Tax Custodial Fund. (LO8-2) The county collector of Suncoast County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 1.5 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Suncoast County General Fund.

The following events occurred during the year:

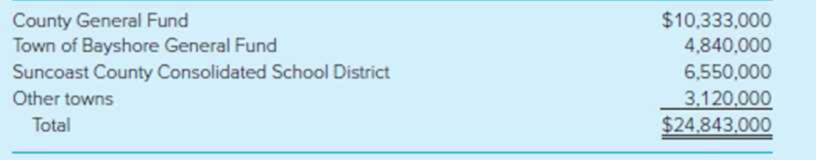

- 1. Current-year tax levies to be collected by the custodial fund were

- 2. $13,700,000 of current taxes was collected during the first half of the year.

- 3. Liabilities to all funds and governments as a result of the first half-year collections were recorded. (A schedule of amounts collected for each participant, showing the amount withheld for the county General Fund and net amounts due the participants, is recommended for determining amounts to be recorded for this transaction.)

- 4. All cash in the tax custodial fund was distributed.

- 5. All additions and deductions were recorded by the custodial fund. Additions and deductions are aggregated because resources are held less than three months.

Required

- a. Make

journal entries for each of the foregoing transactions that affected the tax custodial fund. - b. Make journal entries for each of the foregoing transactions that affected the Suncoast County General Fund. Begin with the tax levy entry, assuming 4 percent of the gross levy will be uncollectible.

- c. Make journal entries for each of the foregoing entries that affected the Town of Bayshore General Fund. Begin with the tax levy entry, assuming 2 percent of the gross levy will be uncollectible.

- d. Which financial statements would be prepared by the tax custodial fund?

a)

Prepare the journal entries for the each of the foregoing transactions that affected the tax custodial fund.

Explanation of Solution

Fiduciary activities: Fiduciary activities are those activities done by persons or organizations to another parties with utmost good faith and trust. A fiduciary activity may involve managing funds, assets and other valuables of a person or a group of people.

The person or organization involved in fiduciary activities need to act ethically in the best interest of others. Government also involve in fiduciary activities by holding the assets of individuals or organization to benefit them.

Tax Custodial fund: One government for different governmental funds and for different governments collects the tax Custodial fund. The tax collected from the citizens is accounted and remit adequate amount of tax to appropriate funds and other governments. The major issue, which makes the accounting of “tax Custodial fund” complex, is the time taken for the collection of taxes.

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare the journal entries for the each of the foregoing transactions that affected the tax custodial fund:

| Date | Accounts title and explanation | Post ref. | Debit ($) | Credit ($) |

| Taxes receivable for other funds and governments—current | $24,843,000 | |||

| Due to other funds and governments | $24,843,000 | |||

| (To record the current year tax levied) | ||||

| Cash | $13,700,000 | |||

|

Taxes receivable for other funds and governments—current | $13,700,000 | |||

| (To record the collection of current year tax ) | ||||

| Due to other funds and governments | $13,700,000 | |||

| Due to county general fund | $5,818,294 | |||

| Due to town of bay shore | $2,629,046 | |||

| Due to sun Coast County consolidated school district | $3,557,903 | |||

| Due to various towns | $1,694,757 | |||

| (To record the reimbursement of county) | ||||

| Due to county general fund | $5,818,294 | |||

| Due to town of bay shore | $2,629,046 | |||

| Due to sun coast county consolidated school district | $3,557,903 | |||

| Due to various towns | $1,694,757 | |||

| Cash | $13,700,000 | |||

| (To record the cash payment made to reimbursement of county) | ||||

| Deductions—Administrative fee | $120,025 | |||

| Deductions—payments of property taxes to other governments | $7,881,706 | |||

| Additions—property tax collections for other governments | $7,001,731 | |||

| (To record the additions and deductions of custodial funds) |

Table (1)

Notes to the above table:

Calculate the tax collected from Bay Shore:

The tax collected from Bay Shore is calculated by initially dividing the amount of tax on Bay Shore by total amount of tax levied and multiplying it with the cash collected. The amount of tax on Bay Shore is $4,840,000, total amount of tax levied is $24,843,000 and cash collected is $13,700,000. The calculation is as follows:

Thus, the tax collected on Bay Shore is $2,669,082.

Calculate Custodian’s liability:

The Custodian’s liability is calculated by deducting 1.5 percentage of the tax collected from it. The amount to be deducted is $40,036

Thus, the Custodian’s liability is $2,629,046.

Calculate the tax collected from school:

The tax collected from school is calculated by initially dividing the amount of tax on school by total amount of tax levied and multiplying it with the cash collected. The amount of tax on school is $6,550,000, total amount of tax levied is $24,843,000 and cash collected is $13,700,000. The calculation is as follows:

Thus, the tax collected on school is $3,612,084.

Calculate agency’s liability:

The agency’s liability is calculated by deducting 1.5 percentage of the tax collected from it. The amount to be deducted is $54,181

Thus, the agency’s liability is $3,557,903.

Calculate the tax collected from towns:

The tax collected from towns is calculated by initially dividing the amount of tax on towns by total amount of tax levied and multiplying it with the cash collected. The amount of tax on town is $3,120,000, total amount of tax levied is $24,843,000 and cash collected is $13,700,000. The calculation is as follows:

Thus, the tax collected on town is $1,720,565.

Calculate agency’s liability:

The agency’s liability is calculated by deducting 1.5 percentage of the tax collected from it. The amount to be deducted is $25,808

Thus, the agency’s liability is $1,694,757.

Calculate the tax collected from county:

The tax collected from county is calculated by initially dividing the amount of tax on county by total amount of tax levied and multiplying it with the cash collected. The amount of tax on county is $10,333,000, total amount of tax levied is $24,843,000 and cash collected is $13,700,000. The calculation is as follows:

Thus, the tax collected on town is $5,698,269.

Calculate agency’s liability:

The agency’s liability is calculated by adding all the deductions made in case of Bay Shore, school, and town. The amount to be added is $120,025

Thus, the agency’s liability is $5,818,294.

b)

Prepare the journal entries for the each of the foregoing transactions that affected the S county general fund.

Explanation of Solution

Prepare the journal entries for the each of the foregoing transactions that affected the S county general fund:

| Date | Accounts title and explanation | Post ref. | Debit ($) | Credit ($) |

| Taxes receivable - Current | $10,333,000 | |||

| Estimated uncollectible current taxes | $413,000 | |||

| Revenues | $9,919,680 | |||

| (To record the current year tax levied) | ||||

| Cash | $5,818,294 | |||

| Taxes receivable - Current | $5,698,269 | |||

| Revenues (collection fees) | ||||

| (To record the collection of current year tax ) |

Table (2)

Calculate uncollectible current tax and revenues:

It is given that the uncollectible current tax is 4 percent of the gross levy. Here, the gross levy is $10,333,000. The uncollectible amount is $413,320

c)

Prepare the journal entries for the each of the foregoing transactions that affected the S county general fund.

Explanation of Solution

Prepare the journal entries for the each of the foregoing transactions that affected the S county general fund:

| Date | Accounts title and explanation | Post ref. | Debit ($) | Credit ($) |

| Taxes receivable - Current | $4,840,000 | |||

| Estimated uncollectible current taxes | $96,800 | |||

| Revenues | $4,743,200 | |||

| (To record the current year tax levied) | ||||

| Cash | $2,629,046 | |||

| Expenditures (collection fees) | $40,036 | |||

| Taxes receivable - Current | $2,669,082 | |||

| (To record the collection of current year tax ) |

Table (3)

Calculate uncollectible current tax and revenues:

It is given that the uncollectible current tax is 4 percent of the gross levy. Here, the gross levy is $4,840,000. The uncollectible amount is $96,800

d)

State the financial statements that would be prepared by the tax custodial fund.

Explanation of Solution

Financial statement to be prepared by the tax Custodial fund:

Tax custodial fund net position is the financial statement to be prepared by the tax custodial fund, which shows the balances of assets and liabilities of the fund. It also comprises of other custodial funds used by the company. In the statement of fiduciary net position, the total asset and liabilities of custodial funds is shown in the single custodial fund column.

Want to see more full solutions like this?

Chapter 8 Solutions

ACCOUNTING F/GOV.+..(LL)-W/CODE>CUSTOM<

- For each of the following events or transactions, prepare the necessacry journal entries and identify the fund or funds that will be affected. 1. A governmental unit collects fees totaling $4,500 at the municipal pool. The fees are charged to recover costs of pool operation and maintenance 2. A county government that serves as a tax collection agency for all towns and cities located within the county collects county sales taxes totaling $125,000 for the month. 3. A $1,000,000 bond offering was issued, with a premium of $50,000, to subsidize the construction of a city visitor center. 4. A town receives a donation of $50,000 in bonds. The bonds should be held indefinitely, but bond income is to be donated to the local zoo. The zoo is associated with the town. 5. A central printing shop is established with a $150,000 nonreciprocal transfer from the general fund. 6. A $1,000,000 revenue bond offering was issued at par by a fund that provides water and sewer services to…arrow_forwardThe County includes an independent school district and two individually chartered towns within the County. The County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2020, the following transactions took place:1. The County levied taxes as follows: County General Fund $27,000,000 School District 14,500,000 Towns 4,500,000 Total $46,000,000 2.The property taxes levied (in transaction #1) were collected. 3. The amounts collected were paid to the school district and towns.Required:Prepare journal entries to record the transactions for the County’s tax collection custodial fund. (If no entry is required for a transaction/event, state “No entry.”)arrow_forward6. Washington County assumed the responsibility of collecting property taxes for all governments within its boundaries. In order to reimburse the county for expenditures for administering the Tax Agency Fund, the Tax Agency Fund is to deduct 1.5 percent from the collections from the city and school district. The total amount deducted is to be added to the collections for the county and remitted to the County General Fund. You are to record the following transactions in the accounts of the Washington County Tax Agency Fund. 1. Current year tax levies to be collected by the Tax Agency Fund were:County General Fund -- $9,800,000Town of Samuels -- 6,200,000Washington County School District -- 9,600,000 2. In the first half of the year $4,120,000 was collected for the County General Fund, $3,456,000 for the Town and $4,608,000 for the School District. 3. Liabilities to all three units were recorded. Required: Record the transactions in the accounts of the Washington County Tax Agency Fund.arrow_forward

- Benton County includes an independent school district and two individually chartered towns within the County. Benton County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2024, the following transactions took place: The County levied taxes as follows: Benton County General Fund $23,700,000 School District 10,500,000 Towns 3,510,000 Total $37,710,000 The property taxes levied in part (a) were collected. The amounts collected were paid to the school district and towns. Required: a1. Record the transactions in the books of the Benton County Tax Agency Fund. a2. Record the transactions in the books of the Benton County General Fund. a3. Record the transactions in the books of the Benton County Independent School District General Fund.arrow_forwardBenton County includes an independent school district and two individually chartered towns within the County. Benton County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2020, the following transactions took place:1. The County levied taxes as follows: Benton County General Fund $ 26,600,000 School District 14,100,000 Towns 4,100,000 Total $ 44,800,000 2. The property taxes levied in part (a) were collected.3. The amounts collected were paid to the school district and towns.Required:a. Prepare journal entries for Benton County and the Benton County Independent School District—identify the funds.arrow_forwardThe county legislature approved the budget for the current year. Revenues from property taxes are budgeted at $800,000. According to the county assessor, the assessed valuation of all of the property in the county is $50,000,000. Of this amount, property worth $10,000,000 belongs to the federal government or to religious organizations and, therefore, is not subject to property taxes. In addition, certificates for the following exemptions have been filed: Homestead $2,500,000 Veterans 1,000,000 Old age, blindness, etc. 500,000 In the past, uncollectible property taxes averaged about 3 percent of the levy. This rate is not expected to change in the foreseeable future. Requirement: Calculate the levy on a piece of property that was assessed for $100,000 (after exemptions).arrow_forward

- The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Fund balance—unassigned goes down and fund balance—restricted goes up. Fund balance—assigned goes down and fund balance—committed goes up. Fund balance—unassigned goes down and fund balance—assigned goes up. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forwardThe city of Belle collects property taxes for other local governments—Beau County and the Landis Independent School District (LISD). The city uses a Property Tax Collection Custodial Fund to account for its collection of property taxes for itself, Beau County, and LISD. The following transactions and events occurred for Belle's Custodial Fund. 1. Property taxes were levied for Belle ( $1,500,000), Beau County ( $750,000) and LISD ( $2,250,000). Assume taxes collected by the Custodial Fund will be paid to Belle’s General Fund. 2. Property taxes in the amount of $3,375,000 are collected. The percentage collected for each entity is in the same proportion as the original levy. 3. The amounts owed to Beau County and LISD are recognized. 4. The Custodial Fund distributes the amounts owed to the three governments. Prepare journal entries to record the above transactions and events for Belle’s Custodial Fund. If an entry affects more than one debit or credit account, enter the accounts in…arrow_forwardIn 2019, a state government collected income taxes of $8,000,000 for the benefit of one of its cities that imposes an income tax on its residents. The state periodically remitted these collections to the city. The state should account for the $8,000,000 in the a. general fund. b. agency funds. c. internal service funds. d. special assessment funds.arrow_forward

- The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Choose the correct.a. Fund balance—unassigned goes down and fund balance—restricted goes up.b. Fund balance—assigned goes down and fund balance—committed goes up.c. Fund balance—unassigned goes down and fund balance—assigned goes up.d. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forwardThe city of Belle collects property taxes for other local governments—Beau County and the Landis Independent School District (LISD). The city uses a Property Tax Collection Custodial Fund to account for its collection of property taxes for itself, Beau County, and LISD.The following transactions and events occurred for Belle's Custodial Fund.1. Property taxes were levied for Belle ( $1,000,000), Beau County ( $500,000) andLISD ( $1,500,000). Assume taxes collected by the Custodial Fund will bepaid to Belle’s General Fund.2. Property taxes in the amount of $2,250,000 are collected. The percentage collectedfor each entity is in the same proportion as the original levy.3. The amounts owed to Beau County and LISD are recognized.4. The Custodial Fund distributes the amounts owed to the three governments.Prepare journal entries to record the above transactions and events for Belle’s Custodial Fund. If an entry affects more than one debit or credit account, enter the accounts in order of…arrow_forwardThe following information pertains to Hempstead City which has a December 31st year-end. Fiscal year 2020 governmental fund property tax revenues that are measurable and available equaled $12,000,000. Sales taxes collected by merchants in 2020 but not remitted to Hempstead City until January 2021 equaled $4,000,000. For the year ended December 31, 2020, Hempstead City should recognize revenues in its governmental fund financial statements of: A. $18,000,000. B. $16,000,000. C. $14,000,000. D. $12,000,000.arrow_forward