Concept explainers

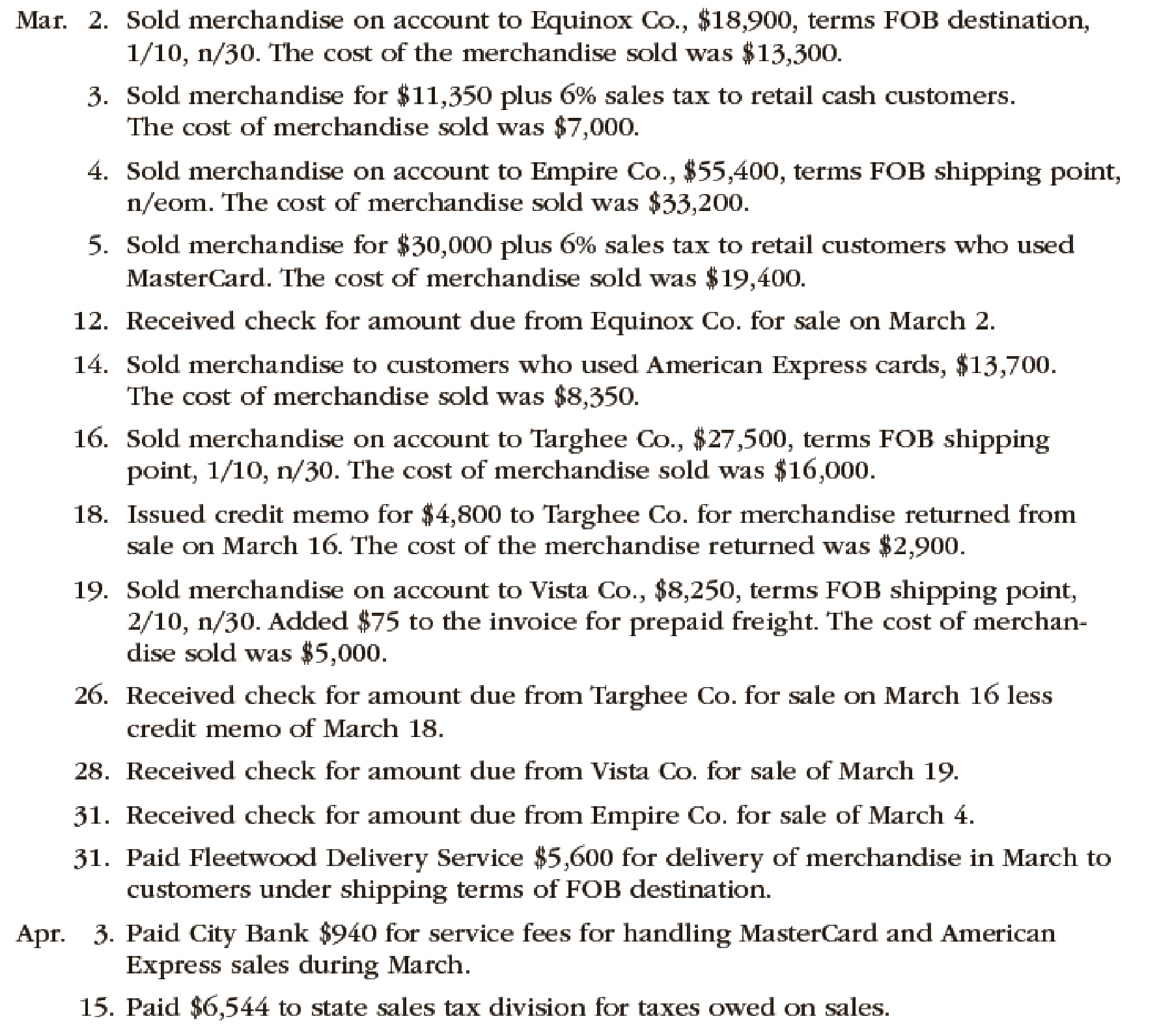

The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Record the sale transactions of the company.

Explanation of Solution

Sales is an activity of selling the merchandise inventory of a business.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Accounts receivable | 18,711 (1) | |

| Sales Revenue | 18,711 | ||

| (To record the sale of inventory on account) |

Table (1)

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

- Sales revenue is revenue and it increases the value of equity by $18,711. Therefore, credit sales revenue with $18,711.

Working Note (1):

Calculate the amount of accounts receivable.

Sales = $18,900

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Cost of Merchandise Sold | 13,300 | |

| Merchandise Inventory | 13,300 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $13,300. Therefore, debit cost of merchandise sold account with $13,300.

- Merchandise Inventory is an asset and it is decreased by $13,300. Therefore, credit inventory account with $13,300.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cash | 12,031 (3) | |

| Sales Revenue | 11,350 | ||

| Sales Tax Payable | 681 (2) | ||

| (To record the sale of inventory for cash) |

Table (3)

- Cash is an asset and it is increased by $12,031. Therefore, debit cash account with $12,031.

- Sales revenue is revenue and it increases the value of equity by $11,350. Therefore, credit sales revenue with $11,350.

- Sales tax payable is a liability and it is increased by $681. Therefore, credit sales tax payable account with $681.

Working Notes(2):

Calculate the amount of sales tax payable.

Sales revenue = $11,350

Sales tax percentage = 6%

Working Notes(3):

Calculate the amount of cash received.

Sales revenue = $11,350

Sales tax payable = $681 (2)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cost of Merchandise Sold | 7,000 | |

| Merchandise Inventory | 7,000 | ||

| (To record the cost of goods sold) |

Table (4)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $7,000. Therefore, debit cost of merchandise sold account with $7,000.

- Merchandise Inventory is an asset and it is decreased by $7,000. Therefore, credit inventory account with $7,000.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Accounts receivable | 55,400 | |

| Sales Revenue | 55,400 | ||

| (To record the sale of inventory on account) |

Table (5)

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

- Sales revenue is revenue and it increases the value of equity by $55,400. Therefore, credit sales revenue with $55,400.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Cost of Merchandise Sold | 33,200 | |

| Merchandise Inventory | 33,200 | ||

| (To record the cost of goods sold) |

Table (6)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $33,200. Therefore, debit cost of merchandise sold account with $33,200.

- Merchandise Inventory is an asset and it is decreased by $33,200. Therefore, credit inventory account with $33,200.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cash | 31,800 (5) | |

| Sales Revenue | 30,000 | ||

| Sales Tax Payable | 1,800 (4) | ||

| (To record the sale of inventory for cash) |

Table (7)

- Cash is an asset and it is increased by $31,800. Therefore, debit cash account with $31,800.

- Sales revenue is revenue and it increases the value of equity by $30,000. Therefore, credit sales revenue with $30,000.

- Sales tax payable is a liability and it is increased by $1,800. Therefore, credit sales tax payable account with $1,800.

Working Note (4):

Calculate the amount of sales tax payable.

Sales revenue = $30,000

Sales tax percentage = 6%

Working Note (5):

Calculate the amount of cash received.

Sales revenue = $30,000

Sales tax payable = $1,800 (2)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cost of Merchandise Sold | 19,400 | |

| Merchandise Inventory | 19,400 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $19,400. Therefore, debit cost of merchandise sold account with $19,400.

- Merchandise Inventory is an asset and it is decreased by $19,400. Therefore, credit inventory account with $19,400.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 12 | Cash | 18,711 | |

| Accounts Receivable | 18,711 | ||

| (To record the receipt of cash against accounts receivables) |

Table (9)

- Cash is an asset and it is increased by $18,711. Therefore, debit cash account with $18,711.

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cash | 13,700 | |

| Sales Revenue | 13,700 | ||

| (To record the sale of inventory for cash) |

Table (10)

- Cash is an asset and it is increased by $13,700. Therefore, debit cash account with $13,700.

- Sales revenue is revenue and it increases the value of equity by $13,700. Therefore, credit sales revenue with $13,700.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cost of Merchandise Sold | 8,350 | |

| Merchandise Inventory | 8,350 | ||

| (To record the cost of goods sold) |

Table (11)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $8,350. Therefore, debit cost of merchandise sold account with $8,350.

- Merchandise Inventory is an asset and it is decreased by $8,350. Therefore, credit inventory account with $8,350.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Accounts receivable | 27,225 (6) | |

| Sales Revenue | 27,225 | ||

| (To record the sale of inventory on account) |

Table (12)

- Accounts Receivable is an asset and it is increased by $27,225. Therefore, debit accounts receivable with $27,225.

- Sales revenue is revenue and it increases the value of equity by $27,225. Therefore, credit sales revenue with $27,225.

Working Note (6):

Calculate the amount of accounts receivable.

Sales = $27,500

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Cost of Merchandise Sold | 16,000 | |

| Merchandise Inventory | 16,000 | ||

| (To record the cost of goods sold) |

Table (13)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $16,000. Therefore, debit cost of merchandise sold account with $16,000.

- Merchandise Inventory is an asset and it is decreased by $16,000. Therefore, credit inventory account with $16,000.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 18 | Customer Refunds Payable | 4,752 (7) | ||

| Accounts Receivable | 4,752 | |||

| (To record sales returns) |

Table (14)

- Customer refunds payable is a liability account and it is decreased by $4,752. Therefore, debit customer refunds payable account with $4,752.

- Accounts Receivable is an asset and it is decreased by $4,752. Therefore, credit account receivable with $4,752.

Working Note (7):

Calculate the amount of refund owed to the customer.

Sales return = $4,800

Discount percentage = 1%

Record the journal entry for the return of the merchandise.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 18 | Merchandise Inventory | 2,900 | |

| Estimated Returns Inventory | 2,900 | ||

| (To record the return of the merchandise) |

Table (15)

- Merchandise Inventory is an asset and it is increased by $2,900. Therefore, debit inventory account with $2,900.

- Estimated retunrs inventory is an expense account and it increases the value of equity by $2,900. Therefore, credit estimated returns inventory account with $2,900.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Accounts receivable | 8,085 (8) | |

| Sales Revenue | 8,085 | ||

| (To record the sale of inventory on account) |

Table (16)

- Accounts Receivable is an asset and it is increased by $8,085. Therefore, debit accounts receivable with $8,085.

- Sales revenue is revenue and it increases the value of equity by $8,085. Therefore, credit sales revenue with $8,085.

Working Note (8):

Calculate the amount of accounts receivable.

Sales = $8,250

Discount percentage = 2%

Record the journal entry.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 19 | Accounts Receivable | 75 | ||

| Cash | 75 | |||

| (To record freight charges paid) |

Table (17)

- Accounts Receivable is an asset and it is increased by $75. Therefore, debit accounts receivable with $75.

- Cash is an asset and it is decreased by $75. Therefore, credit cash account with $75.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Cost of Merchandise Sold | 5,000 | |

| Merchandise Inventory | 5,000 | ||

| (To record the cost of goods sold) |

Table (18)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $5,000. Therefore, debit cost of merchandise sold account with $5,000.

- Merchandise Inventory is an asset and it is decreased by $5,000. Therefore, credit inventory account with $5,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 26 | Cash | 22,473 (9) | |

| Accounts Receivable | 22,473 | ||

| (To record the receipt of cash against accounts receivables) |

Table (19)

- Cash is an asset and it is increased by $22,473. Therefore, debit cash account with $22,473.

- Accounts Receivable is an asset and it is increased by $22,473. Therefore, debit accounts receivable with $22,473.

Working Note (9):

Calculate the amount of cash received.

Net accounts receivable = $22,473

Customer refunds payable = $4,752

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 28 | Cash | 8,160 (10) | |

| Accounts Receivable | 8,160 | ||

| (To record the receipt of cash against accounts receivables) |

Table (20)

- Cash is an asset and it is increased by $8,160. Therefore, debit cash account with $8,160.

- Accounts Receivable is an asset and it is increased by $8,160. Therefore, debit accounts receivable with $8,160.

Working Note (10):

Calculate the amount of cash received.

Net accounts receivable = $8,085

Freight charges = $75

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 31 | Cash | 55,400 | |

| Accounts Receivable | 55,400 | ||

| (To record the receipt of cash against accounts receivables) |

Table (21)

- Cash is an asset and it is increased by $55,400. Therefore, debit cash account with $55,400.

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 31 | Delivery expense | 5,600 | |

| Cash | 5,600 | ||

| (To record the payment of delivery expenses) |

Table (22)

- Delivery expense is an expense account and it decreases the value of equity by $5,600. Therefore, debit delivery expense account with $5,600.

- Cash is an asset and it is decreased by $5,600. Therefore, credit cash account with $5,600.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 3 | Credit card expense | 940 | |

| Cash | 940 | ||

| (To record the payment of credit card expenses) |

Table (23)

- Credit card expense is an expense account and it decreases the value of equity by $940. Therefore, debit credit card expense account with $940.

- Cash is an asset and it is decreased by $940. Therefore, credit cash account with $940.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 15 | Sales tax payable | 6,544 | |

| Cash | 6,544 | ||

| (To record the payment of credit card expenses) |

Table (24)

- Sales tax payable is a liability account and it is decreased by $6,544. Therefore, debit customer refunds payable account with $6,544.

- Cash is an asset and it is decreased by $6,544. Therefore, credit cash account with $6,544.

Want to see more full solutions like this?

Chapter 6 Solutions

Cengagenow For Financial Accounting

- Using the following revenue journal for Bowman Cleaners Inc., identify each of the posting references, indicated by a letter, as representing (1) posting to general ledger accounts or (2) posting to subsidiary ledger accounts:arrow_forwardThe following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to wholesalers and occasionally to retail customers: Instructions Journalize the entries to record the transactions of Green Lawn Supplies Co.arrow_forwardUsing the following revenue journal for Zeta Services Inc., identify each of the posting references, indicated by a letter, as representing (1) posting to general ledger accounts or (2) posting to subsidiary ledger accounts:arrow_forward

- During the month of October 20--, The Pink Petal flower shop engaged in the following transactions: Selected account balances as of October 1 were as follows: The Pink Petal also had the following subsidiary ledger balances as of October 1: REQUIRED 1. Record the transactions in a sales journal (page 7), cash receipts journal (page 10), purchases journal (page 6), cash payments journal (page 11), and general journal (page 5). Total, verify, and rule the columns where appropriate at the end of the month. 2. Post from the journals to the general ledger, accounts receivable ledger, and accounts payable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardPlumb Line Surveyors provides survey work for construction projects. The office staff use office supplies, while surveying crews use field supplies. Purchases on account completed by Plumb Line Surveyors during May are as follows: Instructions 1. Insert the following balances in the general ledger as of May 1: 2. Insert the following balances in the accounts payable subsidiary ledger as of May 1: 3. Journalize the transactions for May, using a purchases journal (p. 30) similar to the one illustrated in this chapter. Prepare the purchases journal with columns for Accounts Payable, Field Supplies, Office Supplies, and Other Accounts. Post to the creditor accounts in the accounts payable subsidiary ledger immediately after each entry. 4. Post the purchases journal to the accounts in the general ledger. 5. a. What is the sum of the creditor balances in the subsidiary ledger at May 31? b. What is the balance of the accounts payable controlling account at May 31? 6. What type of e-commerce application would be used to plan and coordinate transactions with suppliers?arrow_forwardFor each of the following, indicate if the statement reflects an input component, output component, or storage component of an accounting information system. A. A credit card scanner at a grocery store. B. A purchase order for 1,000 bottles of windshield washing fluid to be used as inventory by an auto parts store. C. A report of patients who missed appointments at a doctors office. D. A list of the days cash and credit sales. E. Electronic files containing a list of current customers.arrow_forward

- From the following list, identify which items are considered original sources: A. prepaid insurance B. bank statement C. sales ticket D. general journal E. trial balance F. balance sheet G. telephone bill H. invoice from supplier I. company sales account J. income statementarrow_forwardReview the following transactions for Dish Mart and record any required journal entries. Note that all purchase transactions are with the same supplier.arrow_forwardIn each of the following situations, indicate whether you would expect the business to use a periodicinventory system or a perpetual inventory system. Explain the reasons for your answer.a. The Frontier Shop is a small retail store that sells boots and Western clothing. The store isoperated by the owner, who works full-time in the business, and by one part-time salesclerk.Sales transactions are recorded on an antique cash register. The business uses a manual accountingsystem, which is maintained by ACE Bookkeeping Service. At the end of eachmonth, an employee of ACE visits The Frontier Shop to update its accounting records, preparesales tax returns, and perform other necessary accounting services.b. Allister’s Corner is an art gallery in the Soho district of New York. All accounting records aremaintained manually by the owner, who works in the store on a full-time basis. The store sellsthree or four paintings each week, at sales prices ranging from about $5,000 to $50,000…arrow_forward

- When using a manual accounting information system, which of the following transactions would be recorded in the general journal? Depreciation of office furniture. Cash payment of rent. Sale of merchandise inventory on account. Purchase of merchandise inventory on account,arrow_forwardsources of input data may include all of the following business documents except : a- sales invoice b- cash register tape in a supermarket c- purchase invoice d- the trial balancearrow_forwardWhich of the following will be the Correct source document assuming that your business received invoices from various suppliers each day? a. Credit note b. Purchase invoice c. Sales invoice d. Receiptarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,