PRIN.OF CORP.FINANCE-CONNECT ACCESS

13th Edition

ISBN: 2810023360757

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 9PS

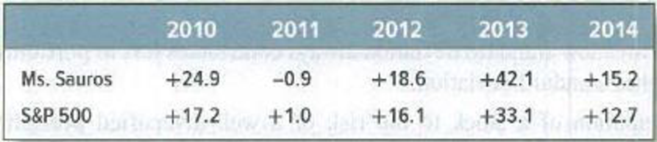

Average returns and standard deviation During the boom years of 2010–2014, ace mutual fund manager Diana Sauros produced the following percentage

Calculate the average return and standard deviation of Ms. Sauros’s mutual fund. Did she do better or worse than the market by these measures?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

During the boom years of 2010-2014, ace mutual fund manager Diana Sauros produced the following percentage rates of return. Rates

of return on the market are given for comparison.

Ms. Sauros

S&P 500

2010

+24.9

+17.2

2011 2012 2013 2014

-0.9 +18.6 +42.1 +15.2

+1.0 +16.1 +33.1 +12.7

a. Calculate the average return and standard deviation of Ms. Sauros's mutual fund. (Use decimals, not percents, In your calculations.

Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

Answer is complete but not entirely correct.

Average rate of return

Standard deviation

19.98 %

10.00 %

You have been given the following return information for a mutual fund, the mark

return correlation between the fund and the market is 0.97.

Market

Risk-Free

Fund

Year

2011

-20.6%

-39.5%

1%

2012

25.1

21.0

3

13.9

2013

13.9

2014

7.6

8.8

4

2015

-2.1

-5.2

What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate

places.)

Sharpe ratio

Treynor ratio

Investments are made to earn a return, but making investments requires the individual to bear risk. A higher return by itself does not necessarily indicate superior performance. It may simply be the result of taking more risk. Given this context, answer the following two-part questions.

A mutual fund generates a 10.8 percent return. During the same period, the market rose by 8.8 percent. If the risk-free rate was 2 percent and the fund had a beta of 1.2 :

Did the fund outperform the market? Explain your response.

Chapter 7 Solutions

PRIN.OF CORP.FINANCE-CONNECT ACCESS

Ch. 7 - Rate of return The level of the Syldavia market...Ch. 7 - Real versus nominal returns The Costaguana stock...Ch. 7 - Arithmetic average and compound returns Integrated...Ch. 7 - Risk premiums Here are inflation rates and U.S....Ch. 7 - Risk Premium Suppose that in year 2030, investors...Ch. 7 - Stocks vs. bonds Each of the following statements...Ch. 7 - Expected return and standard deviation A game of...Ch. 7 - Standard deviation of returns The following table...Ch. 7 - Average returns and standard deviation During the...Ch. 7 - Prob. 10PS

Ch. 7 - Prob. 11PSCh. 7 - Diversification Here are the percentage returns on...Ch. 7 - Risk and diversification In which of the following...Ch. 7 - Prob. 14PSCh. 7 - Portfolio risk To calculate the variance of a...Ch. 7 - Portfolio risk a) How many variance terms and how...Ch. 7 - Portfolio risk Table 7.8 shows standard deviations...Ch. 7 - Portfolio risk Hyacinth Macaw invests 60% of her...Ch. 7 - Stock betas What is the beta of each of the stocks...Ch. 7 - Stock betas There are few, if any, real companies...Ch. 7 - Portfolio betas A portfolio contains equal...Ch. 7 - Portfolio betas Suppose the standard deviation of...Ch. 7 - Portfolio risk Here are some historical data on...Ch. 7 - Portfolio risk Suppose that Treasury bills offer a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In the chapter opener, you learned that Bill Miller's investment performance was alternating between the very top and the very bottom of his profession. What aspect of his investment strategy would lead you to expect that his performance might exhibit greater volatility than that of other mutual funds? The following table shows the annual performance from 2009 to 2012 of Miller's Opportunity fund and the S&P 500 index. Opportunity Year 2009 2010 2011 2012 S&P 500 Fund Return 76.0% 16.6% -34.9% 39.6% Return 26.5% 15.1% 2.11% 16.0% Calculate the average annual return of the Opportunity fund and the S&P 500. Which performed better over this period? If you had invested $1,000 in each in- vestment at the beginning of 2009, how much money would you have in each investment at the end of 2012? Calculate the standard deviation of the Opportu- nity fund's return and those of the S&P 500. Which is more volatile?arrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. Fund Market Risk-Free Year 2011 -21.84 -41.58 38 2012 2013 2014 25.1 21.2 4 14.1 14.5 2 6.4 8.8 -5.2 4 2015 -2.22 3 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Sharpe ratio Treynor ratioarrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. Year 2011 2012 2013 2014 2015 Fund -15.2% 25.1 12.4 6.2 -1.2 Sharpe ratio Market -24.5% 19.5 9.4 7.6 -2.2 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Treynor ratio X Answer is complete but not entirely correct. Risk-Free 1% 3 2 4 2 0.2273 x 3.4773 Xarrow_forward

- In a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Fund Market index 1 -1.2 -0.9 2 +24.8 +16.0 a. Average return a. Standard deviation b. Did Ms. Sauros do better or worse than the market index on these measures? +40.7 +31.7 4 +11.1 +10.9 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. b. Did Ms. Sauros do better or worse than the market index on these measures? Mesozoic Fund Return Market Portfolio. Return +0.3 -0.7 11.40arrow_forwardFund F has been investing in stocks and bonds. You are evaluating the performance of Fund F by comparing its performance with the performance of an appropriate benchmark portfolio B. The performance and weights of F and B over the last year are given in the table below: Asset Class Weight in F Weight in B 0.6 Stocks 0.5 Bonds 0.5 Attribute the performance of Fund F against benchmark portfolio B in the stock class. What is the attribution due to the asset allocation in the stock class? What is the attribution due to the security selection in the stock class? 0.4 Return from F O a. -0.005, -0.008 O b. 0.003; 0.004 O c. 0.012, 0.008 O d. 0.008; 0.012 10% Return from B 3% 8% 5%arrow_forwardYou have been given the following return information for two mutual funds (Papa and Mama), the market index, and the risk-free rate. Year Papa Fund Mama Fund Market Risk-Free 2011 –12.6 % –22.6 % –24.5 % 1 % 2012 25.4 18.5 19.5 3 2013 8.5 9.2 9.4 2 2014 15.5 8.5 7.6 4 2015 2.6 –1.2 –2.2 2 Calculate the Sharpe ratio, Treynor ratio, Jensen’s alpha, information ratio, and R-squared for both funds. (Input all amounts as positive values. Do not round intermediate calculations. Enter all answers as a decimal value rounded to 4 decimal places.) PAPA MAMA SHARPE RATIO: TREYNOR RATIO JENSEN'S ALPHA INFORMATION RATIO R-SQUAREDarrow_forward

- In a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Fund Market index -1.2 -0.9 2 +24.8 +16.0 a. Average retur a. Standard deviation b. Did Ms. Sauros do better or worse than the market index on these measures? 3 +40.7 +31.7 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. b. Did Ms. Sauros do better or worse than the market index on these measures? Answer is complete but not entirely correct. Mesozoic Fund Return Better +11.1 +10.9 19.23 15.14 x Market Portfolio Return 19.53 +0.3 -0.7 8.85 xarrow_forward"The following table gives the rate of return for a certain mutual fund from 2010 to 2014: Year Rate of Return 2010 -5.9% 2011 11.4% 2012 1.4% 2013 12.7% 2014 6.5% Compute the overall rate of return during this period. Round your answer to the nearest tenth of a percent."arrow_forwardLast year, two mutual funds, OHH and FLL, reported the same return and standard deviation, but OHH's beta was higher than FLL's beta. Based on the Sharpe measure, which mutual fund performed better last year? A. FLL B. OHH C. They had the same performance. D. Undetermined because their alphas are unknown.arrow_forward

- You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. Year 2011 2012 2013 2014 2015 Fund -15.2% 25.1 12.4 6.2 -1.2 Market -24.5% 19.5 Jensen's alpha Information ratio 9.4 7.6 -2.2 Calculate Jensen's alpha for the fund, as well as its information ratio. (Do not round intermediate calculations. Enter the alpha as a percent rounded to 2 decimal places. Round the ratio to 4 decimal places.) Risk-Free 1% 3 2 4 2 %arrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. 1TTT Fund Risk-Free Market Year 2011 -20.6% -39.5% 2012 25.1 21.0 3 2013 13.9 13.9 2 2014 7.6 8.8 2015 -2.1 -5.2 2 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Sharpe ratio Treynor ratioarrow_forwardFinance Consider the following information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.89. Year Fund Market Risk-Free 2008 -21.2 % -40.5 % 2 % 2009 25.1 21.1 4 2010 14 14.2 2 2011 6.2 8.8 4 2012 -2.16 -5.2 3 What are the Sharpe and Treynor ratios for the fund? (Round your answer to 4 decimal places.) Treynor ratio 2. Refer to the table below. 3 Doors, Inc. Down Co. Expected return, E (R) 16 % 9.5 % Standard deviation, σ 31 19 Correlation .40 Using the information provided on the two stocks in the table above, find the expected return and standard deviation on the minimum variance portfolio. (Round your answer to 2 decimal places. Omit the "%" sign in your response.) Expected Return % Expected return 3. Consider the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Chapter 8 Risk and Return; Author: Michael Nugent;https://www.youtube.com/watch?v=7n0ciQ54VAI;License: Standard Youtube License