Reconciliation of Absorption and Variable Costing Net Operating Incomes L07—3

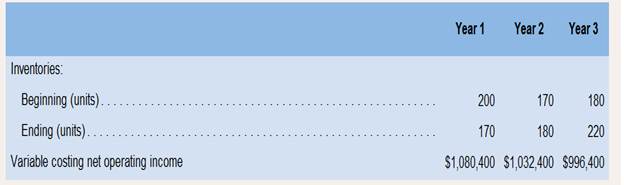

Jorgansen Lighting; Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internalmanagement reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided thefollowing data:

The company’s fixed manufacturing

Required:

1. Calculate each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report.

2. Assume in Year 4 that the company’s variable costing net operating income was $984,400 and its absorption costing net operatingincome was $1,012,400.

a. Did inventories increase or decrease during Year 4?

b. How much fixed

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Introduction To Managerial Accounting

- Variable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forwardVariable and Absorption CostingChandler Company sells its product for $108 per unit. Variable manufacturing costs per unit are $49, and fixed manufacturing costs at the normal operating level of 12,000 units are $240,000. Variable selling expenses are $17 per unit sold. Fixed administrative expenses total $104,000. Chandler had no beginning inventory for the year. During the year, the company produced 12,000 units and sold 9,000. Would net income for Chandler Company be higher if calculated using variable costing or using absorption costing?Calculate reported income using each method.Do not use negative signs with any answers.arrow_forwardVariable and Absorption CostingChandler Company sells its product for $108 per unit. Variable manufacturing costs per unit are $49, and fixed manufacturing costs at the normal operating level of 12,000 units are $240,000. Variable selling expenses are $17 per unit sold. Fixed administrative expenses total $104,000. Chandler had no beginning inventory for the year. During the year, the company produced 12,000 units and sold 9,000. Would net income for Chandler Company be higher if calculated using variable costing or using absorption costing?Calculate reported income using each method.Do not use negative signs with any answers. Absorption Costing Income Statement Sales Answer Cost of Goods Sold: Beginning Inventory Answer Variable Costs Answer Fixed Costs Answer Less: Ending Inventory Answer Cost of Goods Sold Answer Answer Answer Answer Answer Administrative expense…arrow_forward

- Information from SAAX, Inc's first year of operations is available below: Sales in units 5,000 Production in units 8,000 Manufacturing costs: Direct labor $3 per unit Direct material $5 per unit Variable overhead $2 per unit Fixed overhead $100,000 SG&A costs: Variable Cost $5 per unit Fixed cost 80,000 Sales price per unit $105 If SAAX, Inc uses variable costing, what amount of income before income taxes would it have reported? Group of answer choices $270,000 $540,000 25,000 $307,500arrow_forwardLeo Company wishes to determine the fixed portion of its electrical costs (a mixed cost). Management believes that the variable portion of the electrical costs is driven by machine-hours. Information for the previous three months follows: Machine-hours Electrical cost August 33 000 R6 000 September 31 000 R5 850 October 34 000 R6 100 Using the high-low method, the fixed portion of the company's electrical costs would be estimated to be closest to: A. R3 750 B. R4 080 C. R3 267 D. R2 830arrow_forwardSOLVE THE GIVEN MCQS: 1) Kaaua Corporation has provided the following data for its two most recent years of operation: Selling price per unit $ 83 Manufacturing costs: Variable manufacturing cost per unit produced: Direct materials $ 13 Direct labor $ 7 Variable manufacturing overhead $ 4 Fixed manufacturing overhead per year $ 396,000 Selling and administrative expenses: Variable selling and administrative expense per unit sold $ 4 Fixed selling and administrative expense per year $ 72,000 Year 1 Year 2 Units in beginning inventory 0 2,000 Units produced during the year 12,000 11,000 Units sold during the year 10,000 9,000 Units in ending inventory 2,000 4,000 Which of the following statements is true for Year 2? A The amount of fixed manufacturing overhead deferred in inventories is $534,000 B The amount of fixed manufacturing overhead deferred in inventories is $78,000 C The amount of fixed…arrow_forward

- Trend Reporting for Non-Value-Added Costs Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Activity Activity Driver SQ AQ SP Receiving Receiving orders 12,000 24,000 $21 Assembly Labor hours 99,000 120,000 15 Expediting Orders expedited 0 8,000 50 Storing Number of units 0 16,000 7 Assume that at the beginning of 20x2, Cicleta trained the assembly workers in a new approach that had the objective of increasing the efficiency of the assembly process. Cicleta also began moving toward a JIT purchasing and manufacturing system. When JIT is fully implemented, the demand for expediting…arrow_forwardBeiber Boxers contribution income statement utilizing variable costing for 2020 variable costing appears below: Sales ($14 per unit) $84,000 Less variable costs: Cost of goods sold $36,000 Selling & administrative 9,000 45,000 Contribution margin 39,000 Less fixed costs: Manufacturing overhead 24,000 Selling & administrative costs 14,000 38,000 Net income $ 1,000 The company produced 8,000 units during the year. Variable and fixed production costs have remained constant the entire year. There were no beginning inventories. How much is the dollar value of the ending inventory using full costing? $18,000 $17,000 $15,000…arrow_forwardpls show solutions A company produces a single product. Last year, fixed manufacturing overhead was $30,000, variable production costs were $48,000, fixed selling and administration costs were $20,000, and variable selling administrative expenses were $9,600. There was no beginning inventory. During the year, 3,000 units were produced and 2,400 units were sold at a price of $40 per unit. Under variable costing, net operating income would be:arrow_forward

- PROBLEM 2 Elsa, Inc., has only variable costs and fixed costs. A review of the company's records disclosed that when 100,000 units were produced, fixed manufacturing costs amounted to $200,000 and the cost per unit manufactured totaled $5. On the basis of this information, how much cost would the firm anticipate at an activity level of 97,000 units? A. $485,000. B. $491,000. C. $494,000. D. $500,000.arrow_forwardJorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: The company’s fixed manufacturing overhead per unit was constant at $560 for all three years.Required:1. Calculate each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report.2. Assume in Year 4 that the company’s variable costing net operating income was $984,400 and its absorption costing net operating income was $1,012,400.a. Did inventories increase or decrease during Year 4?b. How much fixed manufacturing overhead cost was deferred or released from inventory during Year 4?arrow_forwardBioClinic sells its product for $80 per unit. During 2025, it produced 120,000 units and sold 105,000 units. Costs per unit are: direct materials $25, direct labor $10, variable overhead $5, and variable operating expenses $3. Fixed costs are $840,000 manufacturing overhead, and $75,000 operating expenses. Assuming no variances were reported, no beginning inventory and the company uses absorption costing, what will be reported as gross margin? Question options: a) $3,600,000. b) $3,885,000. c) $2,760,000. d) $3,465,000.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning