Advanced Accounting

12th Edition

ISBN: 9781305084858

Author: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 7.2E

Exercise 7 (LO 4) Equity adjustments with

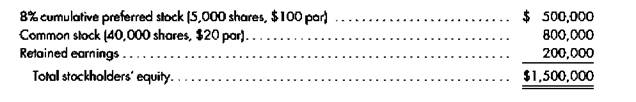

Brian Construction Company did not pay preferred dividends in 2014.

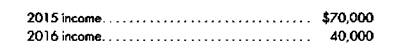

Assume Ace Construction has me following net income (loss) for 2015 and 2016 and does not pay any dividends:

Roller maintains its investment account under the cost method. Prepare the cost-to-equity conversion entries necessary on Roller Company's books to adjust its investment account to the simple equity balance as of January 1, 2017.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

BE17.5 (LO 2) Fairbanks Corporation purchased 400 shares of Sherman Inc. common stock for $13,200 (Fairbanks does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $34.50 per share. Prepare Fairbanks' journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.)

BE17.6 (LO 2) Use the information from BE17.5 but assume the stock is nonmarketable. Prepare Fairbanks' journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment, if any.

GL1501 - Based on Problem 15-4A LO P4

Twist Corp. had no short-term investments prior to year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017.

Apr.

16

Purchased 5,000 shares of Lafayette Co. stock at $26 per share.

July

7

Purchased 3,500 shares of CVF Co. stock at $51 per share.

20

Purchased 1,600 shares of Green Co. stock at $18 per share.

Aug.

15

Received an $1.20 per share cash dividend on the Lafayette Co. stock.

28

Sold 3,000 shares of Lafayette Co. stock at $29 per share.

Oct.

1

Received a $3.30 per share cash dividend on the CVF Co. shares.

Dec.

15

Received a $1.40 per share cash dividend on the remaining Lafayette Co. shares.

31

Received a $2.70 per share cash dividend on the CVF Co. shares.

4. How much is the gain (loss) on the sale of Mad Company ordinary shares on July 18, 2023?

A. P4,500B. P3,000C. P1,500D. P0

5. What is the amount transferred to retained earnings if Jam Company opted to transfer the unrealized gain or loss relating to the shares sold?

A. P11,100B. P5,500C. P5,100D. P1,500

Chapter 7 Solutions

Advanced Accounting

Ch. 7 - Prob. 1UTICh. 7 - Prob. 2UTICh. 7 - Prob. 3UTICh. 7 - Prob. 4UTICh. 7 - Exercise 1 (LO 1) Purchase of shares directly from...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Prob. 6E

Ch. 7 - Prob. 7.1ECh. 7 - Exercise 7 (LO 4) Equity adjustments with...Ch. 7 - Prob. 8.1ECh. 7 - Prob. 8.2ECh. 7 - Prob. 8.3ECh. 7 - Prob. 7.1.1PCh. 7 - Prob. 7.1.2PCh. 7 - Prob. 7.2.1PCh. 7 - Prob. 7.2.2PCh. 7 - Prob. 7.2.3PCh. 7 - Prob. 7.2.4PCh. 7 - Problem 7-4 (LO 3) Sale of partial, then balance...Ch. 7 - Prob. 7.5PCh. 7 - Prob. 7.7.1PCh. 7 - Prob. 7.8.2PCh. 7 - Prob. 7A.1APCh. 7 - Prob. 7A.2.1APCh. 7 - Prob. 7A.2.2AP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. S1: In the statement of changes in equity, the effect of the correction of aprior period error is presented separately for each component of equity.S2: Preference share dividend appear under the retained earnings sectionof the statement of changes in equity A. True, TrueB. False, FalseC. True, FalseD. False True 2.The entity classified a building as held for sale on January 1, 2020. However, the company decided to use it for a product line expansion on December 31, 2020. Which of the following statements are true? The company will record depreciation expense for the year 2020. The company will recognize an impairment loss on January 1, 2020, if applicable. I only II only Both I and II None of the above 3.Which statement is incorrect? Revenues are income that arises from the ordinary course of business activities. Revenues may arise from decrease in liability from primary operations. Generally, revenue is recognized when the earning process is complete and a valid promise of…arrow_forwardProblem 6 (Adapted)Anna company presented the following account balances in the shareholders’ equity section for the year ended December 31, 2018: Preference share capital, 12% P50 par, P3,000,000, Ordinary share capital, P100 par, P6,000,000 and deficit, (P1,350,000). No dividends have been paid on the preference share since 2016. Determine the book value per share under the following conditions:a. Preference share is preferred as to assetsb. Preference share is preferred as to dividendarrow_forwardE 4-4 Equity method The stockholder’s equity accounts of Pop Corporation and Son Corporation at December 31, 2015, were as follows (in thousands): Pop Corporation Son Corporation Capital stock $1,200 $500 Retained earnings 500 100 Total $1,700 $600 On January 1, 2016, Pop Corporation acquired an 80 percent interest in Son Corporation for $580,000. The excess fair value was due to Son’s equipment being undervalued by $50,000 and unrecorded patents. The undervalued equipment had a five-year remaining useful life when Pop acquired its interest. Patents are amortized over 10 years. The income and dividends of Pop and Son are as follows (in thousands): Pop Son 2016 2017 2016 2017 Net income $340 $350 $120 $150 Dividends 240 250 80 90 Required Assume that Pop Corporation uses the equity…arrow_forward

- E 4-4 Equity method The stockholder’s equity accounts of Pop Corporation and Son Corporation at December 31, 2015, were as follows (in thousands): Pop Corporation Son Corporation Capital stock $1,200 $500 Retained earnings 500 100 Total $1,700 $600 On January 1, 2016, Pop Corporation acquired an 80 percent interest in Son Corporation for $580,000. The excess fair value was due to Son’s equipment being undervalued by $50,000 and unrecorded patents. The undervalued equipment had a five-year remaining useful life when Pop acquired its interest. Patents are amortized over 10 years. The income and dividends of Pop and Son are as follows (in thousands): Pop Son 2016 2017 2016 2017 Net income $340 $350 $120 $150 Dividends 240 250 80 90 Required Assume that Pop Corporation uses the equity…arrow_forward33. On December 31, 2018, Calm Company appropriately reported P80, 000 unrealized loss in OIC for equity securities measured irrevocably at FVOCI. Security Cost Fair value at 12/31/19 X 1, 250, 000 1, 600, 000 Y 1, 000, 000 950, 000 Z 1, 750, 000 1, 250, 000 What amount of unrealized loss is recognized in the 2019 statement of changes in equity? a.280,000 b.200,000 c.120,000 d.0arrow_forward1. A company declared a cash dividend on its ordinary shares in December 2020 payable in January 2021. Retained earnings would A. increase on the date of declaration. B. not be affected on the date of payment C. not be affected on the date of declaration D. decrease on the date payment 2. Which of the following should be presented in the statement of changes in equity? A. Distributions to owners B. Investments by owners C. Change in ownership interest in subsidiary that does not result in a loss of control D. All of these are presented in the statement of changes in equityarrow_forward

- Ma4. Question – Changes in Corporation a) Forde Inc. owned a 80% interest in Scott Inc on January 1, 2012, when Scott Inc had the following stockholders' equity: Common stock ($20 par).............................. $360,000 Paid-in capital in excess of par...................... 700,000 Retained earnings.....................................440,000 Total stockholders' equity.......................... $1,500,000 On July 1, 2012, Scott Inc sold 10,000 additional shares to minority shareholders in a public offering for $50 per share. Scott Inc net income for 2012 was $160,000, and the income was earned evenly during the year. Forde Inc. uses the simple equity method to record the investment in Scott Inc. Summary entries are made each December 31 to record the year's activity. Required: Prepare Forde Inc. equity adjustments for 2012 that result from changes in the investment in ScottInc. account. Assume Forde Inc. has $1,000,000 of paid-in capital in excess of par.arrow_forwardExercise 4 – 7On January 1, 2020, Levesque Co. purchased 500,000 ordinary shares of Rowland Co. at ₱14 per share, representing a 25% ownership in Rowland. This allowed Levesque to exercise significant control over Rowland. Rowland declared and paid dividends of ₱1 and ₱2 in 2020 and 2021, respectively. At the end of 2020 and 2021, Rowland’s shares were trading at ₱15 and ₱17 per share. Rowland’s net income in 2020 and 2021 was ₱2,400,000 and ₱3,200,000, respectively.1. Determine the investment income recognized by Levesque in 2020 and 2021.2. Determine the carrying amount of Levesque’s investment on December 31, 2020, and December 31, 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License