Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 6, Problem 30PS

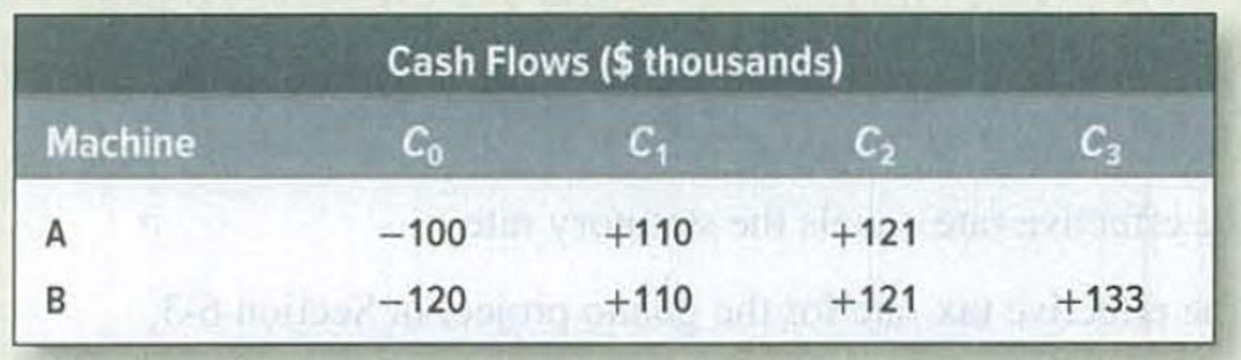

Mutually exclusive investments and project lives Machines A and B are mutually exclusive and are expected to produce the following real cash flows:

The real

- a. Calculate the

NPV of each machine. - b. Calculate the equivalent annual cash flow from each machine.

- c. Which machine should you buy?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You must analyze two projects, X and Y. Each project costs$10,000, and the firm’s WACC is 12%. The expected cash flows are as follows:a. Calculate each project’s NPV, IRR, MIRR, payback, and discounted payback.b. Which project(s) should be accepted if they are independent?c. Which project(s) should be accepted if they are mutually exclusive?d. How might a change in the WACC produce a conflict between the NPV and IRR rankingsof the two projects? Would there be a conflict if WACC were 5%? (Hint: Plot theNPV profiles. The crossover rate is 6.21875%.)e. Why does the conflict exist?

Consider the cash flows for the following investment projects:

(a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?

Consider the cash flows for the investment projects given in Table. Assume that the

MARR = 10%.

(a) Suppose A, B, and C are mutually exclusive projects. Which project would be selected

on the basis of the IRR criterion?

(b) Assume that projects C and E are mutually exclusive. Using the IRR criterion, which

Project would you select?.

Net Cash Flow

B

D.

E

-4,850

2,100

2,100

2,500

4,250

3,200

2,850

800

300

4,250

4,250

2,850

2,900

1,050

500

-835

-835

-835

-835

1,500

3.250

1,600

1,200

2,100

2,100

Chapter 6 Solutions

Principles of Corporate Finance

Ch. 6 - Cash flows Which of the following should be...Ch. 6 - Cash flows Reliable Electric, a major Ruritanian...Ch. 6 - Prob. 3PSCh. 6 - Prob. 4PSCh. 6 - Real and nominal flows Mr. Art Deco will be paid...Ch. 6 - Real and nominal flows Restate the net cash flows...Ch. 6 - Real and nominal flows Guandong Machinery is...Ch. 6 - Working capital Each of the following statements...Ch. 6 - Prob. 9PSCh. 6 - Project NPV Better Mousetraps research...

Ch. 6 - Project NPV A widget manufacturer currently...Ch. 6 - Project NPV Marsha Jones has bought a used...Ch. 6 - Project NPV United Pigpen is considering a...Ch. 6 - Project NPV Imperial Motors is considering...Ch. 6 - Project NPV and IRR A project requires an initial...Ch. 6 - Taxes and project NPV In the International Mulch...Ch. 6 - Depreciation and project NPV Suppose that Sudbury...Ch. 6 - Depreciation and project NPV Ms. T. Potts, the...Ch. 6 - Prob. 20PSCh. 6 - Prob. 21PSCh. 6 - Prob. 22PSCh. 6 - Equivalent annual cash flow Look at Problem 22...Ch. 6 - Equivalent annual cash flow Deutsche Transport can...Ch. 6 - Prob. 25PSCh. 6 - Mutually exclusive investments and project lives...Ch. 6 - Mutually exclusive investments and project lives...Ch. 6 - Mutually exclusive investments and project lives....Ch. 6 - Mutually exclusive investments and project lives...Ch. 6 - Mutually exclusive investments and project lives...Ch. 6 - Replacement decisions Machine C was purchased five...Ch. 6 - Replacement decisions Hayden Inc. has a number of...Ch. 6 - Replacement decisions. You are operating an old...Ch. 6 - Replacement decisions. A forklift will last for...Ch. 6 - The cost of excess capacity The presidents...Ch. 6 - Effective tax rates One measure of the effective...Ch. 6 - Equivalent annual costs We warned that equivalent...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Start with the partial model in the file Ch10 P23 Build a Model.xlsx on the textbooks Web site. Gardial Fisheries is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a. If each projects cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? b. Construct NPV profiles for Projects A and B. c. What is each projects IRR? d. What is the crossover rate, and what is its significance? e. What is each projects MIRR at a cost of capital of 12%? At r = 18%? (Hint: Consider Period 7 as the end of Project Bs life.) f. What is the regular payback period for these two projects? g. At a cost of capital of 12%, what is the discounted payback period for these two projects? h. What is the profitability index for each project if the cost of capital is 12%?arrow_forwardAssume a company is going to make an investment of $450,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Which of the two options would you choose based on the payback method?arrow_forwardConsider two investments with the following sequences of cash flows: (a) Compute the IRR for each investment.(b) At MARR = 10%, determine the acceptability of each project.(c) If A and B are mutually exclusive projects, which project would you selecton the basis of the rate of return on incremental investment?arrow_forward

- IRR: Mutually exclusive projects Nile Inc. wants to choose the better of two mutually exclusive projects that expand warehouse capacity. The projects' cash flows are shown in the following table: . The cost of capital is 18%. a. The internal rate of return (IRR) of project X is %. (Round to two decimal places.) Data table Is project X acceptable on the basis of IRR? (Select the best answer below.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Yes O No Project X $500,000 Project Y $310,000 The internal rate of return (IRR) of project Y is %. (Round to two decimal places.) Initial investment (CF) Is project Y acceptable on the basis of IRR? (Select the best answer below.) Year (t) Cash inflows (CF,) $120,000 $140,000 $105,000 $60,000 1 $100,000 O Yes $160,000 O No $170,000 $190,000 b. Which project is preferred? (Select the best answer below.) $250,000 $30,000 OA. Project X N 34 5arrow_forwarda. They payback period of project A is ___ years (round to two decimal places) The payback period of project B is ____ years. (round to two decimal places) According to the payback method, which project should the firm choose? b. The NPV of project A is $___ The NPV of project B is $___ c. The IRR of project A is ___ The IRR of project B is ___ d. Make a reccomendationarrow_forwardAll techniques: Decision among mutually exclusive investments Pound Industries is attempting to select the best of three mutually exclusive projects. The initial investment and subsequent cash inflows associated with these projects are shown in the following table. Cash flows Initial investment (CF) Cash inflows (CF), t= 1 to 5 OA. Project A a. Calculate the payback period for each project. b. Calculate the net present value (NPV) of each project, assuming that the firm has a cost of capital equal to 11%. c. Calculate the internal rate of return (IRR) for each project. d. Indicate which project you would recommend. a. The payback period of project A is The payback period of project B is The payback period of project C is b. The NPV of project A is $ The NPV of project B is $ (Round to the nearest cent.) The NPV of project C is $. (Round to the nearest cent.) c. The IRR of project A is%. (Round to two decimal places.) The IRR of project B is %. (Round to two decimal places.) The IRR of…arrow_forward

- Consider the cash flows for the investment projects given in Table. Assume that the MARR = 10%. (a) Suppose A, B, and C are mutually exclusive projects. Which project would be selected on the basis of the IRR criterion (b) Assume that projects C and È are mutually exclusive. Using the IRR criterion, which Project would you select? Net Cash Flow A В C D E -4,250 3,200 2,850 -4,250 1,500 3,250 1,600 1,200 -4,250 2,850 -4,850 2,100 2,100 2,100 2,100 2,500 1 -835 2,900 1,050 500 2 -835 3 800 -835 4 300 -835arrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forwardConsider two mutually exclusive projects with the following expected cash flows : Cash Flows Year Project C Project D 0 -15,000 -21,000 1 6,000 6,000 2 12,000 16,000 3 8,000 14,000 Whichever project you choose, if any, you require a return of 12% on your investment. a. If you apply the discounted payback criterion, which project will you choose? Why? b. If you apply the NPV criterion, which project will you choose? Why? c. Based on your answers in (a) and (b), which project will you finally choose? Why ? (i.e clearly explain the strengths and the weaknesses of each method therefore the reason(s) for choosing the project based on the chosen method)arrow_forward

- Problem 1.a Given the following cash flows for Project M: C0 = -1,000, C1 = +200, C2 = +700, C3 = +698 calculate the IRR for the project. Problem 1.b Project X has the following cash flows: C0 = +2,000, C1 = -1,150, and C2 = -1,150. If the IRR of the project is 9.85% and if the cost of capital is 12%, would you accept or reject? Problem 1.c Story Company is investing in a giant crane. It is expected to cost $6.0 million in initial investment, and it is expected to generate an end-of-year after-tax cash flow of $3.0 million each year for three years. Calculate the NPV at 12%. Would you suggest company to invest? Problem 1.d The real interest rate is 3.0% and the inflation rate is 5.0%. What is the nominal interest rate? Problem 1.e Your firm expects to receive a cash flow in two years of $10,816 in nominal terms. If the real rate of interest is 2% and the inflation rate is 4%, what is the real cash flow for year 2?arrow_forwardK Internal rate of return and modified internal rate of return For the project shown in the following table,, calculate the internal rate of return (IRR) and modified internal rate of return (MIRR). If the cost of capital is 13.04%, indicate whether the project is acceptable according to IRR and MIRR. The project's IRR is %. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Initial investment (CFO) Year (t) $80,000 Cash inflows (CF₂) 1 $10,000 2345 $25,000 $10,000 $15,000 $45,000 Print Done -arrow_forwardConsider projects A and B with the following cash flows: C0 C1 C2 C3 A − $ 27 + $ 16 + $ 16 + $ 16 B − 52 + 27 + 27 + 27 a-1. What is the NPV of each project if the discount rate is 10%? (Do not round intermediate calculations. Round your answers to 2 decimal places.) a-2. Which project has the higher NPV? b-1. What is the profitability index of each project? (Do not round intermediate calculations. Round your answers to 2 decimal places.) b-2. Which project has the higher profitability index? c. Which project is most attractive to a firm that can raise an unlimited amount of funds to pay for its investment projects? d. Which project is most attractive to a firm that is limited in the funds it can raise?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License