SURVEY OF ACCOUNTING 360DAY CONNECT CAR

5th Edition

ISBN: 9781260591811

Author: Edmonds

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 32P

Problem 7-32 Accounting for a line of credit

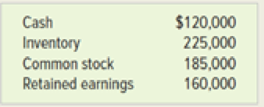

Elite Boat Sales uses a line of credit to help finance its inventory purchases. Elite Boat Sales sells boats

and equipment and uses the line of credit to build inventory for its peak sales months, which tend to be

clustered in the summer months. Account balances at the beginning of 2018 were as follows.

Elite Boat Sales experienced the following transactions for April, May, and June 2018:

- 1. April 1, 2018, obtained approval for a line of credit of up to $700,000. Funds are to be obtained or repaid on the first day of each month. The interest rate is the bank prime rate plus 1 percent.

- 2. April 1, 2018, borrowed $190,000 on the line of credit. The bank’s prime interest rate is 5 percent for April.

- 3. April 15, purchased inventory on account, $210,000.

- 4. April 31, paid other operating expenses of $105,000.

- 5. In April, sold inventory for $420,000 on account. The inventory had cost $250,000.

- 6. April 30, paid the interest due on the line of credit.

- 7. May 1, borrowed $230,000 on the line of credit. The bank’s prime rate is 6 percent for May.

- 8. May 1, paid the accounts payable from transaction 3.

- 9. May 10, collected $380,000 of the sales on account.

- 10. May 20, purchased inventory on account, $230,000.

- 11. May sales on account were $510,000. The inventory had cost $305,000.

- 12. May 31, paid the interest due on the line of credit.

- 13. June 1, repaid $150,000 on the line of credit. The bank’s prime rate is 6 percent for June.

- 14. June 5, paid $280,000 of the accounts payable.

- 15. June 10, collected $630,000 from accounts receivable.

- 16. June 20, purchased inventory on account, $375,000.

- 17. June sales on account were $605,000. The inventory had cost $370,000.

- 18. June 31, paid the interest due on the line of credit.

Required

- a. What is the amount of interest expense for April? May? June?

- b. What amount of cash was paid for interest in April? May? June?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Problem 6-5A

The following selected transactions were completed by Amsterdam Supply Co, which sells office supplies primarily to wholesalers and occasionally to retail customers:

Mar. 2. Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, 1/10, n/30. The cost of the merchandise sold was $13,300.

3. Sold merchandise for $11,350 plus 6% sales tax to retail cash customers. The cost of merchandise sold was $7,000.

4. Sold merchandise on account to Empire Co., $55,400, terms FOB shipping point, n/eom. The cost of merchandise sold was $33,200.

5. Sold merchandise for $30,000 plus 6% sales tax to retail customers who used MasterCard. The cost of merchandise sold was $19,400.

12. Received check for amount due from Equinox Co. for sale on March 2.

14. Sold merchandise to customers who used American Express cards, $13,700. The cost of merchandise sold was $8,350.

16. Sold merchandise on account to Targhee Co., $27,500, terms FOB shipping point, 1/10, n/30. The cost of…

Problem 8-06A

On January 1, 2022, Whispering Winds Corp. had Accounts Receivable of $52,500 and Allowance for Doubtful Accounts of $3,700. Whispering Winds Corp. prepares financial statements annually. During the year, the following selected transactions occurred:

Jan. 5

Sold $4,000 of merchandise to Rian Company, terms n/30.

Feb. 2

Accepted a $4,000, 4-month, 9% promissory note from Rian Company for balance due.

12

Sold $13,200 of merchandise to Cato Company and accepted Cato’s $13,200, 2-month, 11% note for the balance due.

26

Sold $5,500 of merchandise to Malcolm Co., terms n/10.

Apr. 5

Accepted a $5,500, 3-month, 9% note from Malcolm Co. for balance due.

12

Collected Cato Company note in full.

June 2

Collected Rian Company note in full.

15

Sold $2,000 of merchandise to Gerri Inc. and accepted a $2,000, 6-month, 13% note for the amount due.

Journalize the transactions. (Omit cost of goods sold entries.) (Credit account titles are…

Problem 12

Rosalie Co. uses the gross method to record sales made on credit. On June 10, 2020, it made sales of P100,000 with terms 2/10, n/30 to Finley Farms, Inc. On June 19, 2020, Rosalie received payment for 1/2 the amount due from Finley Farms. Rosalie’s fiscal year end is on June 30, 2020. What amount will be reported in the statement of financial position for the accounts receivable due from Finley farms, Inc.? _________ Problem 13

On the December 31, 2020 balance sheet of Mann Co., the current receivables consisted of the following: Trade accounts receivable 93,000 Allowance for uncollectible accounts (2,000) Claim against shipper for goods lost in transit (November 2020) 3,000 Selling price of unsold goods sent by Mann on consignment at 130% of cost (not included in Mann’s ending inventory) 26,000 Security deposit on lease of warehouse used for storing some inventories 30,000 Total 150,000 On December 31, 2020, the correct total of Mann’s current net receivables was…

Chapter 7 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

Ch. 7 - 1. What type of transaction is a cash payment to...Ch. 7 - Prob. 2QCh. 7 - How does recording accrued interest affect the...Ch. 7 - 4. Who is the maker of a note payable?Ch. 7 - How does the going concern assumption discussed in...Ch. 7 - 6. Why is it necessary to make an adjusting entry...Ch. 7 - Assume that on October 1, 2018, Big Company...Ch. 7 - Prob. 8QCh. 7 - Prob. 9QCh. 7 - Prob. 10Q

Ch. 7 - 11. Are contingent liabilities recorded on a...Ch. 7 - Prob. 12QCh. 7 - Prob. 13QCh. 7 - Prob. 14QCh. 7 - Prob. 15QCh. 7 - Prob. 16QCh. 7 - 1. What is the difference between classification...Ch. 7 - 2. At the beginning of Year 1, B Co. has a note...Ch. 7 - 3. What is the purpose of a line of credit for a...Ch. 7 - 4. What are the primary sources of debt financing...Ch. 7 - 5. What are some advantages of issuing bonds...Ch. 7 - 6. What are some disadvantages of issuing bonds?Ch. 7 - 7. Why can a company usually issue bonds at a...Ch. 7 - 15. If Roc Co. issued 100,000 of 5 percent,...Ch. 7 - 16. What is the mechanism is used to adjust the...Ch. 7 - 17. When the effective interest rate is higher...Ch. 7 - 18. What type of transaction is the issuance of...Ch. 7 - 19. What factors may cause the effective interest...Ch. 7 - 20. If a bond is selling at 97, how much cash will...Ch. 7 - Prob. 30QCh. 7 - 22. Gay Co. has a balance m the Bonds Payable...Ch. 7 - Prob. 32QCh. 7 - Prob. 33QCh. 7 - Recognizing accrued interest expense Abardeen...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Effect of warranties on income and cash flow To...Ch. 7 - Effect of warranty obligations and payments on...Ch. 7 - Principle due at maturity versus installments...Ch. 7 - Prob. 9ECh. 7 - Amortization of a long-term loan A partial...Ch. 7 - Prob. 11ECh. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Prob. 14ECh. 7 - Exercise 7-15 Straight-line amortization of a bond...Ch. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Prob. 18ECh. 7 - Prob. 19ECh. 7 - Prob. 20ECh. 7 - Prob. 21ECh. 7 - Exercise 7-22 Preparing a classified balance sheet...Ch. 7 - Exercise 7-23 Effective interest amortization of a...Ch. 7 - Prob. 24ECh. 7 - Prob. 25ECh. 7 - Prob. 26PCh. 7 - Prob. 27PCh. 7 - Prob. 28PCh. 7 - Problem 7-29 Current liabilities The following...Ch. 7 - Prob. 30PCh. 7 - Prob. 31PCh. 7 - Problem 7-32 Accounting for a line of credit Elite...Ch. 7 - Prob. 33PCh. 7 - Prob. 34PCh. 7 - Problem 7-35 Straight-line amortization of a bond...Ch. 7 - Prob. 36PCh. 7 - Prob. 37PCh. 7 - Prob. 38PCh. 7 - Writing Assignment Definition of elements of...Ch. 7 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Periodic inventory accounts, multiple-step income statement, closing entries On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Cash 125,000 Accounts Receivable 340,000 Merchandise Inventory. July 1,2018 415,000 Estimated Returns Inventory 25,000 Office Supplies 9,000 Prepaid Insurance 18,000 Land 300,000 Store Equipment 550,000 Accumulated DepreciationStore Equipment 190,000 Office Equipment 250,000 Accumulated DepreciationOffice Equipment 110,000 Accounts Payable 85,000 Customer Refunds Payable 20,000 Salaries Payable 9,000 Unearned Rent 6,000 Notes Payable 50,000 Amy Gant, Capital 820,000 Amy Gant, Drawing 275,000 Sales 6,590,000 Purchases 4,100,000 Purchases Returns and Allowances 32,000 Purchases Discounts 13,000 Freight In 45,000 Sales Salaries Expense 580,000 Advertising Expense 315,000 Delivery Expense 18,000 Depreciation ExpenseStore Equipment 12,000 Miscellaneous Selling Expense 28,000 Office Salaries Expense 375,000 Rent Expense 43,000 Insurance Expense 17,000 Office Supplies Expense 5,000 Depreciation Expense-Office Equipment 4,000 Miscellaneous Administrative Expense 16,000 Rent Revenue 32,500 Interest Expense 2,500 Instructions 1.Does Simkins Company use a periodic or perpetual inventory system? Explain. 2.Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3.Prepare the closing entries for Simkins Company as of June 30, 2019. 4.What would the net income have been if the perpetual inventory system had been used?arrow_forwardCommunication Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and sales for the year are as follows: Sales April 16,000 units May 16,000 June 20,000 July 24,000 August 28,000 September 28,000 October 18,000 November 10,000 December 8,000 Total units 168,000 Total sales 10,000,000 The president of the company, Connie Kilmer, has asked for your advice on which inventory cost flow method should be used for the 32,000-unit physical inventory that was taken on December 31. The company plans to expand its product line in the future and uses the periodic inventory system. Write a brief memo to Ms. Kilmer comparing and contrasting the LIFO and FIFO inventory cost flow methods and their potential impacts on the companys financial statements.arrow_forwardSales and notes receivable transactions The following were selected from among the transactions completed by Caldemeyer Co. during the current year. Caldemeyer sells and installs home and business security systems. Jan. 3. Loaned 18,000 cash to Trina Gelhaus, receiving a 90-day, 8% note. Feb. 10. Sold merchandise on account to Bradford Co., 24,000. The cost of goods sold was 14,400. I3. Sold merchandise on account to Dry Creek Co., 60,000. The cost of goods sold was 54,000. Mar. 12. Accepted a 60-day, 7% note for 24,000 from Bradford Co. on account. 14. Accepted a 60-day, 9% note for 60,000 from Dry Creek Co. on account. Apr. 3. Received the interest due from Trina Gelhaus and a new 120-day, 9% note as a renewal of the loan of January 3. (Record both the debit and the credit to the notes receivable account.) May 11. Received from Bradford Co. the amount due on the note of March 12. 13. Dry Creek Co. dishonored its note dated March 14. July 12. Received from Dry Creek Co. the amount owed on the dishonored note, plus interest for 60 days at 12% computed on the maturity value of the note. Aug. 1. Received from Trina Gelhaus the amount due on her note of April 3. Oct. 5. Sold merchandise on account, terms 2/10, n/30, to Halloran Co., 13,500. Record the sale net of the 2% discount. The cost of goods sold was 8,100. 15. Received from Halloran Co. the amount of the invoice of October 5, less 2% discount. Instructions Journalize the entries to record the transactions.arrow_forward

- Periodic inventory accounts, multiple-step income statement, closing entries On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Cash 13,500 Accounts Receivable 72,000 Merchandise Inventory, January 1,2019 257,000 Estimated Returns Inventory 35,000 Office Supplies 3,000 Prepaid Insurance 4,500 Land 150,000 Store Equipment 270,000 Accumulated DepreciationStore Equipment 55000 Office Equipment 78,500 Accumulated DepreciationOffice Equipment 16000 Accounts Payable 27,800 Customer Refunds Payable 50,000 Salaries Payable 3,000 Unearned Rent 8,300 Notes Payable 50,000 Shirley Wyman, Capital 515,600 Shirley Wyman, Drawing 25,000 Sales 3280000 Purchases 2650000 Purchases Returns and Allowances 93,000 Purchases Discounts 37,000 Freight In 48,000 Sales Salaries Expense 300,000 Advertising Expense 45,000 Delivery Expense 9,000 Depreciation ExpenseStore Equipment 6,000 Miscellaneous Selling Expense 12,000 Office Salaries Expense 175,000 Rent Expense 28,000 Insurance Expense 3,000 Office Supplies Expense 2,000 Depreciation Expense-Office Equipment 1,500 Miscellaneous Administrative Expense 3,500 Rent Revenue 7,000 Interest Expense 2,000 Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardComprehensive Problem 3Part 5: Note: You must complete parts 1, 2, 3, and 4 of this comprehensive problem before completing part 5. Based on the following information and the post-closing trial balance that follows, prepare a balance sheet in report form at December 31 of the current year: The merchandise inventory is stated at cost by the LIFO method. The product warranty payable is a current liability. Vacation pay payable: Current liability $7,140 Long-term liability 3,360 The unfunded pension liability is a long-term liability. Notes payable: Current liability $ 70,000 Long-term liability 630,000 Kornett CompanyPost-Closing Trial Balance December 31, 20Y5 Account Title Debit Balances Credit Balances Petty Cash 4,500 Cash 243,960 Notes Receivable 100,000 Accounts Receivable 470,000 Allowance for Doubtful Accounts 16,000 Inventory 320,000 Interest Receivable 1,875 Prepaid Insurance 45,640 Office…arrow_forwardComprehensive Problem 3Part 5: Note: You must complete parts 1, 2, 3, and 4 of this comprehensive problem before completing part 5. Based on the following information and the post-closing trial balance that follows, prepare a balance sheet in report form at December 31 of the current year: The merchandise inventory is stated at cost by the LIFO method. The product warranty payable is a current liability. Vacation pay payable: Current liability $7,140 Long-term liability 3,360 The unfunded pension liability is a long-term liability. Notes payable: Current liability $ 70,000 Long-term liability 630,000 Kornett CompanyPost-Closing Trial BalanceDecember 31, 20Y5 Account Title Debit Balances Credit Balances Petty Cash 4,500 Cash 243,960 Notes Receivable 100,000 Accounts Receivable 470,000 Allowance for Doubtful Accounts 16,000 Inventory 320,000 Interest Receivable 1,875 Prepaid Insurance 45,640 Office…arrow_forward

- Exercise 5-7 Recording sales, purchases, shipping, and returns-buyer and seller LO P1, P2 Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $28,500 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy $19,095. Sydney pays $525 cash to Express Shipping for delivery charges on the merchandise. 12 Sydney returns $1,200 of the $28,500 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $804. 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately. (Both Sydney and Troy use a perpetual inventory system and the gross method.) 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.arrow_forwardPARRISH 7-5 END OF PERIOD ADJUSTMENTS Please complete the following, accurately. Thank you. Local Hardware uses periodic inventory method. At the end of the accounting period, the company takes a physical inventory and finds that $20,671 of goods are on hand. Purchases during the period were $76,216 and inventory at the beginning of the period was $25,632. Freight on merchandise coming into the business was $2,799, and returns of merchandise to suppliers amounted to $1776. Please record the journal entry to be made by Local Hardware at the end of the accounting period to close the old inventory and record the new one.arrow_forwardProblem #5 Purchases and Sales Transactions During the month of April 2010, the Mary Paz Abad Company and the Nelson Palete Supply Company entered into the following transactions. Abad purchased merchandise on account from Palete, P243,000. Terms: FOB shipping point; 3/10, n/30. Paid freight charges amounting to P4,000. Apr. 5 Abad purchased merchandise on account from Palete, P470,000. Terms: FOB destination; 3/10, n/30. Freight charges amounted to P7,000. Abad returned P18,000 of merchandise to Palete from the Apr. 5 purchase. 10 Abad paid Palete the amount due on the Apr. 5 transaction less returns and discounts. 11 Abad paid the transportation charges on the Apr. 7 shipment. 14 Abad paid Palete the amount due from the Apr. 7 transaction. Abad purchased merchandise from Palete on account, P270,000. Terms: 20% trade discount; FOB shipping point; 3/10, n/30. 21 Freight charges on the Apr. 21 transaction amounted to P3,000 and were paid by Åbad. 25 26 Abad paid Palete the amount due on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY