FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

6th Edition

ISBN: 9781260529326

Author: Kapoor

Publisher: McGraw-Hill Publishing Co.

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 7, Problem 1P

Summary Introduction

To determine: Whether to recommend buying or renting.

Expert Solution & Answer

Answer to Problem 1P

Rental is recommended.

Explanation of Solution

Determine the amount of rental costs

Therefore, the amount of rental costs is $7,564.

Determine the amount of buying costs

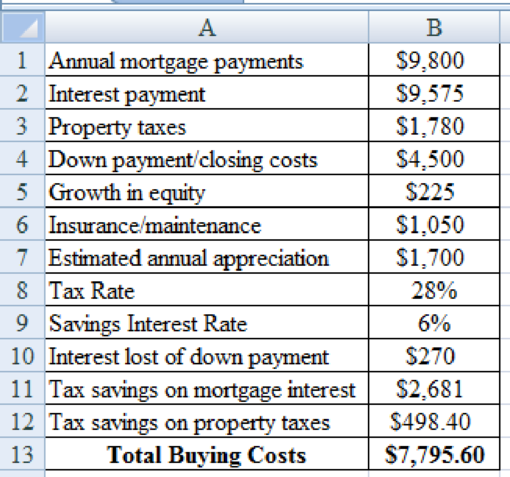

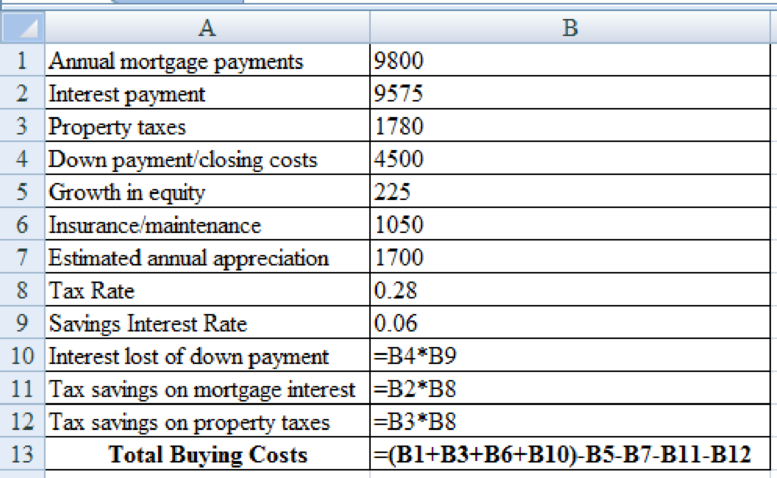

Excel Spreadsheet:

Excel Workings:

Therefore, the amount of buying costs is $7,795.60.

Conclusion

From the results obtained above, it is recommended to rent rather than buying as the rental costs are less than the buying costs.

Therefore, renting is recommended.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

You have a choice between a tax deduction of $1,000 or a refundable tax credit of $300. What factors/circumstances will determine which option is the better choice for you?

Chuck , a single taxpayer earns $81,400 in taxable income and $13,600 in interest from an investment in City of Heflin bonds.

a. How much federal tax will he owe?

b. What is his average tax rate?

c. What is his effective tax rate?

d. What is his current marginal tax rate?

You understand that, given a choice between a $1,000 tax deduction and a $1,000 tax credit, you would opt for the credit every time. But how about as be-tween above-the-line (“for AGI”) and below-the-line (“from AGI”) deductions?

As between a $1,000 “for AGI” deduction and a $1,000 itemized / “from AGI” deduction, which would you generally prefer to have, and why?

Chapter 7 Solutions

FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Lisa records nonrefundable Federal income tax credits of 65,000 for the year. Her regular income tax liability before credits is 190,000, and her TMT is 150,000. a. What is Lisas AMT? b. What is Lisas regular income tax liability after credits?arrow_forwardBased on the discussion in the chapter, evaluate how well each of these taxes meets Adam Smiths four requirements: a. Income tax b. Employment taxesarrow_forwardMelodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountarrow_forward

- Use the table to calculate how much money Lizzie will owe in taxes under a progressive tax program. Give your answer to two decimals. Calculate how much money Lizzie will owe in taxes under a proportional, or flat, tax rate of 30%30%. Give your answer to two decimals.arrow_forward4.An individual made $85,000 for the year. Using the tax given , answer the following questions: A.What is this person's marginal tax rate? B.How much tax does this person owe? C.What is the effective tax rate?arrow_forwardYou already understand that, given a choice between a $1,000 tax deduction and a $1,000 tax credit, you would opt for the credit every time. But how about as be-tween above-the-line (“for AGI”) and below-the-line (“from AGI”) deductions? As between a $1,000 “for AGI” deduction and a $1,000 itemized / “from AGI” deduction, which would you generally prefer to have, and why? Note: As CPAs we’re big on time-efficiency, so we’re also big on acronyms. It takes way too long to say (or type) “adjusted gross income.” We prefer “AGI” instead.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License