Replacement Decisions Suppose we are thinking about replacing an old computer with a new one. The old one cost us $450,000; the new one will cost $580,000. The new machine will be

- a. Suppose we recognize that if we don’t replace the computer now, we will be replacing it in two years. Should we replace now or should we wait? (Hint: What we effectively have here is a decision either to “invest” in the old computer-by not selling it-or to invest in the new one. Notice that the two investments have unequal lives.)

- b. Suppose we consider only whether we should replace the old computer now without worrying about what’s going to happen in two years. What are the relevant cash flows? Should we replace it or not? (Hint: Consider the net change in the firm’s aftertax cash flows if we do the replacement.)

a)

To determine: Net present value of the old and new computer.

Equivalent Annual Cost:

Equivalent annual cost is that cost which shows the operating and maintaining cost of the assets of whole life.

Net Present Value(NPV):

The net present value is differential amount between the net cash inflow from future investments and net cash outflow in the form of cost that the company has to pay at present as initial cost of the investment.

Explanation of Solution

Given,

Salvage value of the old computer is $230,000.

Salvage value of the computer after two years is $60,000.

Cost of new computer is $580,000.

Estimated life of the computer is 5 years.

Salvage value of the new computer is $130,000.

Operating cost is $85,000.

Discount rate is 14%.

Calculated values,

Book value of the old computer is $270,000.

Annual depreciation on the old computer is $90,000.

Formula to calculate the equivalent annual cost of the old computer,

Substitute-$133,966 for the net present value and 1.647 for the PVIFA.

Formula to calculate the equivalent annual cost of the new computer,

Substitute, -$205,923 for the net present value and 3.433 for the PVFA,

Working notes:

Calculate the operating cash flow of old computer,

Calculate the operating cash flow of new computer,

Calculate the present salvage value of new computer,

Calculate the present salvage value of the old computer,

Calculate the initial cost of the old computer,

Calculate the net present value of the old computer,

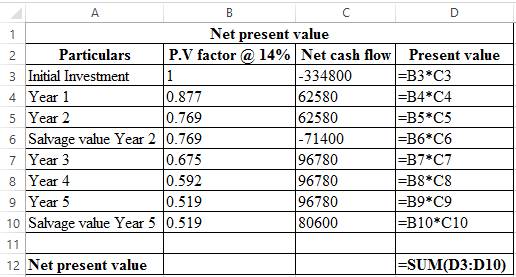

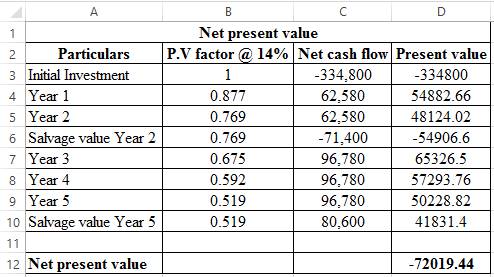

Calculate the net present value of the new computer,

Hence, equivalent annual cost of old and new computer is -$81,339 and -$59,983.

b)

To determine: Incremental net present value.

Net Present Value(NPV):

The net present value is differential amount between the net cash inflow from future investments and net cash outflow in the form of cost that the company has to pay at present as initial cost of the investment.

Explanation of Solution

Formula to calculate the incremental net present value,

Working notes:

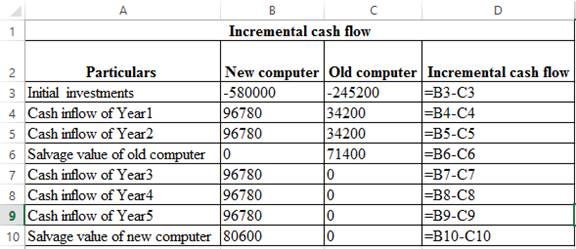

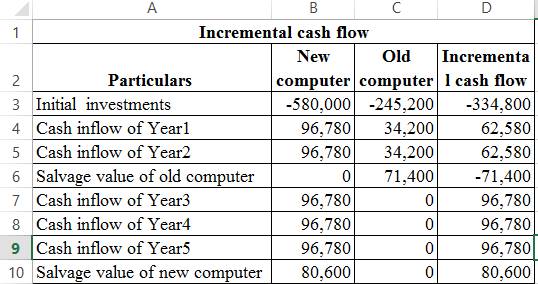

Calculate the incremental cash flows,

Hence, net present value is -$72,019.

Want to see more full solutions like this?

Chapter 6 Solutions

CORPORATE FINANCE-ACCESS >CUSTOM<

- New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $605,000. The MACRS rates for the first 3 years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $380,000 per year in before-tax operating costs, mainly labor. Campbell’s marginal tax rate is 35%. What is the Year-0 cash flow? What are the net operating cash flows in Years 1, 2, and 3? What is the additional Year-3 cash flow (i.e., the after-tax salvage and the return of working capital)? If the project’s cost of capital is 12%, should the machine be purchased?arrow_forwardAlthough the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?arrow_forwardREPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will increase earnings from 24,000 to 46,000 per year. The new machine will cost 80,000, and it will have an estimated life of 8 years and no salvage value. The new riveting machine is eligible for 100% bonus depreciation at the time of purchase. The applicable corporate tax rate is 25%, and the firms WACC is 10%. The old machine has been fully depreciated and has no salvage value. Should the old riveting machine be replaced by the new one? Explain your answer.arrow_forward

- Austins cell phone manufacturer wants to upgrade their product mix to encompass an exciting new feature on their cell phone. This would require a new high-tech machine. You are excited about his new project and are recommending the purchase to your board of directors. Here is the information you have compiled in order to complete this recommendation: According to the information, the project will last 10 years and require an initial investment of $800,000, depreciated with straight-line over the life of the project until the final value is zero. The firms tax rate is 30% and the required rate of return is 12%. You believe that the variable cost and sales volume may be as much as 10% higher or lower than the initial estimate. Your boss understands the risks but asks you to explain the alternatives in a brief memo to the board, Write a memo to the Board of Directors objectively weighing out the pros and cons of this project and make your recommendation(s).arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forwardA mini-mart needs a new freezer and the initial Investment will cost $300,000. Incremental revenues, including cost savings, are $200,000, and incremental expenses, including depreciation, are $125,000. There is no salvage value. What is the accounting rate of return (ARR)?arrow_forward

- Shonda & Shonda is a company that does land surveys and engineering consulting. They have an opportunity to purchase new computer equipment that will allow them to render their drawings and surveys much more quickly. The new equipment will cost them an additional $1.200 per month, but they will be able to increase their sales by 10% per year. Their current annual cost and break-even figures are as follows: A. What will be the impact on the break-even point if Shonda & Shonda purchases the new computer? B. What will be the impact on net operating income if Shonda & Shonda purchases the new computer? C. What would be your recommendation to Shonda & Shonda regarding this purchase?arrow_forwardAverage rate of returncost savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of 125,000 with a 15,000 residual value and an eight-year life. The equipment will replace one employee who has an average wage of 28,000 per year. In addition, the equipment will have operating and energy costs of 5,150 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment.arrow_forwardDauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forward

- Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardAverage rate of returnnew product Hana Inc. is considering an investment in new equipment that will be used to manufacture a smart-phone. The phone is expected to generate additional annual sales of 10,000 units at 300 per unit. The equipment has a cost of 4,500,000, residual value of 500,000, and a 10-year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows: Determine the average rate of return on the equipment.arrow_forwardAn auto repair company needs a new machine that will check for defective sensors. The machine has an Initial investment of $224,000. Incremental revenues, including cost savings, are $120,000, and Incremental expenses, including depreciation, are $50,000. There is no salvage value. What is the accounting rate of return (ARR)?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning