Concept explainers

To calculate: The points that Person X will be willing to pay the interest rate

Introduction:

The total sum of interest that is due for a particular time is the interest rate. The interest rate can be due for a period as a proportion of the sum borrowed or deposited and as the proportion of the sum lent.

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is also represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a period with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

Answer to Problem 65QP

The maximum points that Person X would be willing to pay is 0.1601 or 1.601 points

Explanation of Solution

Given information:

Person X purchases a house and borrows $200,000 on a thirty year fixed rate mortgage. Person X has to pay on monthly basis to finance the purchase. The loan officer of Person X has offered him a mortgage with an annual percentage rate of 4%. The loan officer states Person X an alternative that he can buy down the rate of interest to 3.75% if he pays points up front on the loan. A point on the loan is 1% of the loan value.

Person X believes that he lives only for 8 years in the house before selling the house and purchase a new house. Thus, the Person X pays off the remaining balance of the real mortgage.

Note: The loan payment is for the first eight years and the remaining payment will be a balloon payment at the end. Thus there will be a 264-month payment.

Formula to calculate the monthly rate:

Compute the monthly rate with the original interest:

Hence, the monthly rate is 0.00333 or 0.333%

Formula to calculate the present value

Note: C represents the annual cash flow, r is the rate of exchange, and t denotes the period. The loan payments with the points are based on the original amount borrowed.

Compute the present value annuity:

Hence, the value for C is $954.83

Formula to calculate the balloon payment:

Note: C denotes the annual cash flow, r denotes the rate of exchange, and t denotes the period. The balloon payment is calculated using the formulae of the present value of annuity.

Compute the balloon payment using the formulae of the present value annuity:

Hence, the balloon payment is $167,460.95

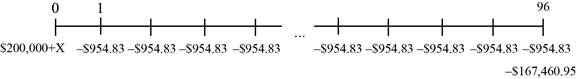

Time line of the payments:

Compute the equation for amount borrowed:

Note: The actual amount that is received in front of the mortgage is the sum of borrowed amount and the points. Considering as X as the dollar amount of the points. The maximum number of points can be solved as it results in the cash flows that have a new rate of interest of 3.75%.

Formula to calculate the monthly rate:

Compute the monthly rate with the original interest:

Hence, the monthly rate is 0.00313 or 0.313%

Formula to calculate the present value annuity:

Note: To determine the maximum number of points that Person X is willing to pay, it is essential to set the annual percentage rate and the effective annual rate of loan with points and without points to be equal.

Compute the cash flows for maximum points using the formulae of present value annuity:

Hence, the maximum dollar amount is $3,202.16

Formula to calculate the maximum points:

Compute the maximum point:

Hence, the maximum points is 0.1601 or 1.601 points.

Want to see more full solutions like this?

Chapter 6 Solutions

FUND. OF CORPORATE FINANCE (LL)

- 5. Finding the interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $12,800 will be worth $16,843.93 seven years in the future, what is the implied interest rate the investor will earn on the security—assuming that no additional deposits or withdrawals are made? 7.60% 0.19% 4.00% 1.32% If an investment of $40,000 is earning an interest rate of 4.00%, compounded annually, then it will take for this investment to reach a value of $53,679.69—assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true—assuming that no additional deposits or withdrawals are made? It takes 14.21 years for $500 to double if invested at an annual rate of 5%. It takes 10.50 years for $500 to double if invested…arrow_forward4. Finding the interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $5,600 will be worth $12,379.82 seven years in the future, what is the implied interest rate the investor will earn on the security—assuming that no additional deposits or withdrawals are made? 12.00% 4.52% 9.60% 0.32% If an investment of $35,000 is earning an interest rate of 4.00%, compounded annually, then it will take for this investment to reach a value of $44,286.17—assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true—assuming that no additional deposits or withdrawals are made? If you invest $1 today at 15% annual compound interest for 82.3753 years, you’ll end up with $100,000. If you invest $5 today at…arrow_forward5.7 An investment will pay $150 at the end of each of the next 3 years, $200 at the end of Year 4, $350 at the end of Year 5, and $550 at the end of Year 6. If other investments of equal risk earn 5% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent. Present value: $ Future value: $arrow_forward

- Q8 You want to buy a $195,000 home. You plan to pay 10% as a down payment, and take out a 30 year loan for the rest. a.how much is the loan amount going to be ?$____b.what will your monthly payments be if the interest rate is 5%? $____c.what will your monthly payments be if the interest rate is 6%? $____arrow_forward2. Which of the following alternatives would you rather receive, assuming an interest rate of 8% per year? Alternative 1: Receive $100 today: Alternative 2: Receive $120 two years from nowarrow_forward1. Find how long will it take for money to triple at {0.05, m = 2} The rule of 72 provides a fast computation in finding the number of years required to double an amount at a given interest rate, just divide the interest rate into 72. For example, if you want to know how long it will take to double your money at 6%, divide 72 by 6 and get 9 years. The rule of 72 is accurate, as long as the interest rate is less than 20%. If the unknown is the interest rate, run backward. Hence to double an amount in 8 years, just divide 72 by 9 to find that it will require an interest rate of about 8%.arrow_forward

- PA3. LO 11.3Use the tables in Appendix B to answer the following questions. If you would like to accumulate $2,500 over the next 4 years when the interest rate is 15%, how much do you need to deposit in the account? If you place $6,200 in a savings account, how much will you have at the end of 7 years with a 12% interest rate? You invest $8,000 per year for 10 years at 12% interest, how much will you have at the end of 10 years? You win the lottery and can either receive $750,000 as a lump sum or $50,000 per year for 20 years. Assuming you can earn 8% interest, which do you recommend and why?arrow_forward4.13 Calculating Annuity Present Value An investment offers $5,200 per year for 15 years, with the first payment occurring one year from now. If the required return is 7 percent, what is the value of the investment? What would the value be if the payments occurred for 40 years? For 75 years? Forever?arrow_forward4. (a) How many years will it take to have $5,800 if you invest $1,500 at 5%compounded monthly?(b) What effective annual interest rate would this be equivalent to?arrow_forward

- 5. How much would you pay today for a perpetuity of $ 1,000 per year if the prevailing interest rate is 5.25%?arrow_forwardQ: Which Is the better option to consolidate debt? Option 1: You have a loan at $21,000 at 16.24% (APR) 3 year term, Making the minimum payment monthly. Option 2: You have two loans; 1: $10, 700 at 8.99% (APR), 3 year term, Making the minimum payment monlthy. 2: $ 10,300 at 12.24% (APR), 3 year Term, Making the minimum payment monthly. Which option saves the most in interest, which is the better option to save the most money?arrow_forwardJUST NEED SUBPARTS D AND E You are trying to decide how much to save for retirement. Assume you plan to save $4,000 per year with the first investment made one year from now. You think you can earn 7.0% per year on your investments and you plan to retire in 29 years, immediately after making your last $4,000 investment. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $4,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 28 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 28th withdrawal (assume your savings will continue to earn 7.0% in retirement)? d. If, instead, you decide to withdraw $70,000 per year in retirement (again with the first withdrawal one…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education