The

Concept Introduction:

The Common stock is the security which is issued by corporations to raise capital. Usually, people who purchase such securities are called stockholder. They are paid a dividend as income

Explanation of Solution

There are various models to determine the price of a common stock. These are as follows:

- The one-period valuation Model

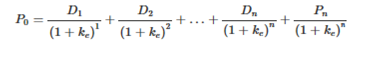

- The Generalized Dividend Valuation Model Under this model, the price of a stock is calculated for n-number of periods. The value of a stock today is the present value of the future cash flows. The only cash flow is a dividend and a final sales price when the stock is ultimately sold after n-period.

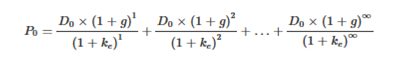

- The Gorden-Growth Model

Under this model, the price of the stock is calculated only for a year period, i.e., an investor keeps a stock only for a year period.

To value the stock today, the present discounted value of the expected cash flow(future payment) is calculated. The cash flow consists of dividend payment and sale price.

where

D1= dividend given by the corporation at the end of the year

P0= Current value of the stock P1= the expected sales price of the stock

Ke= The required return on equity

where

Dn= dividend given by the corporation at the end of n periods

P0= current price of a stock

Pn= Price of stock after n-periods

Ke= the required return on equity

This model estimated the price of the stock when corporations strive to give regular dividend at regular interval of time.

D0=the most recent dividend paid

G= the expected constant growth rate in dividends

Ke=the required return on an investment in equity

Want to see more full solutions like this?

Chapter 7 Solutions

Mylab Economics With Pearson Etext -- Access Card -- For The Economics Of Money, Banking And Financial Markets, Business School Edition (my Econ Lab)

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education