost, Unit Manufacturing Cost, Units to Earn Target Income

Werner Company produces and sells disposable foil baking pans to retailers for $2.95 per pan. The variable cost per pan is as follows:

Direct materials

$0.22

Direct labor

0.56

Variable factory overhead

0.70

Variable selling expense

0.13

Fixed manufacturing cost totals $303,290 per year. Administrative cost (all fixed) totals $41,358.

Required:

1. Compute the number of pans that must be sold for Werner to break even. pans

2. Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent.

Unit variable cost

$

Unit variable manufacturing cost

$

Which is used in cost-volume-profit analysis?Unit variable cost

3. How many pans must be sold for Werner to earn operating income of $11,524? pans

4. How much sales revenue must Werner have to earn operating income 11524$

Q – 5:

Bettina Company incurs the following costs to produce and sell a single product.

Variable costs per unit:

Direct materials $15

Direct labor$7.5

Variable manufacturing overhead$3

Variable selling and administrative expenses$6

Fixed costs per year:

Fixed manufacturing overhead . . . . . . . . . . . . . . . . . $45,000

Fixed selling and administrative expenses . . . . . . . $150,000

During the last year, 15,000 units were produced and 12,500 units were sold. The Finished Goods inventory account at the end of the year shows a balance of $63,750 for the 2,500 unsold units.

Required:

1. Is the company using absorption costing or variable costing to cost units in the Finished Goods inventory account? Show computations to support your answer.

2. Assume that the company wishes to prepare financial statements for the year to issue to its stockholders.

a. Is the $63,750 figure for Finished Goods inventory the correct amount to use on these…

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Inferring Costing Method; Unit Product Cost [LO6–1] Sierra Company incurs the following costs to produce and sell a single product. [picture1] During the last year, 25,000 units were produced and 22,000 units were sold. The Finished Goodsinventory account at the end of the year shows a balance of $72,000 for the 3,000 unsold units.Required:1. Is the company using absorption costing or variable costing to cost units in the Finished Goods inventory account? Show computations to support your answer.2. Assume that the company wishes to prepare financial statements for the year to issue to its stockholders.a. Is the $72,000 figure for Finished Goods inventory the correct amount to use on these statements for external reporting purposes? Explain.b. At what dollar amount should the 3,000 units be carried in the inventory for externalreporting purposes?arrow_forwardT3-6 Variable versus absorption costing (LO 1, 2) Regal Printing, Inc., prints and binds encyclopedias. The following information was found in the accounting records: Sales price per unit $ 103 Direct materials per unit $ 50 Direct labor per unit $ 16 Variable overhead per unit $ 10 Fixed overhead per unit $ 23 Fixed selling costs $ 55,000 Variable selling costs $180,000 Beginning inventory 0 Units produced 100,000 Units sold 90,000 Questions a.Under absorption costing, what is Regal's operating income? b.Under variable costing, what is Regal's ending Finished Goods Inventory balance?arrow_forwardProblem 6-18 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1, LO6-2] Haas Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations: Variable costs per unit: Manufacturing: Direct materials $ 24 Direct labor $ 16 Variable manufacturing overhead $ 4 Variable selling and administrative $ 1 Fixed costs per year: Fixed manufacturing overhead $ 220,000 Fixed selling and administrative expenses $ 140,000 During its first year of operations, Haas produced 40,000 units and sold 40,000 units. During its second year of operations, it produced 55,000 units and sold 30,000 units. In its third year, Haas produced 20,000 units and sold 45,000 units. The selling price of the company’s product is $54 per unit. Required: b. Prepare an income statement for Year 1, Year 2, and Year 3.arrow_forward

- QUESTION 1 QUESTION 1: VARIABLE COSTING QUESTION Bairstow Company manufactures and sells a single product. The following costs were incurred during 2021, the company’s first year of operations: Variable Costs per unit: Production: Direct materials $ 6.00 Direct labour $ 9.00 Variable Manufacturing Overhead $ 3.00 Selling and administrative $ 4.00 FIXED COSTS PER YEAR Manufacturing Overhead $ 300,000 Selling and administrative $ 190,000 During 2021, the company produced 25,000 units and sold 20,000 units. The selling price of the company’s product is $ 50 per unit. Required: 1. Assume that the company uses the absorption costing method: Compute the cost to produce one unit of product. Prepare an income statement for 2021 2. Assume the company uses the variable costing method: a. Compute the cost to produce one unit of product. b. Prepare an…arrow_forwardExercise 1-8 Product Costs and Period Costs; Variable and Fixed Costs [LO1-3, LO1-4] Kubin Company’s relevant range of production is 22,000 to 27,000 units. When it produces and sells 24,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 8.20 Direct labor $ 5.20 Variable manufacturing overhead $ 2.70 Fixed manufacturing overhead $ 6.20 Fixed selling expense $ 4.70 Fixed administrative expense $ 3.70 Sales commissions $ 2.20 Variable administrative expense $ 1.70 Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 24,500 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 24,500 units? 3. For financial accounting purposes, what is the total amount of product costs incurred to make 27,000 units? 4. For financial accounting purposes, what is the total amount of period costs incurred to sell 22,000 units?arrow_forwardQ - 9 Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost Per Unit Direct materials $ 6.00 Direct labor $ 3.50 Variable manufacturing overhead $ 1.50 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 3.00 Fixed administrative expense $ 2.00 Sales commissions $ 1.00 Variable administrative expense $ 0.50 Foundational 1-6 (Static) 6. If 12,500 units are produced and sold, what is the total amount of variable costs related to the units produced and sold?arrow_forward

- TF 3 The following data was prepared by the Oriole Company. Total Variable Fixed Sales price $22/unit Direct materials used $82,650 Direct labor $96,000 Manufacturing overhead $113,670 $17,910 $95,760 Selling and administrative expense $22,700 $13,100 $9,600 Units manufactured 25,200 units Beginning Finished Goods Inventory 19,200 units Ending Finished Goods Inventory 7,000 units Cost of goods sold $ Under variable costing, what is the cost of goods sold? (Round cost per unit to 2 decimal places, e.g. 2.52 and final answer to 0 decimal place, e.g. 2,152.) Cost of goods sold$ Under absorption costing, what is the operating income? (Round cost per unit to 2 decimal places, e.g. 2.52 and final answer to 0 decimal place, e.g. 2,152.) Operating income $ Under variable costing, what is the operating income? (Round cost per unit to 2 decimal places, e.g. 2.52 and…arrow_forwardPROBLEM 7–18 Relevant Cost Analysis in a Variety of Situations [LO 7–2, LO 7–3, LO 7–4]Andretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The company’s unit costs at this level of activity are given below: Direct materials................................$10.00 Direct labor ...................................4.50 Variable manufacturing overhead................2.30 Fixed manufacturing overhead ..................5.00($300,000 total) Variable selling expenses.......................1.20 Fixed selling expenses ......................... 3.50($210,000 total) Total cost per unit..............................$26.50 1. Assume that Andretti Company has sufficient capacity to produce 90,000 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 25% above the present 60,000 units each year if it were willing to increase the fixed selling…arrow_forwardProblem 7-18 Relevant Cost Analysis in a Variety of Situations [LO 7-2, LO 7-3, LO 7-4] Andretti Company has a single product called a Dak. The company normally produces and sells 87,000 Daks each year at a selling price of $50 per unit. The company’s unit costs at this level of activity are given below: Direct materials $ 8.50 Direct labor 11.00 Variable manufacturing overhead 2.50 Fixed manufacturing overhead 7.00 ($609,000 total) Variable selling expenses 4.70 Fixed selling expenses 5.50 ($478,500 total) Total cost per unit $ 39.20 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andretti Company has sufficient capacity to produce 108,750 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 25% above the present 87,000 units each year if it were willing to increase the fixed…arrow_forward

- Exercise 4-6 (Algo) Variable and Absorption Costing Unit Product Costs and Income Statements [LO4-1, LO4-2] Lynch Company manufactures and sells a single product. The following costs were incurred during the company’s first year of operations: Variable costs per unit: Manufacturing: Direct materials $ 11 Direct labor $ 3 Variable manufacturing overhead $ 1 Variable selling and administrative $ 1 Fixed costs per year: Fixed manufacturing overhead $ 330,000 Fixed selling and administrative $ 240,000 During the year, the company produced 30,000 units and sold 23,000 units. The selling price of the company’s product is $43 per unit. Required: Assume that the company uses absorption costing: Compute the unit product cost. Prepare an income statement for the year. Assume that the company uses variable costing: Compute the unit product cost. Prepare an income statement for the year. Do not give answer in imagearrow_forwardQ6 – B Hambar Co. has a unit selling price of $800, variable costs per unit of $520 and fixed costs of $420,000. The company’s sales units are 600,000 for this year. Instructions: a) Determine the contribution margin per unit. b) Using the contribution margin technique, compute the break-even point in units.arrow_forwardPROBLEM NO. 1 Hixson Company manufactures and sells one product for $34 per unit. The company maintains no beginning or ending inventories and its relevant range of production is 20,000 units to 30,000 units. When Hixson produces and sells 25,000 units, its unit costs are as follows: Amount Per Unit Direct materials $ 8.00 Direct labor $ 5.00 Variable manufacturing overhead $ 1.00 Fixed manufacturing overhead $ 6.00 Fixed selling expense $ 3.50 Fixed administrative expense $ 2.50 Sales commissions $ 4.00 Variable administrative expense $ 1.00 For financial accounting purposes, what is the total amount of product costs incurred to make 25,000 units? What is the total amount of period costs incurred to sell 25,000 units?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License