COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

4th Edition

ISBN: 9781260255157

Author: Haddock

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 2CTP

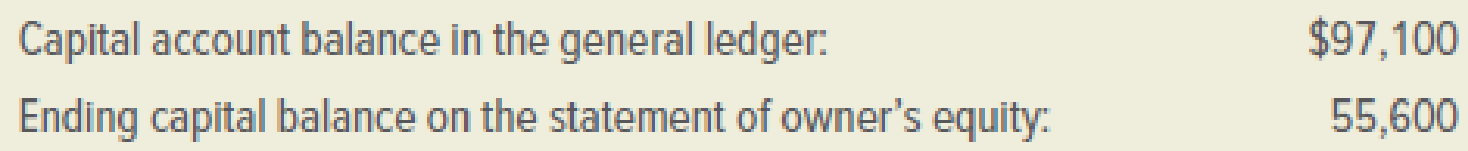

Demetria Davis, the bookkeeper for Home Interiors and Designs Company, has just finished posting the closing entries for the year to the ledger. She is concerned about the following balances:

Davis knows that these amounts should agree and asks for your assistance in reviewing her work.

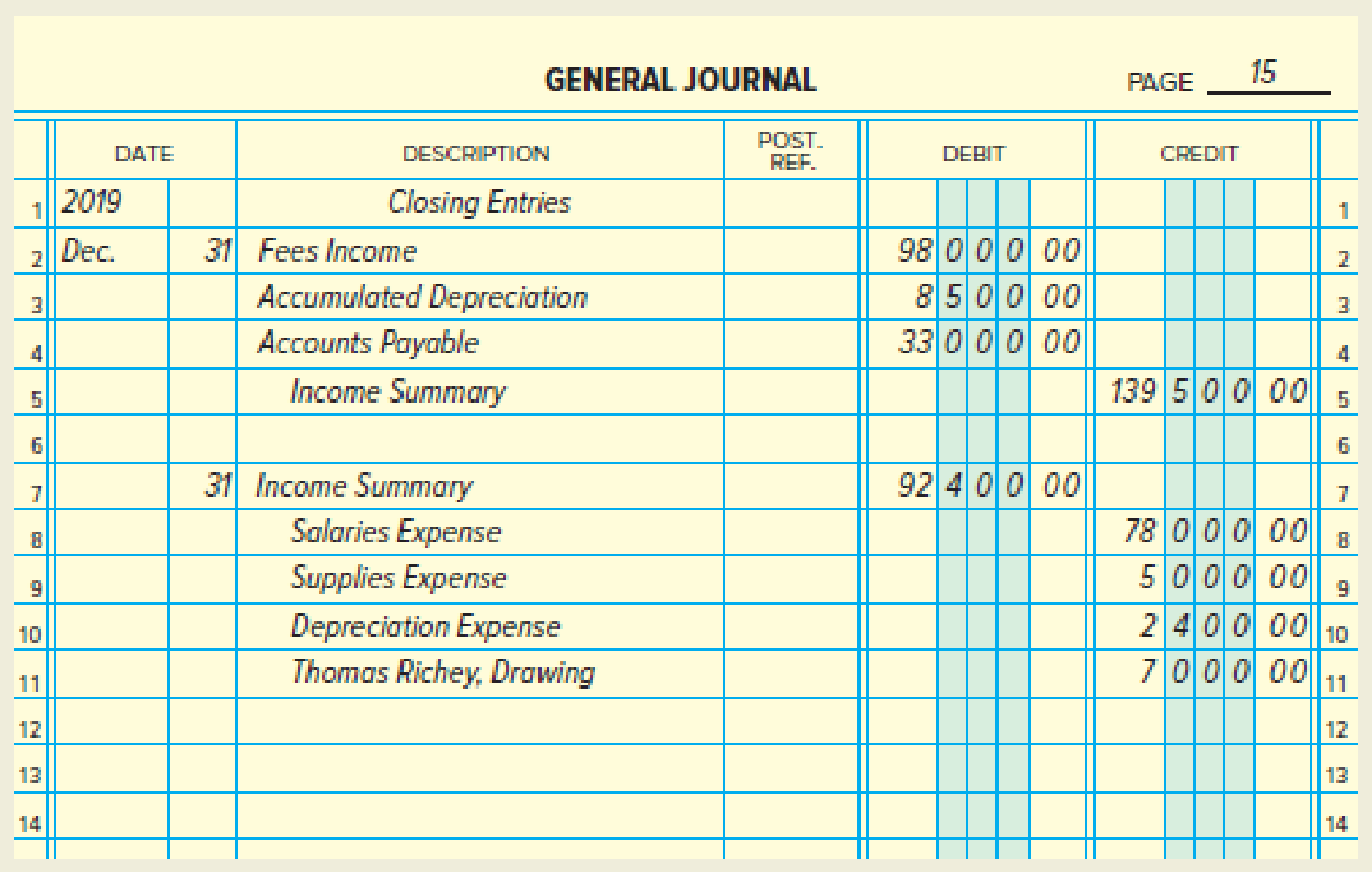

Your review of the general ledger of Home Interiors and Designs Company reveals a beginning capital balance of $50,000. You also review the general journal for the accounting period and find the closing entries shown below.

- 1. What errors did Ms. Davis make in preparing the closing entries for the period?

- 2. Prepare a general

journal entry to correct the errors made. - 3. Explain why the balance of the capital account in the ledger after closing entries have been posted will be the same as the ending capital balance on the statement of owner’s equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Brian Marlow recently was hired to prepare Louise Michenor Consulting’s year-end financial statements. Brain just entered his CPA certificate, and Louise Michneor was one of his first clients. Louise employs a bookkeeper, Martha Hailing, who does the daily journal entries and prepares a year-to-date trial balance at the end of the of each month. Martha gives the December 31 trial to a CPA to make adjustments and generate the financial statements. As Brian was looking through Louise Michenor’s books, he noticed two things. First, in each of the last three years, a different COA had prepared the financial statements. Second, the amount shown on the December 31 trial balance for miscellaneous expense was quite high this year compared to prior years. Brian called Martha to find out is she new why miscellaneous expense had such a high balance. Martha’s response was “ I just do what Louise tells me to do. If she wants to charge personal expenses to the company, it’s none of my business “.…

One year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for advice. He wishes to know how much net income the business earned during the past year. The accounting records consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The accounts at December 31, ( please see the pic)

Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on…

One year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for advice. He wishes to know how much net income the business earned during the past year. The accounting records consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The accounts at December 31, ( please see the pic)

Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on…

Chapter 6 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

Ch. 6 - What is the journal entry to close the drawing...Ch. 6 - How is the Income Summary account classified?Ch. 6 - Prob. 1.3SRQCh. 6 - Prob. 1.4SRECh. 6 - Prob. 1.5SRECh. 6 - Prob. 1.6SRACh. 6 - Prob. 2.1SRQCh. 6 - Prob. 2.2SRQCh. 6 - What accounts appear on the post-closing trial...Ch. 6 - Prob. 2.4SRE

Ch. 6 - Prob. 2.5SRECh. 6 - On which financial statement would you find the...Ch. 6 - Prob. 1CSRCh. 6 - A firm has the following expenses: Rent Expense,...Ch. 6 - Prob. 3CSRCh. 6 - What is the last step in the accounting cycle?Ch. 6 - Is the following statement true or false? Why? All...Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - What accounts appear on a postclosing trial...Ch. 6 - Prob. 4DQCh. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - How is the Income Summary account used in the...Ch. 6 - Briefly describe the flow of data through a simple...Ch. 6 - Prob. 10DQCh. 6 - Prob. 1ECh. 6 - Accounting cycle. Following are the steps in the...Ch. 6 - Prob. 3ECh. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - Prob. 6ECh. 6 - Prob. 7ECh. 6 - Prob. 8ECh. 6 - Prob. 1PACh. 6 - Prob. 2PACh. 6 - Prob. 3PACh. 6 - Prob. 4PACh. 6 - Prob. 1PBCh. 6 - Prob. 2PBCh. 6 - Prob. 3PBCh. 6 - Prob. 4PBCh. 6 - The Trial Balance section of the worksheet for...Ch. 6 - Demetria Davis, the bookkeeper for Home Interiors...Ch. 6 - Prob. 1MFCh. 6 - Prob. 2MFCh. 6 - Why is it important that a firms financial records...Ch. 6 - Prob. 4MFCh. 6 - Prob. 1EDCh. 6 - Prob. 1ICCh. 6 - Prob. 1MPS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume you are a newly-hired accountant for a local manufacturing firm. You have enjoyed working for the company and are looking forward to your first experience participating in the preparation of the companys financial statements for the year-ending December 31, the end of the companys fiscal year. As you are preparing your assigned journal entries, your supervisor approaches you and asks to speak with you. Your supervisor is concerned because, based on her preliminary estimates, the company will fall just shy of its financial targets for the year. If the estimates are true, this means that all 176 employees of the company will not receive year-end bonuses, which represent a significant portion of their pay. One of the entries that you will prepare involves the upcoming bond interest payment that will be paid on January 15 of the next year. Your supervisor has calculated that, if the journal entry is dated on January 1 of the following year rather than on December 31 of the current year, the company will likely meet its financial goals thereby allowing all employees to receive year-end bonuses. Your supervisor asks you if you will consider dating the journal entry on January 1 instead of December 31 of the current year. Assess the implications of the various stake holders and explain what your answer will be.arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardThe partial work sheet for Emil Consulting for June is as follows: Required If you are using Working Papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 4,930arrow_forward

- One year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for advice. He wishes to know how much net income the business earned during the past year. The accounting records consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The accounts at December 31, are as follows: Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2…arrow_forwardOne year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for advice. He wishes to know how much net income the business earned during the past year. The accounting records consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The accounts at December 31, are as follows: Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2…arrow_forwardOne year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for advice. He wishes to know how much net income the business earned during the past year. The accounting records consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The accounts at December 31, are as follows: Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2…arrow_forward

- One year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for advice. He wishes to know how much net income the business earned during the past year. The accounting records consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The accounts at December 31, are as follows: Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2…arrow_forwardOne year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for advice. He wishes to know how much net income the business earned during the past year. The accounting records consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The accounts at December 31, are as follows: Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary. The rent paid in advance on Jan 2…arrow_forwardDaryl Kirby opened Squid Realty Co. on January 1, 2018. At the end of the first year, the business needed additional capital. On behalf of Squid Realty Co., Daryl applied to Ocean National Bank for a loan of $375,000. Based on Squid Realty Co.’s financial statements, which had been prepared on a cash basis, the Ocean National Bank loan officer rejected the loan as too risky.After receiving the rejection notice, Daryl instructed his accountant to prepare the financial statements on an accrual basis. These statements included $65,000 in accounts receivable and $25,000 in accounts payable. Daryl then instructed his accountant to record an additional $30,000 of accounts receivable for commissions on property for which acontract had been signed on December 28, 2018. The title to the property is to transfer on January 5, 2019, when an attorney formally records the transfer of the property to the buyer.Daryl then applied for a $375,000 loan from Free Spirit Bank, using the revised financial…arrow_forward

- Wishbone, Inc., is preparing its year-end balance sheet and needs to determine how much of its assets/liabilities are current or noncurrent. For the following transactions, determine the amount that needs to be included in the balance sheet for the period ending December 31, Year 7, as current or noncurrent. Wishbone paid $16,000 for insurance on October 1, Year 6. Insurance is $500 per month due on the last day of the month. Wishbone pays its employees the Wednesday following the close of the 2-week pay period. Wishbone has 15 employees who each work 40 hours per week for $10 per hour. In Year 7, December 31 is the second Friday of a 2-week pay period. Wishbone has a $10,000 deferred tax asset recorded on its books as of December 31, Year 7. Wishbone expects $3,000 to be reversed in Year 8. During Year 7, Wishbone invested $6,000 in trading securities. It expects to sell half in Year 8 and the remaining half in Year 9. Wishbone purchased new equipment for $15,000 on January 1, Year…arrow_forwardOn January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following transactions during the month: Sharon Matthews transferred cash from his personal bank account to a new account to start a new business, $40,000. Paid rent on office for the month, $6,000. Purchased supplies on account, $3,200. Paid creditor on account, $1,750. Earned fees, receiving cash, $18,250. Paid automobile expenses (including rental charge) for month, $1,880, and miscellaneous expenses, $420. Paid office salaries, $5,000. Determined that the cost of supplies used was $1,400. Withdrew cash for personal use, $2,000. Instructions Journalize entries for transactions (1) through (9), using the following account titles: Cash; Supplies; Accounts Payable; Capital; Drawing; Fees revenues; Rent Expense; Office Salaries Expense; Automobile Expense; Supplies Expense; Miscellaneous Expense. (Explanations may be omitted). Prepare T accounts, using the account titles in (1). Post the journal…arrow_forwardarty Wagon, Inc., provides musical entertainment at weddings, dances, and various other functions. The company performs adjusting entries monthly, but prepares closing entries annually on December 31. The company recently hired Jack Armstrong as its new accountant. Jack’s first assignment was to prepare an income statement, a statement of retained earnings, and a balance sheet using an adjusted trial balance given to him by his predecessor, dated December 31, current year.From the adjusted trial balance, Jack prepared the following set of financial statements. Required: a. Prepare a corrected set of financial statements dated December 31, current year. (You may assume that all of the figures in the company’s adjusted trial balance were reported correctly except for Interest Payable of $240, which was mistakenly omitted in the financial statements prepared by Jack.) b. Prepare the necessary year-end closing entries. c. Using the financial statements prepared in part a, briefly…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License