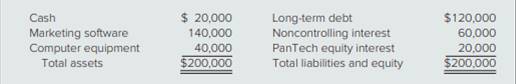

On December 31, 2017. PanTech Company invests $20,000 in SoftPlus, a variable interest entity. In contractual agreements completed on that date, PanTech established itself as the primary beneficiary of SoftPlus. Previously, PanTech had no equity interest in SoftPlus. Immediately after PanTech’s investment. SoftPlus presents the following balance sheet:

Each of the above amounts represents an assessed fair value at December 31, 2017, except for the marketing software. Accordingly the December 31 fair value of SoftPlus is assessed at $80,000.

a. If the marketing software was undervalued by $20,000, what amounts for SoftPlus would appear in PanTech’s December 31, 2017, consolidated financial statements?

b. If the marketing software was overvalued by $20,000, what amounts for SoftPlus would appear in PanTech’s December 31’ 2017, consolidated financial statements?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

ADVANCED ACCOUNTING-LL

- On January 1, 2024, Pikes Corporation loaned Venti Company $311,000 and agreed to guarantee all of Venti’s long-term debt in exchange for (1) decision-making authority over all of Venti’s activities and (2) an annual management fee of 25 percent of Venti’s annual revenues. As a result of the agreement, Pikes becomes the primary beneficiary of Venti (now a variable interest entity). Pikes’ loan to Venti stipulated a 10 percent (market) rate of interest to be paid annually with principal due in 10 years. On January 1, 2024, Pikes estimated that the fair value of Venti’s equity shares equaled $86,000 while Venti’s book value was $66,000. Any excess fair over book value at that date was attributed to Venti’s trademark with an indefinite life. Because Pikes owns no equity in Venti, all of the acquisition-date excess fair over book value is allocated to the noncontrolling interest. Venti paid Pikes 25 percent of its 2024 revenues at the end of the year and recorded the payment in other…arrow_forwardThe table below indicates the carrying amounts (and cost), and fair values of Quintox's FV-OCI investments as of their fiscal year end, November 30, 2017. Investments Carrying Amount Fair Value Claricom Inc. $130,000 $110,000 Michelion Inc. 220,400 201,500 Avacom Inc. 190,000 196,000 Ryinex Inc. 217,300 206,300 $757,700 $713,800 Required: Prepare the journal entry at November 30, 2017 that Quintox would make to record for these investments. iii) On December 28, 2017 Quintox sells all of its Avacom Inc.'s common shares receiving cash proceeds of $204,750. Required: Prepare the three journal entries Quintox would record at December 28, 2017. (Leave an empty line between each journal entry).arrow_forwardEntity A invested in 38,600 shares of a listed company on 1 October 2019 at a cost of $3.95 per share. On 31 December 2019, the shares have a market value of $3.45. Entity A is not planning on selling these shares in the short term and elects to hold them as Fair Value through Other Comprehensive Income. REQUIRED: (1) Measure the amounts of the financial asset recognised in the Statement of Financial Position as at 31 December 2019. (2) Measure the amounts recognised in the Statement of Profit or Loss for the financial asset of the year 2019. (3) Measure the amounts of the Fair Value Reserve recognised in the Statement of Financial Position as at 31 December 2019arrow_forward

- 28. On January 1, 2020, Walang Kayo Co. purchased investment securities for P1,500,000. The securities are classified as investment in equity securities at fair value through profit or loss. At December 31, 2016, the securities had a fair value of P2,100,000 but not yet been sold. The company also recognized a P400,000 restructuring charge during the year. The restructuring charge is composed of an impairment write down of manufacturing facility. Tax rules do not allow a deduction for the write down unless the facility is sold. The facility was not sold by the end of the year. After including the unrealized gain on the equity investment @FVPL and the restructuring charge, the accounting income before tax for the year was P5,000,000. The income tax rate for the current and future years is 30%. What is Walang Kayo’s current tax expense? A. P1,440,000 B. P1,500,000 C. P1,560,000 D. P1,920,000arrow_forwardSwifty Ltd. has a single debt investment that it accounts for using FV-OCI recycled to net income. The carrying value of the debt investment on July 1 after the collection of interest and amortization of premium was $83,100. To date, $1,530 of unrealized losses in fair value adjustments have been recorded to other comprehensive income. On July 1, when the market value of the investment is $82,660, Gauthier sold the debt investment. Using the three-step approach, record the July 1 entries for the sale and reclassification (recycling) entry to net income. Do not give answer in imagearrow_forward18. On December 31, 2012, Columbia Company shows the data presented in the image with respect to its matured obligation. The company is threatened with a court suit if it could not pay its maturing debt. Accordingly, the company enters into an agreement with the creditor for the transfer of a non-cash asset in full settlement of the mortgage. The agreement provides for the transfer of real estate carried in the books of Columbia at P3,000,000. The real estate has a current fair market value of P4,500,000. What amount should Columbia recognize in profit or loss for the year 2012 as a result of this transaction? * Notes payable P5.000,000 Accrued Interest Payable 500,000 a. P500,000 b. P1,000,000 c. P1,500,000 d. P2,500,000arrow_forward

- On its December 31, 2020, balance sheet, Cullumber Company reported its investment in equity securities, which had cost $720000, at fair value of $656000. At December 31, 2021, the fair value of the securities was $693000. What should Cullumber report on its 2021 income statement as a result of the increase in fair value of the investments in 2021?arrow_forwardOn January 1, 2021, an entity purchased marketable equity securities for P5,000,000. The equity securities qualify as a financial asset held for trading. The entity also paid P50,000 as commission to the broker. At year-end, the trading securities have a fair value of P6,000,000. The increase in fair value should be recorded with: a.A credit to Financial asset - FVPL, P1,000,000 b.A debit to Unrealized gain - OCI, P1,000,000 c.A debit to Financial asset - FVPL, P1,000,000 d.A debit to Unrealized gain - P/L, P1,000,000arrow_forwardOn December 28, 2022 (trade date), Francis Corp. enters into a contract to sell an equity security classified as Financial Assets at FVTOCI for its current fair value of P303,000. The asset was acquired a year ago and its cost was P300,000. On December 31, 2022 (financial year-end), the fair value of the asset is P303,600. On January 5, 2023 (settlement date), the asset's fair value is P303,900. If Francis uses the trade date method to account for regular-way sales of its securities, the net amount to be recognized in 2022 comprehensive income is e. P3,900 f. P3,600 g. P3,000 h. PO If Francis uses the settlement date method to account for regular-way sales of its securities, the net amount to be recognized in 2023 comprehensive income is e. P3,900 f. P3,600 h. PO g. P3,000arrow_forward

- Z Corporation has the following transactions relating to its investment during 2020: Jan 5 Acquired 16,000 shares of Y company for P1,500,000 paying an additional P10,000 for brokerage and P5,000 for commission. Feb 14 Received dividends from Y company declared January 10,2020 to the stockholders of records January 31,2020, P16,000. Required:prepare all the necessary entries assuming the investment is 1. Financial asset at Fair Value through profit and loss 2. Financial asset at Fair Value through other comprehensive incomearrow_forwardRamirez Company has a held-for-collection investment in the 6%, 20-year bonds of Soto Company. The investment was originally purchased for $1,200,000 in 2016. Early in 2017, Ramirez recorded an impairment of $300,000 on the Soto investment, due to Soto’s financial distress. In 2018, Soto returned to profitability and the Soto investment was no longer impaired. What entry does Ramirez make in 2018 under (a) GAAP and (b) IFRS?arrow_forwardOn January 1, 2020, the Pacita Corporation purchased equity securities for P2,000,000. The company also paid commission, taxes and other transaction costs amounting to P50,000. Because the securities were acquired not for immediate trading, Pacita exercised its option to measure the change in fair value through other comprehensive income. The securities had the following market values at December 31, 2020 and 2021, respectively: P1,750,000 and P2,100,000. No securities were sold during 2020 and 2021. What amount of unrealized gain or loss should be reported in December 31, 2021 statement of financial position as a component of shareholders’ equity?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education