Concept explainers

Determine the effects of inventory errors using FIFO (LO6–3,6–9)

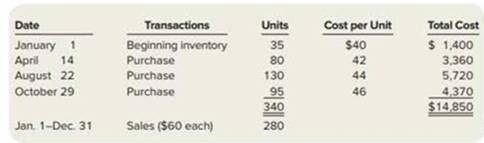

Sylvester has a bird shop that sells canaries. Sylvester maintains accurate records on the number of birds purchased from its suppliers and the number sold to customers. The records show the following purchases and sales during 2018.

Sylvester uses a periodic inventory system and believes there are 60 birds remaining in ending inventory. However, Sylvester neglects to make a final inventory count at the end of the year. An employee accidentally left one of the cages open one night and 10 birds flew away, leaving only 50 birds in ending inventory. Sylvester is not aware of the lost canaries.

Required:

1. What amount will Sylvester calculate for ending inventory and cost of goods sold using FIFO, assuming he erroneously believes 60 canaries remain in ending inventory?

2. What amount would Sylvester calculate for ending inventory and cost of goods sold using FIFO if he knew that only 50 canaries remain in ending inventory?

3. What effect will the inventory error have on reported amounts for (a) ending inventory, (b)

4. Assuming that ending inventory is correctly counted at the end of 2019, what effect will the inventory error in 2018 have on reported amounts for (a) ending inventory, (b) retained earnings, (c) cost of goods sold, and (d) net income (ignoring tax effects) in 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Financial Accounting

- Errors As controller of Lerner Company, which uses a periodic inventory system, you discover the following errors in the current year: 1. Merchandise with a cost of 17,500 was properly included in the final inventory, but the purchase was not recorded until the following year. 2. Merchandise purchases are in transit under terms of FOB shipping point. They have been excluded from the inventory, but the purchase was recorded in the current year on the receipt of the invoice of 4,300. 3. Goods out on consignment have been excluded from inventory. 4. Merchandise purchases under terms FOB shipping point have been omitted from the purchases account and the ending inventory. The purchases were recorded in the following year. 5. Goods held on consignment from Talbert Supply Co. were included in the inventory. Required: For each error, indicate the effect on the ending inventory and the net income for the current year and on the net income for the following year.arrow_forwardCompany Edgar reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 12,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardCompany Elmira reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 32,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forward

- Ethics and Inventory An electronics store has a large number of computers that use outdated technology in its inventory. These computers are reported at their cost. Shortly after the December 31 year end, the store manager insists that the computers can be sold for well over their cost. But the stores accountant has been told by the sales staff that it will be difficult to sell these computers for more than half of their inventory cost. Required: What are the consequences for the accountant of participating in a misrepresentation of the inventorys value?arrow_forwardM7-17 Calculating Effect of Inventory Errors For each of the following scenarios, determine the effect of the error on income in the current period and in the subsequent period. To answer these questions, rely on the inventory equation: Beginning inventory + Purchases - Cost of goods sold = Ending inventory a. Porter Company received a shipment of merchandise costing $32,000 near the end of the fiscal year. The shipment was mistakenly recorded at a cost of $23,000. b. Chiu, Inc., purchased merchandise costing $16,000. When the shipment was received, it was determined that the merchandise was damaged in shipment. The goods were returned to the supplier, but the accounting department was not notified and the invoice was paid. c. After taking a physical count of its inventory, Murray Corporation determined that it had “shrink” of $12,500, and the books were adjusted accordingly. However, inventory costing $5,000 was never countedarrow_forwardSterling Company reported their inventory as $50,700 on the books at December 31, 2021. At the close of the year, the auditors came in and identified the following issues: Product shipped to a customer December 28, 2021 f.o.b. destination costing $4,200, was not received by the customer until January 2022. The product was not included in the inventory balance because it was not in the warehouse. Samples costing $2,300 were delivered to a client for review on December 27, 2021. They are to be returned on January 5, 2022. They were not included in inventory because they were not in the warehouse. Purchases of product in the amount of $2,100 were in transit as of December 31, 2020. They had been shipped f.o.b. shipping point. They were not included in inventory because they were not in the warehouse. Product shipped to a customer December 28, 2020, f.o.b. shipping point cost $2,500. It was not received by the customer until January 2022. The product was not included in the…arrow_forward

- During the year ended December 31, 2021, Angel Company revealed the following events: a) A counting error relating to inventory on December 31, 2020 was discovered. This required an increase in the carrying amount of inventory on that date of P500,000. b)It was also decided to write off P50,000 from inventory which was over two years old as it was obsolete. c) The provision for uncollectible accounts on December 31, 2020 was P200,000. During 2021, an amount of P300,000 was written off on the December 31, 2020 accounts receivable. What pretax adjustment is required to restate retained earnings on January 1, 2021?arrow_forwardIn 2021, the internal auditors of Development Technologies, Inc., discovered that a $4 million purchase of merchandise in 2021 was recorded in 2020 instead. The physical inventory count at the end of 2020 was correct. Assume the company uses a periodic inventory system. Required:Prepare the journal entry needed in 2021 to correct the error. (Ignore income taxes.) (Enter your answers in millions (i.e., 5,000,000 should be entered as 5). If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardJackson Specialties has been in business for more than 50 years. The company maintains a per-petual inventory system, uses a LIFO flow assumption, and ends its fiscal year at December 31. At year-end, the cost of goods sold and inventory are adjusted to reflect periodic LIFO costingprocedures.A railroad strike has delayed the arrival of purchases ordered during the past several months of2011, and Jackson Specialties has not been able to replenish its inventories as merchandise is sold. At December 22, one product appears in the company’s perpetual inventory records at the follow-ing unit costs: Purchase Date Quantity Unit Cost Total CostNov. 14, 1958 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,000 $6 $18,000Apr. 12, 1959 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,000 8 16,000Available for sale at Dec. 22, 2011. . . . . . . . . . . . . . . . 5,000 $34,000 Jackson Specialties has another 8,000 units of this product on order at the current…arrow_forward

- 59 On December 31, 2021, ABC Company sold merchandise for P 675,000 to BBB Company. The terms of the sale were net 30, FOB shipping point. The merchandise was shipped on December 31, 2021, and arrived at BBB on January 5, 2022. Due to a clerical error, the sale was not recorded until January 2022 and the merchandise sold at a 35% markup on cost was included in inventory on December 31, 2021. What was the effect of the error on net income for 2021? Group of answer choices Understated by 675,000 Understated by 500,000 Understated by 175,000 None of the choicesarrow_forwardGrocery Ltd is a retailer and sells various products. It follows the perpetual inventory method. Because of supply chain disruptions, the cost of purchasing products increased during the year 2021. However, considering the economic hardship of people caused by Covid-19 pandemic, the company did not increase its sales price. The company purchases goods on three-month credit and sells goods for cash. The following information relates to the inventories of a particular product and related balances and transactions of the company for the year ended 31 December 2021. The company uses the weighted average method to assign costs to goods sold and ending inventories. The sales price is $3.50 per unit. The income tax rate is 28%. 1 January 2021 Beginning balances: Cash: $60,000 Accounts payable: $8,500. Inventory 10,000 units @ $2.10 per unit. January-February 2021 Sold 4,000 units. February 2021 Sales returns: 10 units. Cash is refunded to customers on return of the…arrow_forwardGrocery Ltd is a retailer and sells various products. It follows the perpetual inventory method. Because of supply chain disruptions, the cost of purchasing products increased during the year 2021. However, considering the economic hardship of people caused by Covid-19 pandemic, the company did not increase its sales price. The company purchases goods on three-month credit and sells goods for cash. The following information relates to the inventories of a particular product and related balances and transactions of the company for the year ended 31 December 2021. The company uses the weighted average method to assign costs to goods sold and ending inventories. The sales price is $3.50 per unit. The income tax rate is 28%. 1 January 2021 Beginning balances: Cash: $60,000 Accounts payable: $8,500. Inventory 10,000 units @ $2.10 per unit. January-February 2021 Sold 4,000 units. February 2021 Sales returns: 10 units. Cash is refunded to customers on return of the…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College