Companywide and Segment Break-Even Analysis; Decision Making L07—4, L07—5

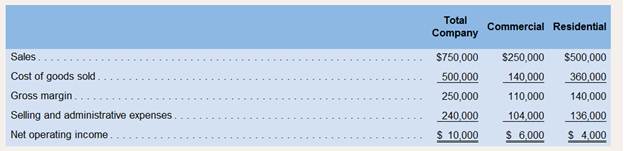

Toxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accountingintern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-evenpoints and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented incomestatement shown below:

In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% salescommission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that would continue to be incurredeven if the Commercial or Residential segments are discontinued, $55,000 of fixed expenses that would be avoided if the Commercial segment is dropped, and $38,000 of fixed expenses that would be avoided if the Residential segment is dropped.

In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% salescommission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that would continue to be incurredeven if the Commercial or Residential segments are discontinued, $55,000 of fixed expenses that would be avoided if the Commercial segment is dropped, and $38,000 of fixed expenses that would be avoided if the Residential segment is dropped.

Required:

1. Do you agree with the intern’s decision to use an absorption format for her segmented income statement? Why?

2. Based on a review of the intern’s segmented income statement:

a. How much of the company’s common fixed expenses did she allocate to the Commercial and Residential segments?

b. Which of the following three allocation bases did she most likely use to allocate common fixed expenses to the Commercial and

Residential segments: (a) sales, (b) cost of goods sold, or (c) gross margin?

3. Do you agree with the intern’s decision to allocate the common fixed expenses to the Commercial and Residential segments? Why?

4. Redo the intern’s segmented income statement using the contribution format.

5. Compute the companywide break-even point in dollar sales.

6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division.

7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salary of$15000 and $30,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the newbreak-even point in dollar sales for the Commercial Division and the Residential Division.

1:

Whether absorption costing method should be used for segmented income statement

Explanation of Solution

Under absorption costing the fixed expenses get deferred to next period due to absorption in closing stock even though they have actually been incurred. As such, profit/loss shown by Absorption costing is not real profit. Hence, variable costing should be used.

2 (a)

Allocation of Common Fixed Costs

Answer to Problem 24P

Solution:

| Particulars | Total Company | Commercial | Residential |

| Actual Selling expenses | $ 240,000 | $ 104,000 | $ 136,000 |

| Less: Variable Selling expenses | $ (75,000) | $ (25,000) | $ (50,000) |

| Less: Traceable fixed selling expenses | $ (93,000) | $ (55,000) | $ (38,000) |

| Balance fixed expenses | $ 72,000 | $ 24,000 | $ 48,000 |

| (common fixed expenses allocated) | |||

Explanation of Solution

- Total selling and administrative expenses are given. These are a sum total of variable selling expenses + traceable fixed selling expenses + common allocated fixed selling expenses;

- Variable selling expenses are given as % of sales and have been computed accordingly in above working note;

- Traceable fixed selling expenses are given in the question;

- Balance remaining after deducting variable selling and traceable fixed expenses will give common fixed expenses allocated.

- Given Variable Sales commission % as 10%

Sales traceable fixed selling expenses

- Formula

- Calculation

The common fixed cost has been allocated as $ 24,000 to Commercial and $ 48,000 to Residential

2 (b)

Allocation basis of common fixed cost out of given options:

Answer to Problem 24P

Solution:

In order to evaluate what basis has been used, we will compute the ratio under all the options and then assess as under:

| Company | Commercial | Residential | |

| Common Fixed Expenses allocated (as per answer 2(a)) | $ 72,000 | $ 24,000 | $ 48,000 |

| Ratio of Common Fixed Expenses allocated | 33% | 67% | |

| Sales | $ 750,000 | $ 250,000 | $ 500,000 |

| Ratio of Sales | 33% | 67% | |

| Cost of Goods Sold | $ 500,000 | $ 140,000 | $ 360,000 |

| Ratio of Cost of Goods Sold | 28% | 72% | |

| Gross Margin | $ 250,000 | $ 110,000 | $ 140,000 |

| Ratio of Gross Margin | 44% | 56% |

As clear from above, the intern used Sales Ratio to distribute common fixed expenses.

Explanation of Solution

- The ratio of individual common allocated fixed expenses to total common fixed expenses works out to 33% and 67% for Commercial and Residential respectively.

- The ratio of individual sales to total sales also works out to 33% and 67% for Commercial and Residential respectively.

- As such, sales ratio has been used for allocating common fixed expenses.

Sales ratio has been used to distribute common expenses

3:

Whether fixed common expenses should be allocated to segments

Answer to Problem 24P

Solution:

Fixed Common Expenses should not be allocated to segments

Explanation of Solution

- Given :

Intern has allocated common expenses on the basis of sales to both the segments

It is not advisable to allocate common fixed costs to segments for evaluating the segment's profitability. These costs would get incurred whether segment exists or not. As such, they make a segment look less profitable and hence should be excluded while evaluating segment wise profitability. However, while deciding whether to continue or drop a segment these costs need to be considered.

In view of reflecting true segment margin, fixed common expenses should not be allocated to segment.

4:

In contribution format, details are shown in the following sequence:

Sales, Total Variable cost, contribution margin, total fixed cost, Net operating Income

Segmented Income Statement in Contribution Format

Solution (a):

| Toxaway Company

Income statement (contribution format) | |||

| Total Company | Commercial | Residential | |

| Sales | $ 750,000 | $ 250,000 | $ 500,000 |

| Cost of Goods Sold | $ 500,000 | $ 140,000 | $ 360,000 |

| Variable selling and administrative expenses | $ 75,000 | $ 25,000 | $ 50,000 |

| Contribution Margin | $ 175,000 | $ 85,000 | $ 90,000 |

| Fixed Expenses | $ 165,000 | $ 79,000 | $ 86,000 |

| Net Operating Income | $ 10,000 | $ 6,000 | $ 4,000 |

Explanation of Solution

- Given:

Sales and Cost of Goods Sold are given in the question

Variable selling and administrative expenses and fixed expenses have been computed in above solutions

- Formula:

- Calculation:

Net Operating Income for Company is $ 10,000 and for Commercial and Residential segment is $ 6,000 and $ 4,000 respectively.

5:

Breakeven point is that level of sales at which the Company is at a No profit no loss situation. This means that the company is able to fully recover its variable cost and fixed cost but nothing above that.

Breakeven point in dollar Sales

Answer to Problem 24P

Solution:

- Break-even point in dollar Sales = $ 707,243

Explanation of Solution

- Break-even point is computed to calculate the minimum sales that must be achieved to arrive at a no profit no loss situation;

- Break-even point in unit salesis calculated by dividing the Fixed cost with contribution per unit Break-even point in dollar salesis calculated by dividing the Fixed cost with contribution Margin %

- Contribution Margin is the ratio of Contribution to Sale value.

- Given:

Fixed Cost has been computed as $ 165,000

Sales is given as $ 175,000

Contribution margin has been computed as $ 175,000

- Formula:

- Calculation:

Toxaway Company will have to make a minimum sale of $ 707,243 to be able to fully recover its variable as well as fixed cost.

6:

Breakeven point in dollar sales for Commercial and Residential division.

Answer to Problem 24P

Solution:

Break-even point in dollar Sales = Fixed Cost/ Contribution Margin %

| Commercial | Residential | |

| Fixed Cost (A) | $ 79,000 | $ 86,000 |

| Contribution Margin (B) | $ 85,000 | $ 90,000 |

| Sales (C) | $ 250,000 | $ 500,000 |

| Contribution Margin % (D = B / C) | 34% | 18% |

| Break even point (A / D) | $ 232,353 | $ 477,778 |

Explanation of Solution

- Given

Fixed cost has been computed in above solutions

Sales is given in the question

- Formula

- Calculation

Commercial will have to make a minimum sale of $ 232,353 to be able to fully recover its variable as well as fixed cost. Similarly, Residential will have to make a minimum sales of $ 477,778

7:

To determine: Break-even point in dollar sales:

Answer to Problem 24P

Solution:

| Commercial | Residential | |

| Sales (A) | 250,000 | 500,000 |

| Cost of Goods Sold (B) | 140,000 | 360,000 |

| Variable selling and administrative expenses (5% of sales) (C) | 12,500 | 25,000 |

| Contribution Margin (D = A-B-C) | 97,500 | 115,000 |

| Fixed Expenses (E) | 94,000 | 116,000 |

| Contribution Margin % (F = D / A) | 39% | 23% |

| Break even point (E / F) | 241,026 | 504,348 |

Explanation of Solution

- Given:

Additional fixed cost is given as $ 15,000 for Commercial and $ 30,000 for Residential.

Variable selling and administrative expenses have been given as 5% of Sales

Cost of Goods Sold is given as $ 140,000 and $ 360,000 for Commercial and Residential respectively

- Formula:

- Calculation:

New Break-even point of Commercial is $ 241,026; New Break-even point of Residential is $ 504,348

Want to see more full solutions like this?

Chapter 7 Solutions

Introduction To Managerial Accounting

- Kanye Achebe just became the operations manager of Weston Transportation. Weston transports large crates for online companies and transports containers overseas. Kanye would like to evaluate each divisional manager on a basis similar to segmental reporting required by generally accepted accounting principles (GAAP) financial statements contained in annual reports. These data include a presentation of net sales, operating profit and loss before and after taxes, total identifiable assets, and depreciation for segment reported. Kanye thinks that evaluating business division managers by the same criteria as the total company is appropriate. A. Explain why you think the chief financial officer (CFO) disagrees and tells Kanye that publicly reporting information might demotivate managers. B. For better evaluation of the managers, what type of information should Kanye propose that the CFO might accept?arrow_forwardCommunication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forwardProfit center responsibility reporting for a service company Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31: The company operates three support departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is a cost driver for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is a cost driver for this work. The following additional information has been gathered: Instructions 1. Prepare quarterly income statements showing operating income for the three divisions. Use three column headings: East, West, and Central. 2. Identify the most successful division according to the profit margin. Round to the nearest whole percent. 3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.arrow_forward

- Corrections to service department charges Panda Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared The service department charge rate for the service department costs was based on revenues. The following additional information is available a.Does the operating income for the two divisions accurately measure performance? b.Using service charge rates for service department charges, correct the divisional income statements.arrow_forwardEffect of proposals on divisional performance A condensed income statement for the Jet Ski Division of Amazing Rides Inc. for the year ended December 31. 20Y2, is as follows Assume that the Jet Ski Division received no charges from service departments. The president of Amazing Rides has indicated that the division's rate of return on a $15,000,000 investment must be increased to at least 12% by the end of the next year if operations are to continue. The division manager is considering the following three proposals Proposal 1: Transfer equipment with a book value of J3.000.000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $264,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $480,000. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,000,000 for the year. Proposal 5? Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $2,280,000, cost of goods sold of $1,400,000, and operating expenses of $463,600. Assets of $4,200,000 would be transferred to other divisions at no gain or loss. Instructions Which of the three proposals would meet the required 12% return on investment?'arrow_forwardSegmented Income Statement, Management Decision Making FunTime Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows: Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm and is seriously considering dropping both the scented and musical product lines. However, before making a final decision, she consults Jim Dorn, FunTimes vice president of marketing. Required: 1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by 1,000 (250 for the scented line and 750 for the musical line), sales of those two lines would increase by 30%. If you were Kathy, how would you react to this information? 2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical lines would lower the sales of the regular line by 20%. Given this information, would it be profitable to eliminate the scented and musical lines? 3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the regular cards by 10%. Would a combination of increased advertising (the option described in Requirement 1) and eliminating one of the lines be beneficial? Identify the best combination for the firm.arrow_forward

- Toxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-even points and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented income statement shown below: Sales $ 750,000 $ 250,000 $ 500,000 Cost of goods sold 500,000 140,000 360,000 Gross margin 250,000 110,000 140,000 Selling and administrative expenses 240,000 104,000 136,000 Net operating income $ 10,000 $ 6,000 $ 4,000 ln preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% sales commission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that would continue to be incurred even if the…arrow_forwardToxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-even points and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented income statement shown below: TotalCompany Commercial Residential Sales $ 975,000 $ 325,000 $ 650,000 Cost of goods sold 663,000 182,000 481,000 Gross margin 312,000 143,000 169,000 Selling and administrative expenses 300,000 134,000 166,000 Net operating income $ 12,000 $ 9,000 $ 3,000 In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% sales commission on all sales. The company’s total fixed expenses include $64,500 of common fixed expenses that would continue to be incurred even if the Commercial…arrow_forwardToxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the company’s divisional managers could use to calculate their break-even points and make decisions. She took the prior month’s companywide income statement and prepared the absorption format segmented income statement shown below: Total Company Commercial Residential Sale 750,000 250,000 500,000 Cost of goods sold 500,000 140,000 360,000 Gross margin 250,000 110,000 140,000 Selling and administrative expresses 240,000 104,000 136,000 Net operating income 10,000 6,000 4,000 In preparing these statements, the intern determined that Toxaway’s only variable selling and administrative expense is a 10% sales commission on all sales. The company’s total fixed expenses include $72,000 of common fixed expenses that would continue to…arrow_forward

- Companywide and Segment Break-Even Analysis Crossfire Company segments its business into two regions—East and West. The company prepared a contribution format segmented income statement as shown below: Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. Use the same format as shown above. What is Crossfire’s net operating income (loss) in your new segmented income statement? 5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break-even points for each region? Why?arrow_forwardRestructuring a Segmented Income Statement Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company’s first effort at preparing a segmented income statement for May is given below. The cost of goods sold and shipping expense are both variable. All other costs are fixed. Required: 1. List any weaknesses that you see in the company’s segmented income statement given above. 2. Explain the basis that is apparently being used to allocate the corporate expenses to the regions. Do you agree with these allocations? Explain. 3. Prepare a new contribution format segmented income statement for May.…arrow_forwardCrossfire Company segments its business into two regions—East and West. The company prepared a contribution format segmented income statement as shown below: Required:1. Compute the companywide break-even point in dollar sales.2. Compute the break-even point in dollar sales for the East region.3. Compute the break-even point in dollar sales for the West region.4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. Use the same format as shown above. What is Crossfire’s net operating income (loss) in your new segmented income statement?5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break-even points for each region? Why?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College