Concept explainers

Super-Variable Costing Income Statement LO4—6

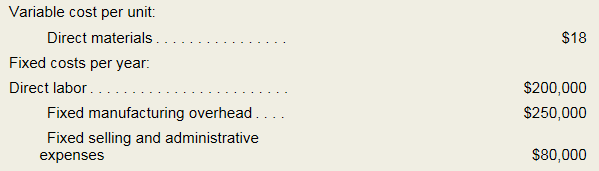

Zola Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

Concept introduction:

Income statement:

The income statement tells about the revenues earned and expenses incurred by the company in a specific period of time. It is also known as operations statement, earnings statement, revenue statement or profit, and loss statement.

- Calculate the unit product cost.

- Prepare an income statement for the given year.

Answer to Problem 5A.1E

- The unit product cost is $18.

- The income statement of Company Z is as follows:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (1)

Explanation of Solution

(a)

Calculate the unit product cost:

The company uses the variable costing method. Under the variable costing method, the variable cost is considered as the product cost. In the given case, the variable cost of the product is $18.

Thus, the unit product cost is $18.

(b)

Prepare an income statement for the given year:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (2)

Want to see more full solutions like this?

- Variable costingsales exceed production The beginning inventory is 52,800 units. All of the units that were manufactured during the period and 52,800 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are 14.70 per unit, and variable manufacturing costs are 30 per unit. Determine (A) whether variable costing operating income is less than or greater than absorption costing operating income, and (B) the difference in variable costing and absorption costing operating income.arrow_forwardPROBLEM 7–18 Relevant Cost Analysis in a Variety of Situations [LO 7–2, LO 7–3, LO 7–4]Andretti Company has a single product called a Dak. The company normally produces and sells 60,000 Daks each year at a selling price of $32 per unit. The company’s unit costs at this level of activity are given below: Direct materials................................$10.00 Direct labor ...................................4.50 Variable manufacturing overhead................2.30 Fixed manufacturing overhead ..................5.00($300,000 total) Variable selling expenses.......................1.20 Fixed selling expenses ......................... 3.50($210,000 total) Total cost per unit..............................$26.50 1. Assume that Andretti Company has sufficient capacity to produce 90,000 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 25% above the present 60,000 units each year if it were willing to increase the fixed selling…arrow_forwardPROBLEM 1 Anna Corporation recently produced and sold 100,000 units. Fixed costs at this level of activity amounted to $50,000; variable costs were $100,000. How much cost would the company anticipate if during the next period it produced and sold 102,000 units? A. $150,000. B. $151,000. C. $152,000. D. $153,000. PROBLEM 2 Elsa, Inc., has only variable costs and fixed costs. A review of the company's records disclosed that when 100,000 units were produced, fixed manufacturing costs amounted to $200,000 and the cost per unit manufactured totaled $5. On the basis of this information, how much cost would the firm anticipate at an activity level of 97,000 units? A. $485,000. B. $491,000. C. $494,000. D. $500,000. PROBLEM 3 A review of Olaf Corporation's accounting records found that at a volume of 90,000 units, the variable and fixed cost per unit amounted to $8 and $4, respectively. On the basis of this information, what amount of total cost would Parry…arrow_forward

- 34 Waterway Co. sells product P-14 at a price of $48 a unit. The per-unit cost data are direct materials $16, direct labour $12, and overhead $12 (75% variable). Waterway Co. has sufficient capacity to accept a special order for 39,300 units, but at a discount of 25% from the regular price. Selling costs associated with this order would be $3 per unit. Determine whether Waterway Co. should accept the special order. (Enter loss with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Please donot provide solution in image format and it should be in step by step format and provide fast solutionarrow_forwardEA5. LO 2.2Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardExercise 6-5 Changes in Variable Costs, Fixed Costs, Selling Price, and Volume [LO6-4] Skip to question [The following information applies to the questions displayed below.] Data for Hermann Corporation are shown below: Per Unit Percent of Sales Selling price $ 125 100 % Variable expenses 80 64 Contribution margin $ 45 36 % Fixed expenses are $85,000 per month and the company is selling 2,700 units per month. rev: 06_04_2020_QC_CS-205709, 06_18_2020_QC_CS-216765, 07_14_2020_QC_CS-216765 Exercise 6-5 Part 1 Required: 1-a. How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. Should the advertising budget be increased?arrow_forward

- Problem 7-18 Relevant Cost Analysis in a Variety of Situations [LO 7-2, LO 7-3, LO 7-4] Andretti Company has a single product called a Dak. The company normally produces and sells 87,000 Daks each year at a selling price of $50 per unit. The company’s unit costs at this level of activity are given below: Direct materials $ 8.50 Direct labor 11.00 Variable manufacturing overhead 2.50 Fixed manufacturing overhead 7.00 ($609,000 total) Variable selling expenses 4.70 Fixed selling expenses 5.50 ($478,500 total) Total cost per unit $ 39.20 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andretti Company has sufficient capacity to produce 108,750 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 25% above the present 87,000 units each year if it were willing to increase the fixed…arrow_forwardInferring Costing Method; Unit Product Cost [LO6–1] Sierra Company incurs the following costs to produce and sell a single product. [picture1] During the last year, 25,000 units were produced and 22,000 units were sold. The Finished Goodsinventory account at the end of the year shows a balance of $72,000 for the 3,000 unsold units.Required:1. Is the company using absorption costing or variable costing to cost units in the Finished Goods inventory account? Show computations to support your answer.2. Assume that the company wishes to prepare financial statements for the year to issue to its stockholders.a. Is the $72,000 figure for Finished Goods inventory the correct amount to use on these statements for external reporting purposes? Explain.b. At what dollar amount should the 3,000 units be carried in the inventory for externalreporting purposes?arrow_forward8. You are More than a Grade (YMG) manufactured 10,000 units in the previous year. An excerpt from their financial statement has been provided below: o Sales Revenue $1,000,000 o Cost of Goods Sold ($400,000) o SG&A expenses ($100,000) o Operating income $500,000 Of the amounts reported on the financial statements, 20% of the cost of goods sold and 60% of the SG&A expenses are variable costs. What is the per unit variable cost? $5.00 unit variable cost $6.00 unit variable cost $14.00 unit variable cost $4.00 unit variable costarrow_forward

- do part 4,5 ASAP!! Hobbs Company produces one product for which following is information is available. Product A $ per unit Selling price 6.00 Direct Material 2.50 Direct Labor 1.40 Variable overhead 1.10 Total Fixed cost $ 120,000 per annum Sales units 200,000 per annum Required: Calculate contribution margin per unit. Calculate break even point in units. Calculate break even point in sales value. Calculate profit for the year based on total contribution. Calculate Margin of safety in units and percentage of sales.arrow_forwardQ - 9 Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost Per Unit Direct materials $ 6.00 Direct labor $ 3.50 Variable manufacturing overhead $ 1.50 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 3.00 Fixed administrative expense $ 2.00 Sales commissions $ 1.00 Variable administrative expense $ 0.50 Foundational 1-6 (Static) 6. If 12,500 units are produced and sold, what is the total amount of variable costs related to the units produced and sold?arrow_forwardExercise 1-8 Product Costs and Period Costs; Variable and Fixed Costs [LO1-3, LO1-4] Kubin Company’s relevant range of production is 22,000 to 27,000 units. When it produces and sells 24,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 8.20 Direct labor $ 5.20 Variable manufacturing overhead $ 2.70 Fixed manufacturing overhead $ 6.20 Fixed selling expense $ 4.70 Fixed administrative expense $ 3.70 Sales commissions $ 2.20 Variable administrative expense $ 1.70 Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 24,500 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 24,500 units? 3. For financial accounting purposes, what is the total amount of product costs incurred to make 27,000 units? 4. For financial accounting purposes, what is the total amount of period costs incurred to sell 22,000 units?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning