Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 5PS

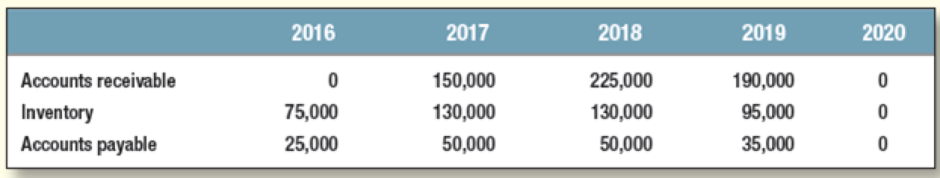

Working capital The following table tracks the main components of working capital over the life of a four-year project.

Calculate net working capital and the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

the following table tracks the main components of net working capital over the life of a 4-year project. calculate the investment in net working capital in year 3. in the presented answers, a negative number represents a cash outflow (additional investment) and a positive number represents a cash inflow (recapture of a previous investment).

year 1

year 2

year 3

year 4

year 5

Accounts receivable

0

156,000

231,000

196,000

0

inventory

78,000

133,000

133,000

98,000

0

accounts payable

26,500

51,500

53,000

36,500

0

1. Calculate the initial cash flow of the project and the operating cash-flows for all years of the project.

Formulas

Project cash flow = project operating cash flow - project change in net working capital - project capital spending

Operating cash flow = Earnings before interest and taxes + depreciation - taxes

Average Rate of Return Method, Net Present Value Method, and Analysis

The capital investment committee of Ellis Transport and Storage Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows:

Warehouse

Tracking Technology

Year

Income fromOperations

Net CashFlow

Income fromOperations

Net CashFlow

1

$58,000

$183,000

$122,000

$293,000

2

58,000

183,000

93,000

247,000

3

58,000

183,000

46,000

174,000

4

58,000

183,000

20,000

119,000

5

58,000

183,000

9,000

82,000

Total

$290,000

$915,000

$290,000

$915,000

Each project requires an investment of $580,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis.

Present Value of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

2

0.890…

Chapter 6 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 6 - Cash flows Which of the following should be...Ch. 6 - Real and nominal flows Mr. Art Deco will be paid...Ch. 6 - Cash flows True or false? a. A projects...Ch. 6 - Depreciation How does the PV of depreciation tax...Ch. 6 - Working capital The following table tracks the...Ch. 6 - Prob. 6PSCh. 6 - Prob. 7PSCh. 6 - Mutually exclusive investments and project lives...Ch. 6 - Replacement decisions Machine C was purchased five...Ch. 6 - Prob. 10PS

Ch. 6 - Prob. 12PSCh. 6 - Working capital Each of the following statements...Ch. 6 - Depreciation Ms. T. Potts, the treasurer of Ideal...Ch. 6 - Project NPV and IRR A project requires an initial...Ch. 6 - Project NPV A widget manufacturer currently...Ch. 6 - Project NPV Marsha Jones has bought a used...Ch. 6 - Project NPV United Pigpen is considering a...Ch. 6 - Project NPV Hindustan Motors has been producing...Ch. 6 - Equivalent annual cash flows As a result of...Ch. 6 - Prob. 25PSCh. 6 - Replacement decisions Hayden Inc. has a number of...Ch. 6 - Prob. 27PSCh. 6 - Prob. 28PSCh. 6 - Prob. 29PSCh. 6 - Prob. 30PSCh. 6 - The cost of excess capacity The presidents...Ch. 6 - Effective tax rates One measure of the effective...Ch. 6 - Equivalent annual costs We warned that equivalent...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Estimate the required net operating working capital (NOWC) for each year and the cash flow due to changes in NOWC.arrow_forwardAverage Rate of Return Method, Net Present Value Method, and Analysis The capital investment committee of Ellis Transport and Storage Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows: Warehouse Tracking Technology Year Income fromOperations Net CashFlow Income fromOperations Net CashFlow 1 $34,200 $104,000 $72,000 $166,000 2 34,200 104,000 55,000 140,000 3 34,200 104,000 27,000 99,000 4 34,200 104,000 12,000 68,000 5 34,200 104,000 5,000 47,000 Total $171,000 $520,000 $171,000 $520,000 Each project requires an investment of $360,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purposes of the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826…arrow_forwardBelow are expected current assets and current liabilities (in million dollars) of a new project. Year 0 1 2 3 4 Inventory 12 16 17 18 14 Accounts payable 5 2 7 9 6 What is cash flow as a result of change in net working capital at year 2?arrow_forward

- The capital investment committee of Iguana Inc. is considering two capital investments. The estimated operating income and net cash flows from each investment are as follows: Year Robotic AssemblerOperating Income Robotic AssemblerNet Cash Flow WarehouseOperating Income WarehouseNet Cash Flow 1 $35,000 $65,000 $21,000 $51,000 2 25,000 55,000 21,000 51,000 3 20,000 50,000 21,000 51,000 4 15,000 45,000 21,000 51,000 5 10,000 40,000 21,000 51,000 Total $105,000 $255,000 $105,000 $255,000 Each project requires an investment of $150,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 12% for purposes of the net present value analysis. Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627…arrow_forwardUse the information provided to answer the questions.Use the information provided below to calculate the following. Where applicable, use the presentvalue tables provided in APPENDICES 1 and 2 1. Calculate the Payback Period of Project A (expressed in years, months and days).2. Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places).arrow_forward1. Calculate the initial cash flow of the project, the operating cash-flows for all years of the project and the terminal cash flow of the project. Use the following formulas Project cash flow = project operating cash flow - project change in net working capital - project capital spending Operating cash flow = Earnings before interest and taxes + depreciation - taxes Terminal cash flow = After-tax proceeds from sale of new asset = proceeds from sale of new asset (minus) - After-tax proceeds from sale of old asset = Proceeds from sale of old asset +/- Tax on sale of old asset +/- Change in net working capitalarrow_forward

- Permanent working capital is funded through Long-term sources of capital Short-term sources of capital 50% long-term and 50% short-term source of capital Payablesarrow_forwardThe following are the cash flows of two projects: Year Project A Project B 0 $ (380) $ (380) 1 210 280 2 210 280 3 210 280 Training If the opportunity cost of capital is 11%, what is the profitability index for each project?arrow_forwardThe capital investment committee of Iguana Inc. is considering two capital investments. The estimated operating income and net cash flows from each investment are as follows: Year Robotic AssemblerOperating Income Robotic AssemblerNet Cash Flow WarehouseOperating Income WarehouseNet Cash Flow 1 $48,000 $152,000 $101,000 $243,000 2 48,000 152,000 77,000 205,000 3 48,000 152,000 38,000 144,000 4 48,000 152,000 17,000 99,000 5 48,000 152,000 7,000 69,000 Total $240,000 $760,000 $240,000 $760,000 Each project requires an investment of $480,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis. Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8…arrow_forward

- Economics Assume the data below describes the real cash flow of a 9-year project and all expenditures made at the beginning of each period. Using 10% discount rate, the investment cost (for the first four years starting from year 0), in present value terms, in year 0 is $1,403.08 and $1,867.50 when evaluated as of the beginning of year 4. What is the accrued opportunity cost of capital at the beginning of year 4? Year 0 = -500 Year 1 = -200 Year 2 = -600 Year 3 = -300 Year 4 = +520 Year 5 = +634 Year 6 = +736 Year 7 = +785 Year 8 = +861arrow_forwardCompany A has provided figures for two investment projects, only one of which may be chosen. These are the calculations based on the figures: Payback Period The Accounting Rate of Return / Return on Capital Employed Net Present Value Project A 2 years 4 months 27.08% £63,705 Project B 2 years 7 months 39.47% £74.971 Analyse and provide recommendations as to what project needs to be chosen based on the calculations above.arrow_forwardThe capital investment committee of Ellis Transport and Storage Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows: Warehouse Tracking Technology Year Income fromOperations Net CashFlow Income fromOperations Net CashFlow 1 $44,000 $145,000 $92,000 $232,000 2 44,000 145,000 70,000 196,000 3 44,000 145,000 35,000 138,000 4 44,000 145,000 15,000 94,000 5 44,000 145,000 8,000 65,000 Total $220,000 $725,000 $220,000 $725,000 Each project requires an investment of $440,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 10% for purposes of the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License