College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 7SPA

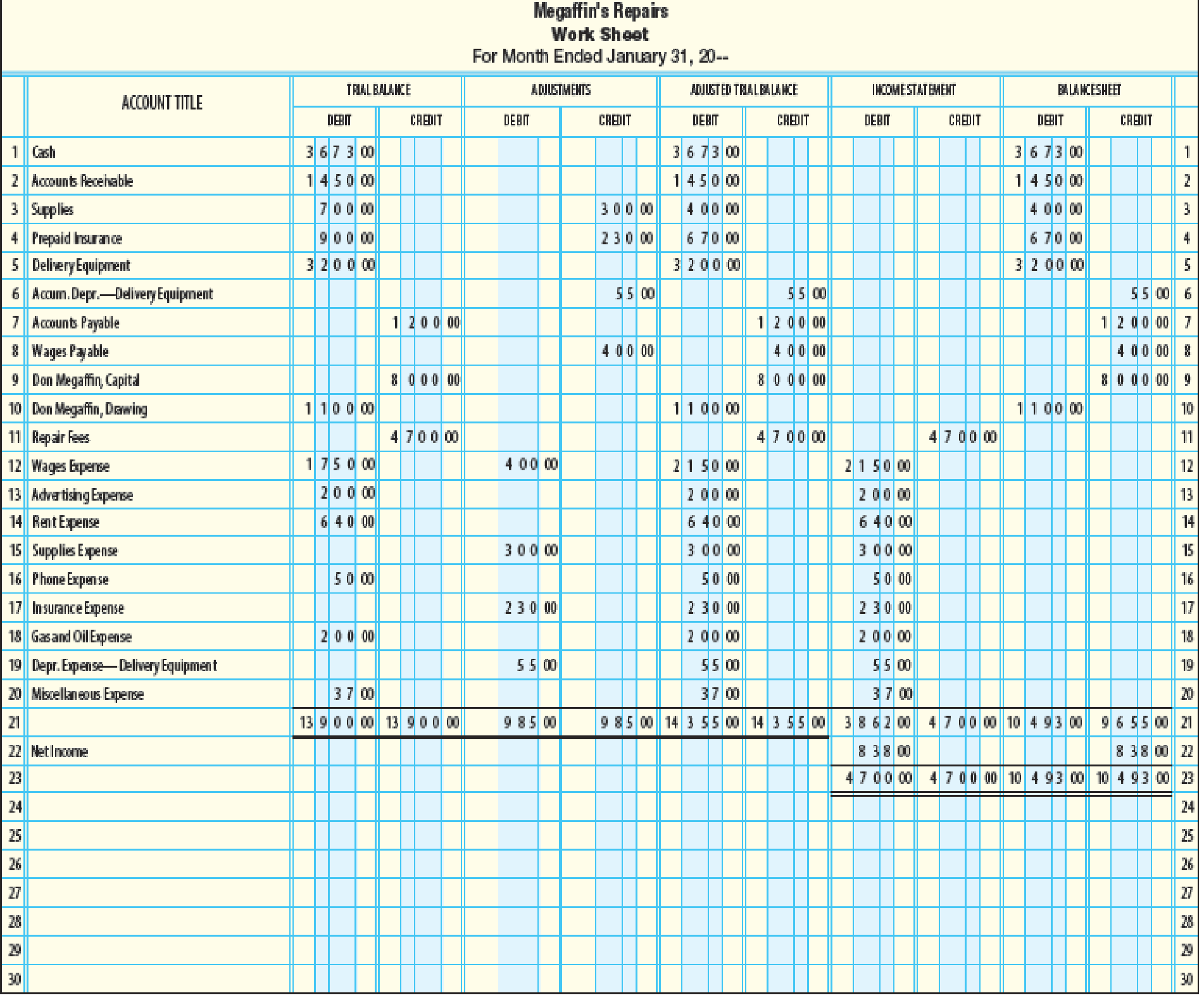

FINANCIAL STATEMENTS Page 206 shows a work sheet for Megaffin’s Repairs. No additional investments were made by the owner during the month.

REQUIRED

1. Prepare an income statement.

2. Prepare a statement of owner’s equity.

3. Prepare a balance sheet.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The partial work sheet for Adams’ Shoe Shine is shown, prepare a statement of owner’s equity, assuming no additional investment was made by the owner.

Adams’ Shoe Shine

Work Sheet (Partial)

For Month Ended June 30, 20--

1

INCOME STATEMENT

INCOME STATEMENT

BALANCE SHEET

BALANCE SHEET

2

ACCOUNT TITLE

DEBIT

CREDIT

DEBIT

CREDIT

3

Cash

3,262.00

4

Accounts Receivable

1,244.00

5

Supplies

800.00

6

Prepaid Insurance

640.00

7

Office Equipment

2,100.00

8

Accumulated Depreciation-Office Equipment

110.00

9

Accounts Payable

1,850.00

10

Wages Payable

260.00

11

Mary Adams, Capital

6,000.00

12

Mary Adams, Drawing

2,000.00

13

Service Fees

4,813.00

14

Wages Expense

1,080.00

15

Advertising Expense

34.00…

From the partial work sheet, prepare an income statement, a statement of owner's equity, and a classified balance sheet. The owner made no additional investments in the business during the month.

Carlos Perez Delivery ServiceWork Sheet (Partial)For Month Ended January 31, 20--

Income Statement

Balance Sheet

Account Title

Debit

Credit

Debit

Credit

Cash

11,000

Accounts Receivable

1,500

Supplies

1,200

Prepaid Insurance

800

Delivery Equipment

5,000

Accum. Depr.—Delivery Equip.

400

Accounts Payable

900

Wages Payable

1,400

Carlos Perez, Capital

15,600

Carlos Perez, Drawing

1,500

Delivery Fees

6,400

Wages Expense

880

Rent Expense

1,100

Supplies Expense

220

Telephone Expense

175

Electricity Expense

320

Insurance Expense

550

Depr. Exp.—Delivery Equip.

400

Miscellaneous Expense

55

3,700

6,400

21,000

18,300

Net Income

2,700…

From the partial work sheet, prepare an income statement, a statement of owner's equity, and a classified balance sheet. The owner made no additional investments in the business during the month.

Carlos Perez Delivery ServiceWork Sheet (Partial)For Month Ended January 31, 20--

Income Statement

Balance Sheet

Account Title

Debit

Credit

Debit

Credit

Cash

11,000

Accounts Receivable

1,500

Supplies

1,200

Prepaid Insurance

800

Delivery Equipment

5,000

Accum. Depr.—Delivery Equip.

400

Accounts Payable

900

Wages Payable

1,400

Carlos Perez, Capital

15,600

Carlos Perez, Drawing

1,500

Consulting Fees

6,400

Wages Expense

880

Rent Expense

1,100

Supplies Expense

220

Telephone Expense

175

Electricity Expense

320

Insurance Expense

550

Depr. Exp.—Delivery Equip.

400

Miscellaneous Expense

55

3,700

6,400

21,000

18,300

Net Income

2,700…

Chapter 6 Solutions

College Accounting, Chapters 1-27

Ch. 6 - Expenses are listed on the income statement as...Ch. 6 - Additional investments of capital during the month...Ch. 6 - Prob. 3TFCh. 6 - Prob. 4TFCh. 6 - Temporary accounts are closed at the end of each...Ch. 6 - Multiple choice Which of these types of accounts...Ch. 6 - Which of these accounts is considered a temporary...Ch. 6 - Which of these is the first step in the closing...Ch. 6 - The ________ is prepared after closing entries are...Ch. 6 - Steps that begin with analyzing source documents...

Ch. 6 - Joe Fisher operates Fisher Consulting. A partial...Ch. 6 - Prob. 2CECh. 6 - Prob. 3CECh. 6 - Identify the source of the information needed to...Ch. 6 - Describe two approaches to listing the expenses in...Ch. 6 - Prob. 3RQCh. 6 - If additional investments were made during the...Ch. 6 - Identify the sources of the information needed to...Ch. 6 - What is a permanent account? On which financial...Ch. 6 - Prob. 7RQCh. 6 - Prob. 8RQCh. 6 - Prob. 9RQCh. 6 - Prob. 10RQCh. 6 - List the 10 steps in the accounting cycle.Ch. 6 - Prob. 1SEACh. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS Page 206 shows a work sheet...Ch. 6 - PROBLEM 6-7A CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - INCOME STATEMENT From the partial work sheet for...Ch. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS A work sheet for Juanitas...Ch. 6 - PROBLEM 6-7B CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - MASTERY PROBLEM Elizabeth Soltis owns and operates...Ch. 6 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FINANCIAL STATEMENTS A work sheet for Juanitas Consulting is shown on the following page. There were no additional investments made by the owner during the month. REQUIRED 1. Prepare an income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet.arrow_forwardJoe Fisher operates Fisher Consulting. A partial work sheet for August 20-- is provided below. Fisher made no additional investments during the month. Prepare an income statement, statement of owners equity, and balance sheet.arrow_forwardA work sheet for Juanita’s Consulting is shown below. There were no additional investments made by the owner during the month. Prepare a General Journal, General Ledger, and a Trial Balance. Juanita’s Consulting Worksheet For Month Ended June 30, 20-- 1 TRIAL BALANCE TRIAL BALANCE ADJUSTMENTS ADJUSTMENTS ADJUSTED TRIAL BALANCE ADJUSTED TRIAL BALANCE INCOME STATEMENT INCOME STATEMENT BALANCE SHEET BALANCE SHEET 2 ACCOUNT TITLE Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit 3 Cash 5,285.00 5,285.00 5,285.00 4 Accounts Receivable 1,075.00 1,075.00 1,075.00 5 Supplies 750.00 (a) 250.00 500.00 500.00 6 Prepaid Insurance 500.00 (b) 100.00 400.00 400.00 7 Office Equipment 2,200.00 2,200.00 2,200.00 8…arrow_forward

- In addition to those accounts listed on the trial balance, the chart of accounts for Walker Consulting also contains the following accounts and account numbers: No. 150 Accumulated Depreciation—Equipment, No. 212 Salaries and Wages Payable, No. 631 Supplies Expense, No. 717 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense.Other data: 1. $800 of supplies have been used during the month. 2. Utilities expense incurred but not paid on May 31, 2022, $300. 3. An insurance policy for 2 years was purchased on May 1. 4. $400 of the balance in the unearned service revenue account remains unearned at the end of the month. 5. May 31 is a Wednesday, and employees are paid on Fridays. Walker Consulting has two employees, who are paid $1,100 each for a 5-day work week. 6. The office furniture has a 5-year life with no salvage value. It is being depreciated at $200 per month for 60 months. 7. Invoices representing $1,700 of services performed…arrow_forwardA work sheet for Juanita’s Consulting for the month ended June 30, 20-- is shown. There were no additional investments made by the owner during the month. Juanita’s Consulting Worksheet For Month Ended June 30, 20-- 1 TRIAL BALANCE TRIAL BALANCE ADJUSTMENTS ADJUSTMENTS ADJUSTED TRIAL BALANCE ADJUSTED TRIAL BALANCE INCOME STATEMENT INCOME STATEMENT BALANCE SHEET BALANCE SHEET 2 ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 3 Cash 5,285.00 5,285.00 5,285.00 4 Accounts Receivable 1,075.00 1,075.00 1,075.00 5 Supplies 750.00 (a) 250.00 500.00 500.00 6 Prepaid Insurance 500.00 (b) 100.00 400.00 400.00 7 Office Equipment 2,200.00 2,200.00 2,200.00 8 Accumulated Depreciation-Office…arrow_forwardA work sheet for the month ended June 30, 20-- for Juanita’s Consulting is shown. There were no additional investments made by the owner during the month. Juanita’s Consulting Worksheet For Month Ended June 30, 20-- 1 TRIAL BALANCE TRIAL BALANCE ADJUSTMENTS ADJUSTMENTS ADJUSTED TRIAL BALANCE ADJUSTED TRIAL BALANCE INCOME STATEMENT INCOME STATEMENT BALANCE SHEET BALANCE SHEET 2 ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 3 Cash 5,285.00 5,285.00 5,285.00 4 Accounts Receivable 1,075.00 1,075.00 1,075.00 5 Supplies 750.00 (a) 250.00 500.00 500.00 6 Prepaid Insurance 500.00 (b) 100.00 400.00 400.00 7 Office Equipment 2,200.00 2,200.00 2,200.00 8 Accumulated Depreciation-Office…arrow_forward

- FINANCIAL STATEMENTS 1. Prepare an income statement. 2. Prepare a statement of owner's equity. 3. Prepare a balance sheet. A work sheet for Megaffin's Repairs is shown below. No additional investments were made by the owner during the month. Megaffin's RepairsWork SheetFor Month Ended January 31, 20-- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Title Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Cash 3,673 3,673 3,673 Accounts Receivable 1,450 1,450 1,450 Supplies 700 300 400 400 Prepaid Insurance 900 230 670 670 Delivery Equipment 3,200 3,200 3,200 Accumulated Depreciation - Delivery Equipment 55 55 55 Accounts Payable 1,200 1,200 1,200 Wages Payable 400 400 400 Don Megaffin, Capital 8,000 8,000 8,000 Don Megaffin, Drawing 1,100 1,100 1,100 Repair Fees…arrow_forwardAt the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: Net income for August $180,900 Total assets at August 31 999,000 Total liabilities at August 31 330,000 Total owner’s equity at August 31 669,000 In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, $9,970. Depreciation of equipment for August, $4,500. Accrued wages at August 31, $3,190. Supplies used during August, $2,790. Required: Question Content Area 1. Journalize the entries toarrow_forwardFrom the list that follows, identify the accounts that should be closed to the owner’s capital account at the end of the fiscal year: a. Accounts Receivable b. Accumulated Depreciation c. Building d. Depreciation Expense e. Fees Earned f. Jackie Lindsay, Capital g. Jackie Lindsay, Drawing h. Land i. Supplies j. Supplies Expense k. Unearned Rent l. Wages Expensearrow_forward

- FINANCIAL STATEMENTS Refer to the trial balance in Problem 3-13A and to the analysis of the change in owners equity in Problem 3-14A. REQUIRED 1. Prepare an income statement for Kohls Home Repair for the month ended May 31, 20--. 2. Prepare a statement of owners equity for Kohls Home Repair for the month ended May 31, 20--. 3. Prepare a balance sheet for Kohls Home Repair as of May 31, 20--.arrow_forwardAt the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and owners equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forwardAt the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April 30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owners equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License