Concept explainers

a.

Record the given events in the

a.

Explanation of Solution

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below.

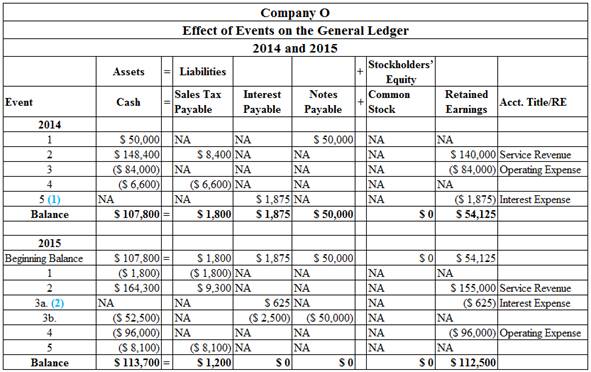

Record the given events in accounting equation:

Table (1)

Working note 1: Determine the sales tax payable on the service rendered in 2014.

Working note 2: Determine the sales tax due for the year 2014.

b.

Prepare an income statement, a statement of changes in

b.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare the income statement for Company O for the year ended December 31, 2014:

| Company O | ||

| Statement of income | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount $ | Amount $ |

| Service Revenue | 140,000 | |

| Expenses: | ||

| Operating Expenses | 84,000 | |

| Total operating expense | (84,000) | |

| Operating income | 56,000 | |

| Interest expense | (1,875) | |

| Net income | 54,125 | |

Table (2)

Prepare the statement of changes in stockholders’ equity of Company O for the year ended December 31, 2014:

| Company O | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount $ | Amount $ |

| Common Stock | 0 | |

| Beginning | 0 | |

| Add/Less: Net Income (Loss) | 54,125 | |

| Ending Retained Earnings | 54,125 | |

| Total stockholder's equity | 54,125 | |

Table (3)

Prepare the balance sheet of Company O as on December 31, 2014:

| Company O | ||

| Balance sheet | ||

| As on December 31, 2014 | ||

| Assets | Amount $ | Amount $ |

| Cash | 107,800 | |

| Total Assets | 107,800 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Sales tax Payable | 1,800 | |

| Interest Payable | 1,875 | |

| Notes Payable | 50,000 | |

| Total Liabilities | 53,675 | |

| Stockholders’ Equity | ||

| Retained Earnings | 54,125 | |

| Total Stockholders’ Equity | 54,125 | |

| Total liabilities and stockholders' equity | 107,800 | |

Table (4)

Prepare the statement of cash flows of Company O for the year ended December 31, 2014;

| Company O | ||

| Statement of cash flows | ||

| For the year ended December 31, 2014 | ||

| Particulars | Amount $ | Amount $ |

| Cash flow from operating activities: | ||

| Inflow from Customers | 140,000 | |

| Inflow from Sales Tax | 8,400 | |

| Outflow for Expenses | (84,000) | |

| Outflow for Sales Tax | (6,600) | |

| Net Cash Flow from Operating Activities | 57,800 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | 0 | |

| Cash Flows From Financing Activities: | ||

| Inflow from loan | 50,000 | |

| Net Cash Flow From Financing Activities | 50,000 | |

| Net Change in Cash | 107,800 | |

| Add: Beginning Cash Balance | 0 | |

| Ending Cash Balance | 107,800 | |

Table (5)

Prepare the income statement for Company O for the year ended December 31, 2015;

| Company O | ||

| Statement of income | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount $ | Amount $ |

| Service Revenue | 155,000 | |

| Expenses: | ||

| Operating Expenses | 96,000 | |

| Total operating expense | (96,000) | |

| Operating income | 59,000 | |

| Interest expense | (625) | |

| Net income | 58,375 | |

Table (6)

Prepare the statement of changes in stockholders’ equity of Company O for the year ended December 31, 2015.

| Company O | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount $ | Amount $ |

| Common Stock | 0 | |

| Beginning retained earnings | 54,125 | |

| Add/Less: Net Income (Loss) | 58,375 | |

| Ending Retained Earnings | 112,500 | |

| Total stockholder's equity | 112,500 | |

Table (7)

Prepare the balance sheet of Company O as on December 31, 2015.

| Company O | ||

| Balance sheet | ||

| As on December 31, 2015 | ||

| Assets | Amount $ | Amount $ |

| Cash | 113,700 | |

| Total Assets | 113,700 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Sales tax Payable | 1,200 | |

| Total Liabilities | 1,200 | |

| Stockholders’ Equity | ||

| Retained Earnings | 112,500 | |

| Total Stockholders’ Equity | 112,500 | |

| Total liabilities and stockholders' equity | 113,700 | |

Table (8)

Prepare the statement of cash flows of Company O for the year ended December 31, 2015.

| Company O | ||

| Statement of cash flows | ||

| For the year ended December 31, 2015 | ||

| Particulars | Amount $ | Amount $ |

| Cash flow from operating activities: | ||

| Cash reeipts from Customers | $155,000 | |

| Inflow from Sales Tax | 9,300 | |

| Cash paid for Expenses | (96,000) | |

| Cash paid for Sales Tax expense | (9,900) | |

| Cash paid for Interest exepnse | (2,500) | |

| Net Cash Flow from Operating Activities | 55,900 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | 0 | |

| Cash Flows From Financing Activities: | ||

| Repayment of loan | (50,000) | |

| Net Cash Flow From Financing Activities | (50,000) | |

| Net Change in Cash | 5,900 | |

| Add: Beginning Cash Balance | 107,800 | |

| Ending Cash Balance | 113,700 | |

Table (9)

Want to see more full solutions like this?

Chapter 7 Solutions

SURVEY OF ACCOUNTING-ACCESS

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education