FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

15th Edition

ISBN: 9781337955423

Author: WARREN, JONES

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 17E

Entries for

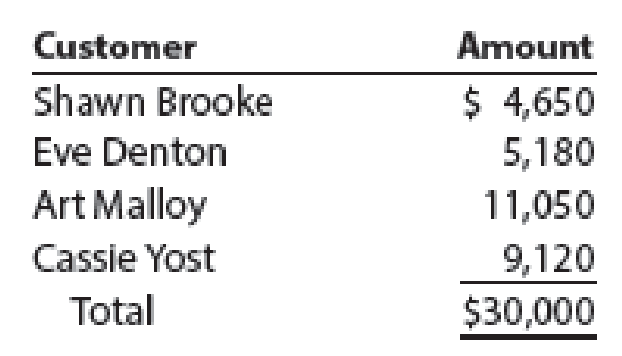

Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:

- A. Journalize the write-offs under the direct write-off method.

- B. Journalize the write-offs under the allowance method. Also, journalize the

adjusting entry for uncollectible accounts. The company recorded $5,250,000 of credit sales during the year. Based on past history and industry averages, ¾% of credit sales are expected to be uncollectible. - C. How much higher (lower) would Casebolt Company’s net income have been under the direct write-off method than under the allowance method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Method

The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31:

June 8.

Wrote off account of Kathy Quantel, $7,910.

Aug. 14.

Received $5,620 as partial payment on the $14,160 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible.

Oct. 16.

Received the $7,910 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt.

Dec. 31.

Wrote off the following accounts as uncollectible (record as one journal entry):

Wade Dolan

$2,290

Greg Gagne

1,420

Amber Kisko

5,460

Shannon Poole

3,160

Niki Spence

870

Dec. 31.

If necessary, record the year-end adjusting entry for uncollectible accounts.

If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank.

a. Journalize the…

Entries for Bad Debt Expense under the Direct Write-Off and Allowance Methods

The following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31:

Apr. 13.

Wrote off account of Dean Sheppard, $6,720.

May 15.

Received $3,360 as partial payment on the $8,940 account of Dan Pyle. Wrote off the remaining balance as uncollectible.

July 27.

Received $6,720 from Dean Sheppard, whose account had been written off on April 13. Reinstated the account and recorded the cash receipt.

Dec. 31.

Wrote off the following accounts as uncollectible (record as one journal entry):

Paul Chapman

$4,500

Duane DeRosa

3,360

Teresa Galloway

2,020

Ernie Klatt

2,820

Marty Richey

1,010

31.

If necessary, record the year-end adjusting entry for the uncollectible accounts.

If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank.…

Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods

The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31:

June 8.

Wrote off account of Kathy Quantel, $8,540.

Aug. 14.

Received $6,060 as partial payment on the $15,290 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible.

Oct. 16.

Received the $8,540 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt.

Dec. 31

Wrote off the following accounts as uncollectible (record as one journal entry):

Wade Dolan

$2,480

Greg Gagne

1,540

Amber Kisko

5,890

Shannon Poole

3,420

Niki Spence

940

Dec. 31 If necessary, record the year-end adjusting entry for uncollectible accounts.Rustic Tables Company prepared the following aging schedule for its accounts receivable:

Aging Class (Numberof Days Past Due)

Receivables Balanceon December 31…

Chapter 8 Solutions

FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

Ch. 8 - What are the three classifications of receivables?Ch. 8 - Dans Hardware is a small hardware store in the...Ch. 8 - What kind of an account (asset, liability, etc.)...Ch. 8 - After the accounts are adjusted and closed at the...Ch. 8 - A firm has consistently adjusted its allowance...Ch. 8 - Which of the two methods of estimating...Ch. 8 - Neptune Company issued a note receivable to...Ch. 8 - If a note provides for payment of principal of...Ch. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Direct write-off method Journalize the following...Ch. 8 - Allowance method Journalize the following...Ch. 8 - Percent of sales method At the end of the current...Ch. 8 - Analysis of receivables method At the end of the...Ch. 8 - Note receivable Prefix Supply Company received a...Ch. 8 - Accounts receivable turnover and days sales in...Ch. 8 - Prob. 1ECh. 8 - Prob. 2ECh. 8 - Entries for uncollectible accounts, using direct...Ch. 8 - Entries for uncollectible receivables, using...Ch. 8 - Entries to write off accounts receivable Creative...Ch. 8 - Providing for doubtful accounts At the end of the...Ch. 8 - Number of days past due Toot Auto Supply...Ch. 8 - Aging of receivables schedule The accounts...Ch. 8 - Estimating allowance for doubtful accounts Evers...Ch. 8 - Adjustment for uncollectible accounts Using data...Ch. 8 - Estimating doubtful accounts Outlaw Bike Co. is a...Ch. 8 - Entry for uncollectible accounts Using the data in...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Effect of doubtful accounts on net income During...Ch. 8 - Effect of doubtful accounts on net income Using...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Determine due date and interest on notes Determine...Ch. 8 - Entries for notes receivable Valley Designs issued...Ch. 8 - Entries for notes receivable The series of five...Ch. 8 - Entries for notes receivable, including year-end...Ch. 8 - Entries for receipt and dishonor of note...Ch. 8 - Entries for receipt and dishonor of notes...Ch. 8 - Prob. 25ECh. 8 - Allowance method entries The following...Ch. 8 - Aging of receivables; estimating allowance for...Ch. 8 - Compare two methods of accounting for...Ch. 8 - Details of notes receivable and related entries...Ch. 8 - Notes receivable entries The following data relate...Ch. 8 - Sales and notes receivable transactions The...Ch. 8 - Allowance method entries The following...Ch. 8 - Aging of receivables; estimating allowance for...Ch. 8 - Compare two methods of accounting for...Ch. 8 - Prob. 4PBCh. 8 - Prob. 5PBCh. 8 - Prob. 6PBCh. 8 - Prob. 1MADCh. 8 - Analyze Ralph Lauren Ralph Lauren Corporation (RL)...Ch. 8 - Analyze L Brands L Brands, Inc. (LB) sells womens...Ch. 8 - Compare Ralph Lauren and L Brands Use the data in...Ch. 8 - Prob. 5MADCh. 8 - Prob. 1TIFCh. 8 - Interest computations Bev Wynn, vice president of...Ch. 8 - Prob. 4TIFCh. 8 - Allowance for doubtful accounts For several years,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Entries for bad debt expense under the direct write-off and allowance methods The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: A. Journalize the transactions under the direct write-off method. B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of 36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: C. How much higher (lower) would Rustic Tables net income have been under the direct write-off method than under the allowance method?arrow_forwardCasebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forwardBristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts receivable. The uncollectible percentage is 3.1% for the income statement method and 4.5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $20,550; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $17,430; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardMillennium Associates records bad debt using the allowance, income statement method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On February 5, Millennium Associates identifies one uncollectible account from Molar Corp in the amount of $1,330. On April 15, Molar Corp unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. February 5, 2018 identification entry C. Entry for payment on April 15, 2018arrow_forwardDetermining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto Parts had an accounts receivable balance of $31,800 and a balance in the allowance for doubtful accounts of $2,980 (credit). During the year, Tennyson had credit sales of $624,300, collected accounts receivable in the amount of $602,700, wrote off $18,600 of accounts receivable, and had the following data for accounts receivable at the end of the period: Required: 1. Determine the desired post adjustment balance in allowance for doubtful accounts. 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 3. Compute bad debt expense. 4. Prepare the adjusting entry to record bad debt expense.arrow_forward

- Funnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable. The uncollectible percentage is 4.4% for the income statement method and 4% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $13,888; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardOlena Mirrors records bad debt using the allowance, balance sheet method. They recorded $343,160 in accounts receivable for the year and $577,930 in credit sales. The uncollectible percentage is 4.4%. On June 11, Olena Mirrors identifies one uncollectible account from Nadia White in the amount of $4,265. On September 14, Nadia Chernoff unexpectedly pays $1,732 toward her account. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. June 11, 2018 identification entry C. Entry for payment on September 14, 2018arrow_forwardInk Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable. The uncollectible percentage is 3% for the income statement method and 5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Millennium Associates records bad debt using the allowance, balance sheet method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On November 22, Millennium Associates identifies one uncollectible account from Angels Hardware in the amount of $3,650. On December 18, Angels Hardware unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. November 22, 2018 identification entry C. Entry for payment on December 18, 2018arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the end of the current year, the accounts receivable account of Parkers Nursery Supplies has a debit balance of 350,000. Credit sales are 2,300,000. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 1,920. (a) The percentage of sales method is used and bad debt expense is estimated to be 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 24,560 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,280. (a) The percentage of sales method is used and bad debt expense is estimated to be of 1% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 22,440 in uncollectible accounts.arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND PERCENTAGE OF RECEIVABLES At the completion of the current fiscal year ending December 31, the balance of Accounts Receivable for Andersons Greeting Cards was 180,000. Credit sales for the year were 1,950,000. REQUIRED Make the necessary adjusting entry in general journal form under each of the following assumptions. Show calculations for the amount of each adjustment and the resulting net realizable value. 1. Allowance for Doubtful Accounts has a credit balance of 2,600. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.5% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 30,250 in uncollectible accounts. 2. Allowance for Doubtful Accounts has a debit balance of 1,900. (a) The percentage of sales method is used and bad debt expense is estimated to be 1.0% of credit sales. (b) The percentage of receivables method is used and an analysis of the accounts produces an estimate of 20,500 in uncollectible accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License