Concept explainers

LO1, LO3, LO4, LO6 15. Comparing Investment Criteria. Consider the following two mutually exclusive projects:

| Year | Cash Flow (A) | Cash Flow (B) |

| 0 | –$235,000 | –$47,000 |

| 1 | 29,000 | 28,700 |

| 2 | 45,000 | 19,900 |

| 3 | 51,000 | 17,300 |

| 4 | 325,000 | 16,200 |

Whichever project you choose, if any, you require a return of 13 percent on your investment.

a. If you apply the payback criterion, which investment will you choose? Why?

b. If you apply the

c. If you apply the

d. If you apply the profitability index criterion, which investment will you choose? Why?

e. Based on your answers in parts (a) through (d), which project will you finally choose? Why?

a)

To compute: The payback period.

Introduction:

Capital budgeting is a process, where the business identifies and assesses potential investments or expenses that are larger (in general).

Answer to Problem 15QP

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $29,000, $45,000, $51,000, $325,000 for Project A for year 1, year 2, year 3, and year 4 respectively. Project A has an initial investment of $235,000. The cash flows of Project B are $28,700, $19,900, $17,300, and $16,200 for year 1, year 2, year 3, and year 4 respectively. The initial investment for Project B is $47,000. The rate of return is 13%.

Formula to compute the payback period of a project:

Compute the payback period of a project for Project A:

Hence, the payback period is 3.34 years for Project A.

Compute the payback period of a project for Project B:

Hence, the payback period is 1.92 years for Project B.

b)

To compute: The NPV (Net Present Value).

Introduction:

Capital budgeting is a process, where the business identifies and assesses potential investments or expenses that are larger (in general).

Answer to Problem 15QP

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $29,000, $45,000, $51,000, $325,000 for Project A for year 1, year 2, year 3, and year 4 respectively. Project A has an initial investment of $235,000. The cash flows of Project B are $28,700, $19,900, $17,300, and $16,200 for year 1, year 2, year 3, and year 4 respectively. The initial investment for Project B is $47,000. The rate of return is 13%.

Formula to calculate the NPV:

Calculate the NPV for Project A:

Hence, the NPV for Project A is $60,579.46.

Calculate the NPV for Project B:

Hence, the NPV for Project B is $15,908.38.

c)

To compute: The IRR for the project.

Introduction:

Capital budgeting is a process, where the business identifies and assesses potential investments or expenses that are larger (in general).

Answer to Problem 15QP

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $29,000, $45,000, $51,000, $325,000 for Project A for year 1, year 2, year 3, and year 4 respectively. Project A has an initial investment of $235,000. The cash flows of Project B are $28,700, $19,900, $17,300, and $16,200 for year 1, year 2, year 3, and year 4 respectively. The initial investment for Project B is $47,000. The rate of return is 13%.

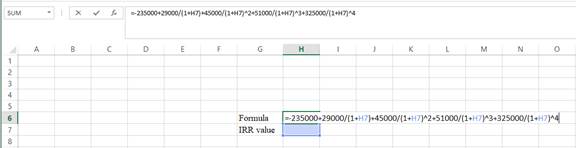

Equation of IRR of Project A:

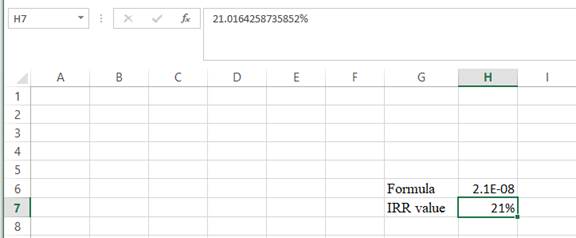

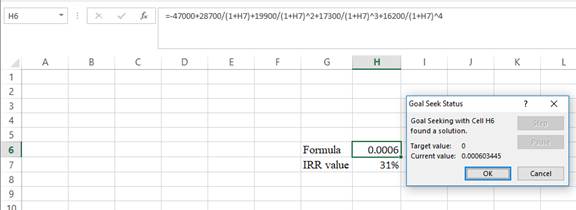

Compute IRR for Project A using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

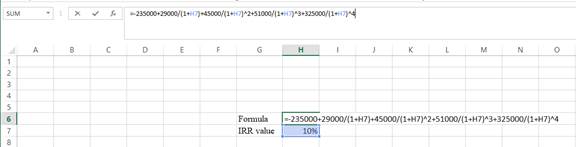

Step 2:

- Assume the IRR value as 10%.

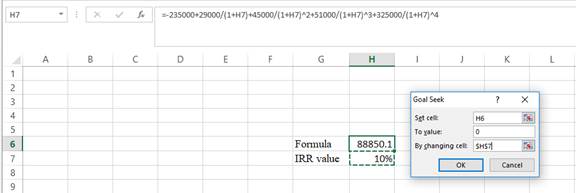

Step 3:

- In the spreadsheet, go to data and select the what-if analysis.

- In the what-if analysis, select goal seek.

- In set cell select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the by changing cell.

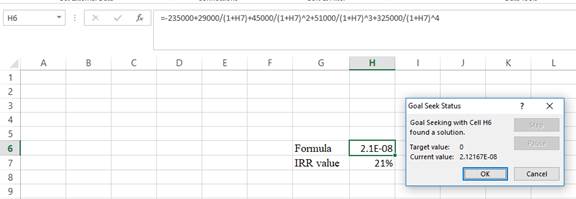

Step 4:

- Following the previous step click OK in the goal seek. The goal seek status appears with the IRR value.

Step 5:

- Thevalue appears to be 21.0164258735852%.

Hence, the IRR value is 21.02%.

Equation of IRR of Project B:

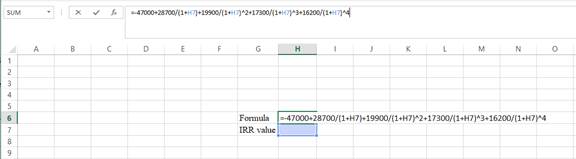

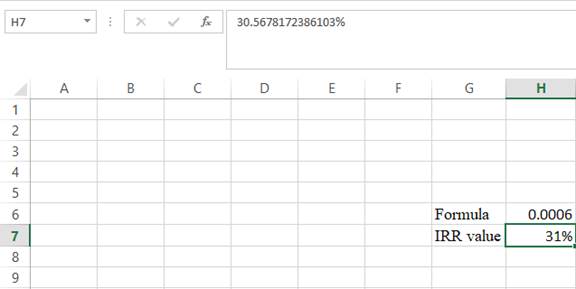

Compute IRR for Project B using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

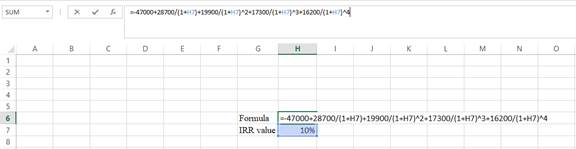

- Assume the IRR value as 10%.

Step 3:

- In the spreadsheet, go to data and select the what-if analysis.

- In the what-if analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the by changing cell.

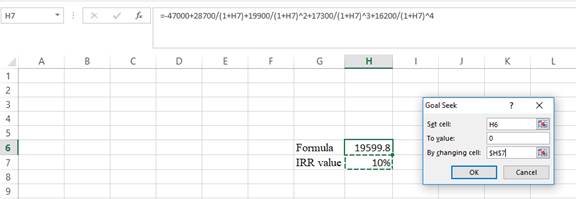

Step 4:

- Following the previous step, click OK in the goal seek. The goal seek status appears with the IRR value.

Step 5:

- Thevalue appears to be 30.5678172386103%.

Hence, the IRR value is 30.57%.

d)

To compute: The profitability index.

Introduction:

Capital budgeting is a process, where the business identifies and assesses potential investments or expenses that are larger (in general).

Answer to Problem 15QP

Explanation of Solution

Given information:

The cash flows for two mutually exclusive projects are $29,000, $45,000, $51,000, $325,000 for Project A for year 1, year 2, year 3, and year 4 respectively. Project A has an initial investment of $235,000. The cash flows of Project B are $28,700, $19,900, $17,300, and $16,200 for year 1, year 2, year 3, and year 4 respectively. The initial investment for Project B is $47,000. The rate of return is 13%.

Formula to compute the profitability index:

Compute the profitability index for Project A:

Hence, the profitability index for Project A is $1.258.

Compute the profitability index for Project B:

Hence, the profitability index for Project B is $1.338.

e)

To discuss: The project that Person X will select with a reason.

Introduction:

Capital budgeting is a process, where the business identifies and assesses potential investments or expenses that are larger (in general).

Explanation of Solution

In this case, the criteria of NPV denote that Project A must be accepted, while payback period, profitability index, and IRR denote that Project B must be accepted. The overall decision must be based on the NPV as it does not have the ranking problem when compared with the other techniques of capital budgeting. Hence, Project A must be accepted.

Want to see more full solutions like this?

Chapter 8 Solutions

ESSENTIALS OF CORPORATE FINANCE (LL)

- Start with the partial model in the file Ch10 P23 Build a Model.xlsx on the textbooks Web site. Gardial Fisheries is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a. If each projects cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? b. Construct NPV profiles for Projects A and B. c. What is each projects IRR? d. What is the crossover rate, and what is its significance? e. What is each projects MIRR at a cost of capital of 12%? At r = 18%? (Hint: Consider Period 7 as the end of Project Bs life.) f. What is the regular payback period for these two projects? g. At a cost of capital of 12%, what is the discounted payback period for these two projects? h. What is the profitability index for each project if the cost of capital is 12%?arrow_forwardComparing Investment Criteria [L01,2,3,5,7] Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$300,000 -$40,000 1 20,000 19,000 2 50,000 12,000 3 50,000 18,000 4 390,000 10,500 Whichever project you choose, if any, you require a 15 per cent return on your investment. a. If you apply the payback criterion, which will you choose? Why? b. If you apply the discounted payback criterion, which investment will you choose? Why? c. If you apply the NPV criterion, which investment will you choose? Why? d. If you apply the IRR criterion, which investment will you choose? Why? e. If you apply the profitability index criterion, which investment will you choose? Why? f. Based on your answers in (a) through (e), which project will you finally choose? Why? Please explain your calculations and conclusionsarrow_forwardConsider the following two projects: cash flows Project A Project B c0 -270 -2170 c1 115 143 c2 115 143 c3 115 143 c4 115 a. If the opportunity cost of capital is 10%, which of these 2 projects would you accept? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 10%. c. Which one would you choose if the cost of capital is 15%? d. What is the payback period for every project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rate of return on the two projects? g. Does the IRR rule in this case gives the same answer as NPV? h1. If the opportunity cost of capital is 10%, whats is the profitability index for each project? h2. Is the project with the highest profitability index also the…arrow_forward

- Consider the following projects: Cash Flows ($) Project C0 C1 C2 C3 C4 C5 A −2,200 2,200 0 0 0 0 B −4,400 2,200 2,200 5,200 2,200 2,200 C −5,500 2,200 2,200 0 2,200 2,200 If the opportunity cost of capital is 10%, which project(s) have a positive NPV? Calculate the payback period for each project. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? Calculate the discounted payback period for each project. Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years?arrow_forward17. Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B)0 −$291,000 −$41,6001 37,000 20,0002 55,000 17,6003 55,000 17,2004 366,000 14,000 a) What is the Internal Rate of Return (IRR) for each of these projects? b) Using the IRR decision rule, which project should the company accept? c) If the required return is 11 percent, what is the Net Present Value (NV) for each of these projects? d) Using the NPV decision rule, which project should the company accept? e) Why do you think the NPV and IRR rules do not agree on same project approval/rejection direction?arrow_forwardHere are the cash flows for two mutually exclusive projects: Project C0 C1 C2 C3 A -$20,000 +$8,000 +$8,000 +$ 10,000 B - 20,000 0 +10,000 + 25,000 a. What is the IRR of each project? b. Investor's expected return is based on risk free rate equal 3% and market risk premium 18%, given beta 1.25, evaluate its investment criteria.arrow_forward

- Q7 - Consider the following project: Year Cash Flow 0 – $ 3,024 1 17,172 2 – 36,420 3 34,200 4 – 12,000 a) Determine the IRR (s) for this project. b) At which rates of return will the project be acceptable?arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$240,000 -$150,000 1 $100,000 $100,000 2 $95,000 $50,000 3 $45,000 $5,000 4 $90,000 $3,000 Whichever project you choose, if any, you require a return of 13% on your investment. a. If you apply the payback criterion, which investment will you choose? Why? b. If you apply the NPV criterion, which investment will you choose? Why? c. Based on your answers in (a) and (b), which project will you finally choose? Why?arrow_forwardYiu are asked to evaluate a capital project (in million 0 1. 2 3 4 Cash flows 75 12 15 39 30 required return 10.0% what is the npv what is the IRR what is the modified internal rate of return what is the payback period would you recommend this projectarrow_forward

- Consider a project with the following cash flows: C0 C1 C2 C3 C4 -20,000 9,000 9,000 9,000 9,000 If the appropriate discount rate for this project is 15%, then the NPV is closest to: Select one: a. -$1,872 b. -$5,700 c. $1,872 d. $5,700arrow_forward5). The HC Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow I (in dollars) Cash Flow II (in dollars) 0 -64, 000 -18,000 1 31, 000 9,700 2 31, 000 9,700 3 31, 000 9,700 a). If the required return is 10%, and the company applies the profitability index decision rule, which project should the firm accept? Why? b). If the company applies the NPV decision rule, which project should it take? Why? c). Explain why your answers in (a) and (b) are different.arrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forward