ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

18th Edition

ISBN: 9781307515596

Author: RECK

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 22EP

Debt Service Fund

Required

Using information provided by the trial balance, answer the following.

- a. Assuming the budget was not amended, what was the budgetary

journal entry recorded at the beginning of the fiscal year? - b. What is the budgetary fund balance?

- c. Did the debt service fund pay debt obligations related to lease agreements? Explain.

- d. Did the debt service fund perform a debt refunding? Explain.

- e. Prepare a statement of revenues, expenditures, and changes in fund balances for the debt service fund for the year ended June 30.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following adjusted trial balance is taken from the General Fund of Avon City for the year ended June 30. Prepare a (post-closing) Balance sheet.

Allowance for uncollectible taxes

Cash

Due from capital projects fund

Due to debt service fund

Encumbrances

Encumbrances outstanding

Expenditures

Fund Balance, nonspendable

Fund Balance, unassigned

Inventory of supplies

Other financing sources -- bond proceeds

Other financing uses -- transfers out

Revenues

Taxes receivable

Unearned (unavailable) grant revenues

Vouchers payable

5,000

121,000

32,000

19,000

23,000

23,000

57,000

9,000

14,000

9,000

18,000

12,000

130,000

25,000

38,000

23,000

DO NOT GIVE SOLUTION IN IMAGE

Prepare the journal entries for the following transactions to consolidate financial statements from fund-level statements to government-wide statements.

Deferred property taxes at the end of the year was $92.

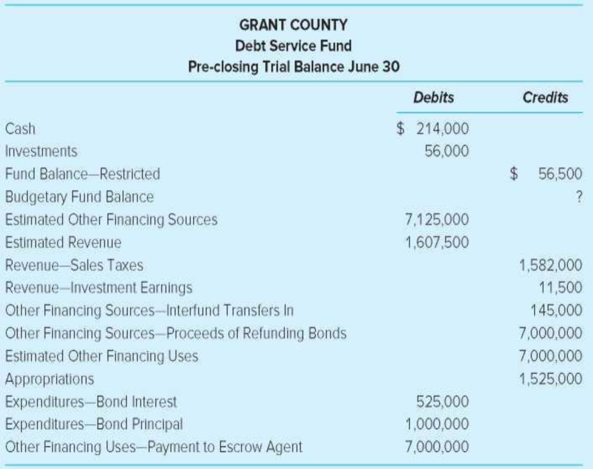

Following is Grant County's debt service fund pre-closing trial balance for the fiscal year ended June 30.

GRANT COUNTY

Debt Service Fund

Pre-closing Trial Balance

June 30

Cash

Investments

Fund Balance-Restricted

Budgetary Fund Balance

Estimated Other Financing Sources

Estimated Revenue

Revenue-Sales Taxes

Revenue-Investment Earnings

Other Financing Sources-Interfund Transfers In

Other Financing Sources-Proceeds of Refunding Bonds

Appropriations

Estimated Other Financing Uses

Expenditures-Bond Interest

Expenditures-Bond Principal

Other Financing Uses-Payment to Escrow Agent

Using Information provided by the trial balance, answer the following.

Debits

Credits

$ 295,000

64,000

$ 63,600

?

6,165,000

2,614,500

1,479,400

13,000

176,000

7,370,000

7,370,000

1,373,000

503,000

870,000

7,370,000

Required

e. Prepare a statement of revenues, expenditures, and changes in fund balances for the debt service fund for the year ended June 30.

(Negative amounts should be Indicated by a minus sign.)

GRANT…

Chapter 6 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The general fund pays rent for two months. Which of the following is not correct? Choose the correct.a. Rent expense should be reported in the government-wide financial statements.b. Rent expense should be reported in the general fund.c. An expenditure should be reported in the fund financial statements.d. If one month of rent is in the first year with the other month in the next year, either the purchases method or the consumption method can be used in fund statements.arrow_forward[The following information applies to the questions displayed below.] The county collector of Suncoast County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 1.7 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Suncoast County General Fund. The following events occurred during the year: 1. Current-year tax levies to be collected by the custodial fund were County General Fund Town of Bayshore General Fund Suncoast County Consolidated School District Other towns Total $10,353,000 4,850,000 6,560,000 3,140,000 $24,903,000 2. $13,720,000 of current taxes was collected during the first half of the year. 3. Liabilities to all funds and governments as a result of the first…arrow_forwardFor the following event, prepare journal entries under a governmental fund (using modified accrual), necessary worksheet entries, and government-wide financial statements (using accrual basis of accounting). The modified accrual statement reflected debt service expenditures in the amount of $500,000 for interest and $612,000 for principal. No adjustment was necessary for interest accruals at year-end. J/E under Modified Accrual Account Debited [ Select] [Select] > > Account Credited [Select] Amount Debited 612,000 500,000 Amount Credited 1,112,000arrow_forward

- 4. The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2020, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Accounts payable Accounts receivable Accrued interest payable Accumulated depreciation Administrative and selling expenses Allowance for uncollectible accounts Capital assets Cash Charges for sales and services Cost of sales and services Depreciation expense Due from General Fund Interest expense Interest revenue Transfer in from General Fund Bank note payable Supplies inventory Totals Debits $32,000 47,000 712,000 89,000 479,000 45,000 17,000 40,000 18,000 $1,479,000 Credits $ 96,000 28,000 45,000 12,000 550,000 4,000 119,000 625,000 $1,479,000 Required: a. Prepare the closing entries for December 31. b. Prepare the Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended December 31. c. Prepare the Net Position section of the…arrow_forwardQuestion 1 The account Deferred Inflows of Resources - Unavailable Revenues is used in governmental funds to record Property taxes that have been collected but not yet earned. Property taxes that will not be collected within 60 days of fiscal year end. Property taxes that are considered uncollectible. Uncollectible and unearned property taxes could be included in Deferred Inflows of Resources Unavailable Revenues.arrow_forwardGreenville has provided the following Information from its General Fund Revenues and Appropriations/Expenditure/Encumbrances subsidiary ledgers for the fiscal year ended. Assume the beginning fund balances are $149 (in thousands) and that the budget was not amended during the year. City of Greenville General Fund Subsidiary Ledger Account Balances (in thousands) Estimated Revenue Taxes For the Fiscal Year Fines & Forfeits Intergovernmental Revenue Charges for Services Revenues Debits 6,048 303 497 370 Credits Taxes Fines & Forfeits Intergovernmental Revenue Charges for Services Appropriations Public Safety General Government 6,080 308 497 368 1,636 3,375 Public Works Culture & Recreation Interfund Transfers Out Expenditures General Government 1,465 724 Estimated Other Financing Uses 48. 1,622 Public Safety 3,360 Public Works 1,443 Culture & Recreation 715 Encumbrances General Government 12 I Public Safety 13 Public Works 21 232 Culture & Recreation 0 Other Financing Uses Interfund…arrow_forward

- The general fund pays rent for two months. Which of the following is not correct? Rent expense should be reported in the government-wide financial statements. Rent expense should be reported in the general fund. An expenditure should be reported in the fund financial statements. If one month of rent is in the first year with the other month in the next year, either the purchases method or the consumption method can be used in fund statements.arrow_forwardThe following information has been provided for the City of Elizabeth for its fiscal year ended June 30. The information provided relates to financial information reported on the city's statement of net position and its total governmental funds balance. Deferred inflows of resources due to unavailability of resources to pay current expenditures Capital assets Accumulated depreciation on capital assets Accrued interest on bonds and long-term notes payable Bonds and long-term notes payable Unamortized premium on bonds payable Compensated absences Total governmental fund balances Total net position of governmental activities Required 5364,608 641,600 356,000 2,908 177,608 2,400 16,708 162,808 612,600 Prepare reconciliation of the governmental fund balances to the net position of governmental activities. (Decreases should be indicated with a minus sign.) CITY OF ELIZABETH Reconciliation of the Balance Sheet-Governmental Funds to the Statement of Net Position Total fund balances…arrow_forwardThe following is a pre-closing trial balance for the Village of Lake Augusta's general Fund as of December 31, 2017: Credits Accounts payable Appropriations Budgetary fund balance Budgetary fund balance: reserve for encumbrances Cash Deferred revenues: property taxes Due to other funds Encumbrances Estimated other financing sources Estimated other financing uses Estimated revenues Estimated uncollectible taxes Expenditures Fund balance Other financing sources Other financing uses Revenues Tax anticipation notes payable. Taxes receivable Totals Debits 116,500 5,000 8,000 200,000 154,000 11.000 29,000 523,500 6,800 160,000 38,000 5,000 3,000 5,000 10,000 2,000 54,700 10,000 199,000 30,000 523,500arrow_forward

- In approving the budget of the City of Troy, the city council appropriated an amount less than expected revenues, what will be the result of this action .a An increase in outstanding encumbrances by the of the fiscal year .b A credit to budgetary fund balance .C A debit to budgetary fund balance .d A necessity for compensatory offsetting action in the debt service fundarrow_forwardThe City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forwardThe following is a pre-closing trial balance for Olson City’s General Fund as of June 30, 2005. (See Image) Prepare Closing entries at June, 30, 2005arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License