EBK CORPORATE FINANCE

4th Edition

ISBN: 9780134202778

Author: DeMarzo

Publisher: PEARSON CUSTOM PUB.(CONSIGNMENT)

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 3P

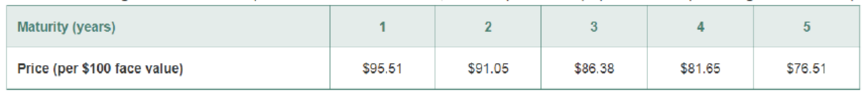

The following table summarizes prices of various default-free, zero-coupon bonds (expressed as a percentage of face value):

- a. Compute the yield to maturity for each bond.

- b. Plot the zero-coupon yield curve (for the first five years).

- c. Is the yield curve upward sloping, downward sloping, or flat?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value):.

a. Compute the yield to maturity for each bond.

b. Plot the zero-coupon yield curve (for the first five years).

c. Is the yield curve upward sloping, downward sloping, or flat?

a. Compute the yield to maturity for each bond.

The yield on the 1-year bond is%. (Round to two decimal places.)

Data table

(Click on the following icon

Maturity (years)

Price (per $100 face value)

in order to copy its contents into a spreadsheet.)

2

$91.99

3

$87.33

1

$96.35

Print

Done

4

$82.48

5

$77.37

X

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value):

Maturity (years)

Price (per $100 face value)

1

$96.32

a. Compute the yield to maturity for each bond.

b. Plot the zero-coupon yield curve (for the first five years).

c. Is the yield curve upward sloping, downward sloping, or flat?

a. Compute the yield to maturity for each bond.

The yield on the 1-year bond is

%. (Round to two decimal places.)

2

$91.93

3

$87.36

4

5

$82.57

$77.42

The following table summarizes prices of various default-free zero-coupon bonds ( $100 face value): Maturity (years) 1 2 3 4 5 {:[" Price (per "$100],[" face value) "]:} $96.33 $91.98 $87.41 $82.53 $77.41 a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward-sloping, downward-sloping, or flat? Note: Assume annual compounding. a. Compute the yield to maturity for each bond. The yield on the 1-year bond is %. (Round to two decimal places.) The yield on the 2-year bond is %. (Round to two decimal places.) The yield on the 3-year bond is %. (Round to two decimal places.) The yield on the 4-year bond is enter your response here%. (Round to two decimal places.) Part 5 The yield on the 5-year bond is enter your response here%. (Round to two decimal places.)

Note:-

Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

Answer completely.

You will…

Chapter 6 Solutions

EBK CORPORATE FINANCE

Ch. 6.1 - What is the relationship between a bonds price and...Ch. 6.1 - The risk-free interest rate for a maturity of...Ch. 6.2 - If a bonds yield to maturity does not change, how...Ch. 6.2 - Prob. 2CCCh. 6.2 - How does a bonds coupon rate affect its...Ch. 6.3 - How do you calculate the price of a coupon bond...Ch. 6.3 - How do you calculate the price of a coupon bond...Ch. 6.3 - Explain why two coupon bonds with the same...Ch. 6.4 - There are two reasons the yield of a defaultable...Ch. 6.4 - What is a bond rating?

Ch. 6.5 - Why do sovereign debt yields differ across...Ch. 6.5 - What options does a country have if it decides it...Ch. 6 - A 30-year bond with a face value of 1000 has a...Ch. 6 - Assume that a bond will make payments every six...Ch. 6 - The following table summarizes prices of various...Ch. 6 - Suppose the current zero-coupon yield curve for...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Suppose a five-year, 1000 bond with annual coupons...Ch. 6 - Prob. 8PCh. 6 - Explain why the yield of a bond that trades at a...Ch. 6 - Prob. 10PCh. 6 - Prob. 11PCh. 6 - Consider the following bonds: Bond Coupon Rate...Ch. 6 - Prob. 14PCh. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Suppose you are given the following information...Ch. 6 - Prob. 26PCh. 6 - Grumman Corporation has issued zero-coupon...Ch. 6 - The following table summarizes the yields to...Ch. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - A BBB-rated corporate bond has a yield to maturity...Ch. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35P

Additional Business Textbook Solutions

Find more solutions based on key concepts

The value of the bond Introduction: The fair value of a particular bond is determined using a technique called ...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Definition of efficient portfolio and determination of return and standard deviation of a portfolio. Introducti...

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

(Evaluating liquidity) The Tabor Sales Company had a gross profit margin (gross profits ÷ sales) of 30 percent...

Foundations Of Finance

(Measuring growth) Septian, Inc.’s return on equity is 16 percent, and the management plans to retain 60 percen...

Foundations of Finance (9th Edition) (Pearson Series in Finance)

To what does the lifetime value of the customer refer, and how is it calculated?

MARKETING:REAL PEOPLE,REAL CHOICES

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following figure which shows the relationship between a three-year bond’s price (vertical axis) and the passage of time (measured in years - horizontal axis). Which of the following statements are consistent with the figure above? Group of answer choices A. This bond pays a coupon of $6. B. This pattern of prices is consistent with a bond whose yield to maturity is below the bond’s coupon rate. C. None of the other statements are correct. D. This bond pays coupons on a quarterly basis.arrow_forwardData table 不 The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is ☐ %. (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) Price (per $100 face value) 1 $95.42 2 3 4 5 $90.99 $86.47 $81.58 $76.46 Print Donearrow_forwardThe bond's annual coupon rate divided by its market price is referred to as the Multiple Choice yield to call. yield to maturity. current yield. term structure of interest rates.arrow_forward

- What is the stand-alone risk? Use the scenario data to calculate the standard deviation of the bonds return for the next year.arrow_forwardThe current zero-coupon yield curve for risk-free bonds is as follows: coupon, risk-free bond? . What is the price per $100 face value of a two-year, zero- The price per $100 face value of the two-year, zero-coupon, risk-free bond is $ (Round to the nearest cent.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) 1 2 3 YTM 4.95% 5.49% 5.76% 4 5.97% 5 6.09% Print Done -arrow_forwardSuppose you are given the following information about the default-free, coupon-paying yield curve: Maturity (years) Coupon rate (annual payment) YTM a. Use arbitrage to determine the yield to maturity of a two-year zero-coupon bond. b. What is the zero-coupon yield curve for years 1 through 4? Note: Assume annual compounding. a. Use arbitrage to determine the yield to maturity of a two-year zero-coupon bond. The yield to maturity of a two-year, zero-coupon bond is %. (Round to two decimal places.) b. What is the zero-coupon yield curve for years 1 through 4? The yield to maturity for the three-year and four-year zero-coupon bond is found in the same manner as the two-year zero-coupon bond. The yield to maturity on the three-year, zero-coupon bond is %. (Round to two decimal places.) %. (Round to two decimal places.) The yield to maturity on the four-year, zero-coupon bond is Which graph best depicts the yield curve of the zero-coupon bonds? (Select the best choice below.) O A. 8- 7- 6-…arrow_forward

- The current yield is defined as the annual interest on a bond divided by par value.Select one:TrueFalsearrow_forwardThe bond shown in the following table pays interest annually in the table attached. a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain.arrow_forwardThe following table summarizes prices of various default-free, zero-coupon bonds (expressed as a percentage of face value): Maturity (years) 1 2 3 4 5 Price (per $1000 face value) 94.5 96.6 88.6 84.5 77.7 a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat?arrow_forward

- The bond shown in the following table attached pays interest annually. a. Calculate the yield to maturity (YTM)for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain.arrow_forwardThe following table summarizes prices of various default-free zero-coupon bonds ($100 face value): (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) Price (per $100 face value) 1 $96.31 a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? Note: Assume annual compounding. a. Compute the yield to maturity for each bond. The yield on the 1-year bond is The yield on the 2-year bond is The yield on the 3-year bond is The yield on the 4-year bond is The yield on the 5-year bond is %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) 2 $91.79 3 $87.10 4 $82.48 5 $77.45arrow_forwardA plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as O A. a yield curve. B. a risk-structure curve. OC. a term-structure curve. 5- O D. an interest-rate curve. Suppose people expect the interest rate on one-year bonds for each of the next four years to be 3%, 6%, 5%, and 6%. If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four years is nearest whole number). %. (Round your response to the 2- Refer to the figure on your right. Suppose the expected interest rates on one-year bonds for each of the next four years are 4%, 5%, 6%, and 7%, respectively. 1. 1.) Use the line drawing tool (once) to plot the yield curve generated. 3 Term to Maturity in Years 2.) Use the point drawing tool to locate the interest rates on the next four years. 5. 3- Interest Rate .....arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

What is modified duration? | Dejargoned; Author: Mint;https://www.youtube.com/watch?v=5yLIybzb_OQ;License: Standard YouTube License, CC-BY