Concept explainers

Purchase and use of tangible asset: Three accounting cycles, doubledeclining- balance

The following transactions pertain to Accounting Solutions Inc. Assume the transactions for the purchase of the computer and any capital improvements occur on January 1 each year.

2018

1. Acquired $80,000 cash from the issue of common stock.

2. Purchased a computer system for $35,000. It has an estimated useful life of five years and a $5,000 salvage value.

3. Paid $2,450 sales tax on the computer system.

4. Collected $65,000 in fees from clients.

5. Paid $1,500 in fees for routine maintenance to service the computers.

6. Recorded double-declining-balance depreciation on the computer system for 2018.

2019

1. Paid $1,000 for repairs to the computer system.

2. Bought off-site backup services to maintain the computer system, $1,500.

3. Collected $68,000 in fees from clients.

4. Paid $1,500 in fees to service the computers.

5. Recorded double-declining-balance depreciation for 2019.

2020

1. Paid $6,000 to upgrade the computer system, which extended the total life of the system to six years. The salvage value did not change.

2. Paid $1,200 in fees to service the computers.

3. Collected $70,000 in fees from clients.

4. Recorded double-declining-balance depreciation for 2020.

Required

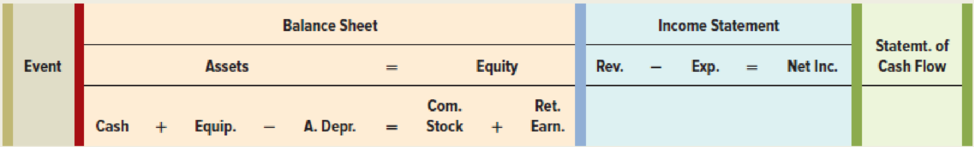

a. Record the previous transactions in a horizontal statements model like the following one.

b. Use a vertical model to present financial statements for 2018, 2019, and 2020.

a.

Record the given transactions in a horizontal statements model.

Explanation of Solution

Horizontal statements model: The model that represents all the financial statements, balance sheet, income statement, and statement of cash flows in one table in a horizontal form, is referred to as, horizontal statements model.

Record the given transactions in a horizontal statements model as follows:

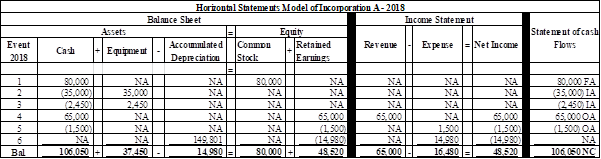

For 2018:

Figure (1)

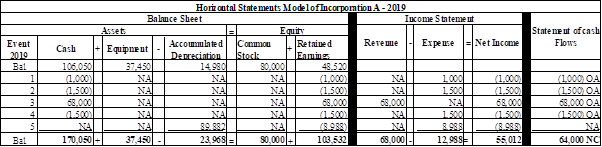

For 2019:

Figure (2)

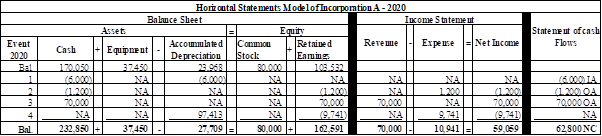

For 2020:

Figure (3)

Note: Refer working notes for the amount of depreciation expense.

Working note 1:

Determine the depreciation rate applied each year.

Useful life = 5 years

Working note 2:

Calculate the depreciation expense for 2018.

Working note 3:

Calculate the depreciation expense for 2019.

Working note 4:

Calculate the depreciation expense for 2020.

b.

Use a vertical model to present financial statements for 2018, 2019, and 2020.

Explanation of Solution

Income statement:

Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Statement of changes in stockholders' equity:

Statement of changes in stockholders' equity records the changes in the owners’ equity during the end of an accounting period by explaining about the increase or decrease in the capital reserves of shares.

Balance Sheet:

Balance sheet summarizes the assets, the liabilities, and the stockholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Statement of cash flows

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Use a vertical model to present financial statements for 2018, 2019, and 2020as follows:

| Incorporation A | |||

| Financial Statements | |||

| For the year ended December 31 | |||

| Income Statements | |||

| Particulars | 2018 | 2019 | 2020 |

| Service Revenue | $65,000 | $68,000 | $70,000 |

| Less: Expenses | |||

| Maintenance Expense | 0 | (2,500) | 0 |

| Computer Service Expense | (1,500) | (1,500) | (1,200) |

| Depreciation Expense (refer working notes) | (14,980) | (8,988) | (9,741) |

| Net Income | $48,520 | $55,012 | $59,059 |

| Statement of Changes in Stockholder's Equity | |||

| Beginning Common Stock | 0 | $80,000 | $80,000 |

| Add: Stock Issued | 80,000 | 0 | 0 |

| Ending Common Stock (A) | 80,000 | 80,000 | 80,000 |

| Beginning Retained Earnings | 0 | 48,520 | 103,532 |

| Add: Net Income | 48,520 | 55,012 | 59,059 |

| Ending Retained Earnings (B) | 48,520 | 103,532 | 162,591 |

| Total Stockholders’ Equity | $128,520 | $183,532 | $242,591 |

Table (1)

| Incorporation A | |||

| Balance Sheet as of December 31 | |||

| Particulars | 2018 | 2019 | 2020 |

| Assets | |||

| Cash | $106,050 | $170,050 | $232,850 |

| Computer | 37,450 | 37,450 | 37,450 |

| Less: Accumulated Depreciation | (14,980) | (23,968) | (27,709) |

| Total Assets | $128,520 | $183,532 | $242,591 |

| Liabilities | $0 | $0 | $0 |

| Stockholders’ Equity | |||

| Common Stock | 80,000 | 80,000 | 80,000 |

| Retained Earnings | 48,520 | 103,532 | 162,591 |

| Total Stockholders’ Equity | $128,520 | $183,532 | $242,591 |

| Total Liabilities and Stockholders' Equity | $128,520 | $183,532 | $242,591 |

Table (2)

| Incorporation A | |||

| Statement of Cash Flows | |||

| For the Year Ended December 31 | |||

| Particulars |

2018 (in $) |

2019 (in $) |

2020 (in $) |

| Cash Flows From Operating Activities: | |||

| Inflow from revenue | 65,000 | 68,000 | 70,000 |

| Less: Outflow for expenses | (1,500) | (4,000) | (1,200) |

| Net Cash Flow from operating activities (C) | 63,500 | 64,000 | 68,800 |

| Cash Flows From Investing Activities: | |||

| Outflow to purchase Computer | (37,450) | 0 | (6,000) |

| Net Cash Flow from investing activities (D) | (37,450) | 0 | (6,000) |

| Cash Flows From Financing Activities: | |||

| Inflow from stock issue | 80,000 | 0 | 0 |

| Net Cash Flow from financing activities (E) | 80,000 | 0 | 0 |

| Net Increase in Cash | 106,050 | 64,000 | 62,800 |

| Add: Beginning Cash Balance | 0 | 106,050 | 170,050 |

| Ending Cash Balance | $106,050 | $170,050 | $232,850 |

(Table 3)

Want to see more full solutions like this?

Chapter 6 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

- Depreciation On July 1, 2016, Dexter Corp. buys a computer system for $260,000 in cash. Assume that the computer is expected to have a four-year life and an estimated salvage value of $20,000 at the end of that time. Required Prepare the journal entry to record the purchase of the computer on July 1, 2016. Compute the depreciable cost of the computer. Using the straight-line method, compute the monthly depreciation. Prepare the adjusting entry to record depreciation at the end of July 2016. Compute the computers carrying value that will be shown on Dexters balance sheet prepared on December 31, 2016.arrow_forwardWhen depreciation is recorded each period, what account is debited? a. Depreciation Expense b. Cash c. Accumulated Depreciation d. The fixed asset account involved Use the following information for Multiple-Choice Questions 7-4 through 7-6: Cox Inc. acquired a machine for on January 1, 2019. The machine has a salvage value of $20,000 and a 5-year useful life. Cox expects the machine to run for 15,000 machine hours. The machine was actually used for 4,200 hours in 2019 and 3,450 hours in 2020.arrow_forwardINTANGIBLE LONG-TERM ASSETS Track Town Co. had the following transactions involving intangible assets: Jan. 1 Purchased a patent for leather soles for 10,000 and estimated its useful life to be 10 years. Apr. 1 Purchased a copyright for a design for 15,000 with a life left on the copyright of 25 years. The estimated remaining (economic) life of the copyright is five years. July 1 Signed a five-year franchise agreement and opened a Starting Line high-tech running shoe store. Paid 50,000 to the franchisor. REQUIRED 1. Using the straight-line method, calculate the amortization of the patent, copyright, and franchise. 2. Prepare general journal entries to record the end-of-year amortizations.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage