Concept explainers

>Continuing Problem

P7-30 Using all journals

This problem continues the Daniels Consulting situation. Daniels Consulting performs systems consulting. Daniels has also begun selling accounting software and uses the perpetual inventory system to account for software inventory. During January 2017, Daniels completed the following transactions:

Jan. 2 Completed a consulting engagement and received cash of $5,700.

2 Prepaid three months office rent, $2,400.

7 Purchased 50 units software inventory on account from Miller Co., $1,050, plus freight in, $50.

18 Sold 40 software units on account to Jason Needle, $2,625 (cost, $880).

19 Consulted with a client, Louis Frank, for a fee of $2,500 on account. (Use general journal.)

20 Paid employee salaries, $1,885, which includes accrued salaries from December of $685. Paid Miller Co. on account, $1,100. There was no discount.

21 Purchased 185 units software inventory on account from Whitestone Co., $4,810. Received bill and paid utilities, $375.

22 Sold 135 units software for cash, $5,265 (cost, $3,470).

24 Recorded the following

- Accrued salaries expense, $775

Depreciation on Equipment, $60; Depreciation on Furniture, $50- Expiration of prepaid rent, $800

- Physical count of software inventory, 50 units, $1,300

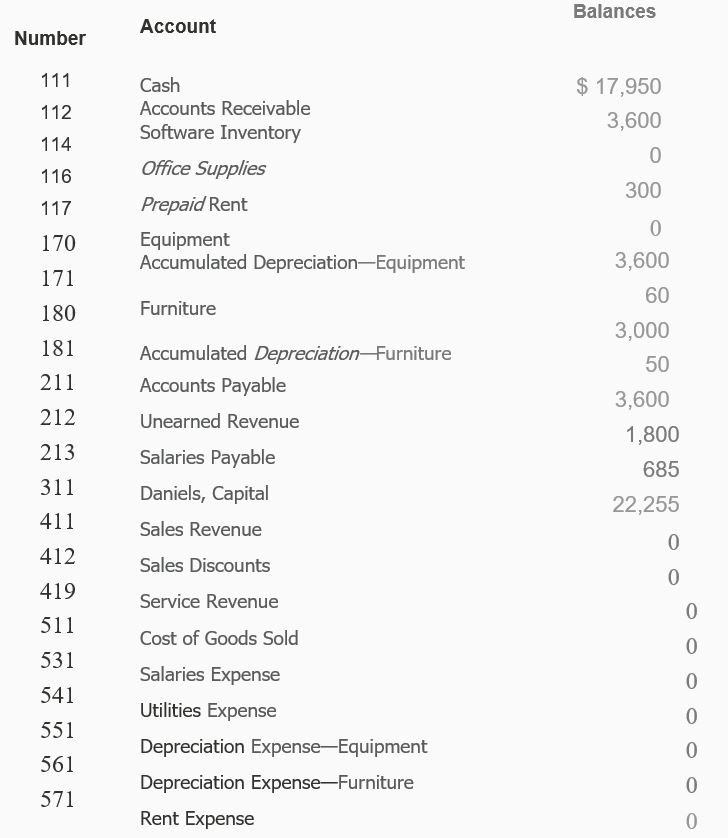

Daniels Consulting had the following

selected accounts with account numbers and normal balances:

Requirements

- Use the appropriate journal to record the preceding transactions in a sales journal (omit the Invoice No. column), a cash receipts journal, a purchases journal, a cash payments journal (omit the Check No. column), and a general journal.

- Total each column of the special journals. Show that total debits equal total credit in each special journal.

- Show how postings would be made from the journals by writing the account numbers and check marks in the appropriate places in the journals.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting, The Financial Chapters (My Accounting Lab)

- This problem challenges you to apply your cumulative accounting knowledge to move a step beyond the material in the chapter. Days cash is outstanding for merchandise: 54.04 days Combining the information provided by various ratios can enhance your understanding of the financial condition of a business. Review the information provided for Na Pali Coast Company in the Mastery Problem. Using this information, respond to the following questions: REQUIRED 1. Compute the average number of days required to sell inventory and collect cash from customers buying on account. 2. Note that Na Pali Coast Company also buys inventory on account. On average, how many days pass before Na Pali pays its creditors? 3. Using the information from your answers to parts (1) and (2), compute the number of days from the time Na Pali Coast pays for inventory until it receives cash from customers on account.arrow_forwardCurrent Attempt in Progress Sandhill Company uses special journals and a general journal. The following transactions occurred during September 2022 Sold merchandise on account to H. Drew, invoice no. 101. $745, terms n/30. The cost of the merchandise sold was $455. Sept. 2 10 12 21 25 27 Purchased merchandise on account from A. Pagan $600, terms 2/10, n/30. Purchased office equipment on account from R. Cairo $6,200. Sold merchandise on account to G. Holliday, invoice no. 102 for $785, terms 2/10, n/30. The cost of the merchandise sold was $430 Purchased merchandise on account from D. Downs $860, terms n/30. Sold merchandise to S. Miller for $665 cash. The cost of the merchandise sold was $420.arrow_forwardI need help working out problems like these. Please explain in detail each step used to complete these journals. Perpetual: LIFO and Moving-Average Vozniak Company began business on January 1, 20-1. Purchases and sales during the month of January follow. Date Purchases Sales Units Cost/Unit Units Jan. 1 100 $2.00 Jan. 5 500 2.30 Jan. 7 300 Jan. 12 300 2.40 Jan. 15 300 Jan. 17 200 2.50 Jan. 19 500 2.70 Jan. 24 800 Jan. 28 100 Jan. 31 200 2.90 Required: Calculate the total amount to be assigned to cost of goods sold for January and the ending inventory on January 31, under each of the following methods. In your calculations round the average unit cost to four decimal places. If required, round your final answers to the nearest cent. Cost of Goods Sold Inventory on Hand 1. Perpetual LIFO inventory method $ $ 2. Perpetual moving-average inventory method $ $arrow_forward

- UNIVERSAL APPLIANCES uses a perpetual system The following are the recent merchandising transactions : 2017 Dec 17 Purchased 10 juicer machines from Westpoint on credit. Invoice price, $300 per unit, for a total of $3,000. The terms of purchase were 2/10, n/30. Dec 18 Sold two of these units for $450 each. Dec 27 Paid the account payable to Westpoint within te discount period. Required : Record journal entries assuming that UNIVERSAL APPLIANCES records purchases at : Net Cost Gross Invoice Price Assume that UNIVERSAL APPLIANCES did not pay within discount period. Record journal entries for making payment on Dec 29 at : Net Cost Method Gross Invoice Price Methodarrow_forwardComfy Recliner Chairs completed the following selected transactions: i (Click the icon to view the transactions.) Record the transactions in the journal of Comfy Recliner Chairs. Explanations are not required. (Round to the nearest dollar.) (Record debits first, then credits. Exclude explanations from journal entries. For notes stated in days, use a 365-day year.) Begin with the transactions for 2024. Jul. 1: Sold inventory to Good - Mart, receiving a $37,000, nine-month, 14% note. Ignore Cost of Goods Sold. Date Debit Credit 2024 Jul. 1 Accounts C More info 2024 Jul. 1 Oct. 31 Dec. 31 Dec. 31 2025 Apr. 1 Jun. 23 Aug. 22 Nov. 16 Dec. 5 Dec. 31 Sold merchandise inventory to Good-Mart, receiving a $37,000, nine-month, 14% note. Ignore Cost of Goods Sold. Recorded cash sales for the period of $21,000. Ignore Cost of Goods Sold. Made an adjusting entry to accrue interest on the Good-Mart note. Made an adjusting entry to record bad debt expense based on an aging of accounts receivable. The…arrow_forwardView Policies Current Attempt in Progress Your accounts receivable clerk, Helen Adams, to whom you pay a salary of $1,540 per month, has just purchased a new Acura. You decide to test the accuracy of the accounts receivable balance of $85,700 as shown in the ledger. The following information is available for your first year in business. Collections from customers Merchandise purchased (1) (2) (3) Ending merchandise inventory (4) Goods are marked to sell at 40% above cost $196,400 321,300 98,550 Compute an estimate of the ending balance of accounts receivable from customers that should appear in the ledger and any apparent shortages. Assume that all sales are made on account. The ending balance of accounts receivable from customers $ Apparent shortagearrow_forward

- Ajman-Retail-Mart-Mart LLC completed the following merchandising transactions in the month of March 2024. At the beginning of March, the ledger of Ajman-Retail-Mart showed Cash of AED12,000 and Owner's Capital of AED450,000. The following are the transactions in March. Date Transactions March 2 Purchased merchandise on account from Wahid Supply AED6,200, terms 1/10, n/30. 4 Sold merchandise on account AED5,500, FOB destination, terms 1/10, n/30. The cost of the merchandise sold was AED3,400. 5 Paid AED240 freight on April 4 sale. 6 11 13 14 16 18 Received credit from Wahid Supply for merchandise returned AED500. Paid Wahid Supply in full, less discount. Received collections in full, less discounts, from customers billed on April 4. Purchased merchandise for cash AED3,800. Received refund from supplier for returned goods on cash purchase of April 14, AED500. Purchased merchandise from Bayan LLC AED4,500, FOB shipping point, terms 2/10, n/30. 20 23 26 27 29 222222 30 Paid freight on…arrow_forwardTransaction Analysis Pollys Cards $ Gifts Shop had the following transactions during the year: Pollys purchased inventory on account from a supplier for $8,000. Assume that Pollys uses a periodic inventory system. On May 1, land was purchased for $44,500. A 20% down payment was made, and an 18-month, 8% note was signed for the remainder. Pollys returned $450 worth of inventory purchased in (a), which was found broken when the inventory was received. Pollys paid the balance due on the purchase of inventory. On June 1, Polly signed a one-year, $15,000 note to First State Bank and received $13,800. Pollys sold 200 gift certificates for $25 each for cash. Sales of gift certificates are recorded as a liability. At year-end, 35% of the gift certificates had been redeemed. Sales for the year were $120,000, of which 90% were for cash. State sales tax of 6% applied to all sales must be remitted to the state by January 31. Required Record all necessary journal entries relating to these transactions. Assume that Pollys accounting year ends on December 31. Prepare any necessary adjusting journal entries. What is the total of the current liabilities at the end of the year?arrow_forwardAnalyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forward

- Record journal entries for the following transactions of Furniture Warehouse. A. July 5: Purchased 30 couches at a cost of $150 each from a manufacturer. Credit terms are 2/15, n/30, invoice date July 5. B. July 10: Furniture Warehouse returned 5 couches for a full refund. C. July 15: Furniture Warehouse found 6 defective couches, but kept the merchandise for an allowance of $500. D. July 20: Furniture Warehouse paid their account in full with cash.arrow_forwardPuzzles, Pranks ** Games is a retail business selling children’s toys and games as well as a wide selection of jigsaw puzzles and accessories. They purchase their inventory from local and national wholesale suppliers. For the year ending December 31, 2017, they reported these revenues and expenses. Using this information, prepare an income statement for Puzzles, Pranks & Games for 2017.arrow_forwardLevchenko Company purchased inventories from a vendor for $16,000 on July 1. The purchase was financed through a $10,000 note with the remainder paid in cash. The vendor charged an additional $400 for shipping, on account. Levchenko paid a moving company $700 cash to move the inventory to a different warehouse. Interest on the note totaled $50, payable in August. a. Determine the cost to be assigned to the inventory. $ b. Record the transactions using the financial statement effects template. Note: Use negative signs with your answers, when appropriate. Select "N/A" as your answer if a part of the accounting equation is not affected. Transaction a. Inventory purchase b. Shipping charge c. Moving cost d. Interest incurred Totals Cash Asset ♦ ◆ ◆ ◆ 0 + Noncash Asset ◆ ◆ ◆ ◆ 0 Balance Sheet Liabilities ◆ ◆ ◆ 0 Contributed + Capital + Earned Capital ♦ ◆ ♦ ♦ 0 Revenues Income Statement Expenses ◆ ◆ ◆ 0 Net = Income 0arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College