FINANCIAL ACCOUNTING (LL)W/CONNECT

18th Edition

ISBN: 9781260801071

Author: PHILLIPS

Publisher: McGraw-Hill Publishing Co.

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 5PA

Preparing a Multistep Income Statement and Computing the Gross Profit Percentage

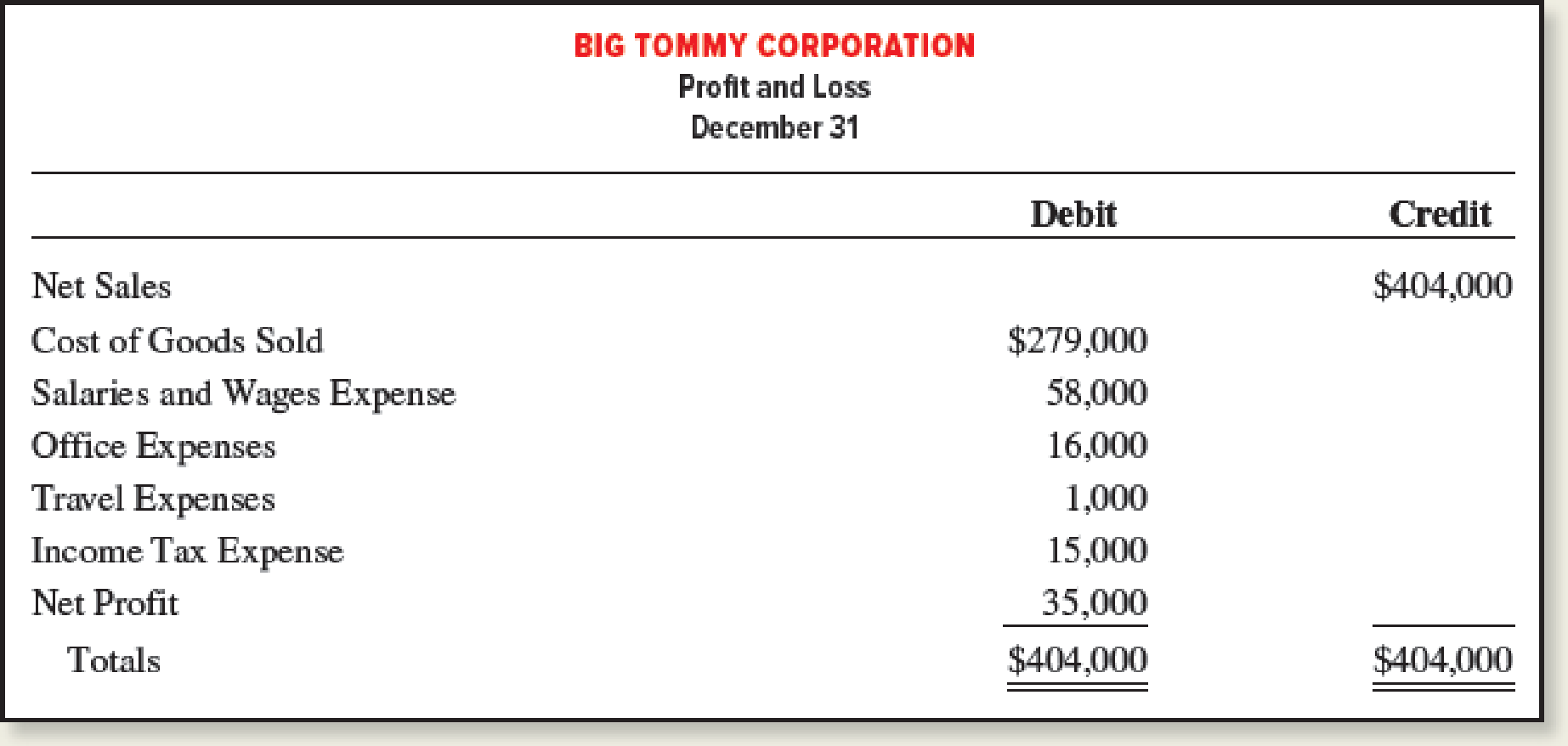

Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format):

Required:

- 1. Prepare a properly formatted multistep income statement that would be used for external reporting purposes.

- 2. Compute and interpret the gross profit percentage (using the formula shown in this chapter and rounding to one decimal place).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the following information for the Problems below.

Skip to question

[The following information applies to the questions displayed below.]Lansing Company’s current-year income statement and selected balance sheet data at December 31 of the current and prior years follow.

LANSING COMPANYIncome StatementFor Current Year Ended December 31

Sales revenue

$

127,200

Expenses

Cost of goods sold

52,000

Depreciation expense

17,000

Salaries expense

28,000

Rent expense

10,000

Insurance expense

4,800

Interest expense

4,600

Utilities expense

3,800

Net income

$

7,000

LANSING COMPANYSelected Balance Sheet Accounts

At December 31

Current Year

Prior Year

Accounts receivable

$

6,600

$

7,800

Inventory

2,980

2,040

Accounts payable

5,400

6,600

Salaries payable

1,080

800

Utilities payable

420

260

Prepaid insurance

360

480

Prepaid rent…

Perform the Reperformance or Recalculation procedures to check the mathematical accuracy ofthe Income Statement. What issue did you find? What is the next step? Create a Correctedversion of the Income Statement.

Income Statement

For the Year Ended

For the Year Ended

Revenue

3/31/2021

3/31/2022

Sales Revenue: Corporate Accounts

$ 353,739.57

$ 343,050.56

Sales Revenues: Storefront

$ 80,649.00

$ 91,411.50

Total Sales Revenue

$ 434,388.57

$ 434,462.06

Cost of Goods Sold: Ingredients

$ 69,736.39

$ 64,645.64

Cost of Goods Sold: Boxes and Cupcake Cups

$ 3,875.55

$ 3,755.55

Cost of Goods Sold: Beverages

$ 5,466.50

$ 5,681.50

Total COGS

$ 76,078.44

$ 74,082.69

Gross Profit

$ 358,310.13

$ 360,379.37

Interest Revenue

$…

Accordingly, 15% of rent, depreciation, and utility expenses pertain to the sales office while the rest pertains to the corporate office.

Questions:

How much is the net sales for the year?

How much is the cost of sales for the year?

How much is the gross profit for the year?

How much is the net income for the year?

Prepare a statement of comprehensive income.

Prepare a financial statement.

Chapter 6 Solutions

FINANCIAL ACCOUNTING (LL)W/CONNECT

Ch. 6 - Prob. 1QCh. 6 - If a Chicago-based company ships goods on...Ch. 6 - Define goods available for sale. How does it...Ch. 6 - Define beginning inventory and ending inventory.Ch. 6 - Describe how transportation costs to obtain...Ch. 6 - What is the main distinction between perpetual and...Ch. 6 - Why is a physical count of inventory necessary in...Ch. 6 - What is the difference between FOB shipping point...Ch. 6 - Describe in words the journal entries that are...Ch. 6 - What is the distinction between Sales Returns and...

Ch. 6 - Prob. 11QCh. 6 - In response to the weak economy, your companys...Ch. 6 - Prob. 13QCh. 6 - Why are contra-revenue accounts used rather than...Ch. 6 - What is gross profit? How is the gross profit...Ch. 6 - Prob. 1MCCh. 6 - Prob. 2MCCh. 6 - Prob. 3MCCh. 6 - Prob. 4MCCh. 6 - Prob. 5MCCh. 6 - Prob. 6MCCh. 6 - Prob. 7MCCh. 6 - Prob. 8MCCh. 6 - A company bundles a product and service that...Ch. 6 - Prob. 10MCCh. 6 - Distinguishing among Operating Cycles Identify the...Ch. 6 - Calculating Shrinkage in a Perpetual Inventory...Ch. 6 - Accounting for Inventory Transportation Costs XO...Ch. 6 - Prob. 4MECh. 6 - Evaluating Inventory Cost Components Assume...Ch. 6 - Recording Journal Entries for Purchases and Safes...Ch. 6 - Prob. 7MECh. 6 - Prob. 8MECh. 6 - Prob. 9MECh. 6 - Prob. 10MECh. 6 - Calculating Shrinkage and Gross Profit in a...Ch. 6 - Prob. 12MECh. 6 - Preparing a Multistep Income Statement Sellall...Ch. 6 - Computing and Interpreting the Gross Profit...Ch. 6 - Computing and Interpreting the Gross Profit...Ch. 6 - Interpreting Changes in Gross Profit Percentage...Ch. 6 - Determining the Cause of Increasing Gross Profit...Ch. 6 - Understanding Relationships among Gross Profit and...Ch. 6 - Prob. 19MECh. 6 - Recording Journal Entries for Purchase Discounts...Ch. 6 - Recording Journal Entries for Sales and Sales...Ch. 6 - Recording Journal Entries for Sales and Sales...Ch. 6 - Prob. 23MECh. 6 - Prob. 24MECh. 6 - Relating Financial Statement Reporting to Type of...Ch. 6 - Inferring Merchandise Purchases The Gap, Inc., is...Ch. 6 - Identifying Shrinkage and Other Missing inventory...Ch. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - Inferring Missing Amounts Based on Income...Ch. 6 - Reporting Purchases and Purchase Discounts Using a...Ch. 6 - Reporting Purchases, Purchase Discounts, and...Ch. 6 - Items Included in Inventory PCM, Inc., is a direct...Ch. 6 - Prob. 10ECh. 6 - Reporting Net Sales after Sales Discounts The...Ch. 6 - Reporting Net Sales after Sales Discounts and...Ch. 6 - Determining the Effects of Credit Sales, Sales...Ch. 6 - Analyzing and Recording Sales and Gross Profit...Ch. 6 - Prob. 15ECh. 6 - Inferring Missing Amounts Based on Income...Ch. 6 - Analyzing Gross Profit Percentage on the Basis of...Ch. 6 - Analyzing Gross Profit Percentage on the Basis of...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - Prob. 23ECh. 6 - Prob. 24ECh. 6 - (Supplement 6A) Recording Journal Entries for Net...Ch. 6 - Prob. 26ECh. 6 - Prob. 27ECh. 6 - Prob. 28ECh. 6 - (Supplement 6A) Recording Purchases and Sales...Ch. 6 - Purchase Transactions between Wholesale and Retail...Ch. 6 - Prob. 2CPCh. 6 - Recording Cash Sales, Credit Sales, Sales Returns,...Ch. 6 - Prob. 4CPCh. 6 - Preparing a Multistep Income Statement and...Ch. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Reporting Purchase Transactions between Wholesale...Ch. 6 - Reporting Sales Transactions between Wholesale and...Ch. 6 - Recording Sales with Discounts and Returns and...Ch. 6 - Prob. 4PACh. 6 - Preparing a Multistep Income Statement and...Ch. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Reporting Purchase Transactions between Wholesale...Ch. 6 - Prob. 2PBCh. 6 - Prob. 3PBCh. 6 - Prob. 4PBCh. 6 - Preparing a Multistep Income Statement and...Ch. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Reporting Cash, Inventory Orders, Purchases,...Ch. 6 - Preparing Journal Entries for Inventory Purchases,...Ch. 6 - Finding Financial Information Refer to the...Ch. 6 - Prob. 2SDCCh. 6 - Ethical Decision Making: A Mini-Case Assume you...Ch. 6 - Prob. 5SDCCh. 6 - Preparing Multistep Income Statements and...Ch. 6 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: a.Prepare an income statement. b.Compare your income statement with the income statement that is available at the FedEx Corporation Web site, (http://investors.fedex.com). Click on Annual Report and Download Annual Report. What similarities and differences do you see?arrow_forwardComparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book and answer the following questions. What was the total revenue for each company for the most recent year? By what percentage did each companys revenue increase or decrease from its total amount in the prior year? What was each companys net income for the most recent year? By what percentage did each companys net income increase or decrease from its net income for the prior year? What was the total asset balance for each company at the end of its most recent year? Among its assets, what was the largest asset each company reported on its year-end balance sheet? Did either company pay its stockholders any dividends during the most recent year? Explain how you can tell.arrow_forwardJasmine Company provided the following income statements for its first 3 years of operation: Refer to the information for Jasmine Company above. Required: Prepare common-size income statements by using net sales as the base. (Note: Round answers to the nearest whole percentage.)arrow_forward

- Scherer Company provided the following income statements for its first 3 years of operation: Refer to the information for Scherer Company on the previous page. Required: Prepare common-size income statements by using net sales as the base. (Note: Round answers to the nearest whole percentage.)arrow_forwardSundahl Companys income statements for the past 2 years are as follows: Refer to the information for Sundahl Company above. Required: 1. Prepare a common-size income statement for Year 1 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 2 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forwardComparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the end of this book and answer the following questions: Required What is the dollar amount of inventories that each company reports on its balance sheet at the end of the most recent year? What percentage of total assets do inventories represent for each company? What does this tell you about the nature of their business? Refer to Note 1 in Chipotles annual report. What inventory valuation method does the company use? Refer to Note 2 in Panera Breads annual report. What inventory valuation method does the company use? How do both companies deal with situations in which the market value of inventory is less than its cost? Given the nature of their businesses, which inventory system, periodic or perpetual, would you expect both Chipotle and Panera Bread to use? Explain your answer.arrow_forward

- Cost of Goods Sold and Income Statement Schuch Company presents you with the following account balances taken from its December 31 adjusted trial balance: Additional data: 1. A physical count reveals an ending-inventory of 22,500 on December 31. 2. Twenty-five thousand shares of common stock have been outstanding the entire year. 3. The income tax rate is 30% on all items of income. Required: 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Schuchs cost of goods sold. 2. Prepare a multiple-step income statement. 3. Prepare a single-step income statement.arrow_forwardThe following data (in millions) were taken from the financial statements of Costco Wholesale Corporation: a. For Costco, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent year for: 1. Revenue 2. Operating expenses 3. Operating income b. Comment on the results of your horizontal analysis in part (a). c. Based upon Exercise 2-23, compare and comment on the operating results of Target and Costco for the recent year.arrow_forwardCuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Required: 1. Prepare a common-size income statement for Year 1 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 2 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 3. Prepare a common-size income statement for Year 3 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forward

- Nueva Company reported the following pretax data for its first year of operations. Net sales 7,380 Cost of goods available for sale 5,670 Operating expenses 1,528 Effective tax rate 20% Ending inventories: If LIFO is elected 631 If FIFO is elected 809 What is Nueva's net income if it elects FIFO?arrow_forwardThe accountant for Dolfin Company prepared the following income statement. The auditor has asked you to use this statement to provide additional information to Dolfin Company on the Final Questions panel. Dolfin Company Income Statement For the Year Ended December 31, 2020 1 Sales $316,840.00 2 Expenses: 3 Cost of merchandise sold $215,451.20 4 Selling expenses 41,189.20 5 Administrative expenses 34,852.40 6 Interest expense 275.00 7 Total expenses 291,767.80 8 Net income $25,072.20 Final Questions The auditor has asked you to prepare additional information about Dolfin Company’s results for last year. Use the data shown on the income statement in your computations. 1. Compute the operating expenses for Dolfin Company. 2. Compute the gross profit for Dolfin Company. 3. Compute the income from operations for…arrow_forwardse the following information for the Problems below. Skip to question [The following information applies to the questions displayed below.]Lansing Company’s current-year income statement and selected balance sheet data at December 31 of the current and prior years follow. LANSING COMPANYIncome StatementFor Current Year Ended December 31 Sales revenue $ 127,200 Expenses Cost of goods sold 52,000 Depreciation expense 17,000 Salaries expense 28,000 Rent expense 10,000 Insurance expense 4,800 Interest expense 4,600 Utilities expense 3,800 Net income $ 7,000 LANSING COMPANYSelected Balance Sheet Accounts At December 31 Current Year Prior Year Accounts receivable $ 6,600 $ 7,800 Inventory 2,980 2,040 Accounts payable 5,400 6,600 Salaries payable 1,080 800 Utilities payable 420 260 Prepaid insurance 360 480 Prepaid rent…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License