Assume that Atlas Sporting Goods Inc. has

a. Compute the anticipated return after financing costs with the most aggressive asset financing mix.

b. Compute the anticipated return after financing costs with the most conservative asset financing mix.

c. Compute the anticipated return after financing costs with the two moderate approaches to the asset financing mix.

d. If the firm used the most aggressive asset financing mix described in part a and had the anticipated return you computed for part a, what would earnings per share be if the tax rate on the anticipated return was 30 percent and there were 20,000 shares outstanding?

e. Now assume the most conservative asset financing mix described in part b will be utilized. The tax rate will be 30 percent. Also assume there will only be 5,000 shares outstanding. What will earnings per share be? Would it be higher or lower than the earnings per share computed for the most aggressive plan computed in part d?

a.

To calculate: The anticipated return, after deducting the finance costs, with the most aggressive approach of the asset financing mix.

Introduction:

Anticipated return:

It is the amount that an individual or company has estimated to earn from an investment. It is one of the factors taken into account by an investor before selecting an investment plan.

Aggressive approach:

When a company selects a plan of low liquidity with high return and long-term financing, it is termed as an aggressive approach.

Answer to Problem 11P

The anticipated return, after deducting the finance costs, with the most aggressive approach of the asset financing mix is $50,400.

Explanation of Solution

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the low liquidity plan is as follows.

The calculation of the finance cost of short-term financing is as follows.

b.

To calculate: The anticipated return, after deducting the finance costs, with the most conservative approach of the asset financing mix.

Introduction:

Conservative approach:

When a company selects a plan of high liquidity with low return and short-term financing, it is termed as a conservative approach.

Answer to Problem 11P

The anticipated return, after deducting the finance costs, with the most conservative approach of the asset financing mix is $8,400.

Explanation of Solution

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the high liquidity plan is as follows.

The calculation of the finance cost of long-term financing is as follows.

c.

To calculate: The anticipated return, after deducting the finance costs, with the two moderate approaches of the asset financing mix.

Introduction:

Moderate approach:

When a company selects a plan of low liquidity with high return and short-term financing or one of high liquidity with low return and long-term financing, it is termed as a moderate approach.

Answer to Problem 11P

The anticipated return, after deducting the finance costs, with the moderate approach of the low liquidity plan and long-term financing of the asset financing mix is $33,600.

The anticipated return, after deducting the finance costs, with the moderate approach of the high liquidity plan and short-term financing of the asset financing mix is $25,200.

Explanation of Solution

Anticipated return in the moderate approach of the low liquidity plan and long-term financing of the asset financing mix:

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the low liquidity plan is as follows.

The calculation of the finance costs of long-term financing is as follows.

Anticipated return in the moderate approach of the high liquidity plan and short-term financing of the asset financing mix:

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the high-liquidity plan is as follows.

The calculation of the finance costs of short-term financing is as follows.

d.

To calculate: The earnings per share if Atlas Sporting Goods Inc. uses the aggressive approach of the asset financing mix with the anticipated return computed in part (a).

Introduction:

Earnings per share:

It is a measurement of the company's profitability. It is calculated by dividing the net income less dividend paid for the prefernece stock by the average number of outstanding shares.

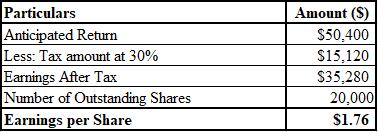

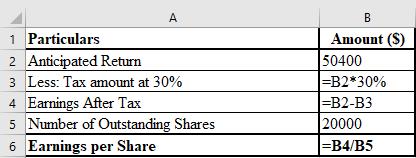

Answer to Problem 11P

The calculation of the earnings per share is as follows.

If Atlas Sporting Goods Inc. uses the aggressive approach of the asset financing mix with the anticipated return computed in part (a), its earnings per share is $1.76.

Explanation of Solution

The calculation of the earnings per share using Excel is as follows.

e.

To calculate: The earnings per share if Atlas Sporting Goods Inc. uses the conservative approach of the asset financing mix with the anticipated return computed in part (b) as well as to check whether it is higher or lower than the earnings per share computed in part (d).

Introduction:

Earnings per share:

It is a measurement of the company's profitability. It is calculated by dividing the net income less dividend paid for the preference stock by the average number of outstanding shares.

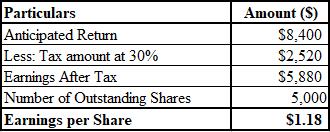

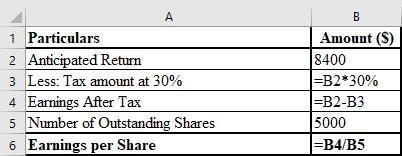

Answer to Problem 11P

The calculation of the earnings per share is as follows.

If Atlas Sporting Goods Inc. uses the conservative approach of the asset financing mix with the anticipated return computed in part (b), its earnings per share is $1.18.

The earnings per share by the conservative approach of the asset financing mix, that is, $1.18 is lower that by the aggressive approach of the asset financing mix, that is, $1.97.

Explanation of Solution

The formula used for the calculation of the earnings per share using Excel is as follows.

Want to see more full solutions like this?

Chapter 6 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Your division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?arrow_forwardBuena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forwardAssume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based on the payback method?arrow_forward

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardWansley Lumber is considering the purchase of a paper company, which would require an initial investment of $300 million. Wansley estimates that the paper company would provide net cash flows of $40 million at the end of each of the next 20 years. The cost of capital for the paper company is 13%. Should Wansley purchase the paper company? Wansley realizes that the cash flows in Years 1 to 20 might be $30 million per year or $50 million per year, with a 50% probability of each outcome. Because of the nature of the purchase contract, Wansley can sell the company 2 years after purchase (at Year 2 in this case) for $280 million if it no longer wants to own it. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? Again, assume that all cash flows are discounted at 13%. Wansley can wait for 1 year and find out whether the cash flows will be $30 million per year or $50 million per year before deciding to purchase the company. Because of the nature of the purchase contract, if it waits to purchase, Wansley can no longer sell the company 2 years after purchase. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? If so, when? Again, assume that all cash flows are discounted at 13%.arrow_forwardAssume a company is going to make an investment of $450,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Which of the two options would you choose based on the payback method?arrow_forward

- Shinedown Company needs to raise $55 million to start a new project and will raise the money by selling new bonds. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 70 percent common stock, 15 percent preferred stock, and 15 percent debt. Flotation costs for issuing new common stock are 9 percent, for new preferred stock, 6 percent, and for new debt, 2 percent. What is the true initial cost figure the company should use when evaluating its project?arrow_forwardDyrdek Enterprises has equity with a market value of $12.6 million and the market value of debt is $4.45 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.9 percent. The new project will cost $2.56 million today and provide annual cash flows of $666,000 for the next 6 years. The company's cost of equity is 11.79 percent and the pretax cost of debt is 5.06 percent. The tax rate is 24 percent. What is the project's NPV? Multiple Choice $208,195 $194,561 $536,049 $183,363 $364,858arrow_forwardSommer, Inc., is considering a project that will result in initial after-tax cash savings of $1.89 million at the end of the first year, and these savings will grow at a rate of 2 percent per year indefinitely. The firm has a target debt-equity ratio of .80, a cost of equity of 12.9 percent, and an after-tax cost of debt of 5.7 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 1 percent to the cost of capital for such risky projects. What is the maximum initial cost the company would be willing to pay for the project?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College