Concept explainers

To calculate: The rate of crossover for two projects and sketch the NPV profile.

Introduction:

The

Answer to Problem 11QP

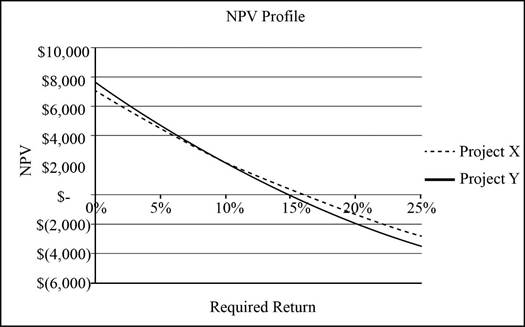

The crossover rate for the two projects is 7.62%. The NPV profiles shows that both projects have a higher NPV for the rate of discount below 7.62% and have a lower NPV for the rate above 7.62%.

Explanation of Solution

Given information:

The details of two projects are provided. The cash flows of project X for year 1, year 2, and year 3, are $13,100, $9,480, and $7,890 respectively. The initial investment is $23,400. The project Y cash flows for 4 years are $9,200, $10,620, $11,180 respectively and the initial investment is $23,400.

Note:

- NPV is the difference between the present values of the cash inflows and the present value of the cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equals zero. Hence, using the available information, assume that NPV is equal to zero and form an equation to compute the IRR.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

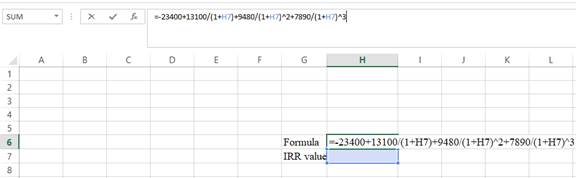

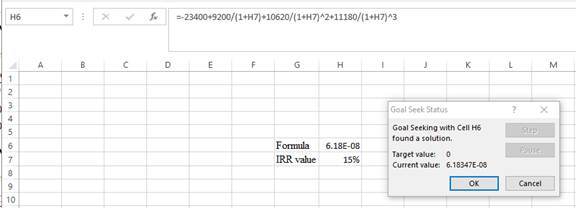

Compute IRR for project X using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

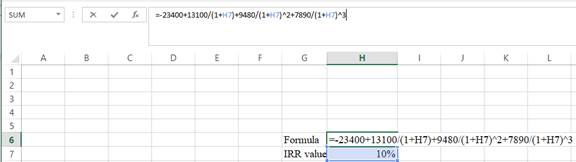

Step 2:

- Assume the IRR value as 10%.

Step 3:

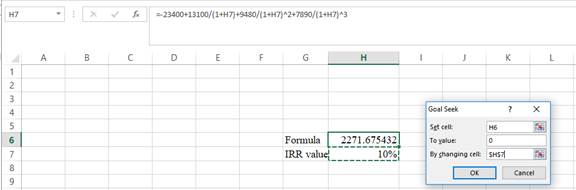

- In the spreadsheet, go to data and select the What-if analysis

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

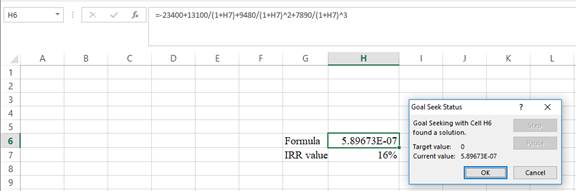

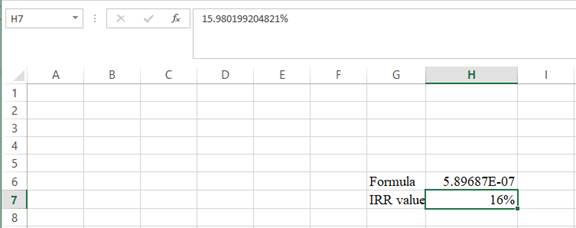

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRR value.

Step 5:

- The value appears to be 15.980199204821%.

Hence, the IRRvalue is 15.98%.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

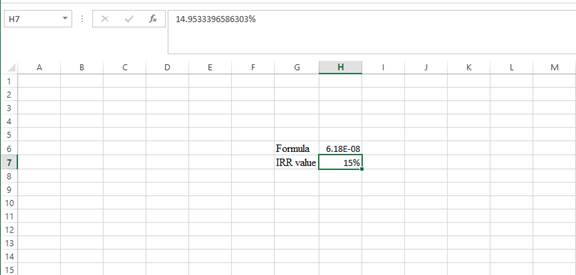

Compute IRR for project Y using a spreadsheet:

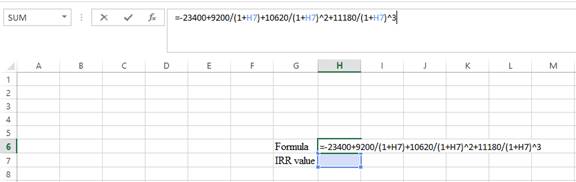

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

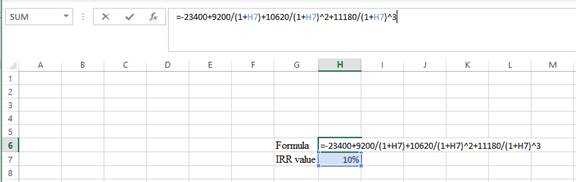

Step 2:

- Assume the IRR value as 10%.

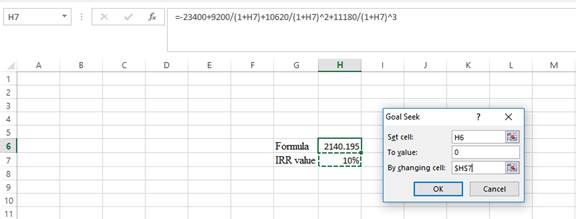

Step 3:

- In the spreadsheet, go to data and select the What-if analysis.

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRRvalue.

Step 5:

- The value appears to be 14.953339658603%.

Hence, the IRRvalue is 14.95%.

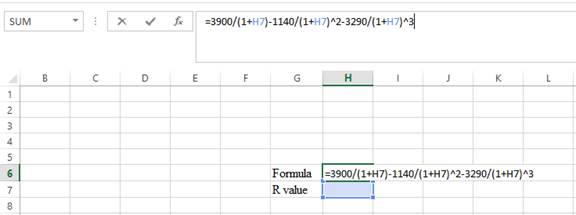

Formula to compute the crossover rate:

Equation of crossover rate to compute R:

Where,

“R” denotes the crossover rate.

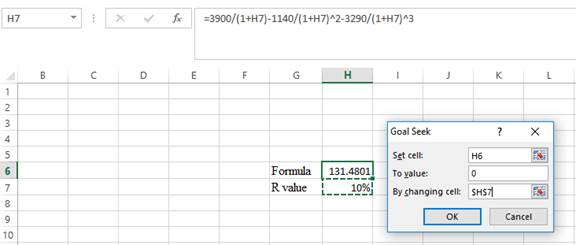

Compute R using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

- Assume the IRR value as 10%.

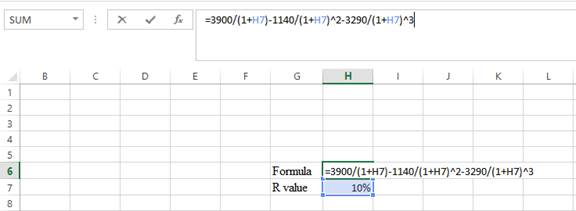

Step 3:

- In the spreadsheet, go to data and select the What-if analysis.

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

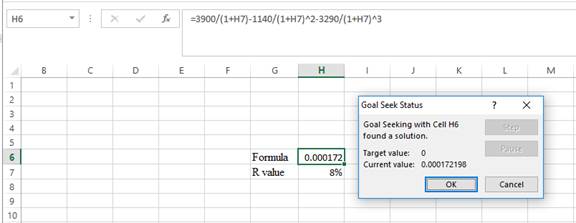

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRRvalue.

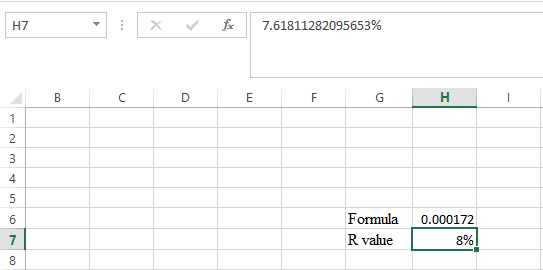

Step 5:

- The value appears to be 7.61811282095653%.

Hence, the R-value is 7.62%.

Formula to calculate the NPV:

Note: As the discount rate is over a range of 0% to 25%, calculate NPV for 0%, 5%, 10%, 15%, 20%, and 25%.

Compute the NPV with the discount rate of 0% for project X:

Compute the NPV with the discount rate of 0% for project Y:

Hence, the NPV for project X and Y at 0% are $7,070 and $7,600 respectively.

Compute the NPV with the discount rate of 5% for project X:

Compute the NPV with the discount rate of 5% for project Y:

Hence, the NPV for project X and Y at 5% are $4,490.51 and $4,652.26 respectively.

Compute the NPV with the discount rate of 10% for project X:

Compute the NPV with the discount rate of 10% for project Y:

Hence, the NPV for project X and Y at 10% are $2,271.68 and $2,140.20 respectively.

Compute the NPV with the discount rate of 15% for project X:

Compute the NPV with the discount rate of 15% for project Y:

Hence, the NPV for project X and Y at 15% are $347.35 and -$18.72 respectively.

Compute the NPV with the discount rate of 20% for project X:

Compute the NPV with the discount rate of 20% for project Y:

Hence, the NPV for project X and Y at 20% are -$1,334.03 and -$1,888.43 respectively.

Compute the NPV with the discount rate of 25% for project X:

Compute the NPV with the discount rate of 25% for project Y:

Hence, the NPV for project X and Y at 25% are -$2,813.12 and -$3,519.04 respectively.

NPV profile:

Want to see more full solutions like this?

Chapter 8 Solutions

ESSENTIALS OF CORPORATE FINANCE (LL)

- Consider projects A and B with the following cash flows: C0 C1 C2 C3 A − $ 27 + $ 16 + $ 16 + $ 16 B − 52 + 27 + 27 + 27 a-1. What is the NPV of each project if the discount rate is 10%? (Do not round intermediate calculations. Round your answers to 2 decimal places.) a-2. Which project has the higher NPV? b-1. What is the profitability index of each project? (Do not round intermediate calculations. Round your answers to 2 decimal places.) b-2. Which project has the higher profitability index? c. Which project is most attractive to a firm that can raise an unlimited amount of funds to pay for its investment projects? d. Which project is most attractive to a firm that is limited in the funds it can raise?arrow_forwardConsider the investment project with net cash flows shown. There are 2 rates of return for the project. One is 43.47%. What is the other? Enter as a percentage without the percent sign. For instance, if your answer is 10.23%, enter as 10.23. n Net Cash Flow 0 -$8000 1 $10000 2 $30000 3 -$40000arrow_forwardGiven the two projects with given cash flows, the NPV of project A is how many more (or less use the negative sign if less) dollars than project B if the discount rate is 9%? Answer with two decimals. Project A Project B CF0: -12,810 CF1: 3,938 CF2: 4,973 CF3: 9,512 CF4: 9,668 CF5: 2,382 CF0: -12,810 -12,970 CF1: 3,938 1,850 CF2: 4,973 2,692 CF3: 9,512 5,045 CF4: 11,857 8,567 CF5: 2,382 14,700arrow_forward

- Here is the cash flow for two mutually exclusive projects. Project C0 C1 C2 C3 A -$20,000 $8,000 $8,000 $8,000 B -$20,000 0 0 $25,000 At what interest rate would you prefer project A to B? ( NPV Value) 2. What is the IRR of each project? Explain you answer using formulas.arrow_forwardHere are the cash flows for a project under consideration: C0 C1 C2 −$7,510 +$5,420 +$19,200 a. Calculate the project’s net present value for discount rates of 0, 50%, and 100%. (Round your answers to the nearest whole dollar.) b. What is the IRR of the project? (Do not round intermediate calculations. Enter your answer as a whole percent.)arrow_forwardNPV Your division is considering two projects with the following cash flows (in millions): a. What are the projects’ NPVs assuming the WACC is 5%? 10%? 15%?b. What are the projects’ IRRs at each of these WACCs?c. If the WACC was 5% and A and B were mutually exclusive, which project would you choose? What if the WACC was 10%? 15%? (Hint: The crossover rate is 7.81%.)arrow_forward

- Consider the following cash flows: C0=-$42 C1=+$38 C2=+$38 C3=+$38 C4=-$76 a. Which two of the following rates are the IRRs of this project? 2.5% 7.8% 14.3% 32.5% 40.0% b. What is project NPV if the discount rates are 5%, 20%, 40%? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 3 decimal places.)arrow_forwardConsider the following cash flows: C0=-$42 C1=+$38 C2=+$38 C3=+$38 C4=-$76 a. Which two of the following rates are the IRRs of this project? check all that apply 2.5% 7.8% 14.3% 32.5% 40.0% b. What is project NPV if the discount rates are 5%, 20%, 40%? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 3 decimal places.)arrow_forwardQ15. Which of the following is NOT potentially problematic for Internal Rate of Return (IRR)? Group of answer choices 1. IRR cannot cope with multiple future cash flows 2. It is assumed that intermediate cash flow can be reinvested at the same rate as the project IRR 3. IRR may produce nonsense answers when there is unconventional cash flow with more than one change of sign'. 4. When comparing 2 projects with very different sensitivity to the assumed discount rate, IRR may conflict with Net Present Valuearrow_forward

- Consider the following two mutually exclusive projects: Second part of the Question Year Cash Flow(X) Cash Flow(Y) 0 –$ 19,900 –$ 19,900 1 8,825 10,050 2 9,050 7,775 3 8,775 8,675 d) At which range of discount rates would you choose Project X over Project Y? e) At which range of discount rates would you choose Project Y over Project X?arrow_forwardA3 4e We have two mutually exclusive investments with the following cash flows: Year Investment A Investment B 0 –$100 –$100 1 10 50 2 30 40 3 50 30 4 70 20 e. If the required return on this project is 10%, would both NPV and IRR give us the same conclusion? Explain your answer.arrow_forwardConsider the following cash flows: C0=-$42 C1=+$38 C2=+$38 C3=+$38 C4=-$76 a. Which two of the following rates are the IRRs of this project? (You may select more than one answer.) check all that apply 2.5% 7.8% 14.3% 32.5% 40.0% b. What is project NPV if the discount rates are 5%, 20%, 40%? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 3 decimal places.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education